Now-former WarnerMedia CEO Jason Kilar’s farewell tour has revealed new details about HBO Max’s conversion funnel (I wrote about one of those details, the championing of product channel fit, on Monday).

In particular, his interviews with Bloomberg’s Lucas Shaw and Puck’s Matt Belloni offered some data points into the HBO Max conversion funnel for AVOD (Shaw) and for the “Project Popcorn” day-and-date release strategy for theatricals (Belloni). But, on their own, they are not particularly insightful.

A recent opinion column by Marketing Week’s Mark Ritson offered some data and an imagined conversion funnel for Netflix in the UK from 2021, and it offers a helpful comparison for the data Kilar shared.

When comparing these new Netflix and HBO Max data points side-by-side across each stage of the conversion funnel, we end up with better insights into why Netflix is testing charging subscribers for password sharing to find growth. But, we end up with more questions about HBO Max's bet on an ad-supported model for growth.

Key Takeaways

Both Netflix and HBO Max need continued growth.

HBO Max launched an ad-supported tier assuming US and international consumers are price-sensitive.

But Netflix data from the UK and US suggests consumers are not price-sensitive in both markets.

New data to emerge about Netflix and HBO Max highlights how price-sensitivity impacts their respective conversion funnels

Assumptions

A quick note on how I am structuring the analysis in this essay.

Basically, the US and UK streaming markets are both primarily English-speaking markets where Netflix is near full market penetration and/or has already reached it. HBO Max has launched ad-free and ad-supported versions in the US, but as per the above, has yet to launch in the UK (a licensing agreement with Sky TV currently prevents HBO Max from launching in the UK (and also in Germany, France and Italy)).

So, generally speaking, there are sufficient similarities between the US and UK markets that we can assume:

Netflix’s decisions in the UK conversion funnel are likely similar to its decisions in the US conversion funnel, and

Both Netflix’s pursuit of growth in the US and HBO Max’s pursuit of growth in the US are navigating similar consumer behaviors.

Therefore, we can broadly but imperfectly compare HBO Max and Netflix's strategies across a conversion funnel.

A "Generic" Conversion Funnel

Mark Ritson of Marketing Week’s opinion piece argued, “Wondering why Netflix wants to stop password-sharing? It’s all about funnels”. I liked the piece for two reasons: its discussion of conversion funnels in 2022, and an imagined conversion funnel for Netflix in the UK that uses available data (and some guesswork).

I particularly liked his take on conversion funnels in streaming:

There has been a whole bunch of shit thrown at funnels in recent years by people who really should know better. I do not know of a way to build strategy without a funnel. It is the backbone of all marketing strategy and, along with targeting and positioning, sits at the centre of the dashboard of every well run brand.

There are nuances of course, usually missed by the critics. The main one is that the generic funnels from the textbooks that run through awareness, consideration, preference, purchase and advocacy are inevitably of little use. Consulting firm McKinsey keeps trying to design and redesign a generic funnel for all its clients and misses this point too.

You need to customise it to your business and your market.

This take highlights how we know little about how HBO Max and Netflix define their respective conversion funnels. That said, we can build a “generic funnel” of Awareness, Consideration, Purchase, Retention and Advocacy, and use this new Netflix and HBO Max data to understand how each is navigating their respective challenges with growth.

In particular, we see a very different understanding of consumer price sensitivity emerge.

Awareness

HBO Max has found growth in the US market with fewer brand assets than Netflix for generating awareness, and a great reliance on Hollywood tentpoles.

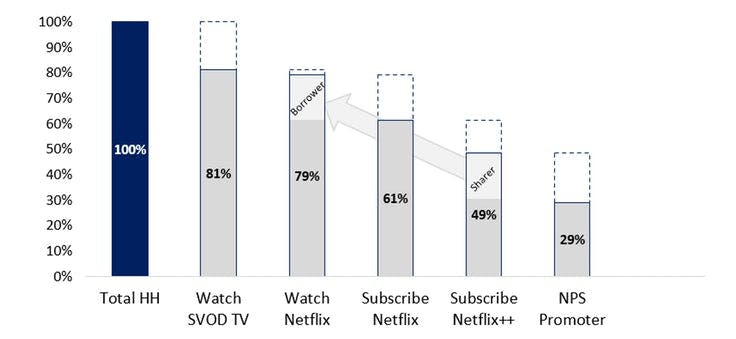

Ritson estimates that in Q2 2019 ~47% of the UK’s 27.8MM households were consuming SVOD, and ~90% of those households were consuming Netflix. By Q2 2021, 81% were consuming SVOD and almost 100% of those households were consuming Netflix. Netflix is believed to have reached similar market penetration in the US.

HBO Max has relied on a very different, more limited strategy of awareness to find growth in the US market. HBO Max’s brand awareness, to date, has been driven mostly by the “robust marketing budget” behind its “Project Popcorn” day-and-date release strategy for Wonder Woman 1984 in 2020 and 17 tentpole movies in 2021.

Consideration

Netflix has established itself as a default option for SVOD streaming in the UK market, and by implication the US market, whereas HBO Max required day-and-date release of theatrical tentpoles to reach similar status.

Ritson’s data suggests that both in Q2 2019 and Q2 2021 almost all UK streaming households considered Netflix to be a solution for consuming SVOD. Netflix’s challenge in 2019 was to growth:

Back in 2019 you would have set an ambitious goal along the lines of ‘increase the proportion of British households that subscribe to Netflix from 42% to 50% by December 2019’. You would have targeted mainstream households that were yet to signup for SVOD and pushed all the hot, exclusive shows to hopefully attract new subscribers. You’d have used a decent ‘long’ emotional campaign with a tagline about stories and a showcase of new programming. You’d have spent your money online, outdoor and (of course) on TV where your target consumer is already consuming the competition.

And that is exactly what Netflix did.

WarnerMedia’s “robust marketing budget” for “Project Popcorn" - as described by Jason Kilar to Matt Belloni - did something similar. It aggressively marketed all the “hot, exclusive” Hollywood tentpole movies that were both in theaters and on HBO Max to attract new HBO Max subscribers. Kilar reinforced a point about consumer choice he had originally made in a December 2020 memo to fans:

In a situation where we have 7 million people dying there are going to be people that make the decision to watch a movie from the comfort and security of their home in the height of a pandemic versus going to a theater. And then, what we wanted to do as a team was to give them a choice to do so.

In other words, "Project Popcorn" sought to drive consideration of HBO Max by aggressively promoting how HBO Max’s conversion funnel had adapted to the market realities of the pandemic, and how it offered consumers a choice. They were "first over the wall" as Kilar told Belloni, and the model "made money", despite cannibalizing theatrical attendance.

Purchase

Price sensitivity does not seem to be an obstacle for Netflix in the UK, and therefore by implication the US. However, HBO Max’s ad-supported tier implies it is an obstacle in the US.

The purchase stage of the funnel highlights an important point about price sensitivity. Ritson estimates that during the pandemic millions of households sign up for Netflix:

…households in the UK signed up in their millions for Netflix. Best estimates would suggest that more than 17 million households, 61% of the total in the UK, now subscribe to the service. Normally when you reach beyond the 60th percentile you start to feel scratchy about further penetration. The ceiling is suddenly visible and you worry about the oxygen left in the room.

Ritson’s opinion argued why Netflix’s conversion funnel in Q2 2021, as he sees it, reflects a need to charge for password sharing:

The biggest opportunity on the 2021 purchase funnel is no longer the households resisting the lure of SVOD. Instead, it’s the 20% of the market who watch Netflix but don’t pay for it.

Ritson is making a two-fold point here about price sensitivity. First, most Netflix subscribers opt for the more expensive multiscreen offers (he estimates ~80% of Netflix subscribers) than the basic tier of £5.99. So, there is not much price sensitivity in the UK market.

Second, his Q2 2021 data suggests that “around a third” of Netflix subscribers with multiscreen access “share some of this multiscreen access with others who do not live in the same household” Given that Netflix’s penetration in the US market is similar to the UK market, we can assume from the Q4 2021 Average Revenue per Membership of $14.56 that there is a similar lack of price sensitivity in the US. [1]

But Kilar painted a picture to Bloomberg’s Lucas Shaw of the US streaming customer as being more price-sensitive than Netflix’s numbers reflect:

“Close to 50% of every new [HBO Max] subscriber is choosing the ad tier. Hulu, the last stat they shared publicly, is they are north of 60%. I suspect that in the not too distant future you’ll see the majority of new HBO Max subs choose the ad-supported option. We tried to price it in a way where we’d be indifferent. We’re making a little more on the ad-supported version because of dollars we’ll generate from advertising.”

If we assume the US and UK streaming markets have similar dynamics because Netflix has maximum market penetration in both, Ritson and Kilar are contradicting each other. Ritson is arguing price sensitivity is a problem limited to 20% of Netflix’s subscribers, but Kilar believes US subscribers are mostly price-sensitive and lower prices will drive growth for HBO Max.

Perhaps the difference can be explained by Ritson focusing on password sharing and Kilar being focused on soup-to-nuts growth. But, the implication is still there: price sensitivity may be a more limited consumer need in the US than Kilar has been arguing.

Retention

Price sensitivity may be more of a factor for HBO Max’s growth than for Netflix’s churn in the US.

New data suggests churn is a very different issue for Netflix and HBO Max: Netflix has more upside in solving for password sharing, whereas HBO Max has more upside in aggressively pursuing new subscribers.

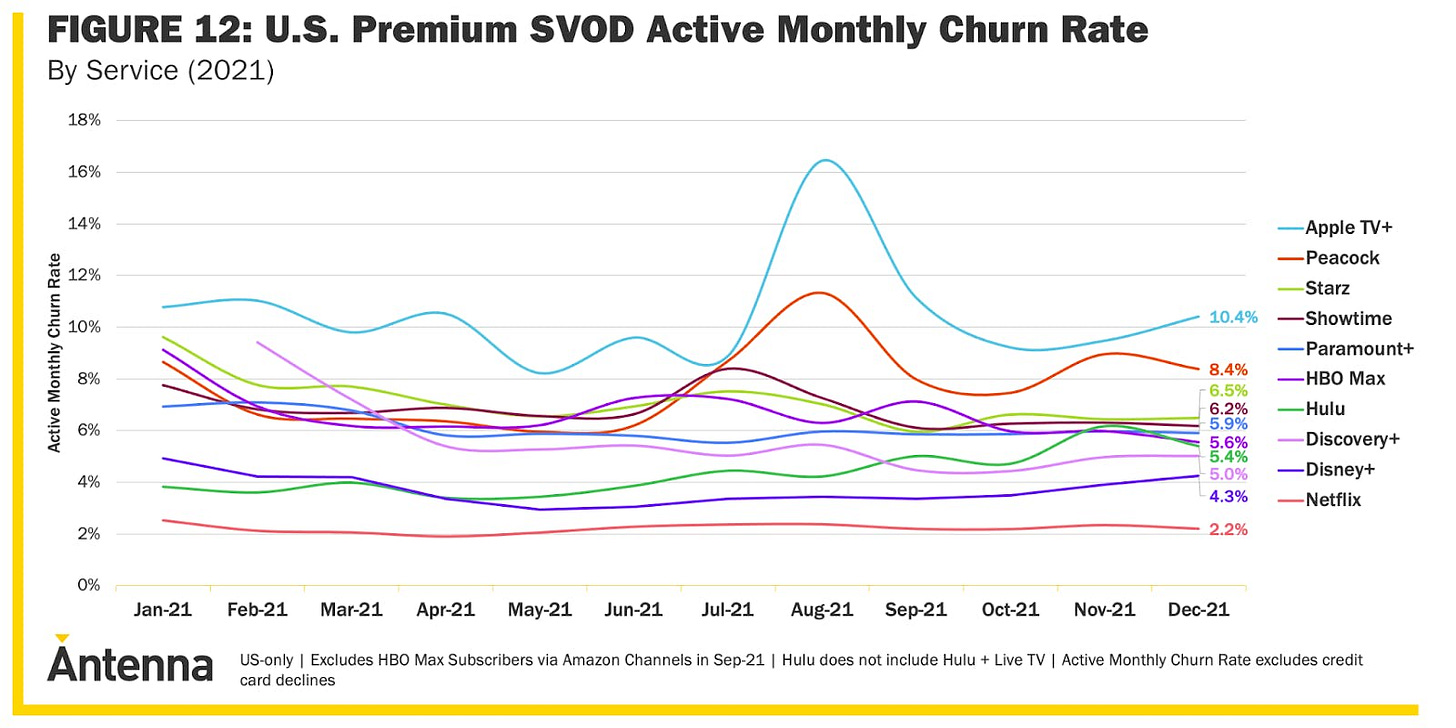

The increase in total households in the UK who watch SVOD TV and also watch Netflix in the UK between Q2 2019 and Q2 2021 would suggest churn is low. Similarly, in the US, churn has been a market low for Netflix (2.2%) according to Antenna data.

This data supports Ritson’s argument for Netflix to focus on password sharing as a pain point with streaming consumers, and a bigger pain point than price.

HBO Max has over 2.5x the churn rate of Netflix’s at 5.6%. Until Q4 2021 it was more expensive than Netflix, but a recent price hike from Netflix now puts the standard tier at $15.49.

Kilar shared with Puck’s Matt Belloni that WarnerMedia focused on “ first views and on consumption” to calculate the worth of a subscriber who signed up to watch a movie from “Project Popcorn”:

Here’s two ways you think about the results of a movie on a streaming service. Number one is “how many new subscribers does that movie bring in?” And the way you think about that, the way you analyze that is what we call first views. So, when you subscribe to HBO Max was the first thing you substantively spent time with? It’s not a perfect metric but it’s a good indication that this was probably what compelled you to join the service. And when you join a service like HBO Max you tend to keep it for a long period of time paying $14.99 a month in the US market and we retain most of the revenue and so you can kind of know economically “here’s what a new subscriber is worth”. So it’s not all attributed to that one movie that brought you in the door, but part of it is.

The second thing that we look at is consumption which is, “How many people - whether or not they were a first time subscriber - watched this movie?” And the reason why that’s so important matters because that’s an indication that you’re delighting customers each month. Because if someone doesn’t watch anything on HBO Max in the course of a month there’s a chance they’re not going to retain it for the next month.

This quote reflects one obvious explanation for the contrast in churn rates: Netflix has been in the marketplace for a decade and HBO Max is only two years old. So HBO Max is a streaming service still figuring out what it needs to offer consumers.

As for Netflix, password sharing for Netflix is its only viable solution for growth in the US and UK “because their funnel is telling them [to] do it.” Ritson adds:

There is no need to sell these customers on the quality of the shows or the many benefits of Netflix with an ad campaign: they have been appreciating these things for years. No need to target them with clever programmatic advertising: they tune into Netflix’s home screen every night. What the company now urgently needs is to persuade/cajole/intimidate these freeloaders to take out a proper subscription.

Netflix confronts price sensitivity as an obstacle to additional growth, but to date has seen its churn rate less impacted by it.

Advocacy

We have little publicly available insight into the Net Promoter Scores for Netflix and HBO Max, but “Project Popcorn” delivered for HBO Max.

It’s worth noting that Ritson also wrote about the unusual strength of Netflix’s Net Promoter Score (NPS) in the UK, a metric used to measure the loyalty and advocacy of consumers:

Netflix continues to represent more than half the total minutes of SVOD watched in the UK. And with an NPS of around +45 it continues to offer an excellent service that is significantly more satisfying than any of the other options available. As is the usual practice, I’ve used NPS here in a different format for the funnel, showing not the net total but the estimated number of premium Netflix subscribers who rate the service with a 9 or 10. That might create what looks like a big drop off for that final bar, but it’s actually a hell of an achievement. Very few brands can create that kind of conversion.

We do not have much insight into HBO Max’s NPS. That said, UK-based Kantar found a total streaming NPS of 44 in the US as of Q3 2021, and reported in Q2 2021 that HBO Max saw its NPS go up from 10th in the US marketplace to 2nd thanks to movies from “Project Popcorn”.

Conclusion

I think Mark Ritson’s perspective that Netflix’s funnel is forcing Netflix to pursue growth by focusing on monetizing freeloaders is particularly valuable. Notably, Netflix’s test in Chile, Costa Rica, and Peru to add sub accounts for up to two people they don’t live with at a lower price, or enable people who share their account to transfer profile information either to a new account or an Extra Member sub account. This is more “nudge” than “persuade/cajole/intimidate”, but it reflects a solution that could solve for monetizing an estimated 18MM “freeloaders” in the US.

This perspective also raises the question of what HBO Max’s funnel is “forcing” it to do. Because, if it is targeting the same subscribers as Netflix, all available data suggests they are not price-sensitive. But Netflix is treating price sensitivity as a problem limited to a subset of its user base (Ritson estimates it to be one-third of its premium subscribers), while Jason Kilar and even new Warner Bros. Discovery CEO David Zaslav promote the assumption that target US and international streaming subscribers are indeed price-sensitive.

But, is that the right assumption?

It is a fascinating question to emerge the day after the official launch of Warner Bros. Discovery. Because Discovery had difficulty scaling with a price-sensitive ad-supported tier (though it seems to have seen ARPU of $10-$11 per subscriber on that tier, or almost 2x the $5.99 price). It is not yet clear whether consumer price-sensitivity is something that actually exists or whether it is imagined by WarnerMedia and Discovery for the purposes of jumpstarting growth.

The short answer is, the answer may be different market-to-market. The longer answer is, if they are right then the bet on an ad-supported model makes sense. But if they are wrong, it is worth diving deeper into what the HBO Max funnel was telling WarnerMedia management when they decided to launch an ad-supported tier, and what it is now telling Warner Bros. Discovery management now.

Footnotes

[1] If we were to calculate a weighted average of basic, standard and premium subscribers in the US, $14.56 implies that subscribers are mostly standard with enough on premium to boost the ARPU by $0.57 above the monthly standard fee of $13.99.

So, if we then assume that ~80% of US subscribers subscribe to premium tiers as they do in the UK, and we assume there are ~68MM US subscribers, then there are 54MM Premium subscribers in the US. Using Ritson’s math, there are 54MM subscribers who are not price-sensitive, and 18MM (one-third) of whom engage in password sharing. If Netflix charges $1 per password sharing subscriber per month, that could be up to $216MM in marginal revenues per year in the US, alone (and globally could be ~$500MM in incremental annual revenues).