A reminder that this week’s schedule will be:

Wednesday: Insights from PARQOR's Four Trends for Q4 2022, and

Today: Key trends I’m considering for Q1 2023.

My predictions for 2023 are scheduled to be published in The Information next week.

The four trends at the heart of PARQOR mailings in Q4 2022 were the product of conversations and research throughout 2022. They are a narrower way of looking at the marketplace than focusing on a broad and dynamic concept like “the streaming wars”, but the exercise ends up being more focused, richer in details and therefore more rewarding.

The one trend I wrote the least about was “There is no such thing as a CTV household, what happens next?” As I wrote on Wednesday, I thought that story would be dynamic. There were angles I was hoping to see — like evidence of advertising spend shifting from Connected TV to smart audio — and I never saw any evidence of those happening. It doesn’t mean those things are not happening, but the signals are harder to find.

The only concrete signals I found? National Public Radio and Edison Research found that 35% of Americans 18 and older now own a smart speaker. Also, Amazon had an estimated installed base of 110M smart speakers across North America in 2021, and Google is estimated to have less than half that. The compound annual growth rate (CAGR) for smart speaker annual shipments in North America is forecast to be just 1.3% for 2021 to 2026, according to research firm Omdia.

So, the trend may be directionally right, but it’s not an obvious story. In 2023, it may be worth keeping an eye on if/when that shift is happening, but not writing more until there is more evidence.

Below are other trends and follow-ups to Q4 2022 trends that I will be considering over the holiday. I will announce the three or four themes for Q1 2023 in early January.

Wishing Happy Holidays to you and your families!

Total words: 1,300

Total time reading: 5 minutes

1. Media companies have millions of consumer credit cards on file, it’s an asset, so now what?

Say what you will about the shortcomings of legacy media’s efforts to take on Netflix, but they end 2022 with databases of millions of credit cards. Disney has hundreds of millions of credit cards. That is a competitive advantage that legacy media companies have never had before.

Media companies are headed into recessionary headwinds and advertisers pulling back spend on linear. Even if Connected TV (CTV) spend is going up as linear goes down — the IAB projects CTV spend will go up 14.4% as linear declines by 6.4%, while GroupM envisions the growth in Connected TV to “more than make up” for the decline in linear.

So the question will be, when ad revenues decline further where will marginal revenues come from? Some answers lie in flywheel-type models built off of those databases (See: Disney Prime). But the other answers are less clear.

As for Customer Data Platforms (CDPs), which enable business models built upon a centralized consumer database, I think their business logic has always been a helpful reference point for how a streaming business could evolve. But, as I wrote in September: “having one database for all consumers doesn’t necessarily translate into revenue growth or operational clarity”. Meaning, solutions like CDPs exist but that doesn’t always mean that an organization can rebuild itself around one.

I think that's true for legacy media companies: they have the asset of a database, but they may not be agile enough to evolve.

2. Who are YouTube’s 0.01% of creators?

This trend in Q4 2022 was “Hollywood’s future lies in the creator economy, what happens next?”

Generally, I think the tide is turning YouTube’s and TikTok’s way because advertisers are beginning to understand that there is “premium” content on both platforms, but more importantly, there are enormous audiences at scale (2.5B monthly active users on YouTube, and over 1B on TikTok).

On YouTube the question is, after Jimmy Donaldson aka MrBeast, are the 0.01% of top earning creators also able to deliver hits? Are there 2,000 of them?

Despite what I wrote last week, I’m becoming less sold that 2,000 exist. With advertisers looking to shift spend away from linear, the burden will increasingly be on YouTube to tell that story better than it has through its blog or the Streamy Awards. The story may not be as tight as YouTube would like it to be.

3. "A constellation of small flywheels" in the tradition of Walt Disney

This quote popped up in my recent Twitter conversation with former WarnerMedia CEO Jason Kilar, and it was from The Recount COO Markham Nolan. It’s the hypothesis of The Chernin Group’s $100MM investment into Night Capital, a joint venture with MrBeast and his management to help other YouTube and TikTok creators to build out their own flywheels of media, commerce and community.

The premise is that platforms enable ecosystems around the creator where media and community can drive commerce (and advertising falls into the mix, too).

My favorite legacy media example of this is Sony’s anime streamer Crunchyroll, which we publicly know very little about since its $1B acquisition by Sony last year. However, private conversations I’ve had suggest that it’s doing quite well.

I think we’re seeing the architecture of post-legacy media business models emerge within companies at a fraction of the scale of legacy media businesses, and I think we’re going to learn more about them in 2023. Whether those businesses are viable or scalable when facing recessionary headwinds is an important question in 2023. Because if they are the future of media, they're worth following more closely.

4. Is scale a solution for Disney?

I frequently read or hear that Bob Iger has returned as CEO to make Disney bigger. But what existing pain points would Disney solve if it was larger?

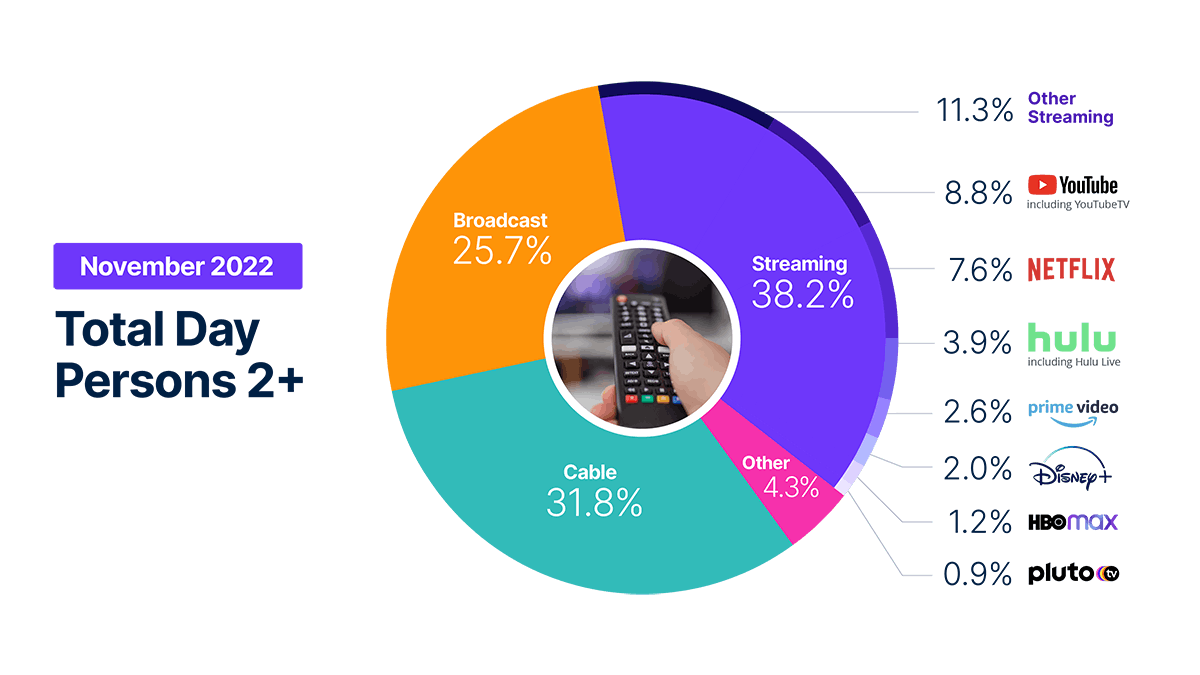

Perhaps it would have more content to compete with Netflix, which has 5,000 to 7,000 titles in its library. Nielsen’s The Gauge for November 2022 has Netflix at 3.8x the consumption of Disney+ (and Netflix says the majority of content consumed on its platform is Kids & Family. YouTube at 4.4x the consumption of Disney+.

Consumption of YouTube and Netflix has continued to grow month-over-month as a percentage of streaming consumption while Disney Plus has remained flat.

So it's not clear how Disney+ getting bigger — meaning, merging with another media company with a streaming service — changes that other than changing the total percentage of consumption in a month and perhaps expanding the Disney+ bundle beyond Star, Hulu and ESPN+.

As I wrote last month, “YouTube and TikTok have rapidly iterated their products to favor creators and audience engagement with their favorite creators. Disney may never catch up.” Audiences have been trained to expect more than a lean-back experience, but that’s in essence what Disney+ is.

How will Disney compete with Cocomelon (owned by Blackstone’s Candle Media, which was founded by former Disney presumptive heirs Tom Staggs and Kevin Mayer), which has 149MM subscribers on YouTube and also dominates the Nielsen charts regularly on Netflix? How will Disney+ compete with CocoMelon’s flywheel business within YouTube when Disney+ doesn’t offer similar engagement or Direct-to-Consumer shopping within its app?

But, it’s not just that. YouTube and TikTok offer a never-ending supply of product from new and newer creators, and their algorithms offer a way of getting that supply in front of as many consumers as possible who might like it. New content on Disney succeeds based on how Disney well markets its series and movies, but new content on those platforms succeeds based on a wide variety of variables that includes the algorithm and community engagement.

The dynamics may not be win-lose for Disney (yet) but the reality is that Disney+ has gone from visionary to dinosaur business in 36 months. I’m not sure how Iger solves this one, because getting bigger won’t change it.