Yesterday WarnerMedia CEO Jason Kilar announced he is stepping down on Friday. I wrote about his vision for streaming and gaming in "Four Powerful Growth Vectors" for Modern Storytelling Companies, Which Ones Are Viable?”

Overall, yesterday’s executive departures from WarnerMedia (nine in total, including Kilar, Warner Bros. CEO Ann Sarnoff, HBO Max Chief Andy Forssell) reflect what I argued in Warner Bros. Discovery Is "A Real Company" Facing A Flip-of-a-Coin Future: I think that Discovery is letting the best talent who can for solve for streaming leave the building.

To be fair, it usually takes about a year or two for the organization to adapt after executive departures like these, but the Discovery executives taking over seem less savvy to building and running direct-to-consumer models for streaming and gaming (and perhaps especially gaming).

Deloitte Data Defines Netflix's Next Chapter

What will be Netflix’s value proposition to consumers after 2022?

It’s worth asking that question as it seems to be underlying everything we’ve learned over the past few weeks:

Netflix CFO Spencer Neumann recently would not rule out an ad-supported model;

Netflix bought its third gaming studio in six months; and

Most recently, Netflix executives have “cautioned employees to be more mindful about spending and hiring”

While none of these are clear signals, they all point to Netflix needing to adapt its operational and financial model to evolving user behaviors. The third in that list - recently reported by Jessica Toonkel of The Information - carries a bit more weight. It implies Netflix may be more sensitive to its story of free cash flow and reduced debt in 2022, which Netflix has been preparing investors for in recent years.

Most of these signals are U.S.-focused, as recent quarterly earnings imply growth has begun to flatten in the U.S., which has Netflix’s highest Average Revenue per User ($14.56) and is 44% of gross revenues. So these signals, even if not pointing to a clear outcome, have significance.

The question is, what are they telling us both individually and collectively?

I think these signals reflect an emerging savvy from consumers that, generally speaking, we have previously seen within a narrower, more tech-savvy consumer subset. In turn, we are seeing Netflix's growth constrained in nuanced ways that we have not seen before, and we are seeing Netflix being forced to innovate in ways that we haven’t seen either them or any other company has done (or, done well enough) before.

Key Takeaways

Netflix faces the question of whether and/or how it must evolve its value proposition in response to evolving consumer trends

Three notable ones are increased churn, password sharing and gaming

Gaming seems to be the only value proposition that seems to be a "must-have" for Millennial and Gen-Z audiences

Gen Z & Millennials are shaping Netflix's strategy

Three consumer behaviors have emerged in recent years that seem new-er for Netflix:

Increased Churn

Password sharing (generational?)

Gaming

In the U.S., a recent Deloitte 2022 Digital Media Trends survey suggests those can be attributed to newer generations of consumers. [1]

1. Increased Churn

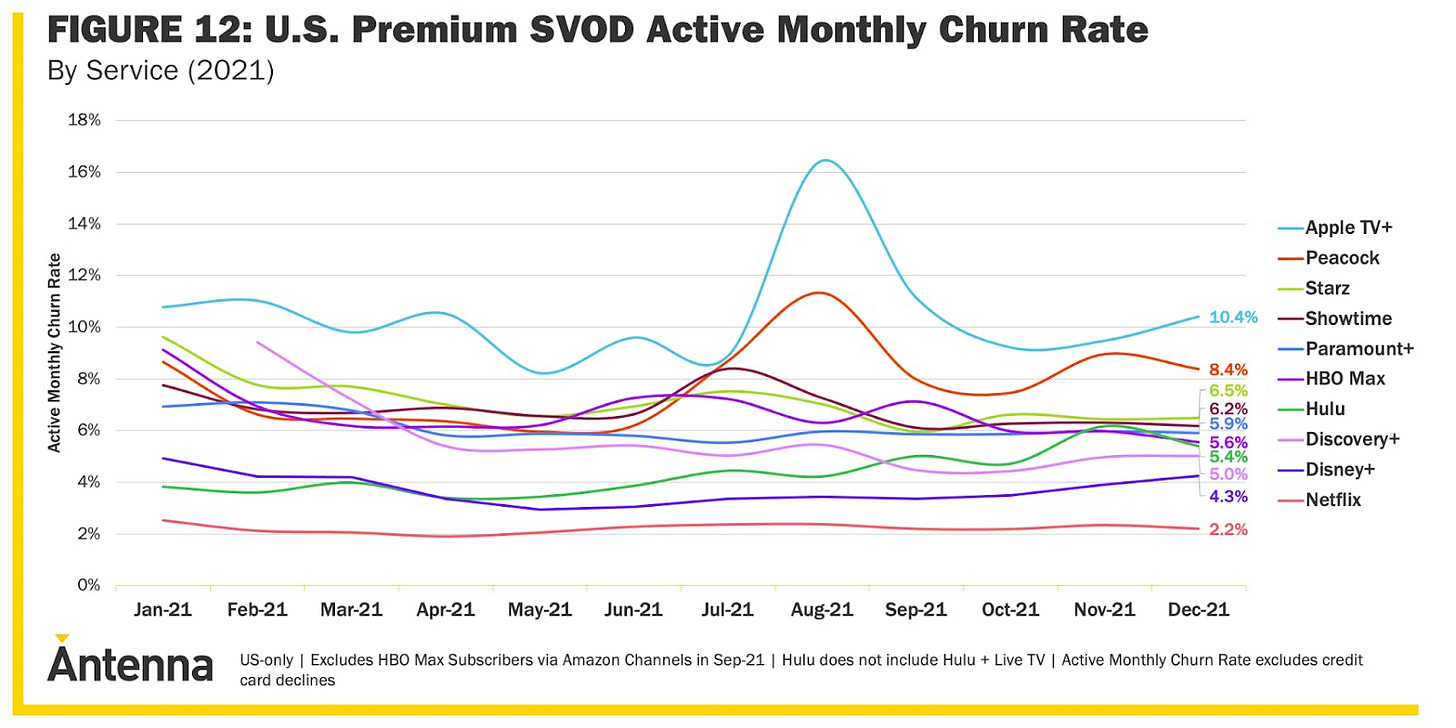

Netflix has historically had low churn - Antenna estimates U.S. churn to be as low as 2.2% monthly.

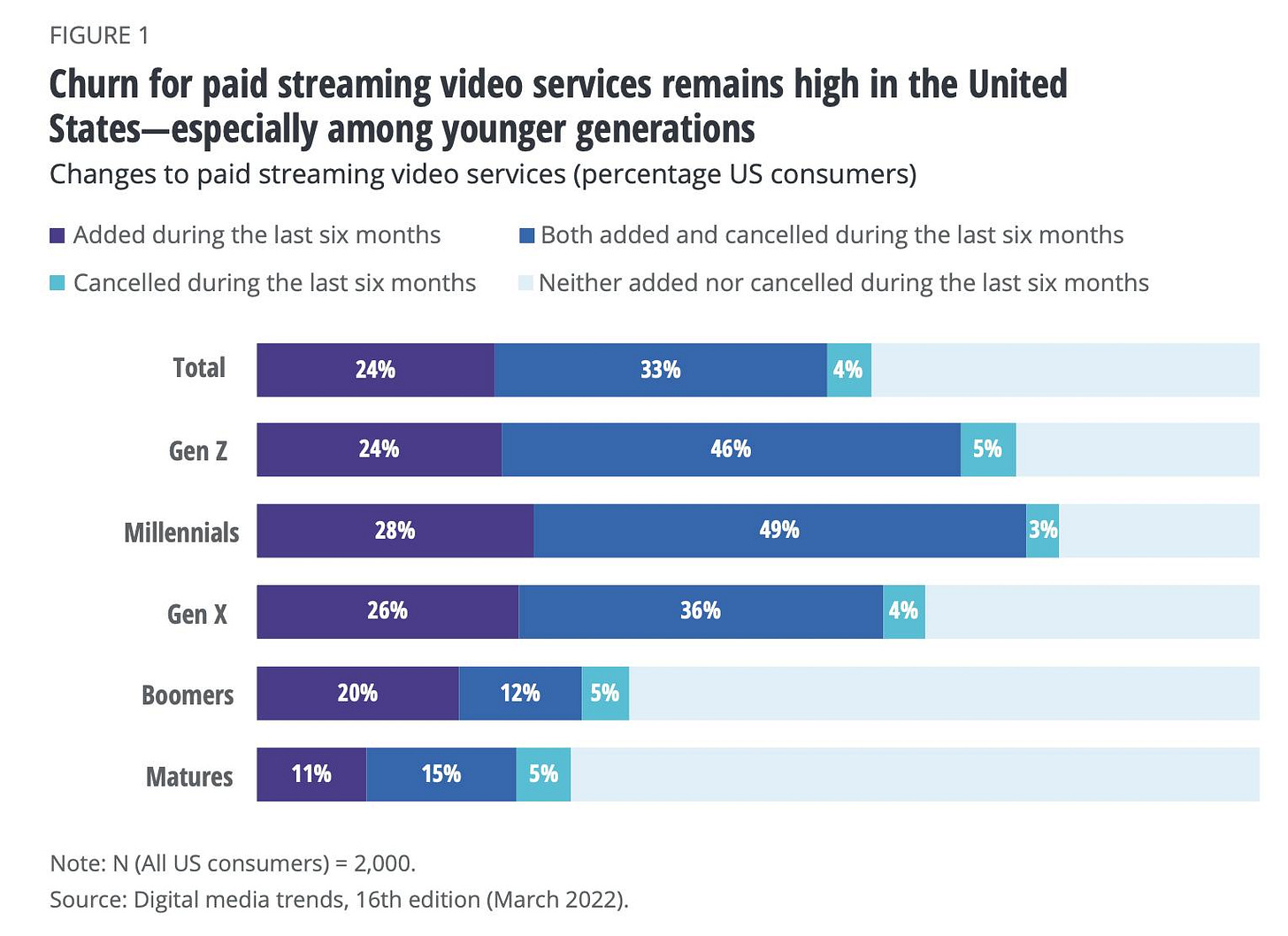

In Deloitte’s 2022 Digital Media Trends survey, over half of both millennial and Gen Z respondents in the U.S. said they added, canceled, or added and canceled a streaming service in the past six months. The survey defined Gen Z as having been born between 1997 and 2007, and Millennials as having been born between 1983 and 1996.

Jana Arbanas, vice chair of Deloitte LLP and U.S. telecom, media and entertainment sector leader, told The Hollywood Reporter:

“I think there is two driving factors behind it,” Arbanas says. “[First] they are comfortable with it, they are digital natives. Signing up for and accessing something and then canceling and reupping it is not daunting to them in the way that it is to some generations that are not digitally native… The second part of that is cost, they are more cost-conscious in that generation.”

The implication from Deloitte’s data is that Netflix’s churn rate may be going up - both domestically and internationally - due to the emergence of “churn-and-return” behavior.

On a related note Jonathan Carson - co-founder of Antenna - told Ryan Faughnder of the Los Angeles Times that “Netflix and other developed, saturated brands” are shifting their focus to retention - while other newer entrants in streaming focus on growth.

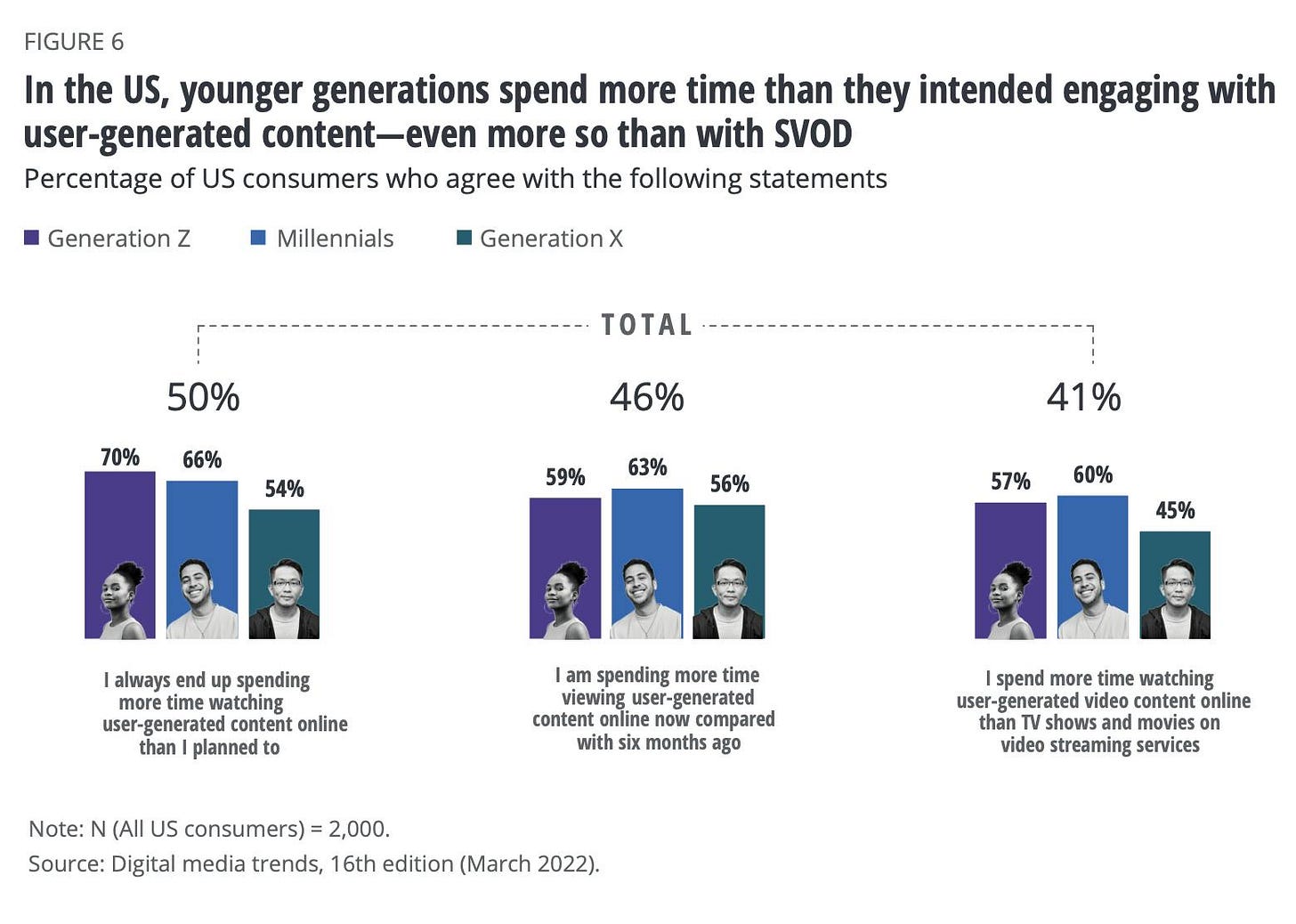

But there is another data point worth considering: ~60% of Gen Z and Millennials say they watch user-generated video content than they do TV shows and movies on video streaming services.

Netflix has always conceded to investors that YouTube is a competitor. But, now, YouTube’s 135MM Connected TV users in the U.S. seems to be an increasingly competitive use case for capturing Gen Z and Millennials seeking to stream entertainment. If the problem is indeed "churn-and-return", YouTube is a free alternative for streaming consumers on Connected TVs, at scale, in the U.S., alone.

So, churn is not just about churn, alone. It is also a problem of economics for Netflix's model: spending billions on Hollywood talent to compete with 2MM creators on YouTube who reach more people on U.S. Connected TVs than Netflix, and for free (a marketplace dynamic I dove into back in February in Tension between Creator Economy Strategies & Short-Form Video Business Models).

2. Password Sharing

The Information’s Jessica Toonkel reported that password sharing among Netflix subscribers “has become more common in the U.S. and other parts of the world than executives anticipated”. She added:

In two separate meetings over the past few weeks, Netflix executives cautioned employees to be more mindful about spending and hiring, according to three people familiar with the discussions.

Nearly 36% of Americans said they share their Netflix account login with relatives, per an Advertising Research Foundation survey of U.S. adults fielded in the second half of 2021 and shared recently by Variety VIP’s Kevin Tran. Tran writes that in Netflix's Latin American tests:

…it’s likely that some Netflix users in [Chile, Costa Rica, and Peru] have people freely using their accounts that they don’t know about, for example. In those instances, the rightful Netflix account owner could simply not verify the devices that the moochers are streaming from, and the moochers would be forced to get their own accounts (or stop accessing Netflix).

At the same time, there are also probably many people who share Netflix passwords who are close and don’t mind communicating when an account verification needs to be done. Keep in mind that once an account holder verifies a device, that device won’t need to be repeatedly verified (at least in this iteration of the test).

So in the testing regions, moochers don’t really have a massive hurdle to clear to continue getting access to a Netflix account for free. [2]

This password-sharing test reflects a delicate balancing act where Netflix keeps its existing users happy and engaged by permitting password sharing. Also, if they can get at least $1 more per user per quarter in Latin America (LATAM), that is +13%/month in ARPU ($7.73 in Q4 2021). With 220 million users around the world, that could end up being substantial revenue on a monthly basis:

United States and Canada (UCAN): +7%/month

Europe, Middle East and Africa (EMEA): +9%/month

Asia-Pacific (APAC): +10%/month

It is no accident they are starting the trial in Chile, Costa Rica and Peru, where Netflix literally gets more “bang” for each marginal “buck”.

But, it is also worth considering the need for this marginal revenue given its free cash flow story, which CFO Spencer Neumann shared with the Morgan Stanley Technology, Media & Telecom Conference last month:

We're building a profitable business. Last time we were here, I think we were at 13% OI margins and a little over $2 billion, $2.5 billion of operating profit. Now we're last year 21% margins over $6 billion of operating profit. We were up over $3 billion negative free cash flow last time we were here, breakeven last year, we'll be free cash flow positive this year, so we're looking to build this amazingly successful business. Those other services are going low price, but they're also losing a lot of money. And I don't know what, I can't speak for how they're going to build their business, but we're focused on ours.

This story is weaker if password sharing grows and user growth slows more than anticipated.

Charging $1 more seems to make sense as a potential solution (and again, it may have the most impact on ARPU in LATAM). But, if it is not a solution, that will only invite more questions about Netflix’s ability to deliver free cash flow, and to reduce both (1) its reliance on debt for day-to-day operations (which it announced it ended in Q4 2021) and (2) its legacy debt load which it carries for “growth leverage”.

Neumann told the Morgan Stanley conference that its debt load would be in the range of $10B to $15B, and is currently on the higher end. With lower growth, it may stay on the higher end, which in turn will only invite more investor anxiety.

In some ways, password sharing could be argued to be the biggest constraint on Netflix's growth than YouTube because it is a problem that is directly solvable by Netflix. If they cannot solve it, it may become an existential threat that directly impacts free cash flow and therefore their ability to pay off their debt. I think this was the implication looming in Jessica Toonkel's article.

3. Gaming

I summed up Netflix's gaming strategy in A Vibe Shift Is Brewing in Streaming:

in January, Netflix Chief Operating Officer Greg Peters described games as part of a “huge, long-term multiyear” vision to create “interactive experiences” around its big franchises. Netflix wants to leverage its intellectual property like Disney does, and to do so it’s betting heavily on gaming. Streaming is a necessary condition of that long-term vision, but it doesn’t have to be at the core of it.

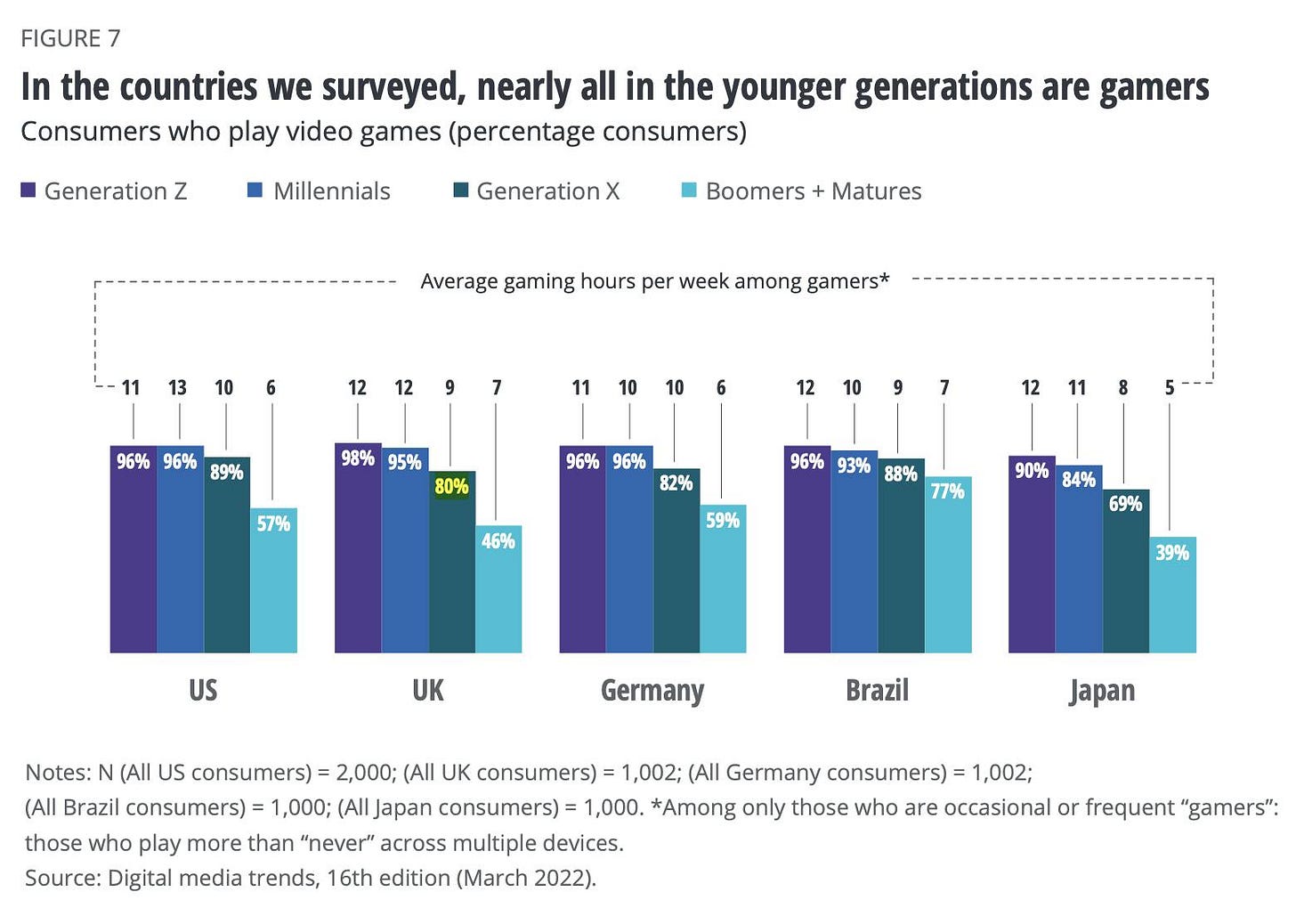

The Deloitte survey showed that over 80% of both men and women in the U.S. say they play video games, and half of the smartphone owners say they play on a smartphone every single day. Gen Z and Millennials game the most, logging an average of 11 and 13 hours of gameplay per week, respectively. In all countries Deloitte surveyed, nearly all younger generations are gamers.

Whereas Gen X gamers have around 10 hours of gameplay weekly, The Streamable’s Lauren Forristal highlighted a Hub Entertainment Research study that found "the average session for weekly console gamers in 2019 was about 90 minutes; in 2021, it was up to around 110 minutes.

So, one rationale for Netflix going into mobile gaming is that it is a weekly behavior engaged in by most of its target user base in the marketplace, globally, and Netflix can evolve its software to meet that consumer use case.

But, the Deloitte data suggests Netflix’s move into gaming also may be a multi-pronged strategy.

First, it addresses retention: Gen Z respondents said they prefer video games as their favorite form of digital entertainment. Churn is highest among this group, with over half of U.S. Millennials (52%) and Gen Z (51%) admitting to having canceled, or both added and canceled, a video subscription service within the last six months.

Second, Gen Zs and Millennials like bundles: 51% would be convinced to keep a streaming video subscription if their service bundled a gaming or music service or another SVOD service.

The implication, then, is Netflix moving into gaming improves engagement but also the perceived value proposition of the service as a bundle to subscribers who like gaming and prefer bundles.

Last, it is worth adding that I think there is a third prong, as I argued last week:

…I think the opportunity lies in a TAM [total addressable market] in mobile gaming that is currently $100B and of which Apple owns $45B. If Netflix can leverage its "ubiquitous access" (its ability to make its content available one click away to its subscribers both on-platform and off-platform (online and offline)), and 220MM subscribers to peel off 1% of that market, that's 3.4% growth in gross revenues annually, at least (off of $29.6B in annual revenue in 2021).

Gaming is a strategic initiative that seems to align with Netflix management’s Disney-like ambitions of multiple avenues for monetizing its IP, but in purely digital terms. It also solves for increasing user engagement, and its need to retain Gen Z and Millennial users, in particular.

But, in pure revenue terms, it also may be a better long-term bet than $1 per month for password sharing given both the TAM and Gen Z and Millennial demand for games.

The Problem with AVOD

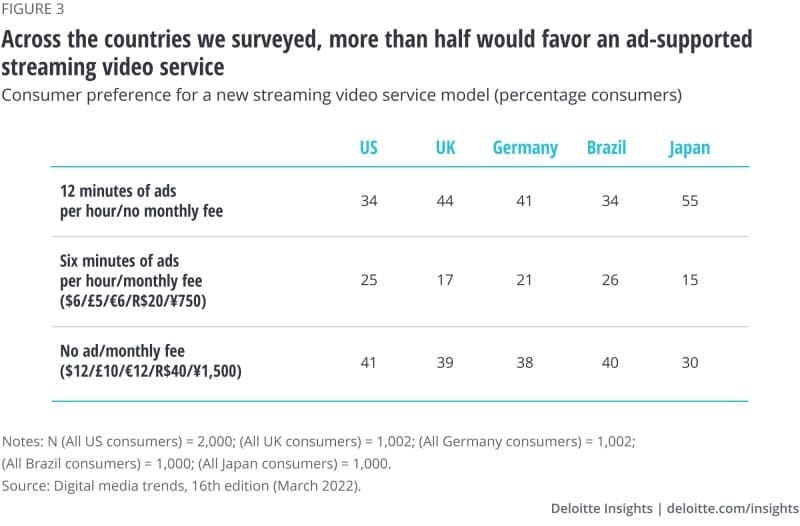

Given last week I wrote about Netflix's gaming zig to Disney or WarnerMedia/Warner Bros. Discovery's AVOD zag, it is worth noting that Deloitte's data highlights Netflix's challenges with the AVOD model, too.

Deloitte’s Arbanas highlighted the problem from demand side to The Hollywood Reporter:

“I think ads are an important part of someone looking to be cost-conscious,” she says. “It might actually be what keeps them. If you can get costs low enough, where it is not worth my time to cancel a subscription, and I am able to keep that subscription for a longer period of time because the cost is not that substantial, and can support it through ads, I think that is a really important way to maintain consumer engagement for a longer period of time. And they are tolerating it, up to a degree.”

This "up to a degree" mirrors how AT&T CEO John Stankey described HBO Max's qualified success in monetizing HBO Max with ads, to date, on its Q1 earnings call:

“The subscription line will possibly dilute a bit, but the advertising line will increase. So when you look at the customer overall, they’re no less profitable, it just books to two different places on the P&L. And our goal—and in fact, what we are seeing today—we are indifferent as to what the customer chooses. Frankly, maybe in some cases, it’s a bit more accretive if they go the ad-supported route.”

Meaning, HBO Max is monetizing ad-supported viewers to a degree that they are happy with, but not at Hulu-type ARPU of $15.50+. Both on the demand side and supply side of AVOD, there is a limit to how well a streaming service can monetize its users.

I was quoted in Ben Thompson’s Stratechery yesterday, highlighting another problem from the supply side:

A second reason to not do advertising is the problem of what kind of ads would Netflix run? This objection was raised by Andrew Rosen, who linked to this article on Digital Content Next explaining the challenges in building an attractive advertising product for connected televisions; Rosen concluded:

Generally, I believe there is a deeper supply-side issue in Connected TV that prevents Netflix from going into AVOD, and it is best reflected in this article on Digital Content Next:

...media buyer reticence around CTV suggests that the market is unsure about the extent to which it can reliably deliver upon its promise. And the reasons for that reticence will be uncomfortably familiar to anyone who has kept abreast of issues surrounding digital advertising more widely.

Deloitte’s survey found that more than half of consumers worldwide are open to an ad-supported offering, but they do not seem to *need* it yet.

Notably, for Netflix 41% of respondents in the U.S. say their preferred streaming service would have a higher price tag and no ads.

There may be a market opportunity in AVOD here, but there is still mostly demand for their subscription service without ads. AVOD as a solution seems more complex than Netflix solving for password sharing or integrating games into its existing software that reaches 220MM+ subscribers worldwide.

Conclusion

In thinking about constraints around Netflix's business model, PARQOR analysis of Netflix has generally approached the company from three different perspectives, to date:

Netflix’s “ubiquitous access” across online and offline channels is a key competitive advantage in streaming (Product Channel Fit framework);

The ability of Netflix management to raise enormous levels of debt without free cash flow implies they are visionaries with fewer limitations from Wall Street than their competition (The Fiduciary vs. Visionary framework);

But, as a pure-play streaming company Netflix operates at a disadvantage to Disney (and Apple TV+) because it lacks key attributes of a modern media business (The PARQOR Hypothesis framework).

Those all analyzed Netflix as a pure play streaming company. With gaming, alone, its value proposition may not be "pure play" anymore, but right now it is closer 95%-99%-play streaming company. That seems on track to change over time.

This brings us back to the original question: what will be Netflix’s value proposition to consumers after 2022?

Netflix’s business model and its story to investors has always been subscriber growth. But the data on what subscribers want from their services suggests that Gen Z and Millennials are no longer invested in consuming content via subscription streaming services. Meaning, there are signals like "churn-and-return" that reflect an emerging consumer savvy in Gen Z and Millennials. This savvy makes Netflix less of a “must-have”, and more of a "nice-to-have".

Gaming seems to be the only solution that we know of that maps to the "must-have" behaviors Gen Z and Millennial consumers of for Netflix’s growth and engagement stories makes sense given the Deloitte survey data. Charging for password sharing may work, too, and if it does, it could drive significant marginal ARPU. But advertising would be a band-aid, at best, with users who do not seem to be demanding it en masse.

Footnotes

[1] It is a worldwide survey but certain media outlets have done a good job doing a deeper dive into the U.S. contextualizing it. So I am relying on both this reporting and from Deloitte.

[2] In case it is not clear, with "moochers", Tran is referring to "people freely using their accounts that they don’t know about".