Member Mailing: "Aggregate Audience" in Sports Streaming & Why More Deals = More Consumer Confusion

Key Takeaways

Over the past two weeks, there has been a flurry of deals and developments in sports streaming

But, streaming is not (yet) a one-to-one replacement for linear distribution of sports broadcasts

The flurry of recent streaming deals suggest it may never be

This has implications for both recent sports streaming deals and recent speculation on ESPN's future in sports betting

Over the past two weeks, there has been a flurry of deals and developments in the sports streaming marketplace:

WarnerMedia reached an eight-year agreement - reportedly worth ~$200MM - for all non-World Cup and CONCACAF US Women's and Mens' national team games to be distributed on WarnerMedia’s streaming service, HBO Max, while the biggest games will also air on TNT.

Apple will have exclusive rights to telecast two “Friday Night Baseball” games each week — totaling about 50 per year — in the U.S. and to eight countries overseas, via its Apple TV Plus (worth $85MM)

MLB also has a two-year streaming deal with Comcast’s NBCUniversal for an 18-game package of games each season that will be on Peacock’s premium tier and will be exclusive (worth $30MM)

Apple is considering acquiring the rights to the NFL's Sunday Ticket package, the rights to mobile device livestreaming and an equity stake in NFL Media),

WarnerMedia could pursue rights to stream NBA games on HBO Max, and

Sports Business Journal's John Ourand delivered an "inside look" at the NBA’s streaming deal with Sinclair

The tempting conclusion is that we are witnessing a significant shift in live sports distribution as Apple, Comcast and WarnerMedia join Amazon and Disney in streaming sports.

But, there remains the "interesting question" of "what the value of sports IP is to streaming", which I raised in Amazon, MGM, and How Lina Khan's FTC Misunderstands the Value of IP in Streaming. I concluded that because sports IP does not (yet) drive viewership at a scale that competes with linear, it instead may be more valuable for driving paid subscriptions.

In other words, streaming is not (yet) a one-to-one replacement for linear distribution of sports broadcasts, and is more valuable as a customer acquisition tactic. A favorite quote of mine from NBA owner Mark Cuban - given in an interview with SportsTechie in April 2020 - suggests it may not ever be a replacement for linear:

One of things that’s changed dramatically in terms of making our games available is that we’ve gone from a bandwidth-constrained environment on paid TV to a non-bandwidth-constrained environment. … With the Mavericks, we’re having conversations: Can we have three, four, five streams of the same game that’s going on traditional TV? You might have one where you have Twitch-like announcers; you might have two of your favorite YouTubers that are doing another stream; you might have your traditional broadcasters doing another stream; you might have a players-only doing another stream. We don’t care if there’s four, five, six streams—we care about the aggregate audience. By setting the priority of being an aggregate audience, then we can do things to experiment and try a lot of different things.

Then there’s the element of gambling. You can have a gamblers feed where it’s geared toward the prop bets going on right now. That might be an element for paid TV that’s kind of a salvation. One of the problems with streaming is that you don’t know what’s going to buffer or when, and you don’t know if everybody is getting the feed at the same time. There’s a delta between a satellite feed and a cable feed and even a good stream—and that’s an issue for gambling on some level, maybe 5G changes that with low latency. But there’s a unique opportunity to juice up paid-TV subscriptions and get gamblers in particular say, ‘There’s this unique paid-TV feed that’s geared toward prop bets, gambling, so I know what’s happening.’

Effectively, Cuban is making two points:

Streaming has enabled the concept of "aggregate audience" across "four, five six streams", and that should be a team's priority in broadcast; and,

The growth of sports betting may counterintuitively save the pay-TV business from disruption of streaming.

They highlight the inherent uncertainty in sports distribution: Audiences no longer have a single solution for watching live sports, but linearr remains the dominant consumer behavior in the cord-cutting era.

If we look at the above six stories through the perspective of these two points, the uncertainty in sports distribution that Mark Cuban highlighted two years ago remains true, if not worse.

[Author's Note: The rest of this essay will be exclusive to members, only.]

"Aggregate Audience"

The basic premises of an aggregate audience is that:

Multiple, simultaneous streams of the same game are now feasible;

Audiences across multiple, simultaneous streams, are scalable individually and in aggregate; and,

Each simultaneous stream has a viable business model.

But, there has been a big difference between what Cuban is imagining and what has played out in the marketplace so far. I covered this territory before for Members in Amazon, MGM, and How Lina Khan's FTC Misunderstands the Value of IP in Streaming.

At the time, I think Mark Cuban was envisioning where different tests of simultaneous streams in the marketplace would likely end up: For example, Amazon's previous three-year deal with the NFL allowed for simultaneous distribution on Amazon Prime Video and Twitch. But, the Twitch stream did not involve Twitch creators doing the commentary.

Amazon's new 10-year deal with the NFL allows for Twitch distribution, too. Conceivably, the NFL was in a position in its 2021 rights deal to create the "three, four, five" streams across linear and streaming. Instead, it has permitted multiple linear broadcasts of the same game (e.g., CBS and Nick, ESPN and the Manningcast on ESPN2) or distributing the same broadcast across linear and streaming (e.g., the Super Bowl).

This has been the trend more broadly in 2022, as I highlighted in that Amazon, MGM member mailing:

...versions of this multi-stream scenario have played out at ESPN with the success of the ManningCast on ESPN2 (1.9MM viewers per game during the regular season, 13% of the Monday Night Football audience), across Turner Networks for this year's NBA All-Star Game (5.4MM for traditional, 852K on alternate TBS broadcast), and the SpongeBob-focused NFL playoff game on Nickelodeon (an average of 2.06 million viewers).

Notably Turner Networks offered alternate live streams of this year's NBA All-Star game across both broadcast (TNT, TBS) and social media (Twitter livestream where fans could vote for the player they want an iso-cam to follow exclusively over the entire second half).

All of these have been conservative executions of what Cuban envisioned two years ago. If Cuban was right, we should be seeing recent streaming deals evolving the marketplace away from the conservative approaches of the past years.

But we are not seeing that now, and there are a few key reasons why.

Problem #1: Cable Operators/MVPDs hold the cards

I think the key assumption of Cuban's vision is something most analogous to Turner Networks' execution of the recent NBA All-Star Game. Meaning:

There is a primary broadcast (TNT)

A secondary broadcast (TBS), and

A livestream broadcast (Twitter)

All were controlled by Turner Networks, but the business and operating model primarily relied on #1 (which got 5.4MM viewers, or 6.3X the TBS Broadcast).

HBO Max was notably not part of that equation because cable operators did not permit it. This was highlighted by Peter Scott, WarnerMedia’s VP of emerging media and innovation, told SportTechie last week at SportsPro OTT Summit USA at Citi Field :

“If we can work a deal out where the cable operators are cool with us doing that, I think you have to look at that as a potential place. And we’ll have to pay some incremental amount to be able to distribute [the NBA] on HBO Max.”

A better example of how cable operators/MVPDs hold the cards is WarnerMedia's eight-year agreement -for all non-World Cup and CONCACAF US Women's and Mens' national team games.

A key detail is that "the biggest games will also air on TNT". First, it is not clear what "the biggest games" will be - it is a broad term that may or may not be contractually defined. Second, putting the two-and-two together of Peter Scott's quote about cable operators, the implication is that this condition was included to make cable operators happy, too.

Meaning there is the concept of "aggregate audience" lurking in these deal terms, but the deal seems more concerned with pleasing cable operators than emerging audience behaviors. [1]

Problem #2: The Bundle is Broken

The bundle offered by cable operators also is an obstacle to "aggregate audience". Sinclair Broadcasting Group is increasingly losing distribution for its linear RSNs, including Dish Network dropping them last November.

Last December I wrote about this problem in Why Q3 2022 Will Be –and Won't Be – A Turning Point for RSNs (Regional Sports Networks), and I highlighted a quote from NBA Commission Adam Silver on Sinclair's linear distribution model:

“The bundle is broken,” Silver said. “It’s clearly broken. Our regional sports networks – Sinclair in particular. They paid $10 billion. It’s not clear it’s a good deal at $5 billion.”

Sinclair has decided to solve for declining distribution of its linear RSNs by building a direct-to-consumer (DTC) streaming service, which it plans to launch in Q3 2022. I highlighted the problem with this strategy in Premier League Bidding, Sports Streaming & "User Intent":

Sinclair is flying blind in terms of who its customers are and will be for DTC; and, even if has some understanding of those customers that it inherited via Fox RSNs, it is building up from ground zero to win them over.

Sinclair's DTC service would be a replacement for linear distribution, effectively ruling out any strategy of "aggregate audience".

Cuban's Mavericks were impacted by this problem earlier in the NBA season: . DirecTV Stream is the only streaming platform that carries Bally Sports Southwest, the local provider of Mavericks, Stars and Rangers games.

After Sinclair bought the Fox Sports Regional Networks in August 2019, YouTube TV, Hulu, Sling TV and FuboTV no longer carry them due to cost.

So Cuban partnered with DirecTV Stream to offer the first 10,000 new DirecTV Stream subscribers who sign up for a Choice package (or higher) a $50 per month credit for each month of maintained service, up to five months.

Sinclair's problems with cable operators have effectively undermined Cuban's own ambitions for "aggregate audience" as a solution.

Problem #3: Who owns the digital rights?

So, in the case of the Mavericks, above, Mark Cuban could negotiate with DirecTV Stream because it is virtual MVPD/cable operator that distributes Mavericks games via Bally Sports Southwest.

But, as I highlighted in Premier League Bidding, Sports Streaming & "User Intent" the NBA still holds power over digital rights for all of its teams, and negotiates on their behalf. This is also true of the NFL and NHL. MLB and Major League Soccer (MLS) permit teams to negotiate separately for their respective digital media rights.

This means that the NBA was effectively an obstacle to Cuban leveraging DTC services and "aggregate audience" as a solution to Bally Sports Southwest being dropped by multiple vMVPDs.

Notably, the NBA leveraged Cuban's "aggregate audience" solution with the All-Star game, but it is less clear how the NBA will pursue this strategy more broadly. SBJ's John Ourand's reporting on the NBA's contract with Sinclair Broadcasting Group's Diamond Sports division broke down how the contract is effectively a series of one-year deals "loaded with around a dozen conditions to make sure that the company’s streaming plans were moving forward".

The NBA is also building behind-the-scenes with Microsoft Azure (which I wrote about back in May 2020 in NBA and Microsoft Azure's New Partnership). The NBA's platform will not be unveiled until the 2022-23 season (which will begin in Q4 2022), but what we know so far suggests that it very much has "aggregate audience" in mind:

The league has already been piloting elements of this streaming experience. In 2020, it began experimenting with alternative streams for League Pass and NBA TV subscribers, including ones enhanced by “influencer” commentary and alternative, courtside camera angles. Subscribers have also been able to watch NBABet Stream telecasts, which include commentary and graphics that cater to the real-time sports bettors.

If it seems like NBA seems to sending a mixed message here - betting on Sinclair while also betting on its own DTC service - there is a good reason for it: teams rely heavily on affiliate revenues from Sinclair and the ad revenues from broadcasts (local media rights can make up to 50% of an MLB team’s total revenue).

The average RSN charges about $3.53 per subscriber per month, and the Sinclair RSNs charge distributors between $2.42 and $7.52 per subscriber per month. Killing those revenues may put its teams in dire financial situations.

The NBA's deal with Microsoft Azure appears to be a back-up plan if Sinclair's DTC streaming strategy fails (and the market consensus is that it will). In two to three years, we may see Cuban's "aggregate audience" solution as the de factoDTC distribution strategy for local NBA games while Turner Networks experiments with more conservative versions of that strategy across its linear networks, HBO Max and possibly Twitter for national broadcasts.

Problem #4: Lack of Scale in Streaming & Advertising

There are two challenges for the NBA's two DTC strategies, and also for recent streaming deals between Peacock and MLB, Apple and MLB and WarnerMedia and U.S. Soccer.

First, audiences in DTC sports streaming have been sub-scale, as I wrote in Amazon, MGM, and How Lina Khan's FTC Misunderstands the Value of IP in Streaming:

Sports IP streaming, to date, has been relatively weak in terms of the scale of tune-in: this year's Super Bowl broadcast on Peacock saw 6MM viewers (up from 5.7MM across CBS platforms in 202o), and an average minute audience of 11.2 million AMA viewers, which takes into account co-viewing from connected devices.

That was about 6 to 11% of the average audience on NBC (99.2MM viewers).

Second, cord-cutting has resulted in the NBA seeing declining local ratings (a key factor in MSG Networks' ongoing standoff with Comcast), and the NHL nationally has sub-scale tune-in, on average. As I wrote about Hulu and Disney's recent deal with the NHL in Subscribers vs. Viewers in Sports Streaming:

NHL games averaged 391,000 viewers across NBC and NBCSN; and, the 15-game Wednesday Night Hockey package averaged 508,000. Basically, Hulu only needs 1% of its subscriber base and 3.6% of ESPN+’s subscriber base (13.8MM) to recreate NBCU’s audiences digitally.

If we use NBC's Super Bowl numbers as a measure, 5% of the 112.3MM total audience for the Super Bowl across NBC properties were streaming, only. Applying that to NHL games on Hulu versus on NBC Sports, that would be ~20,000 viewers.

It is hard to imagine how those audiences will make either streaming service owners or advertisers happy.

[NOTE: I dove deeper into this problem in Subscribers vs. Viewers in Sports Streaming]

Problem #5: Who is incentivized to be the Visionary?

It would not be fair to NBA Commissioner Adam Silver and his team to call Mark Cuban the visionary here. Cuban was effectively communicating the NBA's testing of the "aggregate audience" approach in 2020. The Microsoft Azure platform will add new levels of sophistication to these tests.

Beyond them, though, it is hard to identify the visionaries across 18 soccer rights deals [see footnote 1], or from the six headlines of sports streaming deals. Meaning, the NBA seems less constrained in solving for "aggregate audience" distribution than any other league. The rest seem to be constrained by a fiduciary responsibility of maximizing returns across distribution outlets, regardless of evolving consumer behavior.

These outcomes create a byzantine maze of distribution outlets for consumers. This problem may only get worse, especially if streaming growth in the U.S. continues to plateau. The existing structures for broadcast rights between leagues and teams do not seem to empower sports owners or league commissioners to solve this problem.

ESPN & Sports Betting

I think it is worth briefly highlighting Cuban's perspective on sports betting, too. Because it leads to the counterintuitive conclusion that despite the overlap of DTC business models between streaming and sports betting, linear broadcasts may be the best solution for sports bettors.

Because if Cuban is right, the opportunities for ESPN are either:

to become the default pay-TV solution for sports betting or

to launch a new channel completely devoted to sports betting.

Both of these outcomes are implicitly lurking in the FT piece "Disney plots sports betting push in bid to revitalise ESPN".

In the first instance, ESPN solves for "delta between a satellite feed and a cable feed and even a good stream". It can already do so, at scale, in 76MM households (as of the end of fiscal 2021, down from 84MM in 2020). It would be slowing if not reversing the decline in households with ESPN, while preserving its cash-flow heavy business model.

In the second instance, it would need to convince cable operators/MVPDs to distribute a new channel, effectively an argument for the win-win outcome of additional subscription and ad revenues for Disney and the cable operators/MVPDs in a high growth marketplace: according to Forbes, Americans wagered a record $57.22 billion on sports across 30 states, up 165% from 2020, bringing in an all-time high in revenue of $4.29 billion.

This may explain why Disney CEO Bob Chapek feels that:

...the Disney brand is broad enough to have an ESPN business under our roof and have ESPN in the business of sports betting. That’s not harmful to the mother brand and is beneficial for the ESPN brand. The Disney brand is elastic.

So, the opportunity Cuban envisions in sports betting makes sense, and Disney seems positioned to pursue it. But what will Disney actually do?

I wrote about the speculation that Disney may spin-off ESPN in A Short Essay on CEO Bob Chapek’s Choices for ESPN's Future at Disney. Effectively, a spin-off could merge ESPN with an online sports book: Disney owns 6% of DraftKings, and it has a deal with Caesars that gives it the exclusive right to provide sports betting odds to ESPN.

I also wrote about the challenges of sports betting to Disney's BEADS ecosystem in Chapek's "Three Pillars" for Disney's Future Faces Tough Trade-Offs In Sports Betting. That analysis concluded:

Effectively, solving for sports betting in DTC terms is Disney solving for both the conversion and retention stages of a conversion funnel but without owning the consumer within the Disney BEADS ecosystem. It also means having a lower quality understanding of the sports betting consumer at a time when Disney's CEO demands a "relentless" focus on the consumer.

That means, unlike the ESPN+ subscriber, the sports betting consumer has both one foot in and one foot out of Disney's ecosystem, which is an un-Disney-like outcome. This is a riskier outcome to ESPN and Disney than the risks posed by "edgy" content.

These dynamics may force ESPN to evolve towards super-serving the sports-betting through linear and not streaming. Prop bets - basically side bets over the course of a game that are not directly tied to the actual outcome of the contest - are a good example of why. They keep the gambler engaged over the course of a game, and therefore require near real-time consumption of the game from all those involved.

The implication is any lag in a game's consumption can create advantages to a bettor watching ESPN over a bettor watching a livestream on ESPN+ or even on their mobile phone.

The needs of the sports betting market for real-time consumption have financial implications for all players involved.[2] It may ultimately drive the future of ESPN towards sports betting.

Conclusion

I think the most compelling aspect of Mark Cuban's vision of "aggregate audience" is that it reflects an understanding of how post-cord-cutting audience consumption behaviors have fragmented.

I think the least compelling aspect of this vision is how impractical these solutions are in this streaming marketplace, and I think the past two weeks of headlines reflect exactly that.

As subscriber and former ESPN executive John Kosner wrote to me on this topic, the problem is that "in the old, scarcity of product world, a sports rightsholder could slice its rights several ways and fans would have no choice but to buy them wherever." The last few weeks reflect how that model is still in place, and now fans must navigate an emerging maze of options that muddle whether a game is being broadcast on linear or streaming, and if/how they have access to that broadcast.

Moreover, despite high profile market tests of "aggregate audience" models, recent deals suggest we are further away from, and not closer, aggregate audience models solving for the byzantine maze of streaming rights deals.

But perhaps the most notable problem is that Cuban's version of "aggregate audience" is not in the marketplace, yet, because sports IP does not (yet) drive streaming viewership at a scale that competes with or complements linear. Meaning, even the sports audiences on streaming are too small. The plateau of streaming subscribers combined with the byzantine maze of streaming rights deals seem to point to these audiences becoming smaller, and not larger.

Streaming is not (yet) a one-to-one replacement for linear distribution of sports broadcasts. The flurry of recent streaming deals suggest it may never be.

Footnotes

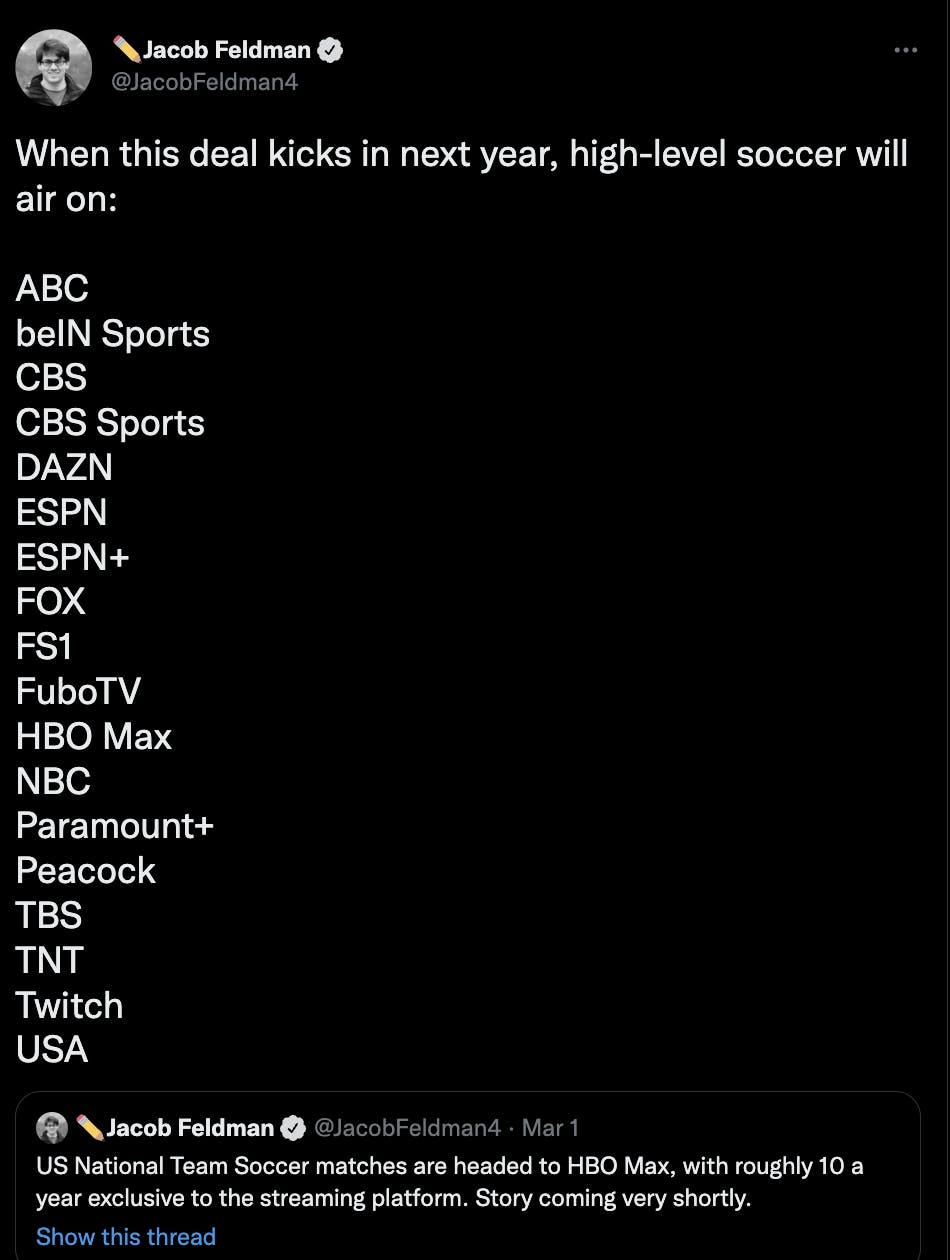

[1] The current status of soccer distribution rights in the U.S. are generally an obstacle to "aggregate audience"as this tweet highlights:

Meaning, 11 of these 18 outlets are on cable operators/MVPDs, and a 12th (Fubo TV) is a virtual MVPD. With sports increasingly important to value proposition of cable operators with the remaining ~70MM linear homes that have yet to cut the cord, it is unlikely to see this change.

[2] We witnessed the costs of arbitrage due to lag recently in Klay Thompson's return game to the Golden State Warriors in January:

Draymond Green's seven-second performance Sunday sparked controversy in the betting community and caused one sportsbook to delay payouts until it investigated the flurry of prop bets that were placed right before tipoff.

An injured Green planned to play seven seconds, only, and those in the know were able to bet before others:

As soon as the news broke of Green's plan -- The Athletic also tweeted the info around 8:31 p.m. -- bettors hustled to get bets in on the under on, for example, Green's total points (7.5), rebounds (8.5) and assists (8.5), before sportsbooks could pull the markets off the board. FanDuel removed Green props from its offerings within minutes of seeing The Athletic's report.