Roku told investors last week, “given the uncertainties and volatility in the macro environment, we are withdrawing our full-year revenue growth rate estimate.” The Roku led to a price drop of almost a third of its closing price last week.

Roku management predicted this economic environment would negatively impact advertising spend, particularly in the scatter market (the inventory available for purchase outside of annual upfront commitments), which is “an important source of ad revenue for Roku.”

Earnings calls from Comcast and YouTube also reported impact from the macroeconomic environment. Comcast spoke to “some choppiness, but nothing really dramatic” whereas Google spoke to the pullback in spend in Q2 reflecting “uncertainty about a number of factors that are challenging to disaggregate”.

The point here is not that they all were impacted differently by the same environment. Rather, it is *why* they were impacted differently.

There is the obvious answer that their CTV business models are different (e.g., Comcast has line items for linear, broadband, media and theme parks). But a comparison of Roku’s results to Google’s and Comcast’s helps to highlight some common themes explaining why they were impacted differently. I found five:

Upfronts (Comcast’s NBCUniversal, Google, Roku)

First-party data vs. Third-Party data, and Cookies

The Value of Original Content

The Platforms Business

Roku, The Trade Desk & The Long Tail

Generally speaking, the CTV advertising marketplace is unbelievably complex (someone described to me recently as “four-dimensional chess”), and no one seems to know where it is all headed (Roku, especially). If there is a cohesive story to these five signals, it is Roku’s importance to the CTV advertising marketplace.

[Author's Note: If your time is limited, each section on a signal offers valuable insights on their own.]

1. 2022 Upfronts

Historically, upfront presentations are where TV executives preview their programming lineups for the coming year and convince advertisers and buyers to place big bets on which shows will be hits. Because of the sheer scale of their inventory and their pricing power, networks lock in as much as 80% of their annual advertising revenues during upfronts week.

All reports for 2022 Upfronts seem to be good returns for the likes of legacy media companies like Paramount (“high-single-digit price increases compared with last year”), Disney (a record $9B, 40% in streaming and digital), and Comcast’s NBCUniversal (“record-breaking”, including $1B for Peacock).

But Roku and Google’s YouTube also had good upfronts: Roku reported “$1B in Upfront commitments” which “surpassed a milestone”, and YouTube told shareholders it had “strong growth in Upfront commitments”. As I wrote in The Upfronts Model Isn’t Dead Yet, this reflects how “The networks are no longer gatekeepers to scarcity”. Also:

If anyone is positioned to disrupt the upfronts model, it’s the platforms. At the head of the pack is Alphabet, with its YouTube subsidiary reporting 135 million connected TV viewers in the U.S. Roku and Amazon also have scale, although they don’t break out their U.S. numbers. All of them can correlate a specific household seeing an ad with an outcome like, say, the sale of a car. Brand managers may still find a success story in fuzzy Nielsen data, but they get a much more vivid narrative about the efficacy of their dollars from the platforms.

The more valuable signal is that YouTube and Roku have proven they can take ad revenue from legacy media at Upfronts. It makes this updated projection for Combined US Linear and Connected TV spend from eMarketer interesting: 2022 shows both CTV and linear growing year-over-year from 2021, and then CTV beginning to take market share from linear in 2023.

The question this chart presents is *which* share of spend Roku and YouTube are taking at upfronts: is it linear spend or is CTV spend that otherwise would have gone to legacy media?

We do not have much evidence. Perhaps the best guide is what NBCUniversal shared in its press release about the $1B for Peacock at upfronts: more than 40 percent of upfront business was conducted outside of the traditional age and gender guarantees (i.e. men 18-49, adult 25-54, etc), and the two strongest sectors were pharmaceuticals and travel, with streaming, technology, retail and CPG also performed well.

Given the “uncertainty about a number of factors that are challenging to disaggregate”, as Alphabet CFO Ruth Porat told investors, it’s effectively guesswork to understand how and where this shift of spend from linear to CTV is occurring (especially at the sector and demographic levels).

But, it is occurring.

2. First-Party Data, Third-Party Data & Cookies

Back in May, I quoted the opening monologue from CEO Jeff Green on The Trade Desk earnings call about how Q1 2022 saw “more positive changes in a short period of time” in the TV landscape than he can remember. He also spoke about how the death of cookies and app tracking have resulted in “a very unique opportunity to upgrade the Internet”.

Roku’s and YouTube’s sales pitches to investors highlighted case studies involving their first-party data as upgrades to the Internet. Roku highlighted Finishing Touch Flawless, a DTC (direct to consumer) beauty brand seeking new customers. It “launched a campaign on Roku’s OneView Ad Platform and used our proprietary ACR (automatic content recognition) data to exclude streamers exposed to its traditional TV ads to drive incremental reach. The campaign drove a 38% lift in sales (for those exposed to campaign vs. those not exposed) with 95% of those incremental sales from customers new to the brand.”

Google management highlighted a case study for YouTube CTV advertising in its Q2 2022 earnings call:

“Take GSK Consumer Healthcare, now Haleon, who piloted CTV campaigns across its top 10 global markets to drive effectiveness at scale and tap into the shift to streaming. The results, 73% of campaigns drove substantial lift in brand and unbranded searches, and viewers were up to 14 times more likely to search for Haleon related terms. Adding CTV to its existing plans also led to greater efficiencies and savings. Haleon has since opted its 2022-2023 investment and is now expanding CTV across LATAM and EMEA markets.”

Google also highlighted an interesting case study for Estée Lauder Taiwan for its advanced night repair serum: “Branded content collaboration with top creators raised awareness, while YouTube shopping shelf feature boosted consideration and to generate new leads and sales, a series of well-orchestrated action formats did the trick. This full funnel strategy drove 29% more unique visits to its website and a 95% increase in sales.”

All are selective evidence/anecdotes, so I won’t push the argument here. That said, what you see in these examples are both Roku and YouTube constructing their own conversion funnels for advertisers and powering them with their respective first-party data. Whichever ways this CTV ad marketplace may play out in a rough macroeconomic environment, it is clear that advertisers seeking effective first-party data solutions and scale will find both in Roku and YouTube.

The challenge for YouTube - and not Roku - is that Google also faces “headwinds” from the post-Anti-Tracking Transparency (ATT) because its advertisers rely on third-party cookies for identifying users across the Google advertising ecosystem. Management has conceded that ATT is impacting advertiser spend, and it is slowly rolling out a phase-out of those cookies in its Chrome browser, now pushed back to 2024.

This could be an advantage to Roku, but it is not yet clear how.

3. Original Content

Roku and Peacock offer original content as part of their value propositions to both audiences and advertisers. However, neither has much of a story for investors about original content.

Roku spun a muted success story for The Roku Channel. It described it as “once again, a top 5 channel on our platform in the U.S. by Active Account reach and by Streaming Hour engagement” - effectively a self-plaudit that means nothing.

It also added a caveat to its spend on original content:

While we will grow our investments in Roku Originals in order to provide new exclusive content for users and advertisers, the foundation of our content spend will continue to be revenue share and fixed licensing agreements, including output deals. Spend will be commensurate not only with the scale and growth of The Roku Channel, but also with the broader macro environment.

Comcast talked up for Peacock “a very strong fall when next day broadcast becomes exclusively ours from Hulu and we’ll be able to take full advantage of our Pay1 window with a number of big movies like Jurassic World: Dominion. We’ll also have Sunday Night Football, Premier League, the World Cup and more originals.” Notably, it did not name any of those originals.

YouTube does not face the same risks, having phased out its originals division in January and now relies heavily on third-party creator economy content. It works closely with over 2MM+ creators in its Partner Program and hundreds of channels with at least 1 million subscribers.

If Roku and Peacock are raising questions about the value of original content to both consumers and advertisers in ad-supported streaming, YouTube seems to be answering them with third-party content creators.

4. Roku, Comcast & Platforms

nScreen’s Colin Dixon had a good post about whether Comcast’s losses of video subscribers are Roku’s gains. Comcast has lost 1.8MM video customers over the past four quarters, and last quarter Roku gained 1.8MM active users, and has gained 8MM over the past four quarters. However, Comcast’s Peacock stayed flat in Q2 2022 and Monthly Active Accounts dropped from 28MM in Q1 2022 to 27MM.

Dixon then makes an interesting argument: “Roku’s performance only reinforces Comcast’s move into the TV platform business.” Meaning, 1.8MM new active users it signed up likely reflects Roku’s success in licensing its operating system (OS) to smart TV manufacturers. So even if hardware sales decline 20% year-over-year ($92.1MM from $113MM), it still finds growth in active users via licensing its OS.

The argument reflects my recent essays on Comcast’s Smart TV strategy (“Why The Comcast & Charter Joint Venture Is About Search & Discovery & Not Bundling” and “A Quick Note On Comcast's Q2 2022, Peacock & The "Half Life" Old Library”):

Roku’s performance only reinforces Comcast’s move into the TV platform business. The company is working jointly with Charter to market its TV OS. It has also moved Xumo, its FAST linear service, into the JV, making it a head-on competitor with Roku. There are also rumors Comcast is thinking of purchasing a TV brand, and Vizio has been linked to the speculation.

Meaning, if Roku’s model is precedent, Comcast is better positioned to capture cord-cutters it is losing in its linear and broadband through the licensing its Xfinity TV OS and Xumo. It may not monetize them as well as linear via streaming, today; but, with CTV ad spend projected to more than double in five years, moving into the Smart TV space better positions Comcast to monetize them in the long run.

5. Roku, The Trade Desk & The Long Tail

I mentioned The Trade Desk, above. Its vision is to become “the de facto DSP [Demand Side Platform] of the open Internet, led by CTV [Connected TV].” A DSP is a single interface that allows ad buyers to manage campaigns across multiple publishers. I recently highlighted in “How Should Comcast Value Hulu in 2024?” that Disney announced it had expanded its deal The Trade Desk to enable brands to target automated ads across Disney properties. That deal builds off of Hulu's video ad-serving technology and makes it easier for advertisers to buy automated ads without sacrificing the ability to narrowly target them.

The Trade Desk has greater reach than Roku - 120MM+ CTV devices as of Q1 2022. But it is much more focused on longer tail, smaller publishers (NOTE: with Hulu's 45MM+ subscribers, Disney may be its largest customer), and less inventory because Roku gets inventory from every consumer-facing, ad-supported app on its platform. The Trade Desk only has access to some inventory on some of those apps..

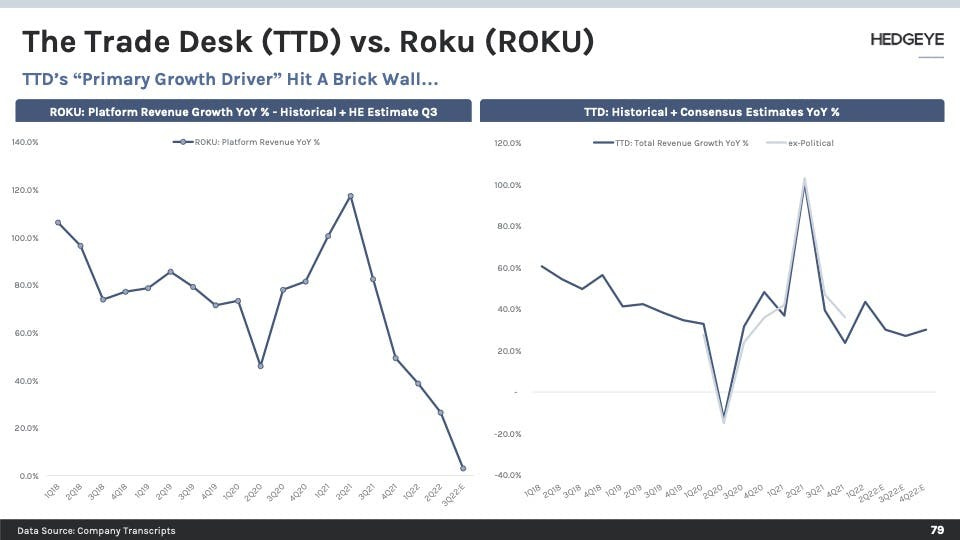

As research analyst Andrew Freedman of Hedgeye recently highlighted in a call with Hedgeye subscribers ($ - paywalled), if Roku is hitting a “brick wall” with the scatter market as the primary source of revenue for The Trade Desk, things could get ugly for The Trade Desk.

Also, as Mike Shields writes, The Trade Desk is actually in a weaker position than Roku because it “does not have a consumer facing business that it can sell ads for. It’s never going to be more than an ad tech company that collects cuts or flat fees from the ad buyers and sellers, unless it radically changes strategy.”

Freedman thinks The Trade Desk is a strong bet for shorting the stock (the earnings call is next week on August 9th). Shields was more circumspect, in part because he was interviewing Chief Client Officer Jed Dederick and therefore needed to be diplomatic.

But, only three months ago CEO Jeff Green was promising a new industry standard with “Unified ID 2.0” (or UID2), which helps publishers like Disney to “create privacy-safe identifiers for their readers, pass those on safely to advertisers, who can then serve relevant advertising without ever knowing anything directly identifiable about the reader.”

The irony is that Roku ends up being in a position of being battered by macroeconomics factors and a pullback in ad spend, but also seeing its competitive OneView DSP in a stronger position than The Trade Desk.

Why? As former SVP Scott Rosenberg told investors on its Q4 2020 earnings call, OneView is for “the case where you're doing a publisher direct buy, you can still leverage Roku identity, Roku data, and capabilities to help optimize that publisher direct buy against all your other activity.” It offers more capability than The Trade Desk and across more inventory and audiences.

That leaves The Trade Desk unusually vulnerable to the same advertiser pullback trends because it operates at a smaller scale.

Conclusion

The advertising pullback and macroeconomic headwinds of 2022 have been tough on the CTV marketplace. That said for observers, these headwinds offer the benefit of exposing important signals for the road ahead.

Upfronts proved that YouTube and Roku have proven they can take ad revenue from legacy media at Upfronts, but it’s not yet clear how that’s actually playing out;

Advertisers seeking effective first-party data solutions and scale will find both in Roku and YouTube (despite headwinds from Anti-Tracking Transparency);

Roku and Peacock are raising questions about consumer and advertiser demand for original content in ad-supported streaming, and YouTube is answering them with third-party content creators;

Roku’s model is precedent for Comcast’s move into Smart TVs as it better positions Comcast to monetize users in the long run; and

The pullback in the scatter market may hurt Roku in the short-term, but it may harm its competition more and that may better position Roku’s DSP efforts with OneView with advertisers.

In short, Roku is getting battered both financially and as a stock, and for objectively valid reasons. But if there is one theme from all these stories, Roku seems to be an increasingly integral part of the CTV ecosystem relative to its larger and more diversified competition (Comcast, Google) and seems positioned to gain from that.