There was a lot of speculation about Hulu’s future going into last week’s Sun Valley conference, which put Comcast CEO Brian Roberts and Disney CEO Bob Chapek into the same room for the first time in a long time. The speculation is centered around a fast-approaching January 2024 deadline where Disney may buy Comcast’s remaining 33% stake in Hulu for a guaranteed floor value of $27.5B (as per a May 2019 agreement around Disney’s acquisition of Fox assets, Disney has a 67% ownership interest and full operational control of Hulu). [1]

CNBC’s Alex Sherman recently dove into the challenges of Hulu’s “messy positioning” within Disney, and laid out potential different futures for Hulu both inside and outside of Disney, including potential spin-offs.

I believe the least plausible future outcome is Hulu being sold back to Comcast.

Why? One of Disney’s post-merger objectives is to automate 50% its ad business in five years, and yesterday Disney announced it had expanded its deal with demand side platform (DSP) The Trade Desk to enable brands to target automated ads across Disney properties. That deal builds off of Hulu's video ad-serving technology and makes it easier for advertisers to buy automated ads without sacrificing the ability to target them narrowly.

Meaning, Hulu’s video ad-serving technology is now too integral to Disney’s overall advertising model to be spun off. That raises two questions:

Why is The Trade Desk deal significant to Disney’s advertising future? And,

How does it help us think about potential deals between Disney and Comcast in 2024?

Disney + The Trade Desk - How it works

According to this March 2021 AdExchanger article, the strategy to achieve that objective is being built upon “a video ad server ‘pressure-tested’ at Hulu” and is being developed by a 500-person engineering and product team led by Jeremy Helfand, previously Hulu’s VP and head of advertising platforms. Disney told AdExchanger that it was making a “nine-figure” investment in the ad platform.

Disney and The Trade Desk are mutually focused on buyers increasingly asking for automation and data to reach viewers across different screens across the Disney ecosystem. AdExchanger reported last year that Disney is courting two different buyers with its new programmatic advertising platform: “Linear TV buyers will be able to buy across new formats more easily and with greater granularity, while programmatic buyers will finally be able to see and bid on all of Disney’s inventory.”

Hulu is integral to this new programmatic ecosystem: Disney Hulu XP is a video ad management platform that enables advertisers "to buy once and deliver to audiences across streaming, sports, entertainment and news content in one single deal".

Disney also offers broader programmatic solutions (Disney Real-Time Ad Exchange, or DRAX), and Hulu Ad Manager for small- and medium-sized businesses. Disney Select enables marketers to select desired audiences from Disney’s extensive library of first-party segments based on buyer behavior, household characteristics and psychographics.

All addressable, biddable inventory across the Disney ecosystem is validated by Disney’s proprietary database called Audience Graph. According to Adweek, the Audience Graph consists of 100 million household IDs, 160 million connected TV IDs and 190 million device IDs and updates in real-time. It provides more than 2,000 segments against which Disney clients can activate.

Disney & The Trade Desk

Privacy changes to devices and web browsers that decrease the targeting capabilities of ads: Apple has already dropped support for third-party cookies on the Safari web browser, and its Anti-Tracking Transparency initiative is an opt-in privacy framework that requires all iOS apps to ask users for permission to share their data., Google plans to drop third-party cookies next year.

As Axios’ Sara Fischer writes, the marketplace “deprecation of third-party cookies has forced advertising companies to come up with alternative ways to target ads using either first-party data sets like Disney’s or alternate data identity solutions like Unified ID 2.0.”

One solution to this problem is “Clean Room” where publishers like Disney can share their aggregated first-party data while still maintaining strict privacy controls. But, in the post-cookie world, advertisers must still reconcile their first-party data with Disney’s first-party data: third-party cookies made that easy, and new privacy standards make that unusually difficult.

That is where The Trade Desk is attempting to set an industry standard with “Unified ID 2.0” (or UID2), which enables a publisher like Disney to help advertisers match their data to Disney’s data. CEO Jeff Green told investors on The Trade Desk's Q1 2022 earnings call that UID2 helps publishers like Disney to “create privacy-safe identifiers for their readers, pass those on safely to advertisers, who can then serve relevant advertising without ever knowing anything directly identifiable about the reader.”

After advertiser data has been reconciled with Disney’s data in the Clean Room, it will be Hulu’s technology driving contextual video ad targeting for advertisers across the Disney ecosystem.

Disney, Comcast & 2024

Looking ahead to 2024, any outcome that involves the sale of Hulu to Comcast (or another third party) cannot include its video ad server, which is now integral to Disney’s future. According to Disney’s 10-K, Disney’s entire ad business in FY 2021 was $12.4B, of which $3.4B came from streaming, and Kantar estimates $2.1B (61%) of that revenue came from Hulu.

That raises the interesting question of how Hulu will be valued by Disney in 2024. Under the agreement:

Comcast has the option to require Disney to purchase Comcast’s interest in Hulu and

Disney has the option to require NBCU to sell its interest in Hulu to Disney.

In either case the value will be (1) Hulu’s underlying, estimated market value (or, “equity fair value”) or (2) a guaranteed floor value of $27.5B.

That means, Disney's best strategy is to reduce Hulu’s underlying, estimated market value and negotiate from there, and Comcast's best strategy is to prove that Hulu is worth much more than $27.5B.

Notably Disney has bent over backward to reduce the value of Hulu as a consumer-facing platform: it killed Hulu’s international expansion in favor the Star brand it had acquired from Fox, and is now moving adult-oriented fare more adult-oriented fare to Disney+, like the third season of queer teen romantic drama “Love, Victor”, whose first season was originally moved from Disney+ to Hulu after Disney’s near-religious corporate focus on being family-friendly.

Moreover, earlier in March 2022 NBCUniversal terminated its content-sharing deal with Hulu as the company redirects its shows to its own, rival streaming service, Peacock. That will mean starting this fall, new episodes of NBCU shows like “Saturday Night Live”, “The Voice” and “American Auto” will no longer be available to stream on Hulu the day after they air. So, Hulu’s third-party library is trending smaller, and in Q1 Hulu saw 1% growth for its SVOD-only service (41.4MM in Q2, up from 40.9MM in Q1, and a decline in its Live TV + SVOD subscribers (4.1MM down from 4.3MM).

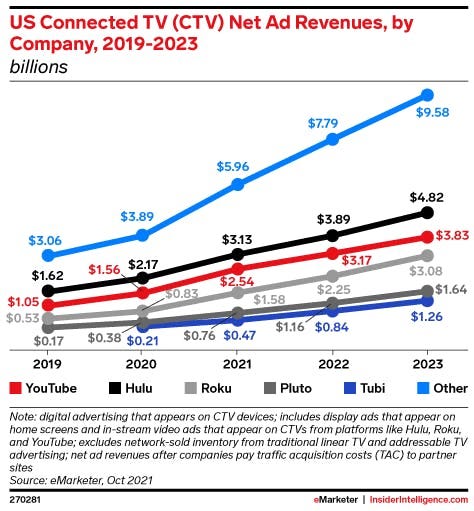

But, Hulu remains integral to the Disney+ bundle: The Entertainment Strategy Guy recently estimated that as many as 15.3MM subscribers are duplicated across Disney+, Hulu and ESPN, leaving somewhere between 26MM and 30MM Hulu-only subscribers. eMarketer projects Hulu will drive $4.5B in ad revenues for Disney in FY 2023, reflecting an annual growth rate of around 25% [2].

All that said, there is no growth story for consumer-facing Hulu without international distribution, without next-day titles from NBCU and without Disney sending adult-oriented titles to Hulu (even if it has proven to be integral to the Disney+ bundle).

If Disney's plan was to kill Hulu's growth story, it seems to be succeeding.

What Will Happen in 2024?

There is a growth story emerging for Disney advertising that relies fundamentally upon Hulu’s ad technology, implying that Hulu is indeed a growth engine for Disney but not as Hulu. Odds are the Disney-Comcast deal did not contemplate this outcome, but Comcast’s share of Disney’s growing ad business is far greater than its share of a Hulu business that is not the growth engine the original deal contemplated.

Looking at Disney's $12.4B ad business and assuming operating margins of 25% [3], if 50% business ($6.2B) of that business was automated it would have generated at least $1.5B in operating income in 2021. At a 25% annual growth rate, that could triple to nearly $5B in operating income by 2025.

A conservative 5x multiple would value this growth in Disney’s advertising business at $25B, and a more aggressive 10x multiple would value that $50B.

So, if you are Comcast, you’re focused on making the “but for Hulu, Disney is not on the path to $5B in additional operating income from advertising in 2025.” And if you're Disney, you're doing everything in your power to neutralize that argument.

The challenge is yesterday's The Trade Desk announcement hurts that story because it implies, but for Hulu's ad server, that deal may not have been possible. The deal is built off of Hulu's ad-serving technology that has been previously "pressure tested" at scale, and not a newer, less-sophisticated and unproven contextual ad-serving technology.

Conclusion

I think Comcast is going to focus on Hulu’s value to Disney’s advertising business, and the bill for Disney’s payment to Comcast is going to be “hefty” - as CuriosityStream’s Chief Product Officer Devin Emery recently tweeted. I think it will be "hefty" enough that some creative, alternate form of agreement will be required because Disney will want to value Hulu differently than my back-of-the-napkin exercise.

I also think Disney will aim for an alternative outcomes because Hulu at nearly 2x its last valuation despite Disney's recent moves to kill its value would only be more bad optics for embattled Disney CEO Bob Chapek.

What might those alternative outcomes be? Given the complexity of Disney's ad business, they is nearly impossible to imagine. But they will all start with Comcast focusing on the value of Hulu to 50% of Disney's ad business.

Footnotes

[1] The New York Times’ Edmund Lee reported back in 2019 that Comcast “could end up lowering its investment over the next few years if it decides to stop financing Hulu, but its stake will never fall below 21 percent”.

[2] Disney reported $2.1B in revenue for Hulu in FY 2021, but its Fiscal Year ends in September. So eMarketer’s estimate for 2022 includes an estimate for Disney’s FY22 Q1 revenues for October through December 2021. Its estimate $3.13B implies that Q4 generated $1.03B in revenues. eMarketer’s projections of $3.89B in 2022 and $4.82B in 2023 suggest a year-over-year growth rate of 24% in both years.

[3] Disney’s OIBDA as a percentage of Revenues for Linear Networks in FY 2021 was 27% and its OIBDA as a percentage of Revenues for Direct-to-Consumer was -10%, so 25% averages out as its percentage of Revenues.