PARQOR is the handbook every media and technology executive needs to navigate the seismic shifts underway in the media business. Through in-depth analysis from a network of senior media and tech leaders, Andrew Rosen cuts through what's happening, highlights what it means and suggests where you should go next.

In Q4 2022, PARQOR will be focusing on four trends: this essay is on the theme, "Hollywood’s future lies in the creator economy, what happens next?”

Also, my newest monthly opinion piece on The Information is now live: “YouTube and TikTok Creators Are Tearing Up Netflix’s Streaming Rulebook”. I argue as Netflix readies its Basic with Ads tier, it’s staring down an existential threat from the likes of TikTok and YouTube, whose “premium” creator content competes for the same advertiser demand.

I think there are two truths to the streaming media business that aren’t discussed enough: software and user interface (UI)/user experience (UX) matter more and libraries matter less than media companies and investors believe.

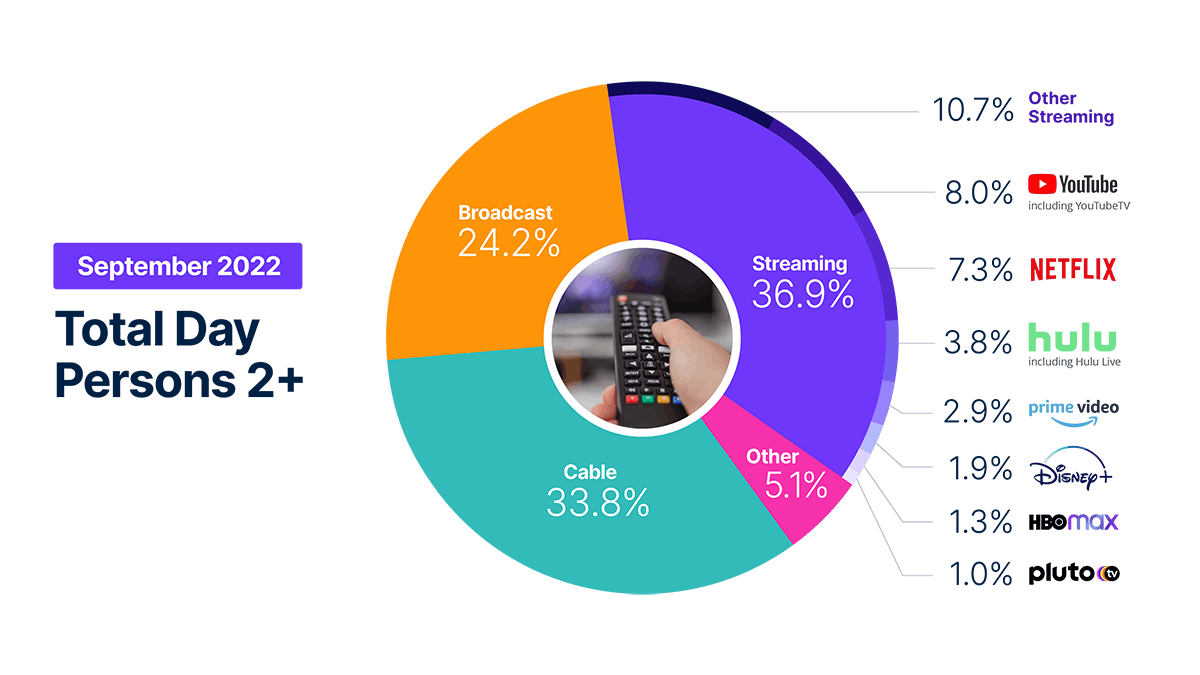

I think these both played out in Nielsen’s The Gauge for September 2022, where Pluto TV surprisingly emerged as one of the most streamed services on TVs. It’s the first Free Ad-Supported TV (FAST) service to land in Nielsen’s The Gauge, and it captured more viewing time than Paramount’s paid subscription service, Paramount+, NBCUniversal’s Peacock, and other niche streaming services.

What’s also notable is how every service above Pluto on this chart offers some degree of personalization. In fact, I would argue that if we asked executives in the streaming space to rank the quality of personalization of each service, I think the survey ranking would come out in this order. The only tweak would be moving HBO Max above Prime Video and Disney+ - the home page personalization is something they have invested in for the past two years and, subjectively, I think it is very good (Disney+ has invested more in recommendations for what users watch next).

Also notable is how every service that are not on the list also do not have competitive personalization algorithms (e.g., AMC+, Starz).

Key Takeaway

Pluto TV is free, it scales, its pay-per-performance business model is closer to YouTube’s and TikTok’s… and it creates value for both its older libraries and third party libraries that streaming’s business model destroys.

Total words: 1,300

Total time reading: 5 minutes

But Pluto takes the familiar format of an electronic programming guide (EPG) – where content sits “cheek by jowl” and fills its with hundreds of individual channels of Paramount-owned content and third-party licensed content. It has long bucked the trend of streaming interfaces that either rely on personalized recommendations or do not and instead demand much more hunting and pecking from the user.

Another way of describing this advantage is something IAB Executive Chairman Randall Rothenberg tweeted back in April: “because [FASTs and niche services] are live, they don’t force the viewer to commit to a choice; she can go back to being a white-noise-consuming, channel-surfing couch potato”

Now that Pluto has surfaced in Nielsen’s streaming ratings, it’s worth discussing some additional marketplace dynamics Pluto’s UX and Pluto’s business model reflect.

Pluto’s UX

Pluto’s UX/UI design of an EPG is purposeful, as ViacomCBS Streaming Chief (and Pluto TV Co-Founder) Tom Ryan told Variety's Andrew Wallenstein back in 2018:

Pluto is a free streaming TV service. It is instant, there is no friction… when we actually launched Pluto we didn’t ask for a sign up because we wanted you to be able to sort of experience that magic of turning on the TV through your web browser.

There is some customization - the user can save favorite channels that load instantly at the top of the EPG.

It’s also worth noting that YouTube and Hulu are scored by Nielsen for their “linear streaming” (YouTubeTV and Hulu Live, respectively) which also offer EPGs. According to Nielsen, linear streaming on MVPDs and vMVPDs represented 5.4% of total television usage and 14.5% of streaming in September. Users still love the EPG as a UX/UI, alongside the 85.1MM or so who have yet to cut the cord from cable, telco and satellite providers.

These all make one wonder whether the EPG is the only other UI/UX that will work in streaming beyond the algorithmically-driven UX/UI. Notably, Amazon, Roku, Tubi, and Peacock all have integrated an EPG into their UX/UI IN some form.

Pluto’s business model of library

Tom Ryan’s interview with Puck’s Matthew Belloni on The Town podcast this week highlighted an interesting business advantage of Pluto’s with an EPG. He argued: “If you can amortize the cost of content over a much larger group of users and hours than a smaller player can, and so when we go out and do an exclusive deal with a third party that’s not Paramount, we’re able to compete well we know we can get an ROI on that content better than some others can.”

Ryan is saying two interesting things about the economics of Pluto’s business. First, Pluto is able to get a higher ROI because of its scale (over 70MM monthly active users across 30 countries), which its EPG UI/UX helps it to achieve and for which it also helps to reduce churn, Also, implicitly, because Paramount has one of the TV industry’s best ad sales team (it’s less clear how competitive its in-house programmatic solutions are).

As for amortization, he’s saying that Pluto’s large base and high engagement drive more and perhaps longer term consumption of licensed content. So, the implication is that the EPG UI/UX helps to drive a better long-term consumption curve of content on Pluto than on other subscription, AVOD and FAST services. Regardless of the sales pitch spin, it’s an important point because he’s echoing licensing partner sentiments about ROI, and implying that Pluto keeps their library content valuable for longer.

Ryan also told Belloni that Pluto is a “capital efficient business model”. This reminds me of how Paramount CEO Bob Bakish describes Pluto's model to investors: Paramount doesn’t pay an actual license fee to third parties who build channels on Pluto - like AMC Networks which has suite of channels on Pluto (including a “The Walking Dead” channel) - but rather structures the licensing fee as an advertising revenue share. Effectively, it’s analogous to YouTube’s and TikTok’s models of pay per performance where the revenue share is based on ads served, which I highlighted on Wednesday.

The EPG technology is a sunk cost that has long since been recouped.

Two Takeaways

Pluto's success in Nielsen offers two counterintuitive takeaways.

The first is that it may be a mistake to conclude that the EPG, alone, is the key to Pluto’s success. Meaning, it obviously is a factor, but a “frictionless” UX/UI may be a better variable to explore here because it’s something that Pluto has in common with algorithmic recommendations on Nielsen’s list. Meaning, algorithmic recommendations are constructed to make streaming UX/UI “frictionless” as frequently as possible (but as churn rates reflect, they are not successful 100% of the time).

The second is that Pluto’s success comes at a time when legacy media companies are also licensing out library content as they build out their streaming services. Paramount generated $5.6B from licensing its content out in 2021, and those revenues were up 27% year-over-year in its most recent earnings. Last August, Parrot Analytics found that Paramount content accounted for 7.4% of the licensed catalog demand for Hulu, 24.8% for Amazon Prime Video, and 25.6% for Netflix.

Both suggest Pluto's business sits in an interesting grey area in the streaming marketplace: it can help to monetize Paramount’s library that is not being monetized on Paramount+, and it also can help to monetize third-party content libraries that are not being monetized on third-party streamers. Its market position and growing success adds some new color to my “The Netflix Paradox”, “'The Office' Paradox” or “The YouTube Paradox”: The value of IP is fragmenting across platforms, new generations “consume their art by algorithm”, and YouTube’s algorithm seems to drive the most impactful engagement with audiences, new and old.

The EPG still has the *it* factor

Pluto is starting to prove that this may not be always true, and that the EPG still has advantages over the YouTube and Netflix algorithm. That's great news for Paramount and Fox, both of whom are betting on the FAST model in the long run (NBCUniversal has Xumo, which is also an EPG and for which we don’t have much publicly available data).

But Pluto’s success in Nielsen also reinforces the shortcomings of Paramount+: specifically, its lack of a personalization algorithm makes most of its library undiscoverable for the average user, and therefore unintentionally kills the value of Paramount's library on Paramount+. Pluto preserves if not rescues that value.

Paramount management sells investors on the two working hand-in-hand – Ryan does so with Belloni on the podcast – but I think it’s now objectively clear that Pluto TV is the better streaming bet for Paramount in the long run. It’s free, it scales, its pay-per-performance business model is closer to YouTube’s and TikTok’s… and above all else, it creates value for both its older libraries and third party libraries that streaming’s business model destroys.