I have a new opinion piece up on The Information, "Netflix’s Best Advertising Bet Won’t Require Software".

I argue "Let the other streamers invest in precision-targeted digital ad delivery. The old network TV model may wind up being a better fit for the market leader."

It's an angle I had not considered in "Mark My Words, We Must Imagine Other Business Models for Netflix Than Advertising".

Going down the rabbit hole of Netflix's "less is more" approach to its business model - a ruthless focused on total subscriptions as its defining metric (now referred to as “members”) - the old network TV model of “non-targeted, highly limited, national advertising across very few breaks" is as simple a premium access model as one could imagine, and is more compelling than the complexities of ad targeting (which I still believe they won't pursue).

The Vibe Shift… “It’s All Happening”

In the middle of what has been an extraordinary week for the media news cycle (Netflix earnings miss, CNN+ killed off), a lawyer from Netflix’s APAC office posted my last opinion piece for The Information, “A Vibe Shift Is Brewing In Streaming”, and wrote:

The market's problem which Andrew Rosen describes in this article from a while back, is that no one really knows how to value a company like Netflix. Is it tech? Is it media? Is it something else? As the company branches out into gaming and maybe one day even more, the question of comps becomes an even harder one. Today the Street's decided that NFLX should be valued like an old school media business (IMO, wrong). Tomorrow - who knows?

It helped me to realize that the early signals of the “vibe shift” I had predicted are now gaining momentum. How do we think about these signals amidst the emerging chaos?

How will Netflix tell its story now?

To date, Netflix has driven a tightly-constructed narrative around a subscription model, only, and the objective of “we want to entertain the world”. Until the past two quarters, it has defied market concerns for its billions in debt that funded the content spending to pursue that objective. It was even able to weave gaming into that narrative, touting that its software would mean “no ads and no in-app purchases” in any games it hosted.

In January, Netflix Chief Operating Officer Greg Peters described games as part of a “huge, long-term multiyear” vision to create “interactive experiences” around its big franchises.

As Joe Flint of the Wall Street Journal reported:

Netflix executives said the company expects to continue to grow spending on content to more than $20 billion this year while scrutinizing it more closely. Ms. Bajaria said that doesn’t mean the service will go cheap on production. “We’re always going to make great shows and have the amount of money needed for the creator’s vision,” she said.

In other words, big franchises matter more now but the focus from investors and Netflix is now on spending. But Netflix seems to need more than reduced spending, as suggested by Co-CEO Reed Hastings’ admission that Netflix will need to pursue an ad-supported model.

Gaming is nowhere close to being a growth pitch to Wall Street. It’s too early to convince them Netflix is positioned to capture a percentage of a mobile gaming Total Addressable Market that is currently $100B.

In this light it is understandable that Hastings basically improvised a sales pitch for an ad-supported model:

“The online ad market has advanced, and now you don’t have to incorporate all the information about people that you used to. So we can be a straight publisher and have other people do all of the fancy ad-matching and integrate all the data about people.”

This actually doesn’t make any sense in practice, as I argue in The Information today. But, it’s a better answer than “please wait for us to solve for gaming”.

CNN+: The right experiment with the wrong management team

Let’s start here: I think the launch of CNN+ was very much a move that reflected the “vibe shift”. Meaning, I think it’s good, long-term business logic to begin imagining the post 24/7 linear news feed world and leveraging this moment in the marketplace to test those ideas out.

It was a lean start-up-type experiment - one that was trying to figure out the optimal value proposition for the CNN brand with cord-cutting consumers.

But, as CNBC’s Alex Sherman reported, it was not the kind of experiment that incoming Warner Bros. Discovery management was ready to stomach:

[Warner Bros. Discovery’s head of global streaming JB] Perrette told employees that once new leadership made the decision that CNN+ didn’t fit strategically into the company’s plans, the most logical move was to shut it down as soon as possible “and not a second longer,” two of the people said.

He also cited previous Discovery launches of niche streaming networks, such as Food Network Kitchen and GolfTV, and said the company has arrived at the conclusion consumers don’t want to pay more money for small services. While Warner Bros. Discovery will take streaming risks, it won’t undertake efforts where it already knows the end result, he said, according to the people familiar with the meeting.

The priority for WBD management is HBO Max (or whatever it is renamed to) as a single platform.

Maybe I’m giving the previous WarnerMedia leadership too much credit - though I think they have objectively earned it with their growth story for HBO Max - but I do think a lean start-up test makes more sense than lumping all content together.

There are two reasons:

A key objective of the CNN+ test was to gather learnings about the next generation of CNN viewers, and now those learnings are going to be lumped in with other learnings about unscripted content and news on the HBO Max app. I don’t think that’s a positive outcome.

A key weakness in Discovery’s approach to streaming has been a risk-aversion to owning the Direct-to-Consumer relationship 100%, and instead relying on third-party distributors like Amazon and Roku (and now Verizon’s Play+) Why not A/B test that with CNN+ and the team it inherited?

If my doubts existed about the incoming Warner Bros. Discovery team’s ability to run a direct-to-consumer were speculative before - as I wrote in Incoming Warner Bros. Discovery Leadership Meet HBO Max's Purchase Funnel - they seem to be reasonable now.

Are we discounting YouTube?

This tweet’s focus on UGC hit on a point that I argued in Why YouTube Sees Hollywood’s Future in the Creator Economy:

But when MrBeast can deliver higher returns and better viewing metrics with Hollywood budgets than the legacy media-streaming services can, that’s a wake-up call: The audience’s desires are changing, and creators are meeting those evolving desires while the services struggle to scale.

That point was about YouTube’s top-earning creator, Jimmy Donaldson, aka MrBeast, who posted a real-life version of Netflix’s “Squid Game” which he had produced on a $3.5 million dollar budget but released for free.

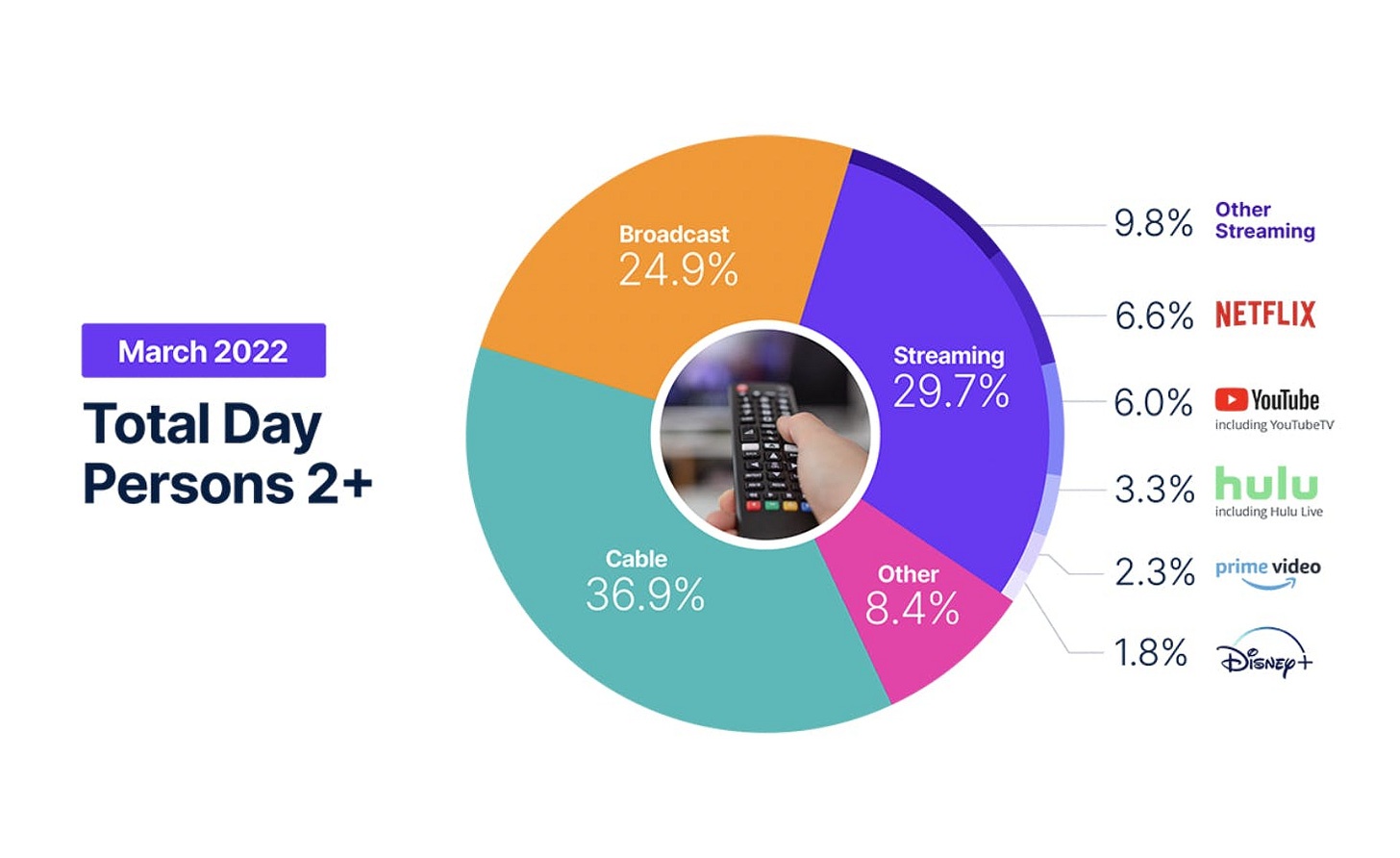

YouTube has always been a competitor to Netflix. Nielsen’s most recent Gauge for March 2022 showed YouTube up 0.3% month-over-month (MoM) to Netflix’s 0.2% MoM.

It’s a minor difference, it may mean nothing or it may mean something.

But, as we get closer to a YouTube Brandcast during this year’s Upfronts featuring “top creators and music talent”, which it earned from reaching 135MM people on connected TVs in the U.S., we have to start wondering whether Wall Street and the broader streaming marketplace simply have yet to fully comprehend YouTube’s success.

Assuming 2MM creators in YouTube's Partner Program globally, and assuming MrBeast's model puts him in anywhere between 0.1% and 1% of all creators, there are 2,000 to 20,000 creators now working towards figuring out how to produce content faster and better than legacy media and Hollywood studios.

Does this data reflect the “vibe shift” accelerating their momentum? It’s a question that increasingly demands answers after Netflix’s brutal quarter.