[Author's note: this week's Friday mailing is late because I am traveling.]

Yesterday The New York Times broke the news that YouTube plans to put its collective foot on the gas pedal for YouTube Shorts, its TikTok competitor, and will announce "more opportunities for content creators to earn money on its video service" in a new YouTube Shorts Partner Program.

There were two aspects to the program that stuck out to me based on past PARQOR essays:

YouTube "plans to let more video creators earn money from the platform, lowering the barriers to entry for its partner program",

YouTube will bring ads to Shorts but will only pay 45% of the money to Creators, which is less than the 55% they pay to creators in their Partner Program.

Even if for short format content, it seems like YouTube is doubling down on its advantages over legacy media streaming services.

Lowered Barriers to Entry

A point I frequently make is that Jimmy Donaldson aka MrBeast and 2MM other content creators in YouTube's Partner Program worldwide (and growing) are competing for the same audiences as legacy media companies across Connected TVs and smartphone screens worldwide. And, they are finding wins with an approach of faster and cheaper productions that also are high quality.

There is an ongoing debate across the advertising and production marketplaces about how the market defines premium content. Donaldson and the Partner Program is actively flipping and evolving the definition of premium content, as are TikTok creators.

Amjad Hanif, YouTube’s vice president of creator products, spoke to The Verge today to offer marginally more details on how YouTube is lowering the barriers:

YouTube’s also trying to make it easier for creators to monetize on the platform, especially those who haven’t yet hit the bar — 1,000 subscribers, and either 10 million Shorts views in the last 90 days or 4,000 longform watch hours overall — to get into its Partner Program. The company is introducing a new tier through which creators can get to features like the Super Thanks tipping option and paid channel memberships without being part of the ad program. Hanif won’t say the exact requirements for that tier except that it would be much lower than the existing ones. “And so, a lot of creators earlier in their careers who have taken a little bit longer to join the program will be able to join much earlier,” he says, “and start getting a paycheck much sooner than they were in the past.”

Hanif told The Verge he expects to grow the creator base in the partner program by 50% to 3MM by the end of 2023.

Shorts on CTV

There's an important detail not mentioned in either story that emerged last month: YouTube is going to support YouTube shorts within its smart TV app. So putting the two and two together, YouTube is expanding its inventory of content for advertisers across mobile and connected TV devices.

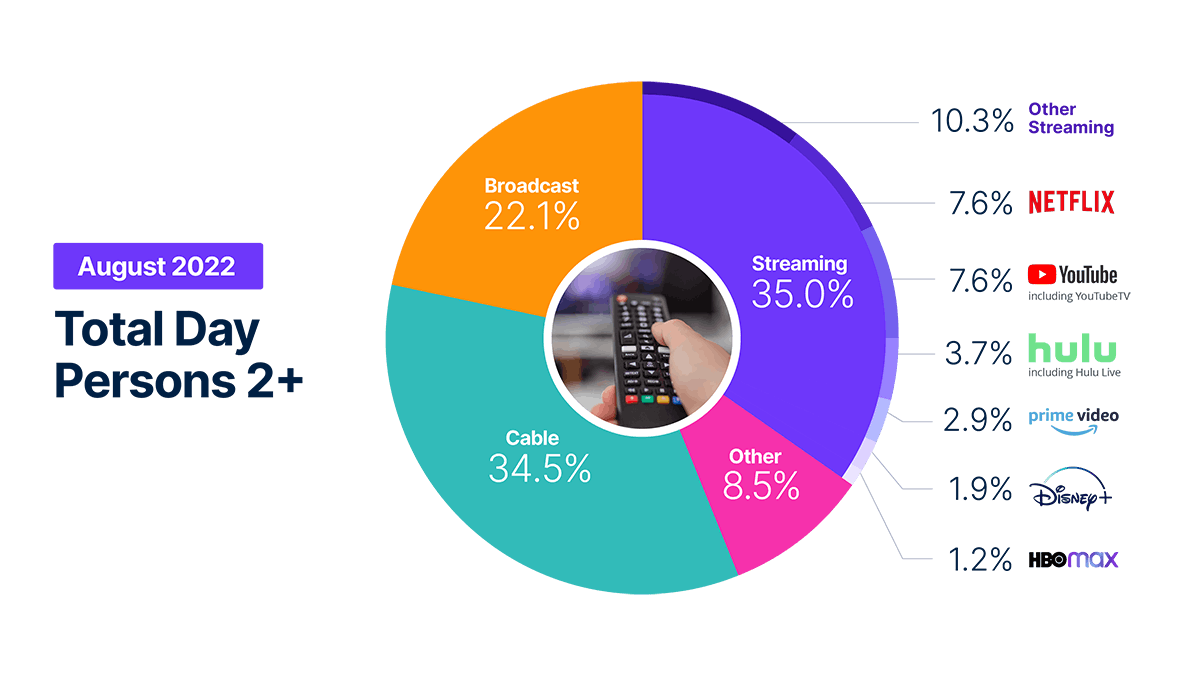

Netflix already competes with YouTube for attention on CTVs - according to Nielsen's most recent The Gauge they were neck-and-neck in August 2022 (and YouTube is on 135MM CTV devices in the U.S.).

YouTube seems poised to capture more valuable CTV and streaming ad dollars with "premium content" at a time when Netflix and Disney are trying to build a story for advertisers at a smaller scale. It does not appear to be a game where YouTube is winning at their expense, yet. But Shorts has 1.5B monthly users and it is positioned to compete on TVs, immediately.

45/55 split

Hanif explained to The Verge that the flip of the revenue share with creators from 55/45 to 45/55 in Shorts, only, partially reflects a payment for the music used on the platform. It will allow creators to use anything in the library without worrying about rights.

The YouTube Shorts Partner Program has not figured out how the revenue share will work yet - Hanif told The Verge YouTube will split the revenue from total ads served across a number of videos and distribute it to each of the video creators - and it has yet to define a view.

The implication is that both objectives are secondary to the primary need in the marketplace: "Advertisers want to know what users actually watch, [Hanif] says, and so do creators."

Comcast, Peacock & Hulu

The story reminded me of something I wrote about last month called “The Netflix Paradox”, “'The Office' Paradox” or “The YouTube Paradox”. The value of IP is fragmenting across platforms, new generations “consume their art by algorithm”, and YouTube’s algorithm seems to drive the most impactful engagement with audiences, new and old.

I think there is the argument to be made that YouTube has supercharged its value for building fan bases of IP with this move into Shorts in a way that's even more detrimental to legacy media streamers. Because more creators being paid will lead to more premium content on Shorts, and more consumption of Shorts will lead to more consumption of older IP like "The Office" via Shorts instead of Peacock.

YouTube users' need for platforms like Peacock will only decrease in that instance. For people were wondering why Comcast's Brian Roberts told the Goldman Sachs Communacopia Conference that if Hulu was for sale - which he described as "a pure-play, fabulous, scaled streaming service" after he had sung the praises of Peacock - "Comcast would be interested". It was partially a negotiating tactic with Disney, but I think it could be argued it was also a warning signal about Peacock's inability to compete with platforms at a larger scale.

YouTube's Shorts announcement will only drive the knife of that reality into its competition.