Member Mailing: Chapek's "Three Pillars" for Disney's Future Faces Tough Trade-Offs In Sports Betting

Key Takeaways

On Monday, Disney CEO Bob Chapek sent out a memo outlining three pillars for the future of Disney

One pillar argues for a "relentless focus on our audience", and "We must evolve with our audience, not work against them"

Sports betting confronts Disney with a future where neither will 100% own the sports betting consumer

The sports betting consumer will be best understood by sports betting companies

That outcome threatens Disney's PARQOR Hypothesis advantages over other media companies

Last week, sports journalists Andrew Marchand and John Ourand discussed the impact of sports betting on sports media (~9:30 in) on their new NY Post podcast Marchand & Ourand.

They argued Disney and ESPN notably do not want to build a sports betting ecosystem around ESPN+. Disney is actively avoiding content and outcomes that are too "edgy" for both the ESPN and Disney brands, and sports betting requires "edgy" content and outcomes.

On Monday, Disney CEO Bob Chapek sent out a memo that went out to all Disney staff outlining three pillars for the future of Disney, the third of which was "relentless focus on our audience":

We are a big company with many constituents and stakeholders, all of whom have a place in our decision-making. But at the end of the day, our most important guide—our North Star—is the consumer. Right now, their behavior tells us and our industry that the way they want to experience entertainment is changing—and changing fast thanks to technology and the pandemic. We must evolve with our audience, not work against them. And so we will put them at the center of every decision we make.

On its face, the statement seems obvious: technology is disrupting Disney's model and it needs to adapt. That is in keeping with the story Disney has told since it launched Disney+, and a key theme of former CEO Robert Iger's autobiography, The Ride of a Lifetime.

I wrote about this in Robert Iger, Mark Zuckerberg & Vision, where I included Iger's story of holding the video iPod for the first time:

You can't tell anyone about this," [Steve Jobs] said. "But what you're talking about with television shows--that's exactly what we’ve been imagining." He slowly withdrew a device from his pocket. At first glance it looked just like the iPod I'd been using."This is our new video iPod," he said. It had a screen the size of a couple of postage stamps, but he was talking about it like it was an IMAX theater. '"This is going to allow people to watch video on our iPods, not just listen to music," he said. "If we bring this product to market, will you put your television shows on it?"

I said yes right away.

Any product demo by Steve was powerful, but this was a personal demonstration. I could feel his enthusiasm as I stared at the device, and I had a profound sense of holding the future in my hand. There could be complications if we put our shows on his platform, but in the moment I knew instinctively that it was the right decision.

It was an "aha!" moment, one where Iger realized that Disney's future faced "complications" from a new technology but was also a distribution channel that Disney content needed to be on.

Sports betting also is a new technology that creates "complications" for Disney's future. But, it is also a growing trend amongst younger demographics:

More than 60% of current sports gamblers are ages 40 or younger — 46% are millennials, while 15% are Gen Z adults, according to preliminary findings of an online consumer survey by Kagan, a media research group within S&P Global Market Intelligence.

The open question is whether Disney's brand and ESPN's brand need to be invested in sports betting given the different, if not higher risks, for those complications.

Chapek's statements to investors and the public reflect an ongoing openness to navigating those complications, and the language and logic of this third pillar suggest that if sports betting is what younger audiences want, then Disney and the ESPN brand must evolve with that demand.

The PARQOR Hypothesis sheds a different light on the "complications" posed by sports betting. Whoever Disney ends up partnering with on sports betting will have an ecosystem whose strengths and weaknesses also will be reflected in the PARQOR Hypothesis.

In other words, in order to capture sports betting consumers, Disney must figure out if and how its ecosystem will map to a sports betting ecosystem.

That outcome will require Disney and the sports betting company to share the sports betting consumer, and at risk to both their evolving DTC and broader business models.

Moreover, that outcome will dilute Disney's attempts at a "relentless focus" on this next generation of consumer, and will position Disney's PARQOR Hypothesis advantages over the rest of the media marketplace at risk.

The PARQOR Hypothesis – A Refresher

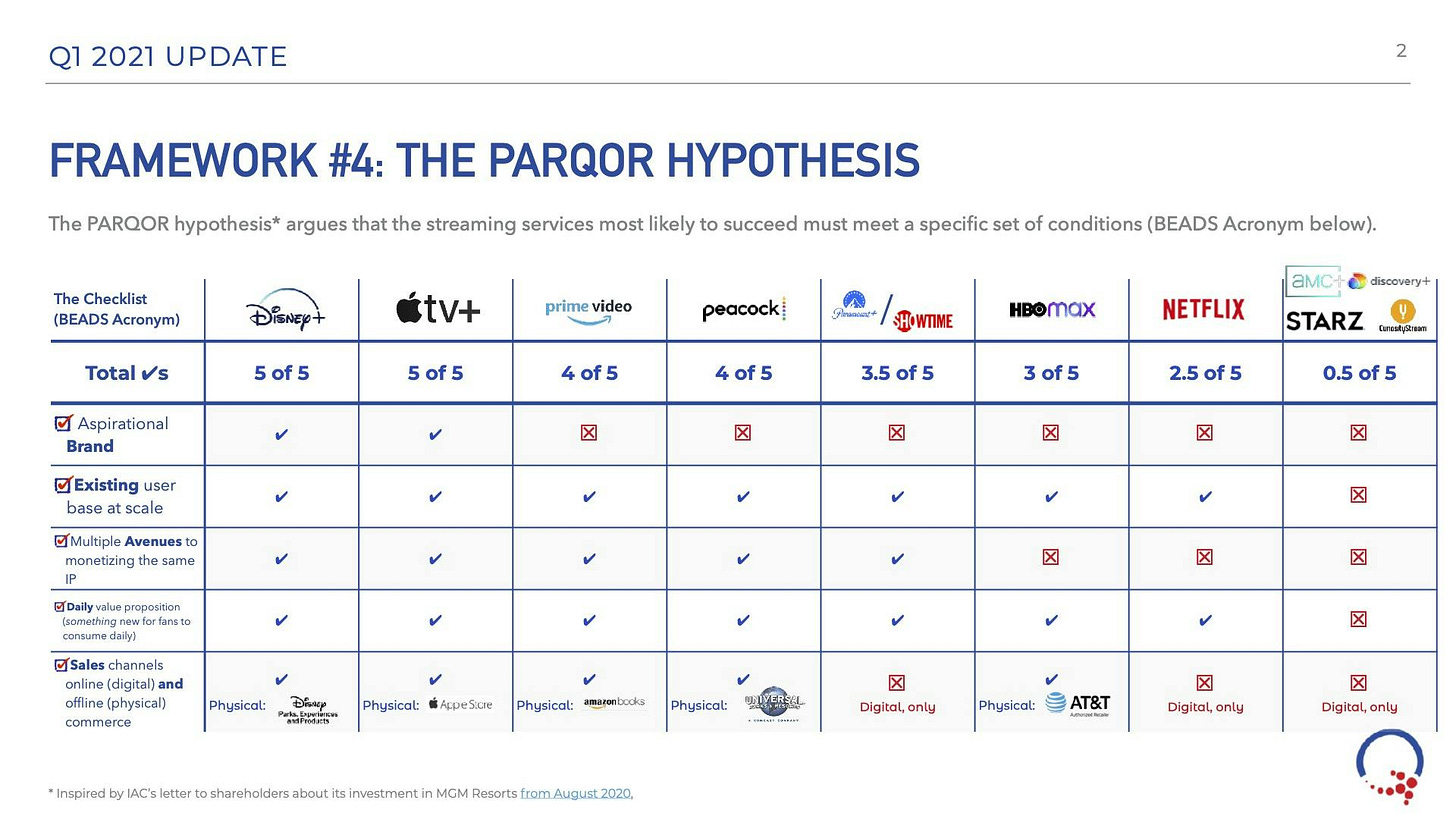

As longtime readers may recall, IAC's August 2020 letter to shareholders about its investment in MGM Resorts inspired the PARQOR Hypothesis. It lays out a checklist of five attributes for why Disney has advantages over pure-play streaming companies in the future media marketplace.

The PARQOR Hypothesis argues that the media businesses most likely to succeed must meet these five attributes, and highlights any missing pieces they (arguably) may need to solve for to optimally succeed.

Those attributes are summed up in the BEADS acronym:

an Aspirational Brand

Existing user base at scale

Multiple Avenues to monetizing the same IP, and

Daily value proposition (something new for fans to consume daily)

Sales Channels: Online (digital) and offline (physical) commerce

The slide above reflects the streaming marketplace as seen through the PARQOR Hypothesis in Q1 2021 (NOTE: there has been no reason to update it since). Notably, Disney and Apple TV+ are the only two streaming businesses that meet all five attributes. [1]

The premise of IAC's investment in MGM Resorts was that MGM has similar advantages to Disney, but it was weakest in online sales. IAC's $1B investment and DTC expertise are being leveraged to help MGM to solve for that pain point.

MGM's share price has more than doubled since August 2020, more than doubling IAC's investment.

Disney, Chapek & Sports Betting

Based on Chapek's comments at the Goldman Sachs Communicopia Conference last September, the thesis seems to be that they are "interested" in sports betting, but they are not willing to commit to an outcome yet:

Let's just say that our fans are really interested in sports betting. Let's say that our partners with the leagues are interested in sports betting. So we're interested in sports betting.

Strategically, what sports betting gives us is the ability to appeal to a much younger sports fan viewer who can be very strong in their affinity for those sports. And so it's definitely a place we want to be.

He fleshed this out further in the Q4 2021 earnings call:

...we do believe that sports betting is a very significant opportunity for the company. And it's all driven by the consumer.

It's driven by the consumer, particularly the younger consumer that will replenish the sports fans over time and their desire to have gambling as part of their sports experience. It's not necessarily a lean back. It's a little bit of a lean forward-type experience that they're looking for. And as we follow the consumer, we necessarily have to seriously consider getting into gambling in bigger way.

And ESPN is a perfect platform for this. We have done substantial research in terms of the impact to, not only the ESPN brand, but the Disney brand in terms of consumers' changing perceptions of the acceptability of gambling. And what we're finding is that there is a very significant installation. Gambling does not have the cache now that it had, say, 10 or 20 years ago.

And we have some concerns as a company about our ability to get in it without having a brand withdrawal. But I can tell you that given all the research that we've done recently that that is not the case. It actually strengthens the brand of ESPN when you have a betting component, and it has no impact on the Disney brand. Therefore, to go after that demographic opportunity plus the, of course, not insignificant revenue implications, that is something that we're keenly interested in and are pursuing aggressively.

This mirrors the language of his memo from Monday, suggesting sports betting will be crucial to capturing a younger demographic for ESPN through DTC.

The Tradeoffs of Control

A Wall Street Journal report from August 2021 suggested two scenarios were being discussed within Disney around sports betting:

[ESPN] has held talks with players that own major sportsbooks, including casino operator Caesars Entertainment Inc. and online gambling company DraftKings Inc., the people said. ESPN has existing marketing partnerships with both companies.

On offer is the right for a suitor to use the ESPN name for branding purposes and potentially rename its sportsbook after the leading sports TV network in the U.S., the people said. A deal could come with an exclusive marketing commitment that would require the sports-betting firm to spend a certain amount of money advertising on ESPN’s platforms, one of the people said.

In terms of the PARQOR Hypothesis, the former scenario would be Caesars as both online and offline sales channels for ESPN+ and sports betting, and the latter would be DraftKings as an online sales channel, only.

IAC's investment in MGM Resorts was predicated on helping MGM to own a sales channel (online) it had struggled to build, and IAC invested $1B of the $4B it earned from the Match IPO to create a win-win scenario from that strategy.

Disney does not plug as cleanly into either Caesars' or DraftKings' ecosystems. [2]

Ourand and Marchand framed the challenges for Disney with these partnerships in terms of content: Barstool Sports has set the market standard around sports betting content with "edgy" content, and other outlets like Action Network are focused on surfacing information that helps sports bettors find opportunities. [3]

In other words, a key challenge for Disney is how to plug sports betting into its own BEADS ecosystem both in terms of its relationship with consumers and the content it will provide to them. Because that reflects a deeper issue about what it means for Disney's ecosystem to transition to an increasingly DTC relationship without it owning the online sales channel.

By analogy, Iger saw challenges with the iPod because it created new distribution channels for Disney's library that were both online (iTunes) and offline (iPod), and both of which Apple controlled. But, he also understood that Jobs and his team understood that distribution model better than him and his team at Disney, and there was no fighting that reality.

Sports betting is different because it threatens multiple elements of Disney's BEADS ecosystem:

It forces Disney to consider compromising both its own and ESPN's aspirational Brands

It requires Disney to share the DTC relationship with its Existing user base at scale (76MM ESPN linear homes, 17MM+ ESPN+ subscribers and 43MM+ Hulu subscribers) instead of owning it outright

Sports betting companies will own the addition Avenues to monetizing its ESPN IP

ESPN+ and ESPN.com will be competing with the sports betting sites on a Daily value proposition (something new around sports betting for fans to consume daily), and Barstool Sports alone has 100MM+ monthly uniques with "edgier content"

It forces Disney to consider compromising control over both its online and offline Sales Channels, the latter especially in this case of

None of these challenges invite easy solutions.

On the flip side, Disney must plug its brands into a sports betting ecosystem but with the caveat that "executives have said they want the company to avoid being directly involved in gambling transactions", as The Wall Street Journal reported.

In this scenario, Disney is conceding to the sports betting company the transactional stages of the DTC conversion funnel closest to the consumer.

In streaming terms, that is the equivalent of ceding DTC transactions to the Amazon Channels store, something which Disney reached a deal with IMDb TV in February 2020 in order to avoid Disney+ being distributed on Amazon Prime Video Channels.

Bob Chapek and his team face the challenge of walking a fine line between avoiding an Amazon Channels store-like outcome with Caesars or DraftKings, but also of needing that type of outcome as a form of insurance/insulation from the riskier elements of sports betting.

Disney's DTC Is THE Pain Point

In financial terms, the challenge for Disney+ is its operating income relies heavily (40% in Q4) on the "original direct-to-consumer business – its Parks business –but does not rely on DTC for operating income: the division lost $1.6B in FY 2020 and $630MM in Q4 2020, alone.

With the pull-forward impact of the pandemic – which saw subscriber growth flatten at Disney+ and Hulu but not ESPN+ – that number may not improve anytime soon.

A $3B multi-year brand-licensing deal with a sports betting dampens those losses substantially and brings Disney's DTC division closer to break-even, especially if the deal is short-term. The implication, then, is that sports betting is a necessary condition for any Disney solutions to DTC.

But, unlike IAC Disney is not in a position to solve the DTC relationship for sports betting companies. Sports betting runs a far more sophisticated marketing operation and conversion funnel than Disney because the model requires it.

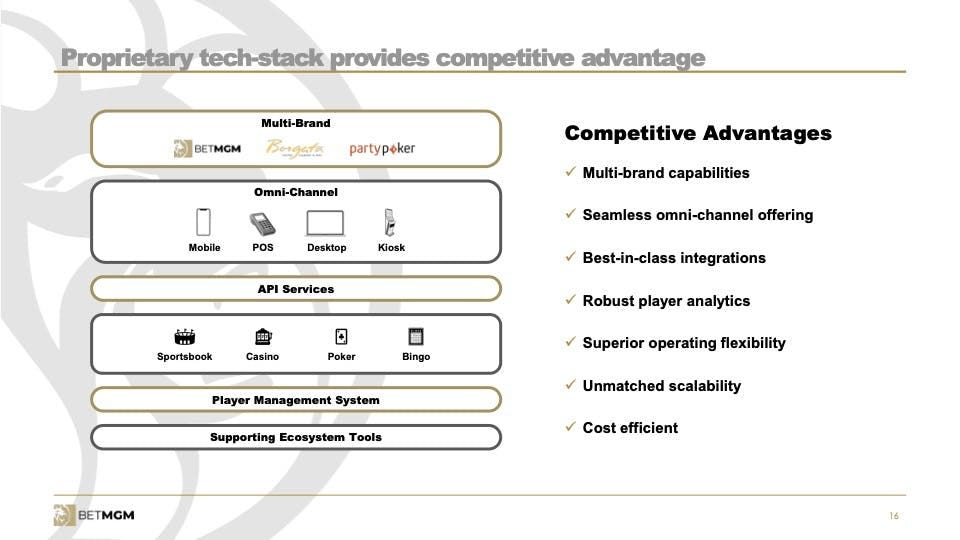

I wrote about this in August 2021 in MGM Resorts M life "Convergence" vs. "Metaverse" Convergence. MGM's tech stack highlights where Disney may be disrupted by a partner.

Following MGM Resorts M Life members through any one of the four omni-channel destinations to a game highlights just how much information Disney will not have access to.

So, Disney needs those sports betting companies to own the sports betting DTC relationships at a time when Disney's CEO is telling the company that DTC is one of three priorities for the future of the entire company. Those are conflicting objectives with no obvious compromises, and likely more technical ones like limited data-sharing and revenue sharing.

Conclusion: A Question of Vision?

Back in October I wrote A Short Essay on CEO Bob Chapek’s Choices for ESPN's Future at Disney. I described Chapek as:

a fiduciary executive who understands he is constrained by the reality that sports are important to Disney’s domestic business model, and to its consumer and guest value propositions. [But, he is also] an executive who does not have a vision for where sports is headed, nor seems to feel invested in it.

That take was based on an answer he gave at the Goldman Sachs Communicopia Conference last September to a different question, “where does ESPN fit into your portfolio over time?”

I think as much as Chapek's crossroads with ESPN, sports betting, and DTC invites comparisons to Robert Iger's crossroads with the iPod – because both reflect watershed moments for Disney's digital future – what the PARQOR Hypothesis helps to highlight is just how different these two moments are.

I believe Chapek is more a fiduciary than a visionary, and is unfortunate in the sense that his predecessor (Iger) had the unusual skillset of being able to be both (as the iPod story reflects). I also think that, to date, he has not been served well by his lieutenants, something I both argued in an essay back in September (Are Disney CEO Bob Chapek's "Top Lieutenants" the Right Fiduciaries for DTC Streaming?), and on Twitter yesterday.

But, I also think that the PARQOR Hypothesis highlights how sports betting does not offer any easy solutions for Disney's DTC aspirations. What happens in the sports betting conversion funnel is far more sophisticated than what happens in Disney's DTC conversion funnel for its streaming apps.

Effectively, solving for sports betting in DTC terms is Disney solving for both the conversion and retention stages of a conversion funnel but without owning the consumer within the Disney BEADS ecosystem. It also means having a lower quality understanding of the sports betting consumer at a time when Disney's CEO demands a "relentless" focus on the consumer.

That means, unlike the ESPN+ subscriber, the sports betting consumer has both one foot in and one foot out of Disney's ecosystem, which is an un-Disney-like outcome. This is a riskier outcome to ESPN and Disney than the risks posed by "edgy" content. [4]

Footnotes

[1] There is only one change I would make: WarnerMedia has successfully built into an aspirational brand, giving it a score of 4 out of 5. In addition, post-merger Warner Bros. Discovery will put discovery+ into HBO Max's column.

[2] In a funny way, the IAC letter to shareholders is an implicit argument for Disney to partner with MGM Resorts, as MGM understands how to navigate the issues Disney is confronting.

[3] A challenge with this reporting for sportsbooks surfaced on Sunday in Klay Thompson's return to the Golden State Warriors.

Teammate Draymond Green was not supposed to play due to an injury, but opted for a ceremonial starting role. That created an opportunity for savvy bettors.

Bettors who were tipped off to the plan on social media looked to capitalize on an apparent lock—betting the under on Green’s prop bets, a player known for filling up the stat sheet....

At least one sportsbook has refunded those who bet the over and honored winning under tickets. Another chose to void over bets, while one has marked them as a loss.

[4] Marchand and Ourand discussed sports reporter Pat McAfee as an interesting example of the challenges for Disney on the content side. McAfee just signed a $120MM deal for FanDuel to be the exclusive sponsor of his show (on YouTube and SiriusXM). This is in addition to the work he does with the WWE as a color commentator on Friday Night Smackdown, and commentator work he does on ESPN.

Marchand said on the podcast that "McAfee and Dan Katz "couldn't exist at ESPN", and it is "a big ask for them to grow at ESPN". Being "edgy" at ESPN/Disney is hard, people swear on the Internet.