Good afternoon!

The Medium delivers in-depth analyses of the media marketplace’s transformation as creators, tech companies and 10 million emerging advertisers revolutionize the business models for “premium content”.

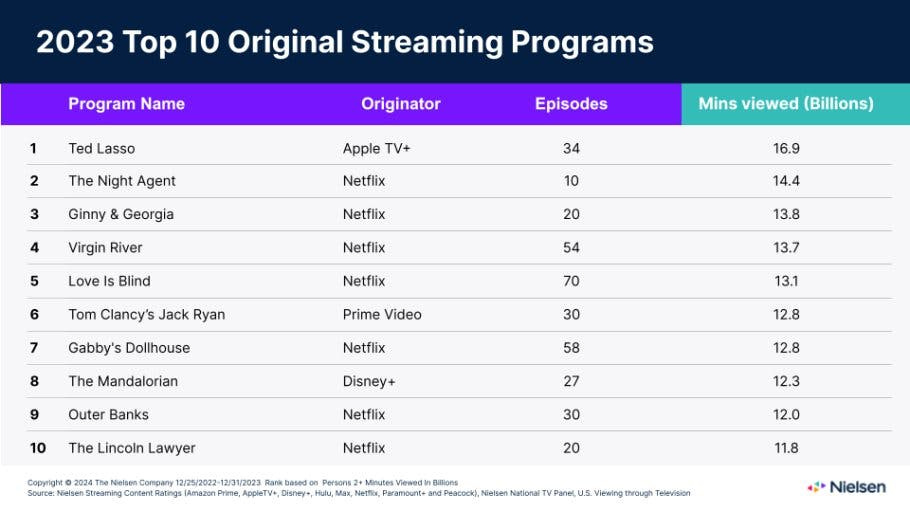

This week's Nielsen’s report US Streaming Video Top 10s for 2023 showed that legacy media streaming services and Apple TV are scoring wins against Netflix's dominance. “Ted Lasso” was the most-watched original program in the US even though Apple TV+ “has a smaller relative footprint than the other platforms”. But, as I argued in last October’s “Reconsidering Streaming's Subscription Models”, this competitive dynamic also implies that “subscription may be the wrong pricing model given these platforms’ challenges with streaming churn.”

That essay was built upon a surprising admission shared by Warner Bros. Discovery CFO Gunnar Wiedenfels at an investor conference: “too many viewers sign up for a streaming service for a low monthly fee, binge content for two or three weeks and then cancel.” Consumers paid a monthly fee for cable TV because it was a utility. But Max, Apple TV+, Disney+ and other legacy media streamers have struggled to establish themselves as similar utilities.

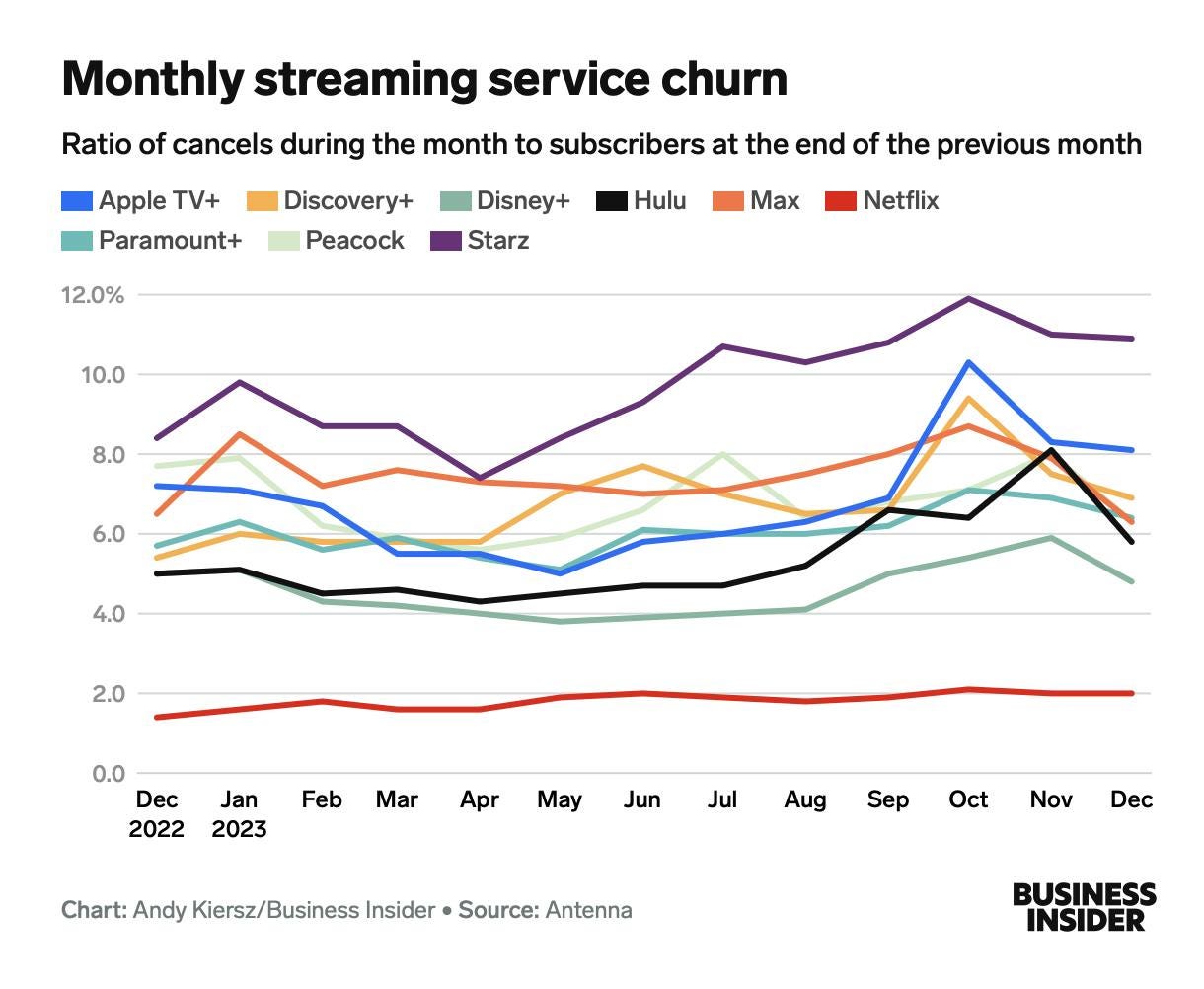

Antenna churn data from 2023 suggests that their monthly churn rates are all above 4%, suggesting that anywhere from 50% to over 100% of services' subscribers regularly churn out over a year. For Netflix, at 2% per month that figure is closer to 25%.

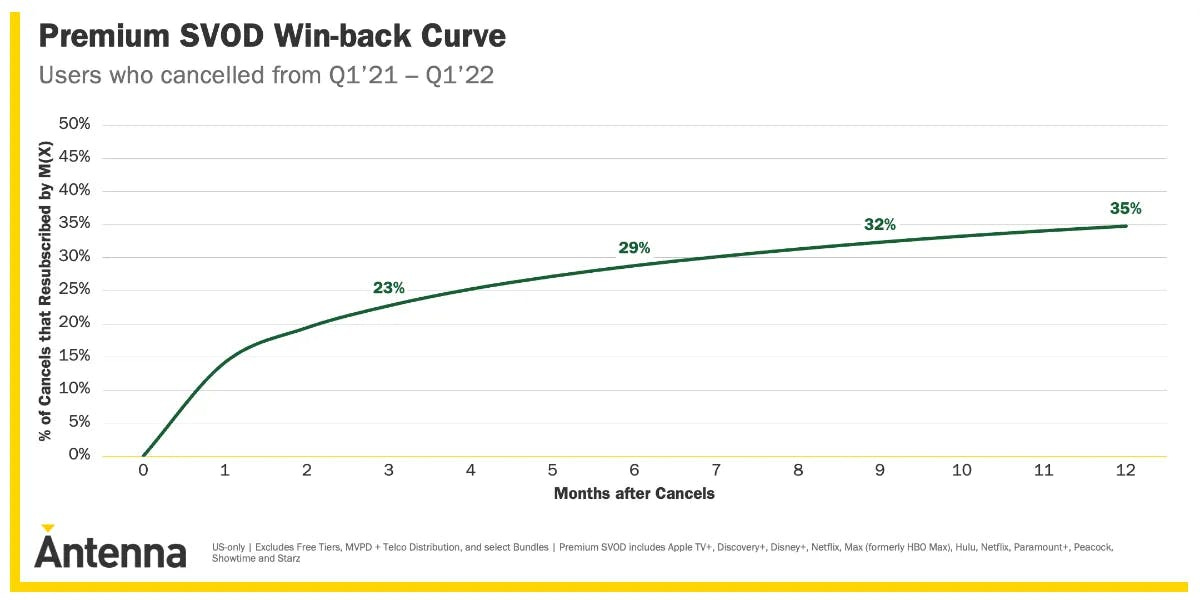

Other data recently released by Antenna shows that 33% of all subscribers are “serial churners”, or users who frequently sign up for and then quit subscription streaming platforms. About a third of those who quit premium SVOD services were “won back” within 12 months. Nearly 25% of SVOD service cancelers returned to their respective services within three months after quitting. The overall message is that audience loyalty across all streaming services tends to be fleeting. Put in terms of Monday's essay, these platforms are failing to sustain markets around their content on a month-to-month, if not annual, basis.

Key Takeaway

Even the best stories with public data like Nielsen suggests that the leading legacy media companies need help from third parties to scale their best content, new and old. Streaming platforms that have not prioritized market-making technologically and strategically now need this help.

Total words: 1,300

Total time reading: 5 minutes

PVOD > Subscription

In “Reconsidering Streaming's Subscription Models”, I highlighted how NBCUniversal seemed to have more success financially for its movies with pay windows like premium video on demand (PVOD) than its Peacock streaming service. I offered the example of “The Super Mario Bros. Movie”, which generated over $1 billion globally while in theaters last Spring and summer. The movie generated more than $75 million.

In the PVOD model, Universal charges as much as $25 to rent a film for 48 hours and $30 to buy a movie as little as 17 days after theatrical release. It keeps 80% of the revenue. So 3 million purchases at $25 per purchase grosses $75 million and nets $60 million in revenue. Assuming that data is U.S.-only, we can imagine a hypothetical scenario of whether Universal opted to streaming the movie Peacock 90 days after its theatrical release.

In that scenario, those same 3 million PVOD customers would instead be paying $4.99 per month to watch it, or $15 million in gross revenue per month. To generate the same $60 million in revenue, those 3 million consumers would either need to (1) all stay on Peacock for four months or (2) churn and return for four months out of the 12 months.

For the first case, 7% of that 3 million would churn out per month from Peacock. So 63% of those sign-ups would last the four months, having generated just over $50 million in four months and 16% short of what the PVOD benchmark of $60 million.

For the second case, one-third or 1 million of those 3 million sign-ups would be serial churners. Only one third or 330,000 would be likely to churn and then be “won back” within 12 months. The problem with that scenario is that the remaining 2 million subscribers are not guaranteed to stick around, either. At a 7% monthly churn rate, only 320,000 of those subscribers will be left at the end of the year. The end of the year total would be under 700,000 subscribers remaining.

Notably, “The Super Mario Bros. Movie” was released for streaming in December and is now available both on Netflix and Peacock.

Ted Lasso, Disney Movies & The Power Law

Returning to the Nielsen data, Bill Gorman aka TV Grim Reaper tweeted that “Ted Lasso” accounted for “an incredible 24.7% of all scripted show viewing on Apple TV+ in 2023” (67.91 billion minutes, total). That is an extreme example of a “power law”: a handful of titles are watched for more than 100 million minutes, and the rest have lower consumption.

As I’ve highlighted in recent essays, Nielsen’s weekly Top 10s for Disney+ and Hulu have consistently reflected this power law (though not to this extreme). So, it is not surprising that only one Disney+ series landed in Nielsen's top 10 Original Streaming Programs (“The Mandalorian”). The more surprising result was that six Disney movies ended up in the top 10 Streaming Movies for 2023 (though “Avatar: The Way of Water” was also distributed on Max). Only two of those movies—“Avatar: The Way of Water” and “Elemental”—were released in 2023.

This data is a helpful point in understanding the challenges Disney+ faces as a platform that needs to offer “the type of user experience consumers need on a month-to-month basis.” On the one hand, the data suggests Disney+ subscribers can find and consume Disney library content within the platform. On the other hand, it suggests the investment in expensive original series from “Star Wars” and Marvel universes is becoming harder to justify. Older movies in Disney's library can compete with Netflix—“Moana”, released in 2016, is in first place and “Encanto”, released in 2021, is in second place—but new series with large budgets cannot generate the scale of audiences that Netflix can at lower budgets.

That suggests Disney+ library offers value to consumers, but the Disney+ platform does not. Disney may rely upon its movies for the recurring revenues from streaming. But, at around 5% monthly churn, it is still losing 60% of its audience per year, and of whom we can assume only 20% are likely to return.

So, the use cases for which consumers will pay a monthly subscription fee to Disney are fewer than it had assumed.

Leaving Money On The Table

To frame the above in market-making terms, Nielsen data suggests Disney is unusually good at driving streaming revenues from content for which a market has already been made by third-parties (theatrical distributors). NBCUniversal seems to acknowledge it is unable to do so on Peacock, alone, and would rather rely on PVOD and licensing. Its show “Suits” was the #1 most-streamed show or movie in the U.S. in 2023, and that was because it licensed the show to Netflix.

Effectively, Disney and NBCUniversal have both realized that the markets for their libraries of original content—new and old—are narrower than they imagined. That is not unlike Netflix's realization about its market limits that I wrote about on Monday, but at a smaller scale and with less advanced "plumbing" on their back-ends. There are recurring revenues from subscriptions available, but not for all content they offer. The free market may value their new movies and series more, and therefore pay more via PVOD or licensing.

The ambition for monthly recurring revenues with the assumption that new content will make markets now seems fundamentally misguided. Even the best stories with public data like Nielsen suggests that the leading legacy media companies need help from third parties to scale their best content, new and old. Streaming platforms that have not prioritized market-making technologically and strategically now need this help.