Good afternoon!

The Medium delivers in-depth analyses of the media marketplace’s transformation as creators, tech companies and 10 million emerging advertisers revolutionize the business models for “premium content”.

On Monday, likely Paramount acquirer David Ellison told investors “when you look at the landscape as it exists today, there are a lot of technology companies that are rapidly expanding into media companies, and we believe it is essential for Paramount to be able to expand its technological prowess to be both a media and technology enterprise."

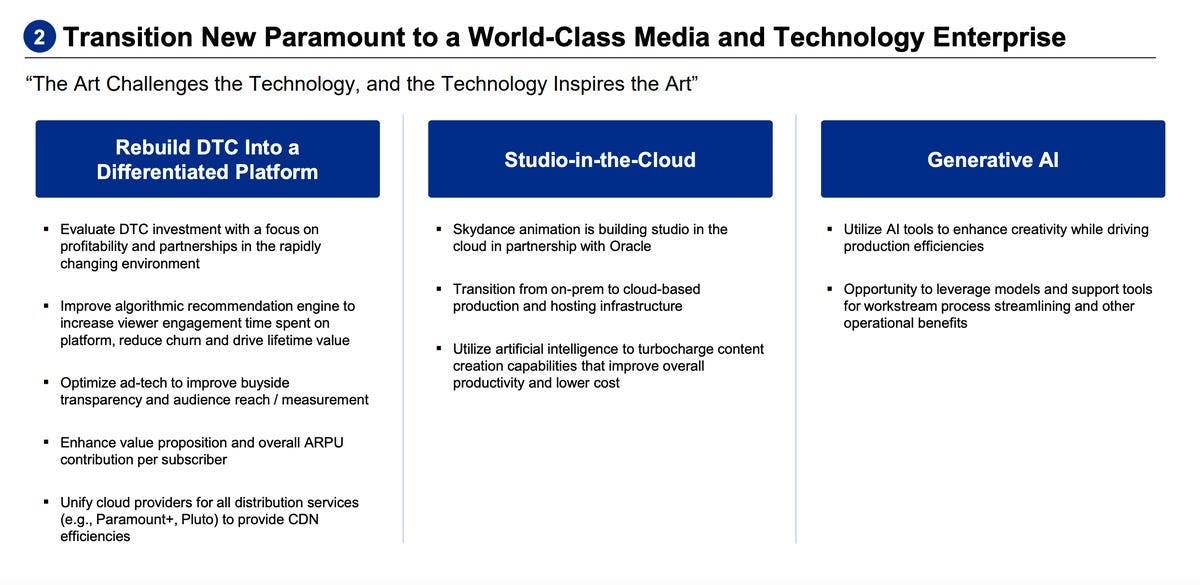

He offered a basic outline of three technology priorities in an accompanying presentation:

The slide certainly mirrors my argument in Monday’s essay: Investing in emerging technologies may be as important, if not more important, than investing in intellectual property (IP). Marshall McLuhan's “the medium is the message” continues to be true and emerging new technologies are transforming the value of IP outside of linear and theatrical. That is as much a competitive challenge as it is an existential challenge for the long-term value of content libraries.

But, Ellison frames the purpose of the investments with the competitive challenge of “technology companies that are rapidly expanding into media companies.” The contrast highlights two questions:

Is rebuilding a DTC platform the best use of Paramount's balance sheet for its shareholders?

If not, what is an alternative investment strategy that both protects IP and delivers returns from tech investments?

Key Takeaway

The strategic focus of the new Paramount should not be on “technology companies that are rapidly expanding into media companies". Rather, the focus should be on investing the $1.5 billion influx of cash in businesses expanding the value of IP beyond film and TV.

Total words: 1,300

Total time reading: 5 minutes

Why Rebuild Paramount+?

I have long argued that the insufficient scale of Paramount+ reflects the technology’s limitations. More specifically, I argued in “Why So Many Streaming Services Are Struggling that the service was a bet on Paramount’s “storytelling moat”—its storytelling expertise and the deep content library—over a “distribution moat”, or the technological expertise behind the algorithms for personalized recommendations, the dynamic user interfaces and operational back-ends for content distribution over the internet.

Ellison is promising an Oracle-built “distribution moat” (his father, Oracle co-founder and Executive Chairman Larry Ellison, contributed $6 billion to the Paramount deal). The business logic seems to be that if Oracle believes it can build a competitor to Netflix, it should seize the opportunity to do so with Paramount’s library.

But, Netflix has proven that most consumers are happy to pay a subscription fee for lower-quality content than Paramount is known for producing. The competitive advantages of Paramount's library will matter little. Paramount will be stuck in a pivot towards producing cheaper content at scale. As I argued back in April, the business case for Oracle’s technology being a competitive advantage “reads speculative, at best, and therefore a path to growth seems speculative, too.”

Also, building a streaming service in the post-ZIRP (zero interest-rate policies) marketplace differs significantly from building one over five years ago with "free money" from ZIRP. There are fewer upsides with investors—the market incentive of a “streaming multiple” for a stock price seems to be long forgotten—and Netflix iterating into gaming suggests there seem to be fewer competitive advantages to be found.

An Alternative Investment Strategy…

Something about the dilemma of investing in the IP or the technology reminded me of a Twitter exchange I had with Salil Dalvi, a former NBCUniversal executive and friend who passed away suddenly two years ago. His family has since taken down his social media accounts. But, I still have a past essay (on the Substack archive) with snippets of the exchange from four years ago.

His basic point was that much of Discovery’s library (Food Network, HGTV) is “fundamentally video wallpaper” which is “FANTASTIC for low-engagement, low conflict viewing over HOURS.” That is ideal for linear. But, on the internet, food and home content are “atomized across shows, clips, how-to and data” and “a Huge chunk of it is FREE.” For this reason, TV content popular on linear TV cannot compete with free content in streaming.

The idea was there were better direct-to-consumer models for Discovery to have invested in than streaming. Those models may share characteristics with Discovery brands but are otherwise independent of legacy media business models (also known as “orthogonal”). Discovery could leverage its balance sheet to “expand their operating definition of the food and home categories” and pursue a strategy focused on these models:

1-being a last man standing on linear 2-reinventing linear formats on legacy platforms to capture more of that audience 3-announce an investment fund to manage foodtech and home tech businesses: will include cross platform content.

The premise is similar to a venture fund focused on a particular sector. But, it is different in that Discovery could have leveraged its existing assets—the scale of its linear distribution, specifically—to scale those investments. In doing so, they could have expanded their "operating definition of the food and home categories” beyond advertising and affiliate fees.

The model is not unlike what we have seen creators like Jimmy Donaldson aka MrBeast pursue with his Feastables chocolate brand, or Logan Paul and KSI are pursuing with Prime Hydration. Feastables brings in $100 million in annual revenue for Donaldson, and Prime Hydration passed $1.2 billion in sales last November. Both have benefitted from the reach of the influencers’ respective YouTube channels.

…for Paramount+Skydance?

Salil’s key insight was that the expensive, linear-first content on legacy streaming platforms was struggling to compete with free content in streaming. The more efficient economics of the internet made that a losing battle in the long run. He was right: According to Nielsen’s The Gauge, Fox-owned free service Tubi is now outperforming all legacy media streamers, and Paramount-owned Pluto trails NBCUniversal’s Peacock by 0.2%. The best strategy for delivering shareholder value, then, was not to bet on expensive TV and film content succeeding in streaming. Tubi’s success suggests that is true, today, too.

The question is whether pursuing an orthogonal investment strategy is a better alternative means of delivering shareholder value. Meaning, leveraging the existing scale of linear and streaming to boost business investments in the same sector. In 2021, HGTV and Food Network reached 82 million households and more than 55 million total viewers per month. That number is now down to 70 million as of November 2023, a decline of 15%.

The challenge for Paramount’s new owners is that its linear networks are not in verticals with a wealth of DTC businesses like food or home. They are in reality TV and music (MTV), kids (Nickelodeon) and comedy (Comedy Central). Creators like MrBeast and Logan Paul have proven that is not necessarily a barrier to success, but they also have different relationships with their audiences.

That leaves Paramount’s library of intellectual property as its only asset. I argued in April that the best orthogonal bets with their IP are four business models being funded by investors both private and public:

Gaming (e.g., licensed third-party character “skins” in online games like Fortnite and Roblox)

Blockchain (e.g., non-fungible tokens (NFTs), memecoins)

Generative AI tools (e.g, learning language models that learn from data and produce content autonomously); and,

Creator economy (e.g., media companies partnering with influencers for promotion)

All are orthogonal in the sense that these models do not need to rely on third-party IP to succeed. But, they can unlock value for the IP outside of the confines of traditional media models.

To Invest or Not To Invest?

One important question is whether these business models are the types of investment opportunities that will deliver the returns that DTC streaming has not. All available signals suggest that, as long free streaming platforms dominate (YouTube) or rapidly grow in popularity (Tubi), there are better long-term returns for Paramount’s IP outside of streaming traditional TV and movies.

Another important question is if Paramount's new management laid out a vision for an orthogonal investing strategy, whether investors would be more bullish on it than streaming. Notably, Disney's stock is down nearly 20% since it announced the Epic deal. But, Disney's bet on Epic is for the long-term: It is pursuing the deal to maximize the value of Disney IP beyond its walled gardens, and beyond linear and theatrical especially.

What Disney seems to have understood is that IP and content libraries are less valuable behind walled gardens, and more valuable in the hands of next-generation technology companies. So, the new Paramount's strategic focus should not be on “technology companies that are rapidly expanding into media companies" like Amazon or Apple. Rather, the focus should be on investing in companies that understand consumers' relationship with IP are expanding beyond film and TV.