Friday Mailing: $68B in Linear Ad Spend & Netflix, It's Early Days for CDPs in Media

Once one sees the world as a split between the demand-side between the 200 “retail-cartel” advertisers and the 10MM e-commerce brands who advertise on Google and Facebook, it becomes hard to see things the same way again.

This week, it was helpful for better understanding the dynamics around “retail-cartel” demand Netflix’s ad inventory, and why Disney’s model may be positioned for leveraging data from companies among the 10MM DTC to improve its value proposition to consumers.

1. Netflix

A recent post on Netflix from Mike Shields - Netflix needs advertisers. Advertisers really need Netflix. - is effectively a story about the 200 “retail-cartel” advertisers needing better inventory. He makes two points that relate to the “retail-cartel”.

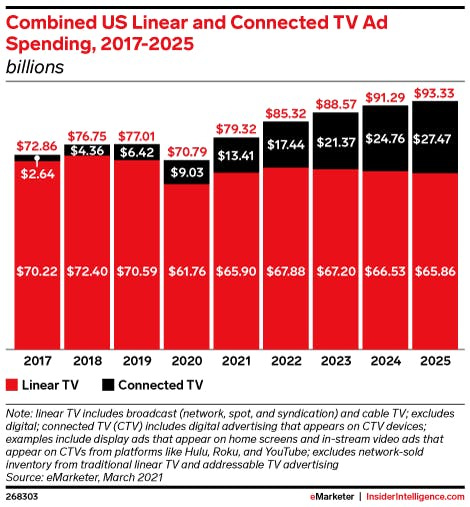

First, linear TV has averaged around 20 minutes of ad time per hour (and more on basic cable), bur ad-supported streamers are promising anywhere from four to six minutes of ad time per hour. To Shields it’s clear that Connected TV (CTV) inventory is not a one-to-one replacement for linear: “You can’t shove a $70 billion of TV ad into a container that only holds a quarter of what the previous one did, no matter how much you raise prices.”

Second, because of this dynamic, he argues if Netflix “can convert a significant chunk of that subscriber base to ad supported, and [add] a few more million new ad-supported subs, brands may be able to access a much larger, reliable audience with CTV - one that is closer to classic TV.” (NOTE: This reflects the argument I made in Netflix’s Best Advertising Bet Won’t Require Software).

However, Netflix is also going to have limited ad space because, as Insider recently reported, Netflix “wants to serve fewer such ads than competitors like Hulu and HBO Max and that it plans to experiment with sponsorships and product placements.”

“Limbo”

Through the lens of the 200 “retail-cartel” advertisers, the CTV and ad-supported streaming marketplaces have related problems. Shields points out the obvious one is insufficient supply to meet $68B in annual spend shifting from linear to CTV. That means, there is effectively nowhere for that spend to go but towards inelastic demand for linear and perhaps whatever marginal inventory Netflix may end up offering.

The less obvious one is, as the IAB wrote, the trend of “the century-old retail-media cartel’s lock on the consumer economy” is being broken by 10MM e-commerce retailers. This trend would imply the $68B will be stuck in a limbo of both inelastic demand for linear and declining size from competition. Notably, this is reflected in eMarketer's projections for linear ad spend through 2025.

The other implication from this chart is that the growth of CTV ad spending will not be driven by the zero-sum shifting of ad dollars from the linear ad spend of the “retail-cartel”. Instead, we are witnessing a limbo where prices for linear ad inventory can only go up while retail sales lose share to e-commerce. It’s not clear how long this will play out, but eMarketer trends suggest it could last well past 2025.

It's Early Days for CDPs in Media

On the flip side, a conversation I had with some entrepreneurs last night teased out an angle that I hadn’t considered before about the 10MM e-commerce brands and data: as media companies move into a more Consumer Data Platform (CDP)-driven world, those businesses that already rely on those models - like Disney, Apple, Amazon and Netflix - will need more and better first-party data on their consumers. E-commerce businesses or even software APIs that capture particularly valuable consumer behaviors can deliver that data.

First-party data is an increasingly valuable currency in advertising, and especially to the 10MM e-commerce advertisers. As I wrote on Wednesday, “These e-commerce brands need a more intimate relationship with the customer than “retail-cartel” brands, and that requires deeper, richer data on the customer across the conversion funnel to both build and maintain that relationship with an eye to both Customer Acquisition Cost and Lifetime Value.” Brand managers need a “more vivid narrative about the efficacy of their dollars”.

Much of the conversation now is about how the shift to CTV advertising is opening legacy media inventory to the 10MM e-commerce brands, and how they will be buying with the aspiration of mapping their customer data to legacy media first-party data.

But, a business like Disney also needs the data of those e-commerce brands. On this note it’s important to remember what Disney CEO Bob Chapek outlined last year to the JP Morgan Global Technology, Media and Communications Conference:

…for the very first time, we've got the opportunity to take our original direct-to-consumer business, which is our park business, and use it for our newest direct-to-consumer business. And we've got [a] tremendous amount of information on our consumers from our parks business and what would happen if we married that and actually mine that data to help people subscribe to Disney+ knowing what we know.

With the benefit of hindsight, this quote tells us two things. The first I have focused on, to date, is the merging of databases to manage and build out its customer relationships across streaming and theme park platforms. This is effectively a Customer Data Platform (CDP) approach (NOTE: I wrote about this in MGM Resorts M life "Convergence" vs. "Metaverse" Convergence).

“…for the very first time”

The second is the phrase “…for the very first time”, which I’ve always taken at face value. But it’s actually a broader point about this moment in time: we truly are in the early days of CDP approaches across platforms.

This was highlighted in a recent Digiday article on how the “vast majority of marketers are unhappy with their Customer Data Platforms”. Ronan Shields writes, “Only 10% of marketers to have bought into the first-generation of customer data platforms believe their purchases are fit for purpose with even less (1%) certain such technology will stand up to the requirements of tomorrow.”

Shields also highlights how first-party data - the data owned by a publisher or vendor with the consumer's permission to use - is required to fuel these platforms, quoting a consultant who says “with a CDP, if you haven’t got anybody signed up [with their registration data], then you can’t do much.” So a business like Disney ends up having two advantages in the marketplace with the 10MM retail e-commerce advertisers.

The first is simply advertising: by centralizing valuable first-party data, they can offer advertisers the ability to reach Disney+ subscribers across various platforms (NOTE: I believe this is what they are doing with their programmatic solution Disney XP, which builds off of Hulu’s ad-targeting back-end).

But the second is, they can offer these vendors win-win partnerships and/or acquisitions to plug into Disney’s CDP. Because the better Disney’s first-party data is, the better Disney will be able to serve both its consumers and its advertisers.

It’s not quite clear which other businesses are thinking this way: for example, Comcast does not seem to have yet adopted a unified CDP approach for Peacock consumers, Comcast residential consumers, and Universal Theme Parks visitors. But, as the ad market evolves more towards the CTV model and a growing need for better first-party data, it makes a ton of sense that we'll see acquisitions of and/or partnerships with e-commerce companies by media businesses like Disney who are savvier with their CDPs.

Corrections

Clarification

I had an exchange with IAB Executive Chairman Randall Rothenberg about the definition of “retail-cartel”, which is not as clearly defined in the IAB deck as it has been in my conversations with him. He wrote me that the term includes “not just retailers, but all consumer brands that historically sold AT retail, as well as the media they advertised on. This historically was the bulk of advertisers. There’s a risk that your readers may think you’re referring only to retailers like Walmart, and not the Calvin Klein’s and L’Oreals etc that sell at Walmart. “

Correction

I wrote in Wednesday’s mailing, The Core Tension/Weird Dance At Upfronts for Connected TV (CTV) Dollars:

According to a recent Publicis Commerce report, retail was a $6.6T marketplace in the U.S. in 2021 and e-commerce was a $94B marketplace, a 7x difference. E-commerce also has a 16% share of the U.S. retail market, about 10% ahead of Publicis forecasts and, before the recent macroeconomic downturn, seeing monthly sales grow year-over-year.

A reader pointed out that not only is the math incorrect, it's not possible that e-commerce is only a $94B marketplace. He was right, that number is for March 2022 e-commerce, alone. It has been updated to read:

According to a recent Publicis Commerce report, retail was a $6.6T marketplace in the U.S. in 2021 and Publicis estimates e-commerce had roughly a 16% share of the U.S. retail market - a $1T marketplace, or a 6.25x difference. E-commerce’s share of retail is pacing 10% ahead of Publicis forecasts and, before the recent macroeconomic downturn, was seeing monthly sales grow year-over-year.