ESPN "Flagship" & The Agency of Sports Fandom

ESPN's streaming launch treats DTC consumers as passive subscribers. But, as The New York Times has learned, they want more control over the economics.

[Author’s Note: PARQOR Platinum subscribers will receive a monthly update for both August and September next month.

Correction: A reader pointed out that the annual fees for the NBA and WWE were incorrect. They have been updated.]

Last Thursday, the ESPN “flagship” streaming app launched with a press tour from ESPN Chairman Jimmy Pitaro. The “relaunched” and “enhanced app”—but “not a new app” —is “ aligned with cord-cutters and an emerging generation of younger, “cord-never” sports fans who watch sports across multiple apps and place bets on sports.

He also shared that ESPN management is “agnostic” whether consumers access ESPN via “DirecTV or Charter, or through Hulu Live or YouTube TV or directly [from ESPN]”. However, management’s concern is still that subscriber churn in streaming will exceed what it is seeing “in the traditional ecosystem.”

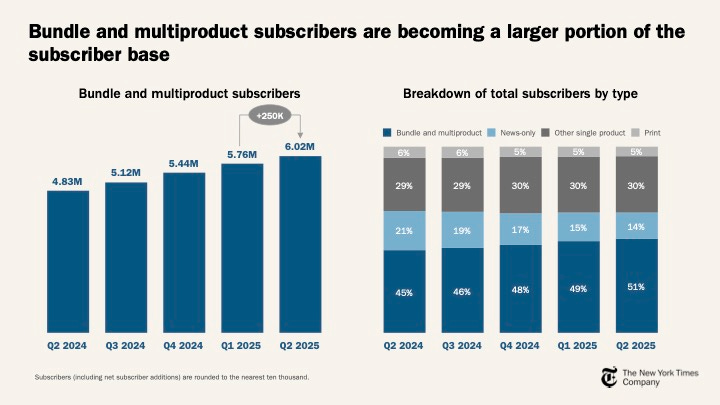

This contrasts with The New York Times approach to sports fandom. When it acquired The Athletic for $500 million in 2022, management bet that it could upsell a bundle or multiproduct subscriptions horizontally—across news, games, shopping recommendations and podcasts—to both 1 million The Athletic subscribers and existing NYT subscribers.

The results speak volumes: As of Q2 2025, a majority of its total subscriber base are bundle and multiproduct subscribers, digital subscriptions grew over 15% year-over-year to $350 million, and The Athletic generated $5.8 million in operating profit in Q2 2025 after breaking even in 2024.

The Agency vs. Fandom Problem

Last year, I argued the best business model for sports streaming is a platform that captures “fandom” by getting its subscribers “addicted to watching their own local and favorite sports teams.” This was inspired by a description of The Athletic giving the NYT “an audience of nearly one million subscribers addicted to coverage of their own local and favorite sports teams.”