PARQOR is the handbook every media and technology executive needs to navigate the seismic shifts underway in the media business. Through in-depth analysis from a network of senior media and tech leaders, Andrew Rosen cuts through what's happening, highlights what it means and suggests where you should go next.

In Q4 2022, PARQOR will be focusing on four trends: this essay is on the trend of "Linear channels seem doomed. What happens next?"

I'm keen to connect with subscribers and readers on a free trial to learn more about you need from a subscription service. Click here to set up an appointment: https://calendly.com/andrew_parqor/30min

[Author's Note: There was not a Member Mailing on Wednesday because while editing, it became clear the essay simply didn’t work. I have since figured it out and below it is today’s mailing.]

Also, a quick note regarding the new details about Netflix’s “Basic with ads” tier, which otherwise would have been the topic of today’s Friday mailing: As we’ve seen with other initiatives like gaming and interactive video, Netflix starts conservatively and evolves iteratively. That said, ~60% of all Netflix subscribers watch kids and family content every month, and kids content is the hardest to monetize with targeted advertising due to The Children's Online Privacy Protection Act of 1998 (COPPA).

So, I imagine any upside to Netflix’s business from advertising most likely will come from the broader bucket of family content, and less likely will come from kids content until it solves for its COPPA-related pain points (which also exists on YouTube).

Next week Netflix will kick off Q3 2022 earnings for media. Even if there is no rhyme or reason to public markets right now, cord-cutting continues to be a very real and getting real-er trend: one estimate found that overall pay TV subscribers fell 6.1% in Q2, and lost 1.95MM customers in the quarter. Cable network affiliate fees are flat to possibly negative, and they’re the bread of the “bread and butter” of legacy media cable businesses (the butter being advertising). Recent research from MoffettNathanson senior analyst Craig Moffett also estimated AMC Networks affiliate revenues are down 7%, reflecting declining demand for its networks and content in particular.

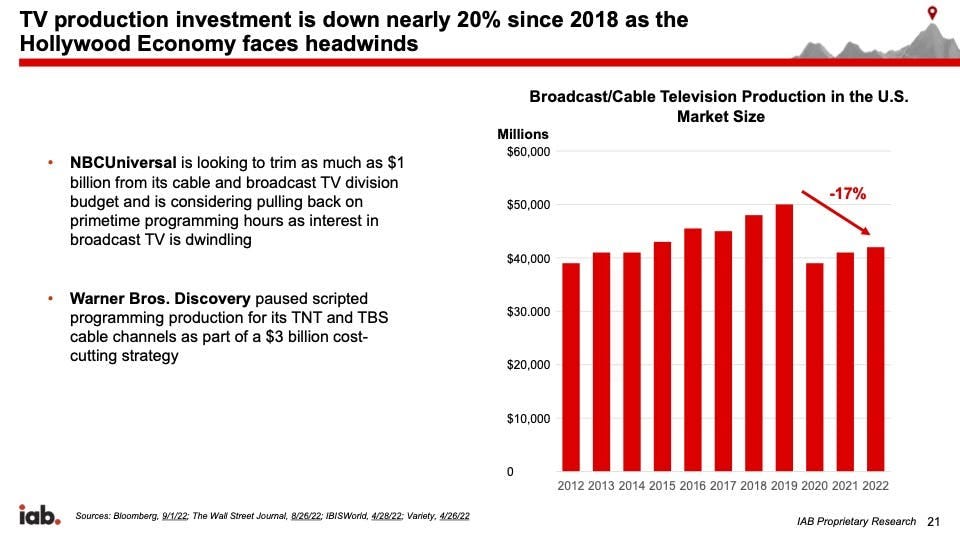

Last week I mentioned the scenario of AMC Networks disappearing from linear distribution due to a lack of demand. We won’t know until early November how it weathered Q3 2022, but odds are the story will be one of decline, and therefore we’re incrementally closer to its linear business “disappearing”. That dynamic was summed up elegantly in a presentation at the IAB Brand Disruption Summit 2022 by Chris Bruderle, IAB’s Vice President of Research & Insights,

The other trend worth noting lately is the promise of more blockbuster game titles by 2030 from the likes of Electronic Arts (EA) and Sony PlayStation Studios. Because, as I noted last week, as gaming production ramps up for larger gaming audiences, those resources will compete for visual effects (VFX) editors schooled in Unreal Engine and the Unity VFX platform.

The point is not that AMC Networks’ loss may be EA’s gain by 2030 - though AMC’s “The Walking Dead” series and its spin-offs do rely heavily on VFX, so that dynamic will play out in some form or another. Rather, the point is that the decline of AMC Networks and the end of “The Walking Dead” series (Sunday November 20th) will start a trend that will put a lot of post-production talent back on the market, and some in demand from gaming's growing ambitions with Gen Z and Gen Alpha.

These two clear signals of decline (linear) and growth (gaming) are interdependent, but they also imply some uglier dynamics hiding beneath.

Key Takeaway

Linear and film production's decline seem to be the gaming world's gain in Visual Effects. However, the clarity of those signals hide a messier story.

Total words: 1,500

Total time reading: 6 minutes

Gaming

The transcript of EA CEO Andrew Wilson’s recent appearance at the Goldman Sachs Communacopia + Technology Conference is a must-read primarily because it lays out what gaming in 2030 could look like. Because he shared some big numbers and projections for exponential growth.

First, EA currently has a player base of 600MM and growing who engage with EA one-and-a-half hours per day “playing games and connecting with their friends”, on average. Wilson stated the long-term objective is “1 billion people engaging in-game and out of game and you’re getting 2, 3 hours a day”, which “unlocks tremendous opportunity” for EA on a 10-year time horizon.

Second, EA envisions Gen Z and Gen Alpha as “an audience that will represent 4 billion people by 2030 and 45% of the workforce and have tremendous buying power.” So Wilson framed the challenge as “as we think about that across our sports businesses, as we think about that across our owned IP or our licensed IP business, what are those things that we can bring into this ecosystem and really use our games and these global online communities as platforms for engagement.” The solution is great IP and more franchises that” represent greater global communities”.

PlayStation Studios chief Hermen Hulst echoed this business logic in a recent interview with Axios, which is now in a new console cycle with the 2020 launch of the PlayStation 5, Sony has also begun expanding into PC and mobile development. Hulst is located in Amsterdam, from where he coordinates the work of ~4,000 developers across 19 studios from Japan to California.

He shared with Axios that they currently have 12 “live ops multiplayer”, or live service games, which “are usually multiplayer and designed for years of post-release content that can generate additional revenue”. It will also continue to invest in its core strength of narrative-driven single-player games, like “The Last of Us”, “Horizon” and the upcoming “God of War Ragnarok”. “The Last of Us Part 2” recently sold over 10MM copies.

So, the takeaways from the above is two-fold:

Over the next decade Gen Z and Gen Alpha are an enormous and growing audience increasingly going to be engaging primarily with online multiplayer games and popular IP; and,

In order to capture that audience, major gaming companies like EA and Sony Playstation are going to be producing more original titles.

There is also an implicit takeaway: streaming services betting on fantasy, comics and other VFX-heavy genres will keep VFX artists high demand. So the ambitious objectives of EA and Sony, alone, are poised to have negative impacts in streaming.

This dynamic is already playing out, according to Axios: “Numerous investigative reports about the industry in recent years described overworked developers “crunching” long hours to an unhealthy degree, including at flagship Sony studio Naughty Dog.” A similar dynamic has been playing out with Disney’s Marvel, with whom some VFX artists refuse to work with again, and Disney+ She-Hulk, which suffered from obviously sub-par VFX (enough so that it joked about them in its recent season finale).

Connecting the dots….

As reflected in this slide from the IAB presentation, film production rates and theatrical attendance are going down, too:

There is also a consumption shift playing out in homes that was evident at this year’s upfronts. Variety’s Brian Steinberg highlighted in “TV Shows Take a Back Seat as Upfronts Focus on New Ad Tech”: “The networks seemed like they were trying to prove they had sheer tonnage more than they did sustainable programming concepts”. That was unusual for upfronts, which historically have relied on talent and shows as the value proposition for sales. So, not only are there fewer original TV and cable productions, but these productions have increasingly less value to audiences and advertisers.

There is a generational shift at play here, too. Games have more value to Gen Z and Gen Alpha because 9 in 10 Gen Alpha and Gen Z are game enthusiasts, according to recent research from NewZoo. Also, as EA’s Andrew Wilson laid out, they will be over 50% of the world’s population by 2030. The demand for VFX and gaming production resources to produce more titles will trend northwards as we head towards 2030. One likely source of additional talent to help this market will be VFX artists who no longer get work from cable and linear networks.

A market dynamic with little data

The problem is, despite these clear signals of the trends, there’s no dashboard of the data for these trends nor is there much publicly available data: A senior studio executive recently complained to me about the lack of pricing transparency for him to evaluate post-production studios.

Almost everything I’ve learned to date is from conversations with executives in the space. One subscriber with a Visual Effects business shared with me post-production in TV and film is a $150B marketplace and $140B goes to third parties. According to one recent estimate, VFX is ~20% of that at $26.3B.

I also spoke to a head of corporate development at one of the major studios as a follow-up and he pointed out that the post-production marketplace is “an 8x8 matrix” of various services and businesses within them. So picture editing, sound editing, sound mixing, and color correction are all examples of niche post-production marketplaces which will be impacted by AMC Networks’ decline. Unlike VFX, not every sub-market will find new-found demand from gaming.

A problem of transparency

This all reflects the ultimate problem:

We have two very clear signals from two different marketplaces to play out over the next 10 years;

There’s an obvious overlap between them with the growth of adoption of Unity and Unreal Engine platforms in both gaming and TV productions;

And therefore, even if opportunities for talent are fewer in linear and film, there will be more opportunities in gaming and streaming.

No one I’ve spoken to seems to be able to imagine how this dynamic will play out. It's too complex and they have asked for help. Part of the dynamic is demand from gaming companies like EA and Sony is positioned to hoover up VFX talent abandoned by TV and film. But, that hasn't happened yet. The other part of the dynamic is more available post-production talent for declining TV and film marketplaces. Streaming should be positioned to pick up that talent, but it may not always.

Multiple executives have told me that the VFX market is the one most on everyone’s minds because VFX artists require 10 years of experience to be hired in film and TV. So, when there are fewer VFX artists because they’ve been hoovered up by gaming companies, there is no immediate supply of experienced VFX artists to replace them. That outcome of a supply of inexperienced artists will hurt both gaming and streaming.

In short, the obvious story is that the decline of AMC Networks and other linear channels is about to set off a messy set of market dynamics that we won’t have much insight into, nor will we be able to track their impact (NOTE: though I think we are seeing this play out in continued delayed movie release dates, including Marvel’s recently announced delays this past week).

The clarity of the signals from the gaming marketplace are a too-easy answer for a complicated dynamic in post-production. We will learn more about what the decline of linear in Q3 will look like, and maybe that will help to fill in the bigger picture. But we'll still have very little insight into a post-production marketplace getting squeezed by these two dynamics, and that's a warning signal for the next decade.