[Author’s Note: This is the final mailing for 2024. As my survey from earlier this month suggested, exciting changes are in store to the focus and format of The Medium. More on that in January!

In the meantime, if you have not taken the survey already, please do so over the holiday. I will leave it up and through the New Year. Your feedback is invaluable to me and to what I am building!]

Back in February’s “The Media Revolution Will Be Prompted”, I shared a prediction of Samir Chaudry of the YouTube creator duo Colin and Samir:

The best creators will use [artificial intelligence (AI) to make sure human audiences connect with the best storytelling, he said. Those at risk will be those who don’t know how to tell a story.

There are two stories within that prediction. The first is an elegant but Darwinist vision: Human storytelling will still matter but AI will be a necessary condition for connecting with audiences. Those who assume AI will compensate for their lack of storytelling skills will not survive.

The second story is about connection: AI will not favor any one format (e.g., video, audio, games). Instead, it will only favor which stories and storytellers can connect with audiences.

The traditional media model of aggregating assets across TV, movies, books, theme parks, music and live events no longer connects audiences with the best storytelling. The decline of the cable business means it no longer optimally monetizes them. That model has been proven to be too expansive and uncoordinated to evolve with the emergence of retail-first, consumer-first models over the past two decades, it is irrelevant now.

In 2025, we will no longer be talking about the media businesses of the last century. Instead, we will be discussing an explosion of new businesses of storytelling.

Key Takeaways

1, There will be no AI-generated hits, blockbuster or niche

2. AI emerges as a “storytelling” performer

3. A messy debate about the “Quality” vs. Possibility of storytelling emerges

4. “The new business of living room content” redefines the role of producer

5. The value of IP libraries for TV series and movies continues to decline

6. Netflix continues to pivot and evolve away from its legacy media movie and TV DNA

7. A small business using Meta’s Movie Gen tools will create most successful AI-generated ad campaign of 2025

8. Only Spotify and YouTube will have outsized influence in the IP licensing marketplace for AI

And, some predictions for legacy media in 2025

Total words: 2,400

Total time reading: 10 minutes (~1 minute per prediction)

1. There will be no AI-generated hits, blockbuster or niche

Why we will see it

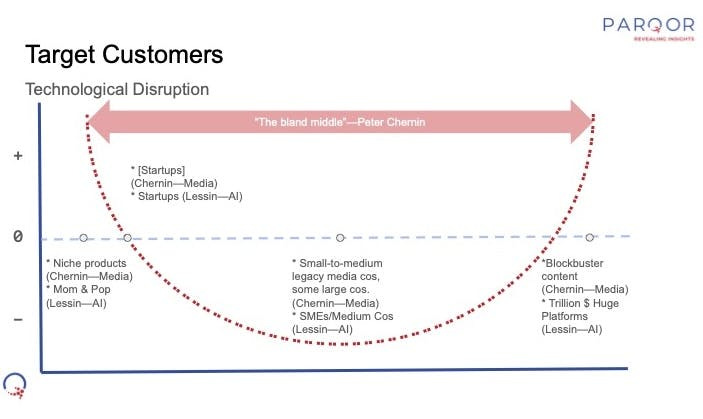

According to TCG founder Peter Chernin, technological disruption means AI-generated storytelling will “aggregate at two extremes: the big blockbuster hits and niche products”. The rest of the stories—what Chernin calls the “bland middle”—will be “gone, and gone forever.”

There is also a more AI technology-focused lens on technological disruption from Slow Ventures partner (and “intern” at The Information) Sam Lessin:

“AI is a new business weapon... who benefits? just like "cloud" before it - the moms and pops get powerful new tools, the $T big platforms profit from arms dealing. and the "middle" gets crushed.”

Here is a slide from a deck with my business plan for 2025 (and beyond) that sums up these two takes (and if you’d like to walk through the deck with me, please respond to this email):

We are not yet seeing models for niche or blockbuster hits for AI-generated content. Last month, Tom Paton’s AiMation Studios released “Where the Robots Grow”, the first feature-length fully animated movie made entirely with artificial intelligence (AI) tools. It cost only $8,000 per minute, and was made with a team of nine people in 90 days.

Paton shared with me recently that trying to get the movie released “became like a dance with Hollywood where they were making offers but we couldn't get anyone to budge off of a [Q2] 2025 release.” He ended up releasing the movie for free on YouTube, instead.

That dynamic will not change in 2025, resulting in neither niche AI hits nor AI blockbuster movies.

Why I may be wrong

Payment platforms like Stripe already enable micropayments and AI platforms like OpenAI’s ChatGPT and Google’s Gemini and smaller players like Midjourney already charge monthly subscriptions. The conditions are in place for the economics of niche storytelling business models in AI to emerge quickly.

2. AI emerges as a “storytelling” performer

Why we will see it

I wrote in Monday’s “NotebookLM, AI Storytelling vs. AI Performances” that AI will be less a storyteller and more a producer of faster, cheaper “performances” of stories. This question is how and whether consumer demand for this service will scale in 2025. I think it will.

On a related note, venture capital firm Andreessen Horowitz is predicting “A next generation Pixar” will emerge in the gaming sector in 2025 “using AI for interactive experiences.” Netflix seems to be making one version of this bet with its recent announcement that former Netflix VP of Games Mike Verdu is now VP, GenAI for Games.

He described the opportunity as “a 'once in a generation’ inflection point for game development and player experiences using generative AI.” He will be “focused on a creator-first vision for [artificial intelligence (AI)], one that puts creative talent at the center, with AI being a catalyst and an accelerant.”

Why it may not happen

In the case of NotebookLM, will audiences feel an affinity for two faceless, non-human AI co-hosts debating someone else’s work? That does not read compelling enough on its own.

In the case of Netflix, Fable Simulations founder Edward Saatchi predicted the earliest a Hollywood studio will “take the plunge” on interactive generative AI platforms will be in mid-2026.

3. A messy debate about the “Quality” vs. Possibility of storytelling emerges

Why we will see it

When I interviewed creator Don Allen Stevenson III for last month’s "Armed With AI, Small Businesses Also Challenge Hollywood", he said something interesting about “creative possibility” in storytelling with AI: “some of the best stuff that I throw AI and like generative AI tools at are the stories that I wouldn't have gotten a budget for” when working at a Hollywood studio like Dreamworks. The ideas that studios “forced” visual effects designers to do were the ones that “the studios had confidence that it would make X amount of money.”

Tools like OpenAI’s Sora, Google’s Veo2 and RunwayML all present an uneasy tension between the more TV and movie-centric concepts of quality, and the promise of “creative possibility” from generative AI. Producer and actor Ben Affleck made the case against it at a CNBC conference last month:

“AI can write you excellent imitative verse that sounds Elizabethan. It cannot write you Shakespeare. The function of having two actors, or three or four actors, in a room, and the taste to discern and construct that, is something that currently entirely eludes AI's capability, and I think will for a meaningful period of time.”

Despite Affleck’s references to Shakespeare and his own movie “Good Will Hunting”, there is no universal standard of “quality” in Hollywood. According to Forbes, low-budget television animation sourced from overseas studios costs between $10,000 and $20,000 a minute and “isn’t anywhere near the quality of ‘Where the Robots Grow’”.

Then there is a third variable: Newfound efficiencies and possibilities in production models from AI will matter less if consumers increasingly prefer their favorite IP in different formats than TV or movies.

So, anyone looking for a clear answer to how generative AI will impact Hollywood storytelling is going to find themselves trying to reconcile these three moving pieces.

Why I may be wrong

We will likely see some studios figure out how to integrate AI into their storytelling (and Disney recently integrated AI into the opening credits of its Disney+ series “Secret Invasion”). However, it will be inevitable that traditional studios will be disrupted by AI storytelling in 2025.

4. “The new business of living room content” redefines the role of producer

Why we will see it

Consumers are increasingly becoming the “producers” of their favorite stories. YouTube now dominates streaming on household televisions across the U.S. (according to Nielsen's The Gauge) and around the world. I wrote in “Netflix, YouTube & The New Business of Living Room Content”:

“The more YouTube competes with Netflix on television screens worldwide, the more YouTube is proving that consumers' ‘choice and control’ over the medium of the internet means fans are the producers of the content they want to watch. “

ReelShort, a short-form vertical video platform, is generating $40 million per month from a female-heavy audience—half of which is in the United States—with “soapy romance mini-dramas with one-minute episodes and up to 80 episodes in a “series.” Its app currently has 50 million monthly active users who make micro-payments by buying “coins” to watch content.

Both reflect how consumers are increasingly playing direct roles in determining which content is produced and the “quality” of content they want to see. In 2025, that status will be further cemented in the marketplace with more consumer-as-producer models emerging.

Why I may be wrong

I won't be.

5. The value of IP libraries for TV series and movies continues to decline

Why we will see it

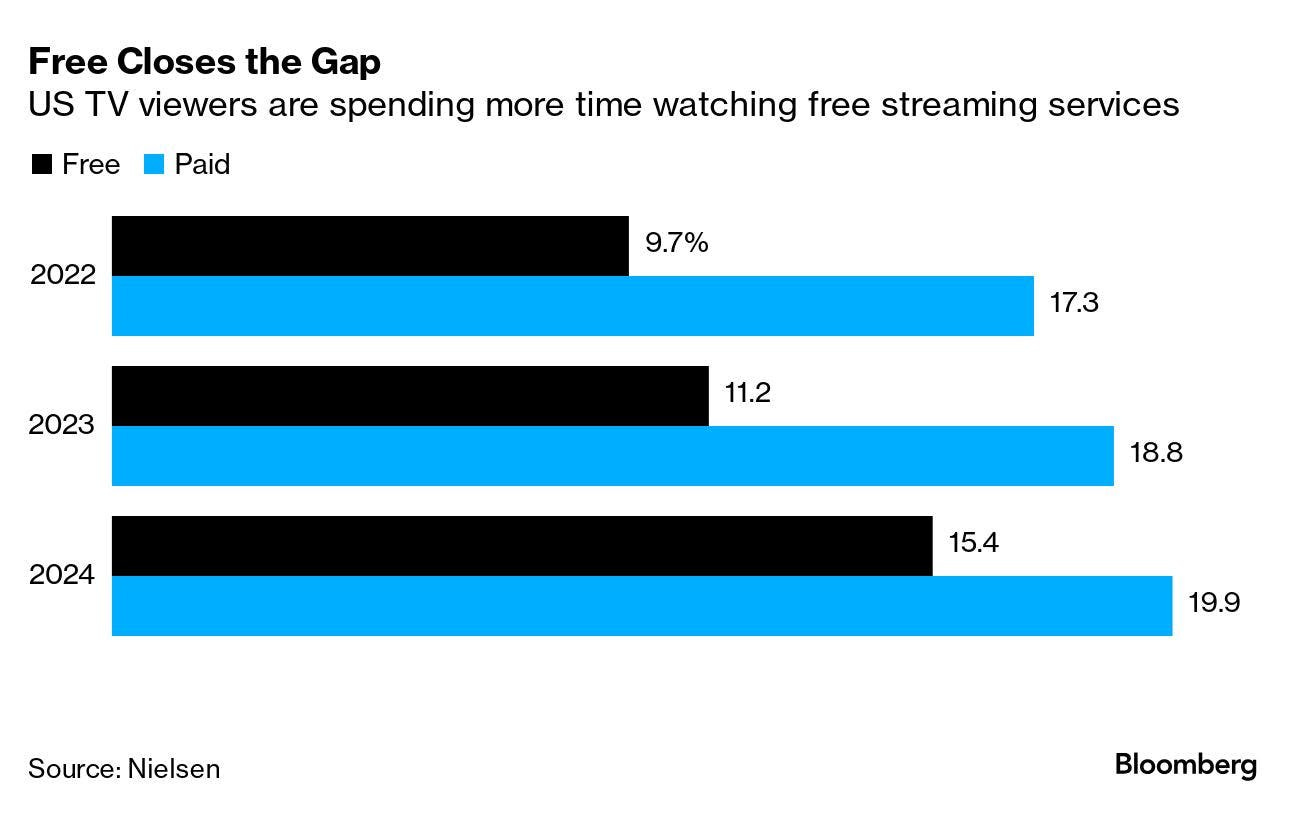

I previously argued in “Back To The Future Of Pre-Paramount Decrees Studio Distribution” that the next generation of consumers “value the user experience (UX) as much as the content, enough to prefer free services to paid services with historically popular IP.”

In other words, the growing popularity of social video platforms and FASTs seems to have catalyzed both a decline in the value of IP libraries to consumers and in the business of monetizing them. Now, free services are growing a lot faster than paid ones.

If we follow Marshall McLuhan’s path of thinking, the internet is a more interactive medium than the more passive viewing mediums of television or theatrical. That means consumer standards of "quality" for TV and movie content in those mediums are also more passive, and their standards of "quality" within the medium of the internet are more interactive.

It offers an abundance of choice. The value proposition for consumers is not just “possibility” but the ability to find interactive experiences with storytelling that map more narrowly to their needs.“Quality” storytelling increasingly reflects those narrow needs more than any previous standard established by TV and theatrical mediums.

Consequently, IP will continue to become less valuable for TV series and movies. It will become more valuable for more interactive offerings.

Why it may not happen

It will. This is an irreversible trend.

6. Netflix continues to pivot and evolve away from its legacy media movie and TV DNA

Why we will see it

In September, Co-CEO Ted Sarandos told the Royal Television Society’s (RTS) London Convention 2024 that Netflix must cannibalize its own business and “constantly challenge ourselves, to break [the business] and move our business forward on behalf of our consumers.”

Netflix is leveraging mobile gaming to continue storylines between seasons of its reality shows. It is distributing live sports events globally (Jake Paul vs. Mike Tyson, NFL Christmas Day games). It also will be making a reality show called “Inside” with British YouTube superstars The Sidemen. It is evolving beyond TV and movies.

It is also moving beyond Hollywood. Back in March, research firm Ampere Analysis projected more than half of Netflix’s content spending this year — $7.9 billion of about $15.4 billion total — would go toward titles produced outside of North America. So, 2024 will likely mark the first time the majority of the streamer’s budget will be spent on either local original content for international markets or the licensing of internationally produced titles.

A future of faster and cheaper TV shows, movies, some sports events and mobiles games seems counterintuitive for a platform that had Disney-like ambitions only three years ago.

However, this seems to the result of its competition for consumer attention and advertiser dollars from Silicon Valley—YouTube and Amazon Prime Video especially—is forcing it to unlock new competitive advantages.

Why I may be wrong

According to its latest What We Watched report, people watched over 94 billion hours on Netflix in the first half of 2024. It is growing towards 300 million global subscribers and has churn rates below 2%, according to research firm Antenna. This may be a "molehill" of a “problem” in 2025 before it becomes a "mountain" of a problem in the longer run.

7. A small business using Meta’s Movie Gen tools will create most successful AI-generated ad campaign of 2025

Why we will see it

Back in September and early October, I argued Meta seems to be betting that "small businesses are becoming creators faster than creators are becoming small businesses."

The pace at which AI models are evolving—Google announced Veo 2 less than two weeks after it revealed Veo and OpenAI released its o1 version of its video generation model Sora only 10 months after its release—suggests that Meta’s Movie Gen will be publicly released in mid-2025 to “hundreds of millions” of small business advertisers.

Meta’s advertising platform and “family of apps” are instant distribution outlets for its AI-generated content to over 3.27 billion daily active people. That is a significant competitive advantage. Odds are at least one small business figures out a viral advertising “hit” on the platform.

Why I may be wrong

We still do not know if AI-generated ads generate the type of brand awareness or conversion behavior when compared to other rich media format ads. It may take as long as a decade before we do. That is as long as it took for podcasts and the creator economy on platforms like Spotify, YouTube, Instagram and TikTok to prove itself out.

8. Only Spotify and YouTube will have outsized influence in the IP licensing marketplace for AI

I wrote in November that large media companies need more opportunities to monetize their large libraries of IP than within the closed marketplaces of their walled gardens. The logical solutions are either to aim to build free marketplaces where the IP can be more accurately valued or to let third-party technologies rethink their walled gardens for them.

I think the latter will happen simply because platforms like Spotify, TikTok and YouTube (which I argued is “AI’s frenemy”) already leverage algorithmic technology to ensure third parties' IP rights are not violated by AI or creators. They are friendly to AI-generated content (as long as that content is labeled as such). There will be no market need for a new market entrant to technologically or legally reinvent the proverbial wheel here.

Why I may be wrong

There may not be a solution. Intellectual property licensing is especially complicated in film and TV because of the myriad of rights holders (cast, crew, production, investors, and more). AI plays in the grey areas of IP licensing because it does not create “new” IP nor is it clear how it uses IP to train its models (this is the basis of ongoing lawsuits against Meta and OpenAI).

Legacy Media Predictions

Three years closer to 2029 means we’ll see NFL starting testing the waters for a new deal

Disney and Epic hit the same operational and cultural roadblocks within The Walt Disney Company that past gaming and creator economy ventures have hit, and they dial back their ambitions.

A smaller streamer drops its owned-and-operated subscription streaming model and licenses its content library entirely to Amazon.

Neither Skydance nor Apple pursue the “cloud-usage model” I proposed in a September essay. However, Hollywood’s need for a free marketplace for content buying will push the market to find a solution, so we cannot rule it out?