Good afternoon!

The Medium identifies a few key trends each fiscal quarter that reveal the most important tensions and seismic shifts in the rapidly and dramatically changing media marketplace. The key trends help you answer a simple question: "What's next for media, and where's it all going? How are the pieces lining up for business models to evolve, succeed, or fail?"

Read the three key trends The Medium will be focused on in Q3 2023. This essay focuses on "Legacy media companies are throwing in the towel on their bets to own the consumer relationship in streaming and beyond."

Charter and Disney reached a deal on Monday, shortly after Monday’s essay—“Why Charter's Game vs. Disney May Not Be So Wicked”— went out.

Charter’s position leading into the negotiations had been that “it was unwilling to keep paying for Disney’s traditional channels without offering access to its streaming content, given that Disney in recent years made most of its highest-profile content available on streaming, in turn decreasing the appeal of its cable channels.” So, either Disney would need to agree to Charter’s terms, or it would need to figure out a way to replace lost linear revenues with direct-to-consumer (DTC) revenues overnight. With its streaming business stagnating in the U.S., that was not going to be a feasible solution.

The past two essays have focused on how Charter’s (and implicitly Comcast’s) aggressive message to Disney was: “You wholesale guys still haven’t figured out retail yet”. If Disney could not work out a deal, $2.2 billion in lost annual revenue would have no immediate replacements in streaming. That said, the final deal was never going to be an entirely wholesale outcome or an entirely retail outcome. But, any outcome that revealed Disney’s retail first, direct-to-consumer ambitions have hit a wall was going to be a more wholesale than retail outcome by definition.

And that is the outcome we got on Monday.

Key Takeaway

The assumption of Disney's deal with Charter is that many Spectrum customer will opt into the free subscription from Disney+ and ESPN+. But, there is also a burden on Disney to convert these subscribers, and there is still something fundamentally weak about the Disney streaming value proposition that this deal does not bolster.

Total words: 2,200

Total time reading: 9 minutes

Charter & Disney’s Deal Points

Overall, the deal seems to preserve much of Disney’s wholesale business and, within certain plans. In exchange for Disney’s demands for higher license fees and higher penetration minimums, Charter is dropping eight Disney networks: Baby TV, Disney Junior, Disney XD, FXX, FXM, Freeform Nat Geo Mundo and Nat Geo Wild. Bloomberg reported that Disney will be losing $2.13 per subscriber per month across all eight channels, or according to one estimate about $1.5 billion.

However, Disney will receive an increase on the subscriber fee—undisclosed but estimated to have been an objective of $1.57 more per subscriber—on its remaining 19 cable networks on Charter, which include the ABC Owned Television Stations, Disney Channel, FX and the Nat Geo Channel, and all six ESPN channels. Last, ESPN is guaranteed pay for 85 percent of Spectrum TV subscribers. When—or perhaps even if, according to a post-mortem podcast interview with Justin Connolly, President of Disney Platform Distribution—ESPN launches its Direct to Consumer product, this number will drop to 80 percent.

On the retail side, the outcome ended up being more wholesale with “hard bundle” terms. To remind you, a “hard bundle” is when a streamer works with a local provider to give their customers immediate access to a streaming service as well as direct-to-consumer and à la carte distribution or sometimes a hybrid of all three to achieve growth).

The press release shared that “in the coming months”, the Disney+ Basic ad-supported offering will be bundled into the 9.5 million customers of the $60 per month Spectrum TV Select package. Charter will pay Disney a wholesale price for the service. ESPN+, and then later the ESPN DTC service, will be provided to subscribers in the Spectrum TV Select Plus tier at no additional fee, according to Bloomberg.

Charter also will market “Disney+, Hulu and ESPN+, as well as The Disney Bundle” to all of its customers – in particular its large broadband-only customer base – for purchase at retail rates.

A Key, Core Dynamic At Play

I think two quotes from executives involved in the deal highlight a key, core dynamic at play that I have yet to see discussed. Charter’s CFO Jessica Fischer told the Bank of America Media, Communications & Entertainment Conference on Wednesday that the deal “met all of our objectives”. The primary objective was to prevent content "leaking out of the system" to streaming services. Meaning, its customers were paying fees to subsidize streaming content for people without cable. Customers who were subscribing to both Disney streaming services and Charter linear packages were paying twice for that content. Charter sought to end that. Another key objective for Charter was the flexibility to offer a wide range of packages, including less expensive "skinny" packages that will not include the more expensive ESPN networks.

As for Disney, according to Dana Walden, co-chair of Disney Entertainment, its key objectives were “maintaining channels where they are valuable to us in the distribution ecosystem, and then we’re making sure that we have a solid pipeline of that programming to Hulu or Disney+.”

The general perception is that Charter has accomplished setting a new precedent in cable bundling. “Hard bundles” are nothing new: They have been core to Paramount Global’s distribution strategy for Paramount+, to date. But a “hard bundle” that requires the sacrifice of a “long tail” of cable channels and higher penetration minimums is new.

The little-discussed dynamic missing from the coverage of the deal is that this sacrifice would not have been possible without the existence of Disney's streaming services. Meaning, that the channels are lost but the content still has a home that its fans can access. Walden all but conceded this to The Hollywood Reporter:

“When we looked across the portfolio to try to identify where the greatest value in this deal was to us, we definitely made some trade-offs with the following thinking in place: The digital networks are for the most part targeted, and they super-serve an audience in the linear ecosystem, but they are also windowed onto what we are calling our primary channels [Disney Channel, FX, Nat Geo],” Walden says. “So you know the Nat Geo suite, ultimately that programming also airs on Nat Geo and then it is windowed over to Disney+, similarly with Disney Junior and Disney XD. And then FXX has been a valuable source of programming for Hulu, and so we don’t intend to change how we program that channel right now. It’s very much connected to our pipeline of general entertainment to Hulu.

Notably, she is conceding Charter’s critique that Disney has indeed been forcing the consumer to pay twice for the same content. But, she is also saying that Disney programming from those channels will still capture “super-served” fans of this niche programming via Disney+ and Hulu. She is also acknowledging that Disney’s struggling streaming business now carries the additional burdens of needing to capture and monetize those lost linear audiences.

Does The Deal Solve for Disney DTC?

The question is whether the deal helps Disney with those burdens, or whether those burdens is too costly for Disney.

In theory, the deal helps with that burden because Disney+ is included in the Spectrum TV Select package. In practice, Spectrum consumers will still need to opt-in to Disney+ via Spectrum to get it for free (and presumably Spectrum and Disney will make it easy for them to switch from a plan). We do not know how many Spectrum linear customers currently have Disney+, but we can assume there are just over 40 million Disney+ subscribers in the U.S.—a majority of its 46 million as of FY Q3 2023. There are just over 110 million broadband homes in the U.S., or around 36%. So, a rough estimate is that Disney+ currently has about 5.4 million Spectrum subscribers among its 15 million linear subscribers, or 57% of the 9.5 million Spectrum TV Select base.

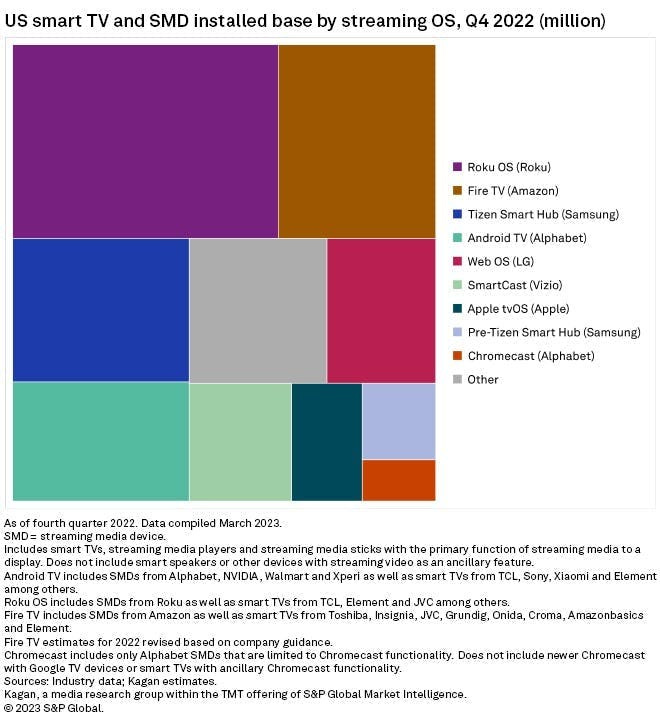

There seems to be an assumption that Disney will receive a wholesale fee for all 9.5 million Spectrum TV Select customers. That seems incorrect, a problem best reflected in a chart of U.S. smart TV and streaming media device owners from research firm Kagan from last Thursday’s essay.

Those consumers can still stream Disney apps via Roku, Amazon Fire TV, Android TV or other Smart TV and/or connected TV device manufacturers, as this chart from research firm Kagan reflects.

Odds are Spectrum consumers are already subscribing to Disney via their existing smart TV devices, the majority of which are not Xumo or Spectrum devices. So, Charter paying a wholesale fee for all 9.5 million subscribers would mean Disney would be paid twice by a Spectrum consumer subscribing through Roku. Spectrum then would pay a separate wholesale fee for that same customer. As we saw above, a different version of that problematic rationale is why Charter sought to renegotiate its carriage deal with Disney.

Instead, I believe the "hard bundle" requires that Disney will be paid a monthly wholesale fee for every Spectrum customer that opts into Disney+. The rationale is offering Spectrum consumers the service for free is likely to convert many of those 6 million over to a new plan. For Disney, that should translate into lower churn, more guaranteed recurring revenues on those consumers and, ideally, the deal will convert more of the 3.5 million customers who have yet to sign up for it.

But, it seems unlikely that Disney will sign up all 9.5 million Spectrum TV Select package subscribers. As we are seeing in Nielsen’s The Gauge, Disney+ is only grabbing 2% of all TV consumption, which is 20% to 24% of what YouTube (9.2%) and Netflix (8%) are capturing. There is still something fundamentally weak about the Disney+ value proposition that this deal does not bolster.

As for ESPN…

Big question marks also exist for ESPN+ and the future ESPN DTC product after this deal. ESPN+ has proven to have very little value to consumers: All ESPN streaming viewing, including ESPN+, was 0.06% of all streaming viewing in July 2023, according to supplemental data from Nielsen’s The Gauge. The service needs more scale (it has 25.2 million subscribers, down 100,000 from the previous quarter) and more engagement. It will get marginally more of both from being included in the Spectrum TV Select Plus tier.

As for Disney+, Spectrum subscribers will need to opt-in to subscribing to ESPN+, and the same will be true when the “flagship” ESPN DTC app eventually launches. But, the math of the deal also implies that ESPN’s future is unlikely to reach 100% DTC. Consumer engagement now happens across multiple platforms. This deal is an attempt by Disney and Charter “to build a framework that recognizes that change”, as Justin Connolly told The Marchand and Ourand Sports Media Podcast yesterday.

ESPN Chairman Jimmy Pitaro now sounds less bullish than his past predictions that it will be “inevitable” that ESPN will experience a full shift to DTC. As he told The Hollywood Reporter, “ultimately when we do take our primary channels direct-to-consumer, we have the opportunity to upsell that offering to a much larger sports fan base.” But, the deal terms with Charter, above, show how vital linear distribution of ESPN is to Disney’s business. Pitaro is conceding that the deal may be, at best, a marketing deal for ESPN’s future streaming aspirations. But, ESPN's future still lies in linear.

Who Is Disney’s Customer on Spectrum?

The biggest throwaway line of the press release may be Charter’s promise to market “Disney+, Hulu and ESPN+, as well as The Disney Bundle” to its base. Free marketing is valuable, but the ultimate question is, who are the target customers?

The deal suggests future customers for ESPN are most likely going to be linear (wholesale), and some are going to be streaming (retail). The deal tells us less about who the future customers will be for Disney+ in Charter’s “hard bundle” . The assumption is that many if not most will opt into the free subscription from Disney+, and therefore Disney will have more reliable recurring revenues at near zero churn from Charter subscribers.

A fun question to ask is whether there is truth to what Walden is saying, above, about Disney+ being a solution for capturing niche consumers. As I wrote in my Medium Shift column for The Information last week, that is a version of the product company model, which takes the consumer relationship in-house, capturing and monetizing niche behaviors instead of specific demographics.

Assuming there is truth to it, Disney+ may be a better service for fans of niche programming than a cable channel. At $7.99 per month or even $4.79 per month (60% of $7.99), Disney will be making 20x to 30x the multiples on the rates it was getting for those niche channels (as X user Modest Proposal recently pulled together from a Kagan rate card and assuming a 3% bump), it is better economics than the pennies it was earning for those subscribers individually. But, these subscribers are more likely to total the tens or even hundreds of thousands—but not in the millions—so Disney will be taking a hit despite the higher returns (and we have not factored in a 4% to 5% monthly churn yet rate either).

But, if Walden is not telling the truth and simply offering spin for publicity’s sake—something MoffettNathanson’s Craig Moffett intimated today in his interview with Stratechery’s Ben Thompson—then the deal with Charter will do little to solve Disney’s problems in building out a retail business. Because in that instance, there never really was the demand for the “long tail” of Disney content on linear and therefore Disney does not have the demand for that same content on Disney+. Instead, Disney's best business model in media was and will continue to be wholesale.

Looking at the outcomes for ESPN, ESPN+ and Disney+ in this deal, it’s hard not to escape that this is the core takeaway from this deal.