Member Mailing: Disney, MGM Resorts, Flywheels, Brands & Changing Customer Demand

Good afternoon!

The Medium delivers in-depth analyses of the media marketplace’s transformation as creators, tech companies and 10 million emerging advertisers revolutionize the business models for “premium content”.

Each fiscal quarter, The Medium identifies three or four new trends that have momentum and seem poised to play out at a larger scale in 2023. These key trends pinpoint dynamic and constantly evolving developments in the media marketplace that are emerging from incremental shifts or fundamental changes. The bi-weekly mailings analyze these trends as developments emerge in real-time.

Read the three key trends The Medium will be focused on in Q4 2023. This essay focuses on "In the shift from wholesale to retail models, there are many business models that delight consumers but no single, dominant one."

Outside of Disney (Parks and Cruises) or NBCUniversal (Universal Theme Parks), we do not often hear about the overlap between the media and travel and leisure industries. Sports betting has changed this dynamic casino brands like MGM and Caesars have been moving into the space.

Arguably the most notable example has been Penn Entertainment closing an acquisition of media company Barstool Sports for around $500 million this past February to launch a sports betting service. It shortly thereafter sold it back to Barstool founder Dave Portnoy for $1 and a long list of contractual covenants because regulatory obstacles related to Portnoy had become too expensive to resolve. At the end of 2023, Barstool is now out of the sports betting business, and Penn has pivoted to Disney’s ESPN as a partner for “ESPN Bet”, which has had a strong launch with app downloads since last week.

The other example of the overlap was laid out in an August 2020 letter to shareholders from IAC CEO Joey Levin outlining a $1 billion investment in MGM Resorts. Levin argued that MGM Resorts was unusually well-positioned to succeed in sports betting because it then had over 35 million registered members of its M-Life Rewards program—which has since been rebranded to “MGM Rewards”—and its ecosystem mirrored “Disney’s advantages over pure-play streaming companies with an iconic brand and multiple avenues to monetize the same intellectual property between streaming, theatrical releases, merchandise, and theme parks.”

As longtime readers remember, that sentence was the foundation of the PARQOR Hypothesis, an original and proprietary framework for identifying which media companies are best positioned for success in streaming. The premise is that those companies who centralize the value of their intellectual property and monetize it in multiple ways with audiences at scale will succeed.

It has not played out that way, to date, for either Disney or NBCUniversal. I learned in Las Vegas last weekend that this has not played out for MGM Resorts and IAC, either, despite its stock price now being over 2x the price when IAC invested. The question is why that is, and I think two key pieces of the answer lie in changing consumer demand for IP and consumer product design in sports betting.

Key Takeaway

In these fast-changing times the consumer relationship to flywheels seems to be weaker. Solving for consumer-savvy means questioning the strength of the consumer relationship with the brand. Solving for tech-savvy means delivering more consumer-centric products.

Total words: 1,600

Total time reading: 7 minutes

Changing Consumer Demand

When we look back on 2023, Disney and NBCUniversal are going to be case studies on how consumer demand evolved. Disney's “The Marvels” recently flopped at the box office last month, generating only $47 million on opening weekend. It has generated $162 million worldwide in less than two weeks, well under its $200 million production budget.

This was the worst opening weekend ever for any Marvel Cinematic Universe film. Other than last year’s “Avatar: The Way of Water,” acquired as part of Disney’s $71 billion deal for the majority of 21st Century Fox, Disney hasn’t had a movie gross $1 billion since the last Star Wars movie in 2019. Disney had only two successes to speak of in 2023: Pixar’s “Elemental” ($496 million worldwide) and Marvel’s “Guardians of the Galaxy, Vol.3” ($845 million worldwide)

NBCUniversal has had a better year, grossing $4 billion at the box office with hits like “The Super Mario Bros. Movie” ($1.4 billion), “Oppenheimer” ($950 million) and recent horror hit “Five Nights at Freddy’s” ($272 million grossed on a $25.1 million budget). An important and notable difference in those strategies has been Universal Studios’ bet on video games IP. “Super Mario Bros.” is a well-known property of Japanese gaming company Nintendo. But “Five Nights at Freddy’s” is a well-known video game series that consists of nine video games rolled out between 2014 and 2021.

Quite simply, Universal Studios delivered theatrical hits but none of Disney’s studios did. Both companies anticipated changing consumer demand differently. Disney assumed that its “flywheel” would generate inelastic demand for Marvel IP and the Pixar brand across theatrical and streaming platforms. Disney’s assumption was proven wrong in theatrical, but had a mixed record in streaming: The second seasons of the MCU’s “Loki” came and went to mixed reception from fans and critics, despite a $141 million budget.

Meanwhile, Universal’s success with gaming IP seems to be ahead of a trend that market researcher Newzoo has reported. People younger than 13—Generation Alpha—spend 22% of their entertainment time playing games, more time than they spend streaming movies and shows (17%) or watching television (16%). Generation Z—people ages 13 to 27—and Millennials, who are roughly ages 27 to 42, spend as much time gaming as they do streaming.

The takeaway seems to be that emerging demand for gaming IP across platforms may be stronger than demand for existing IP within flywheel ecosystems. In other words, Disney’s position as “an incumbent business model with strong customer relationships” seems vulnerable to competitors who are savvier about evolving consumer demand towards IP related to games. Theme parks and streaming do not seem to drive the type of consumer loyalty that Iger and his management team assumed in 2019. Gaming IP seems to have stronger, deeper ties with consumers. Even Warner Bros. Discovery, which lacks the elements of a flywheel ecosystem, learned this in 2023 with “Hogwarts Legacy”. The immersive, open-world action role-playing game generated more than $1.3 billion in the first quarter of this year alone.

Consumer Product Design

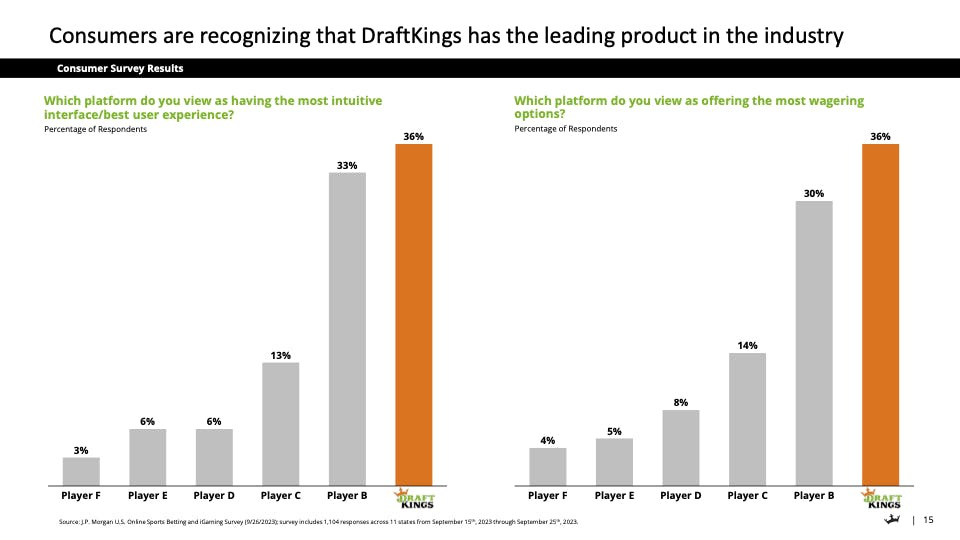

The Disney/PARQOR Hypothesis flywheel model seems to be hitting a wall at MGM Resorts, too. BetMGM is number one in iGaming in the U.S. (e.g., online casino games or slots played on a mobile device or computer) but is #3 in sports betting at a 10% market share behind FanDuel (45.1%) and DraftKings (32%).

MGM CEO William Hornbuckle explained on the Q3 earnings call that the problem is the BetMGM consumer-facing product “wasn't where it needed to be” over the last 18 months. Meanwhile, DraftKings Co-Founder, Chairman & CEO Jason Robins told investors that its success reflected the company’s belief that “the heart and soul of the organization is product and technology.” As a result, analysts like those I spoke with over the weekend and at Oppenheimer have concluded that “[C]ompetencies in product development and customer acquisition that [DraftKings] utilized to become the daily fantasy sports market leader will allow the company to be a critical player in accelerating the shift in US sports betting from [around] $150 billion wagered illegally/offshore to licensed domestic operators.”

As it was explained to me by an analyst who covers DraftKings and MGM Resorts over the weekend, after 2016 entrants into the new sports betting burn hundreds of millions of dollars to try to capture market share. Around 18 months ago, DraftKings pivoted to focus on product development. DraftKings revenue of $4.5 billion to $4.8 billion and positive adjusted EBITDA of $350 million to $450 million. In the long run, it expects revenue to hit $6.2 billion by 2026 with an adjusted EBITDA of $1.4 billion. By 2028, the operator is expecting revenue to reach $7.1 billion coupled with an adjusted EBITDA of $2.1 billion. Its stock price is up nearly 300% over the past 18 months.

As it shared with investors on its Investor Day last week, consumers love the product:

The key innovation seems to be their investment in and innovation around parlay products— allowing users to turn an initial stake or winnings from a previous bet into a greater amount—as Robins explained last year. That has been key to driving the percentage of money that DraftKings retains after all bets have been settled on a particular market, also known as “hold” (or more popularly known as the “vig”). Robins also talked up on the Q3 earnings call “product improvements and CRM improvements” helping to drive faster growth in new states that legalize sports betting.

MGM Resorts does not have a remotely similar story for BetMGM despite IAC’s involvement. The management of the MGM Resorts ecosystem has not been conducive to product development or IAC’s ability to contribute to it. DraftKings has seized upon that weakness and seems to be thriving.

The Tension

Looking at the flywheel model in both the media and travel and leisure markets in 2023, it seems vulnerable to more agile competitors. Both MGM Resorts and Disney were vaunted by IAC three years ago for their flywheel models. Today, both seem to be struggling with the premise that their consumer relationships are as strong as they have assumed.

NBCUniversal is an interesting example here. It has found wins by rethinking audience demand beyond the parameters of Universal IP. But, like MGM Resorts, it has struggled with consumer-facing products. Its streaming service Peacock has 28 million subscribers—about 40% of Netflix’s since launching in 2020—and a projected $2.8 billion in losses in 2023. That said, as I wrote in October’s “Reconsidering Streaming's Subscription Models”, it has also found success in premium VOD (PVOD) models. In the PVOD model, Universal charges as much as $25 to rent a film for 48 hours and $30 to buy a movie as little as 17 days after theatrical release. It generated hundreds of millions of dollars in revenue for movies that it would not otherwise have generated via streaming.

That experiment reflects an understanding of changing consumer demand that Disney’s myopic pursuit of streaming as a one-to-one replacement for theatrical and linear TV distribution has not. It also reflects IAC’s and MGM Resorts’ failure to evolve the BetMGM product. The lesson from 2023 seems to be that not every media company with a flywheel or PARQOR Hypothesis model needs to be agile. Rather, the flywheel model of the 20th century is starting to lose to more agile, tech-savvy and consumer-savvy competitors.

Solving for consumer-savvy means questioning the strength of the consumer relationship with the brand. Solving for tech-savvy means delivering more consumer-centric products. The challenge for Disney, MGM Resorts and NBCUniversal seems to be agility, and only NBCUniversal achieved a marginal solution. In these fast-changing times the consumer relationship to flywheels seems to be weaker, and centralized IP is harder to monetize when there is decreasing value in both the IP and means of delivery to consumers.