Friday Mailing: Netflix Tackles Audience Fragmentation With ""The Most Exciting Entertainment On Earth"

PARQOR is the handbook every media and technology executive needs to navigate the seismic shifts underway in the media business. Through in-depth analysis from a network of senior media and tech leaders, Andrew Rosen cuts through what's happening, highlights what it means and suggests where you should go next.

In Q4 2022, PARQOR will be focusing on four trends. This essay focuses on the themes, "Media companies have consumer credit cards on file. What happens next?"

After the appearance of Co-CEO Reed Hastings at this week’s Dealbook Conference, Netflix now seems to have two value propositions to investors:

Its investor relations website says its long-term view is “streaming entertainment is replacing linear TV”; and,

Hastings’ told the Dealbook Conference that “We want the brand to be the most exciting entertainment on earth, and where you want emotional stimulation. And for us that is around films, series and games”

Games and streaming movies and TV series over the Internet are two very different value propositions. The first has been the long-running and ongoing paradigm shift away from traditional linear and theatrical distribution channels. Until recently, it was a value proposition that had investors excited about the future of media companies with streaming services: Netflix’s enormous scale and the enormous scale of the Internet reflected the exciting potential for the future of movies and TV.

To date, investors have soured on that vision, though as of late they have soured less — as of today, Netflix’s stock is down 46% year-to-date after being down as much as 70% year-to-date. It is up nearly 13% over the past three days. This all raises an interesting question: is Netflix’s “new” vision statement working? Are investors warming up to games and a broader value proposition of “the most exciting entertainment on earth”?

In other words, when the value proposition of streaming fails to win over both investors and the Total Addressable Market of consumers, what is a better value proposition? One that is as simple as the linear model (profitable distribution at scale), or a more Internet-focused vision of “streaming entertainment is replacing linear TV” that includes gaming?

Key Takeaway

What will be the media business models around “exciting entertainment” and “beloved characters in worlds” that can solve for fragmentation of audience behaviors? No one has any good answers for investors, yet.

Total words: 1,700

Total time reading: 7 minutes

The problem with games

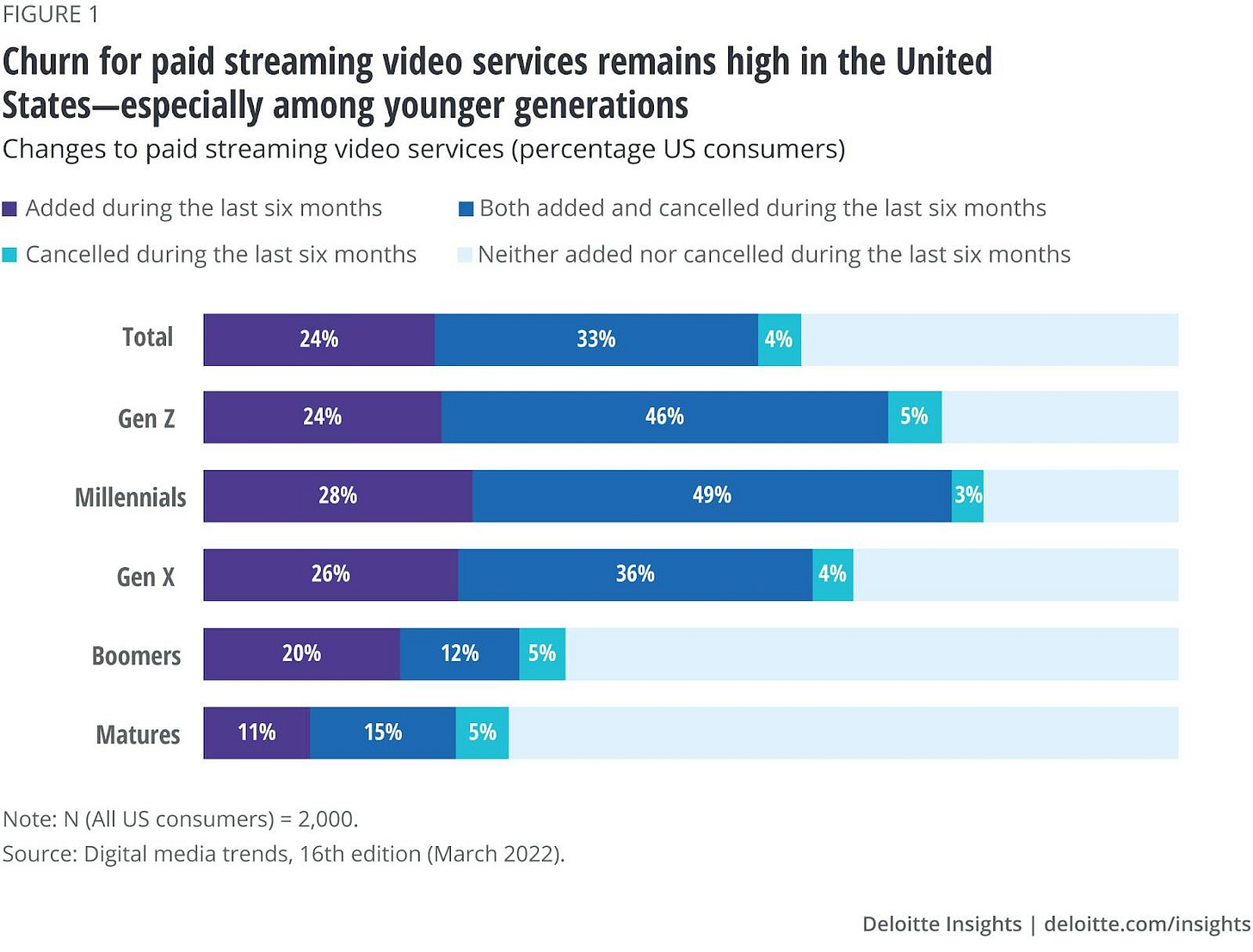

Games are complicated both as a value proposition and as a business. The upside of games is that for a streaming-only business like Netflix, it’s a must-have value proposition to capture more audiences. Deloitte’s 16th annual annual “Digital Media Trends” survey found that younger generations of audiences are more prone to churn out from paid streaming services.

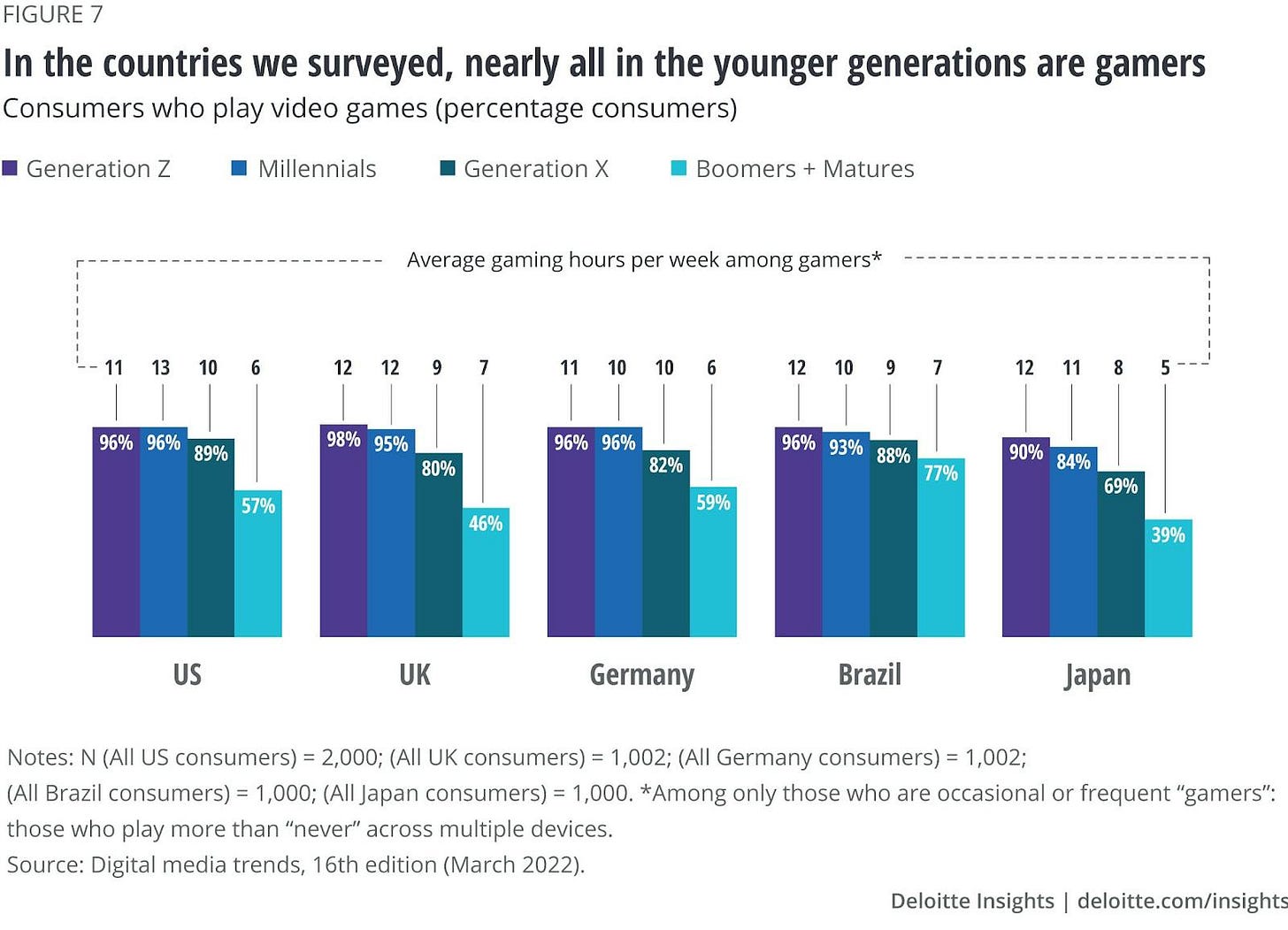

It also found that nearly all younger generations are gamers.

So, to keep growing with a new generation of younger audiences, games seem like an obvious win for Netflix. But Netflix's value proposition is currently a bit convoluted and much less clear than “pay a subscription fee to watch and/or download series and movies across all your devices”.

Netflix’s value proposition for games is that they are only mobile and only can be downloaded and played outside the Netflix app. The Netflix mobile app links to the app store of the device, where the user can download the game and get exclusive access with their Netflix account. So, a Netflix game is not “streaming entertainment” as a value proposition.

Netflix’s sales hook for its model is no in-app purchases and no advertising. As a business, mobile gaming typically relies on hits, within which it relies on its heaviest spenders and in-app advertising (we learned in the Epic v. Apple trial that high spenders in mobile gaming accounted for less than half a percent of all Apple accounts in 2017 but generated 53.7% of all App Store billings for the quarter). So the only upside to Netflix from a "hit" game will be more subscriptions, and no marginal revenues.

“Beloved characters in worlds”

Back in March, I wrote about “WarnerMedia & Netflix's Narrow but Fascinating Challenges in AVOD & Gaming”, where I highlighted a podcast interview between then-WarnerMedia CEO Jason Kilar and Recode’s Peter Kafka. Instead of “entertainment” as value proposition, Kilar talks about “beloved characters in worlds”:

...the biggest opportunity in storytelling is to pursue a strategy that we have and let me explain what I mean by that. Which is, if you’re going to invest a lot of upfront capital in creating beloved characters in worlds, I think it’s only natural if you have the capabilities and if you have the skillset in terms of leadership and talent to be able to lean into telling those stories, both in a linear fashion with narrative storytelling but also an interactive fashion with gaming. And so we happen to have that conviction, we happen to have that skillset - both at the leadership level and at the software developer level. So we're able to do it and we're able to do it with confidence and high judgment. Very few companies on the planet or in that position because gaming is hard to my earlier point and it’s not for the faint of heart.

Kilar also noted in the same interview that, like Deloitte, WarnerMedia was seeing that “a lot of people” turn to gaming as their “first go-to choice when it comes to entertainment”.

WarnerMedia’s answer prior to the Warner Bros. Discovery merger was to build out HBO Max – which hosts and streams Warner Brothers IP – and also build out gaming so that it could offer its “own immersive persistent environments” where “beloved characters are in Warner Brothers games” and not in other companies' games.

As a value proposition, it’s both broader and narrower than Netflix’s. It is broader in the sense that it aims for “immersive persistent environments” as its gaming business models, and is aiming for multiple business models. It is narrower in that it focuses on “beloved characters in worlds”, either on TV or in games, and building a business that charges access to those characters and those worlds.

The best story for media investors in 2023?

Both Hastings and Kilar are attempting to offer a simpler explanation of what the value proposition of a media business model is to both investors and consumers. Now that linear TV is no longer able to offer the scarcity of audiences aggregated in the tens of millions or even the hundreds of millions, and now that streaming no longer seems to be the dominant alternative for consumers, how will media businesses scale and make money?

Hastings’ answer is Netflix will scale by offering "the most exciting entertainment on earth”. Whether this ultimately will win back investors is TBD.

As for Warner Bros. Discovery, its new management team no longer talks about games or beloved characters, and happily will trash Kilar and his team’s strategy to anyone who will listen. But for the sake of argument, if Kilar and his team were still around, would the angle of storytelling about “beloved characters in worlds” across media be a “good” story for investors?

I don’t believe Kilar's turn of phrase was intended as a mission statement with investors — I never saw it show up anywhere after the podcast interview. But, its premise was that in a fragmented media marketplace, a media company's value proposition is beloved characters and IP, and audiences will pay to access and engage with beloved characters and IP across mediums. The better WarnerMedia was at becoming a single destination for those, the better off its streaming and gaming business models would be in the long run. This is, in essence, the Disney business model (though, notably, Disney licenses its IP to third parties for gaming and WarnerMedia was aiming to keep them in-house).

Netflix has struggled to build its library of IP even as it finds itself “duking it out” with Disney over the long run in streaming, as Hastings told the Dealbook Conference. It has found success with Stranger Things and Bridgerton, and it's betting on Matilda the Musical from its Roald Dahl library acquisition, which will be released next Friday. But otherwise, it has had difficulty creating both beloved characters and worlds that audiences want to engage with across media. Its gaming initiative is in the early stages and, as Hastings suggested to the Dealbook Conference, the ambition in gaming is long-term: “Talk to us after we’re a big leader in games. We have a lot of investment to do in games.”

The WarnerMedia strategy points to an important question: if Netflix can’t build a library of IP and beloved characters (MGM TV owns the IP rights to The Addams Family franchise, so it doesn’t own its recent hit “Wednesday”), then how will Netflix's business model succeed with games in the long-run?

A value proposition for fragmentation?

It has been easy to fear for the future of legacy media companies as cord-cutting declines because there are two profitable line items, affiliate and advertising revenues, that are in decline. If they decline, then operating income declines and the business has less cash to reinvest in its future. Similarly, as theatrical attendance drops, there are few profitable hits to add a cushion to operating results.

The question now is what the media business models will be around “exciting entertainment” and “beloved characters in worlds” that can solve for fragmentation of audience behaviors. Netflix’s is simple: a single subscription fee solved. WarnerMedia’s was more complicated: a mix of subscription (HBO Max) and in-app purchases (“Multiversus”, its immersive persistent environment game that had reached over 20MM total players as of August 2022) alongside theatrical and TV.

But neither of these offers a compelling answer to fragmentation. It may be that we’ve reached a moment where the promise of the extraordinary, global Total Addressable Market of the Internet is still attainable for media companies, but scale requires multiple paths and not just one path.

That's a complicated story to tell investors who are used to [affiliate revenues] + [advertising revenues] = profit. It's still not yet clear what the new business model paradigm for media is, or if it's here, the largest players still don't have a good description of it yet.