Good afternoon!

The Medium delivers in-depth analyses of the media marketplace’s transformation as creators, tech companies and 10 million emerging advertisers revolutionize the business models for “premium content”.

Each fiscal quarter, The Medium identifies three or four new trends that have momentum and seem poised to play out at a larger scale in 2023. These key trends pinpoint dynamic and constantly evolving developments in the media marketplace that are emerging from incremental shifts or fundamental changes. The bi-weekly mailings analyze these trends as developments emerge in real-time.

Read the three key trends The Medium will be focused on in Q4 2023. This essay covers "the less-discussed lens on how the demand for “premium content” is being redefined by creators, tech companies and 10 million emerging advertisers" and "In the shift from wholesale to retail models, there are many business models that delight consumers but no single, dominant one."

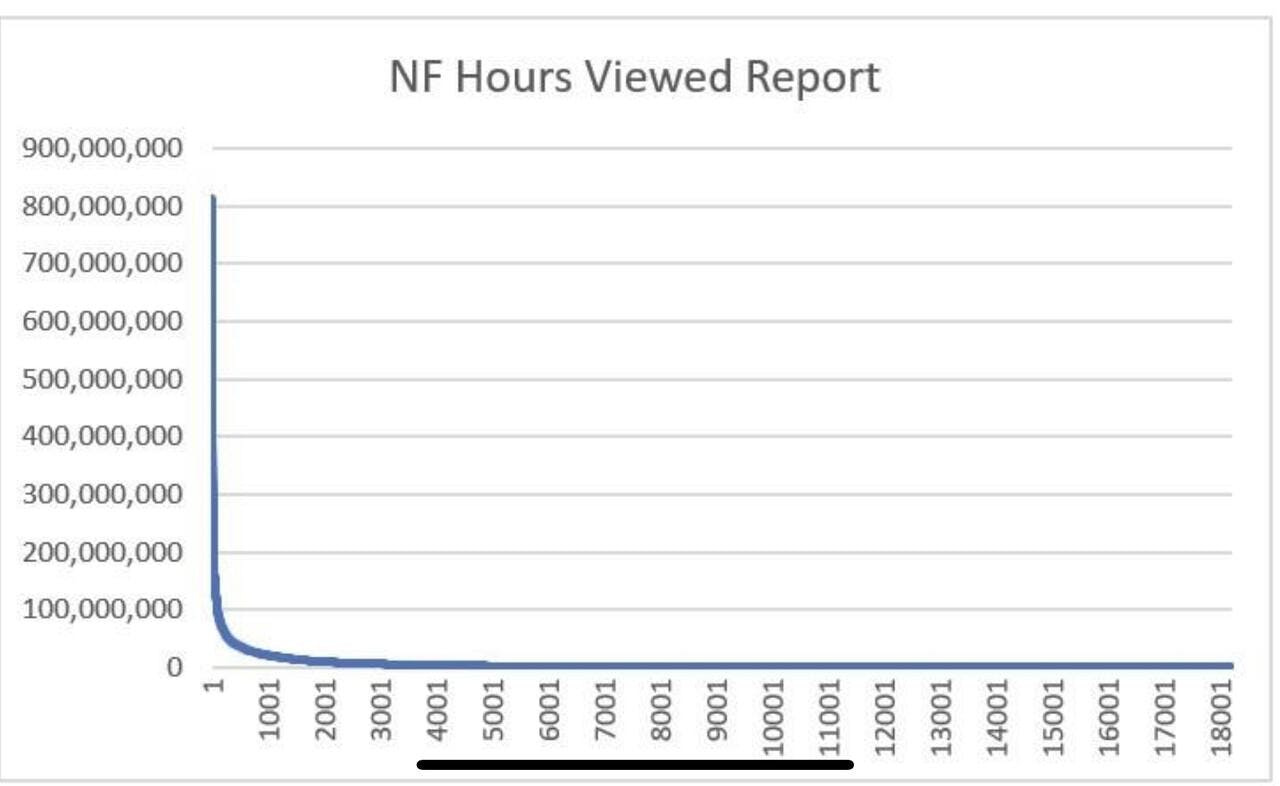

Netflix surprised everyone with the release of “What We Watched”, a report with viewership data for 99 percent of its movies and shows from the first six months of 2023. The data was shared in an Excel spreadsheet with four columns but over 18,000 rows.

The move was interpreted as related to the recently-ended Hollywood writers and actors strikes. CNBC’s Alex Sherman shared on X/Twitter that “creators were upset Netflix went public with all the info abruptly without speaking to them about their individual numbers first.” However, co-CEO Ted Sarandos told reporters that the new data releases were intended, partially, to help resolve “an atmosphere of mistrust over time with producers and creators and the press about what was happening." The timing was part of "a continuum for several years", and was "not driven by anything" else.

There are more answers to the question of timing than Sarandos lets on. A positive spin is that Netflix is now openly asserting what IAC Chairman Barry Diller asserted back in 2019: Netflix “won the game” a long time ago. It is now the market standard in streaming. A negative take is that Netflix’s recent iterative pivots into gaming, livestreaming and advertising fall outside of Netflix Executive Chairman and Co-Founder Reed Hastings’ focus on subscription streaming (and he notoriously resisted advertising for over 15 years). “What We Watched” distracts from Netflix’s growing need to adapt to rapidly changing consumer behaviors. Streaming is important to the business, but its future lies as in its new initiatives, and the data release distracts from that.

The truth probably lies somewhere in between.

Key Takeaway

The limited dataset of “What We Watched” tells the story of Netflix as a streaming behemoth. Without additional data from gaming, livestreaming and advertising, it seems vulnerable to "The Innovator's Dilemma".

Total words: 1,500

Total time reading: 6 minutes

Upside: Netflix Has Already Won

Diller’s then-provocative and now-prescient argument was that Netflix had already won because “No one is going to compete with Netflix in gross subscribers”. Back then, Netflix and Amazon had upended the stability of six movie companies which had a “hegemony over the entire movie distribution business”. Now, Amazon owns one of those movie companies (MGM Studios). In the U.SAmazon and Netflix jointly capture over 11% of total broadcast, cable and streaming consumption that occurs via television, according to Nielsen’s most recent The Gauge. Meanwhile, their legacy media competitors each struggle to capture more than 1% and Disney is the lone exception at 1.9%.

So, a reasonable interpretation of “What We Watched” is that Netflix is making a statement to post-strikes Hollywood that it has the standard for a successful streaming business model. This presents a two-fold problem for its legacy media competitors who offer little data transparency beyond participation in Nielsen Top 10s. First, their datasets will inevitably be smaller because their scale and total consumption are lower. Second, the standard distribution of consumption will inevitably look the same: a “power law” distribution where the difference between consumption of the most-watched content and the rest is non-linear and exponential.

This is not a new story: This dynamic plays out in weekly Top 10s for Disney+, where a handful of titles are watched for greater than 100 million minutes. All ten of Netflix’s titles for the same week ( ending November 12, 2023) had over 200 million minutes of viewing.

The message to is they are better off licensing content than attempting to distribute it themselves. Sarandos offered a diplomatic version of this pitch with the example of its recent success with NBCUniversal’s “Suits”:

“What is interesting is a show like "Suits" which has been played on USA for a long time, had been available on Peacock and had been available on Amazon for a couple of years before it hit Netflix, and yet we were able to unlock this enormous global audience for it. That’s a combination of our large subscriber base and our recommendation system that knew to put Suits in front of people who were going to love it the most. So that’s a reflection of what we do best. I do not think that that necessarily would happen in reverse, that other outlets would have a better chance finding more viewing for the programming that we have on Netflix, which is why we don’t do it…I do think that we can add tremendous value when we license content, I’m not positive that that’s reciprocal.”

Diller argued in 2019 that “Hollywood is irrelevant” because they no longer can get direct access to audiences. Licensing offers a better future for getting their content in front of audiences than competing than competing with Netflix. On that note, licensed content made up 45% of viewing in the dataset.

Downside: Netflix Is In New Territory

The cynical argument is that “What We Watched” emerges at a time when the market conditions for Netflix’s subscription model are changing. It has listed YouTube, TikTok and Epic Games as competitors. YouTube competes head-to-head with Netflix on TV screens in the U.S. and had 21% more consumption than Netflix in Nielsen’s The Gauge for October.

More importantly, streaming is no longer the sole driver of Netflix’s business model. Its pursuit of an advertising model reaches only 15 million monthly active users, or 6% of its global user base. The execution is experiencing some bumps, too: It replaced its President of Advertising after one year on the job. Netflix is increasingly moving into games: It now offers more than 80 exclusive mobile games and is developing a major-publisher-type console game. Today, it is releasing mobile versions of three games in the “Grand Theft Auto” franchise to its mobile app (NOTE: I wrote about this in "Netflix's "Grand Theft Auto" Bundle (R)evolution").

App analytics company Apptopia (which pulls data from 50 countries) estimated in August that Netflix’s games had been downloaded a total of 23.3 million times and averaged 1.7 million daily users, or 0.7% of its total user base of 250 million. It is reasonable to assume that will change after today’s release of the Grand Theft Auto games, and the looming question is, to what extent?

Netflix is also moving into live streaming and sports, adding “The Netflix Slam”—a match between Rafael Nadal and Carlos Alcaraz—to the mix after “The Netflix Cup”, a broadcast of a match between race-car drivers from the Netflix series "Drive to Survive" and PGA golfers from "Full Swing". There is no data released for the latter yet.

All three businesses need scale to succeed. Games are tied to the subscription model, only—”No ads. No extra fees. No in-app purchases.”—whereas the Basic with Ads tier and livestreaming model creates marginal subscription revenue and revenue from sponsorships and advertising.

Netflix also needs to pursue these initiatives: Its advertising tier has captured millions of subscribers that its subscription-only tiers may not have or simply lost to churn. Its gaming offerings capture a new demographic: Market researcher Newzoo says people younger than 13—Generation Alpha—spend 22% of their entertainment time playing games, more time than they spend streaming movies and shows (17%) or watching television (16%). Generation Z—people ages 13 to 27—and Millennials, who are roughly ages 27 to 42, spend as much time gaming as they do streaming.

So, the cynical take on the data release is that it distracts from the fact that Netflix has won yesterday’s battles. It has become so dominant that it has become a large incumbent whose customers prefer the incumbent product. According to Clayton Christensen's "The Innovator's Dilemma", this leaves Netflix vulnerable to nimbler, more innovative companies who can serve the next generations of consumers better.

The Reality: Somewhere in Between

The data in “What We Watched” tells shareholders that Netflix has defined and will continue to define the future of streaming. The data does not support the cynical story nor does it imply it. Rather, the cynical take emerges from asking about Netflix’s motivations for releasing the data, now, after the Hollywood strikes.

We are unlikely to receive the same level of transparency into Netflix’s livestreaming, advertising or gaming businesses. It is too early to do so, as Sarandos indirectly explained to reporters while discussing Netflix’s earlier decision not to release viewership data:

“In the early days, it wasn’t really in our interest to be that transparent because we were building a new business and we needed room to learn. But we also didn’t want to provide road maps to future competitors.”

There were plenty of reasons to be cynical about the streaming model back then: Netflix was heavily indebted, theatrical was dominant, DVD rentals still produced "free money", Hollywood studios were still powerful and neither growth in subscriptions and pricing power were guaranteed. Investors were funding its streaming losses while then-CEO Reed Hastings’ confidence both allayed their concerns and rankled Hollywood.

Today, Netflix is in the position to self-fund its innovations in gaming, livestreaming and advertising, and Co-CEOs Sarandos and Greg Peters are confidently predicting they can leverage Netflix’s “current core film and series” to build all three out. But, the question is whether a 25-year-old, more mature incumbent can successfully evolve in those directions. Without the data from its three evolutionary initiatives, it is hard to imagine Netflix being anything more than a streaming behemoth. “What We Watched” unintentionally emphasizes the need for more data on those initiatives.