I recently was interviewed for an upcoming article on Amazon Prime Video’s upcoming “Lord of the Rings: The Rings of Power” series. While discussing with the writer through how it might be marketed, I realized it could end up being *the* global streaming event of our lifetimes.

Amazon’s scale is extraordinary and lies well beyond its more than 200MM Prime subscribers and 300MM active customer accounts globally. Amazon Prime Video is in more than 180 countries worldwide, excluding Mainland China, Iran, North Korea, and Syria. It also owns Twitch, which has 31MM average daily visitors (as of December 2021), and it has 120 million monthly active users across Twitch, FreeVee and its other ad-supported properties. Amazon also sells its proprietary Fire TV devices, of which it has sold 150MM worldwide.

“The Lord of the Rings” has been translated into more than languages and sold more than 150MM copies worldwide. “The Lord of the Rings” trilogy and “The Hobbit” trilogy each grossed ~$2.9B worldwide in theaters over the past two decades.

In short, there is enormous built-in, global demand for “Lord of the Rings”-related IP, and there is a reasonable argument to be made that, excluding China, Amazon has the scale and capabilities to reach most of the 8B people worldwide.

Fairly or unfairly, Amazon’s success with “The Rings of Power” will ultimately reflect how its model is solving for important, often thorny, problems in streaming that are existential pain points for its streaming competition.

1. Prime Video - The Basics

The basics of Amazon’s business have always been straightforward to understand (Retail, AWS, Advertising), but the basics of Prime Video have always been a bit of a mystery because Amazon tends not to discuss them. It is worth briefly recapping what we know to better understand the basic advantages of its $1B bet on “The Rings of Power”.

Business Model

Prime memberships offer monthly access (at $14.99 per month) or annual ($139 per year) to content including Prime Video, audiobooks, digital music, e-books, and other non-AWS subscription services.

As Amazon Prime CEO Andy Jassy recently wrote to shareholders, “The Rings of Power” is one of a number of “unique benefits” to “make Prime even better for members”. In other words, the measure of success for The Rings of Power will be in sales - over $400B in 2021 (and $469.8B including Amazon Web Services) - and not in subscriber growth or a Netflix-esque self-reported metric like hours viewed in the first 28 days. This is true even though it is the Amazon Studios division, under Jennifer Salke, which is betting $1B on the series.

Effectively, for 0.25% of its annual Net Sales in 2021, Amazon believes “The Rings of Power” can make existing Amazon Prime subscribers even happier (and presumably reduce churn), find new Prime subscribers, grow Net Sales more than 0.25% , recoup $1B in production costs, and drive overall growth.

It all reads unconventional and extraordinary: Amazon Studios is spending $1B but not to drive streaming subscribers.

Reach

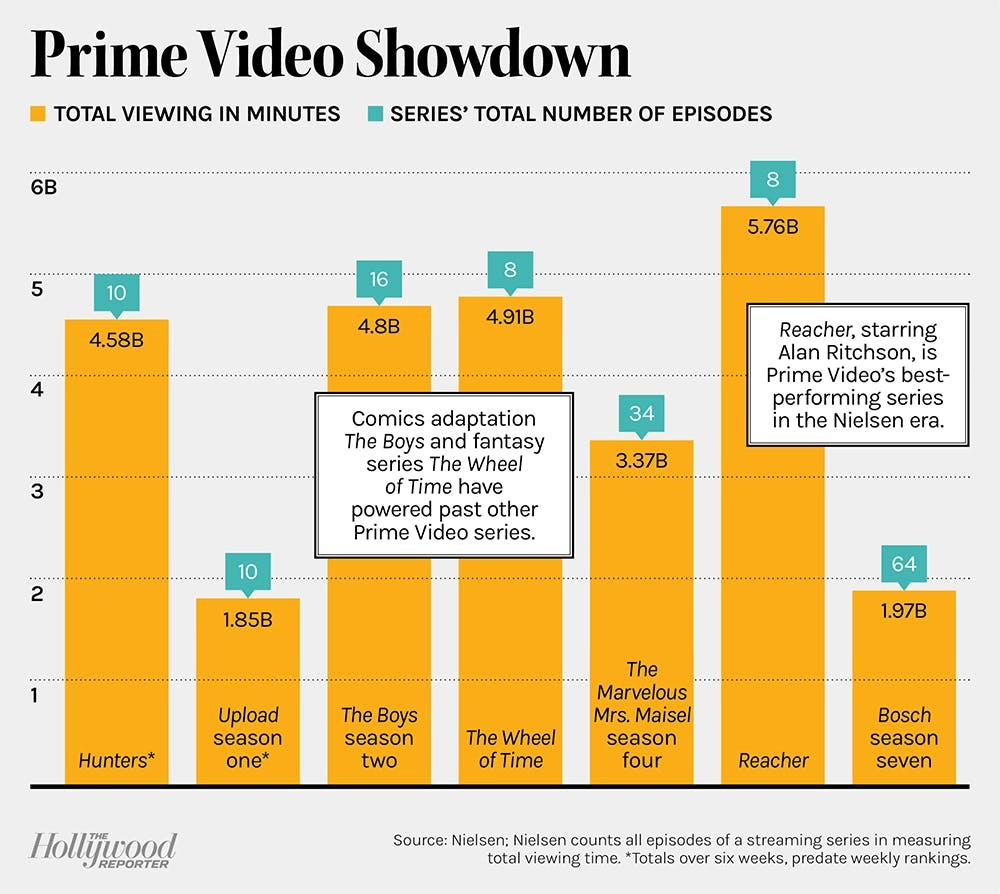

Again, Amazon has 200MM Prime subscribers and 300MM active customer accounts globally. The only lens we have into Prime Video’s success in originals is Nielsen ratings, which are for the U.S., only, and are counted based on Nielsen’s methodology [NOTE: The Hollywood Reporter recently had a good recap of the data on Amazon’s most-viewed original series.]

Its recent superhero action series “The Boys” had 5.42B minutes streamed through July 10th, according to Nielsen, and applying Netflix’s standard of hours viewed that is 90MM hours viewed in the U.S. over its entire duration.

Amazon's adaptation of the Lee Childs novels, “Reacher”, tallied 5.76B minutes of viewing during six weeks in the ratings service's top 10, or 96MM hours viewed.

By comparison, Netflix reported over 188MM hours viewed of “Stranger Things 4” worldwide for the week of July 4th to July 10th, alone. “Squid Game” recorded 1.65B hours viewed (or 99B minutes viewed) and “Stranger Things 4” recorded 1.35B hours viewed (81B minutes viewed) in the first 28 days. Netflix is able to drive exponentially more viewership in the U.S.[1]

Amazon does not have a success metric, though it has happily touted hit shows like “The Boys” and “Invincible” showing up in Nielsen Top 10s. So, should “The Rings of Power” be a smash hit, there remains the open question of how it will report to shareholders the success of “The Rings of Power”.

2. Amazon's Technological Advantages

The success of “The Rings of Power” ultimately requires Amazon to maximize its existing technological infrastructure to deliver a hit. Meaning, Amazon must maximize both awareness and ease of access to “The Rings of Power” within its ecosystem of software and hardware in order to scale.

In conversion funnel terms, Amazon’s entire ecosystem is structured so as to be able to put “The Rings of Power” one click away from anyone who may be browsing Amazon.com, watching a Twitch livestream, or logging into their Fire TV. Normally there are two, perhaps even three, steps between Awareness and Conversion (e.g., Engagement, Consideration) in a generic, five-stage conversion funnel.

Amazon’s ecosystem minimizes that friction, if not eliminates it altogether, in streaming, thereby improving the odds someone who sees marketing for “The Rings of Power” will click to watch it.

Marketing

I wrote in Why the "Streaming Wars" Are Actually About Product Channel Fit back in October 2020: “I would argue [the "streaming wars"] are about which companies are savvy enough to understand the marketing required to drive scale in those channels where it finds product-channel fit.”

This has been a consistent theme of PARQOR mailings: the seemingly inelastic demand for content seems unlikely to translate into user and/or revenue growth if streamers cannot solve for marketing on-platform and off-platform.

This does not apply to Amazon, largely because of its Prime bundle of services. Amazon recently shared its business logic for Prime marketing expenses, as it wrote in its recent 10-K: “While costs associated with Amazon Prime membership benefits and other shipping offers are not included in marketing expense, we view these offers as effective worldwide marketing tools, and intend to continue offering them indefinitely.”

So, “The Ring of Power” may ultimately be accounted for as a marketing expense for Amazon Prime membership (and therefore implying Amazon Studios is a services business for Prime... a conclusion which invites a rabbit hole of questions).

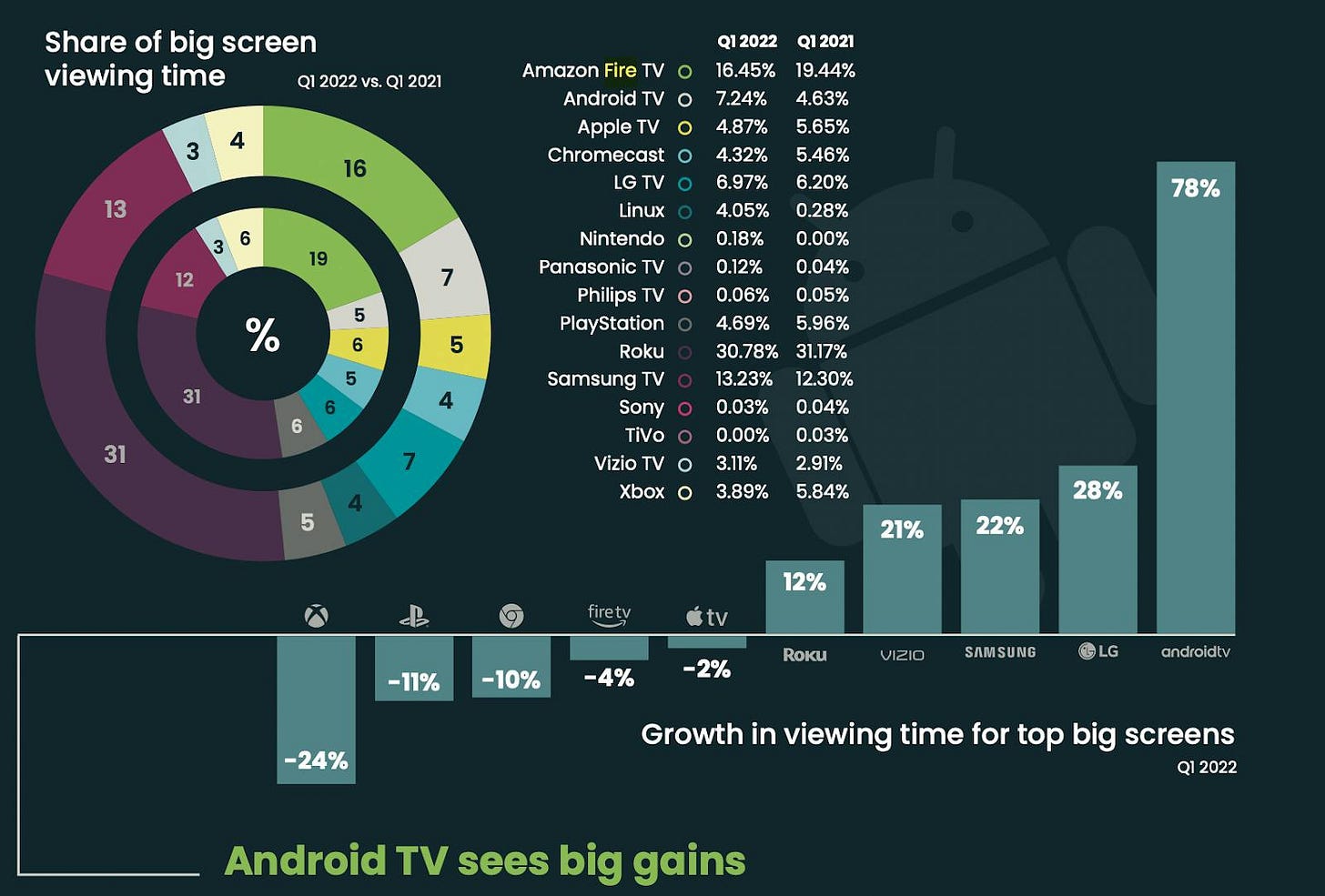

But it will also have to be marketed elsewhere online - especially on other dominant Smart TV ecosystems like Android TV, Roku and Samsung; mobile ecosystems like iOS and Android; and, of course YouTube - and it will have to buy offline linear and billboard inventory for awareness. So there will be marginal expenses, too.

So there is reason to believe that much of the $1B budget invested so far ($465MM for the first season, alone) reflects off-platform marketing costs Amazon expects to incur globally. It spent about $32.6B in marketing in 2022 (50% growth year-over-year), so if marketing “The Rings of Power” ends up totaling $250MM in 2022, it will be less than 1% of annual marketing spend for a show that will drive Amazon's brand globally around an extraordinary cultural event.

Smart TV UX & UI

User Experience (UX) and User Interface (UI) are variables positioned to have "as dramatic an effect on television’s economics as the digital platforms have had.”

I argued in After Netflix's Self-Inflicted Wounds, Five Recommendations for Streaming CEOs: “the more streaming apps must rely on Smart TV and CTV software to scale - and especially to hit ad impressions goals - the more expensive it will be for them to do so.

There is the obvious UX and UI advantage of delivering and promoting “The Rings of Power” to 150MM Amazon Fire TV devices worldwide - it is free marketing for a device millions of users rely on worldwide.

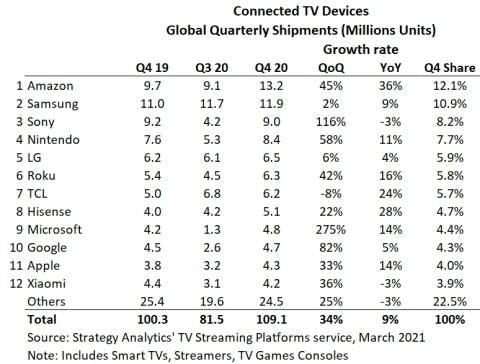

But the advantage is more significant when we look at market share. Amazon had a significant and growing share of global quarterly shipments back in 2020, according to a 2021 study from Strategy Analytics’ TV Streaming Platforms service.

Notably, 12% of 1.3B CTV devices worldwide is 156MM, or what Amazon has been sharing with investors.

Conviva has found that globally Amazon has since begun to lose its share of TV viewing time, dropping year-over-year from 19.44% in 2021 to 16.45%. Meaning that since the pandemic it may not be selling as many devices and usage of other devices has gone up.

Conviva also found that in the U.S., Roku has a 40% share of big screen streaming minutes, and Fire TV has less than half of that at 18%, with Samsung at 11%.

So, Amazon has extraordinary scale in CTV devices, but data suggests it is losing market share to its competition.

3. Why “The Rings of Power” Is Significant

From the above we have a general sense of the advantages of Amazon’s global scale, the economics of its content spend, discoverability on CTV devices, and the favorable economics of its marketing spend. It all points to two questions that have loomed in the streaming marketplace for a long time and now loom larger:

Who can compete with a streaming service whose business model drives hundreds of billions of dollars in retail sales and bundled memberships?

What will the streaming marketplace look like in five years after Amazon can comfortably launch and scale a series with a $1B budget while Netflix struggles to maintain a trajectory towards free cash flow and Warner Bros. Discovery struggles to cut $43B in debt?

The reason they now loom larger was summed up elegantly in a Richard Rushfeld essay for The Ankler from last night:

We've got a lot of Great Men roaming the landscape using studios as their playthings; not a lot of great roadmaps of where they see this journey going. Beyond paying down debt and trust us...

This is what it all comes down to. The people running the companies now, if we were locked alone in a room with them, armed with very good Bourbon and a cattle prod, and put the question to them, "What does you business look like in five years?" — do you have any confidence that a single one of them could give you a convincing answer?

Amazon faces none of these problems or questions (it is not funding content spend with debt), and the success of "The Rings of Power" will reinforce why that is true. Amazon CEO Andy Jassy does not need to be in this metaphorical room because he can answer Rushfeld's question (a mix of retail, AWS, and Advertising), and because he’s about to prove that it’s impossible to have a global hit in streaming without the software and hardware infrastructure to deliver it to consumers.

Conclusion

Amazon’s “Lord of the Rings: The Rings of Power” series is shaping up to be a seismic event in streaming. Not just in the scale of distribution and the favorable marketing economics that are in place to reach the enormous built-in demand for the IP. But it also is positioned to set a new standard for Wall Street for what extraordinary global success in streaming looks like, and to reinforce just how far away legacy media efforts from reaching that standard.

The timing could not be worse for legacy media executives and to some extent for a struggling Netflix (though Netflix still has technological advantages and "ubiquitous access", its ability to make its content available one click away to its subscribers both on-platform and off-platform (online and offline)).

The simpler, more distilled takeaway is that the “Lord of the Rings: The Rings of Power” may end up being the proof of concept that forces every other streaming service to realize it needs to build or to be part of a more multi-dimensional relationship with the consumer. Meaning a PARQOR Hypothesis-type relationship where consumers can be monetized in multiple ways - or find a new home within an ecosystem where it can be a part of one. [2]

Because five years from now, it looks like the objective to become a sole competitor to Netflix, Amazon, Apple and perhaps even Comcast is looking more and more to be a suicide mission.

Footnotes

[1] Netflix’s rationale for hours viewed as a standard is “it is a strong indicator of a title’s popularity, as well as overall member satisfaction, which is important for retention in subscription services. In addition, hours viewed mirrors the way third parties measure popularity, encompasses rewatch (a strong sign of member joy) and can be consistently measured across different companies.”

[2] I think this conclusion offers another lens on why Warner Bros. Discovery management will regret decision to reject the WarnerMedia streaming strategy (which I wrote about in Friday's "Warner Bros. Discovery, “For the Fans” & The Attribution Gap"). Because I think they understood that the consumer relationship could not be limited to streaming, and as Amazon veterans themselves (like CEO Jason Kilar), they understood this market reality).