In Q2 2023, PARQOR will be focusing on three trends. This essay focuses on "'Premium content' is being redefined by creators, tech companies and 10 million emerging advertisers".

To remind you, PARQOR identifies a few key trends each fiscal quarter that reveal the most important tensions and seismic shifts in the media marketplace. Must-read stories or market developments are not always obvious from press reports or research analysis, and often require a deeper dive. PARQOR’s analysis questions established ideas and common wisdom, reassesses the moving pieces, and reveals the potential in the media marketplace in 2023.

I have been asked the same question in casual business meetings over the past week: how do I see the next five years playing out in media?

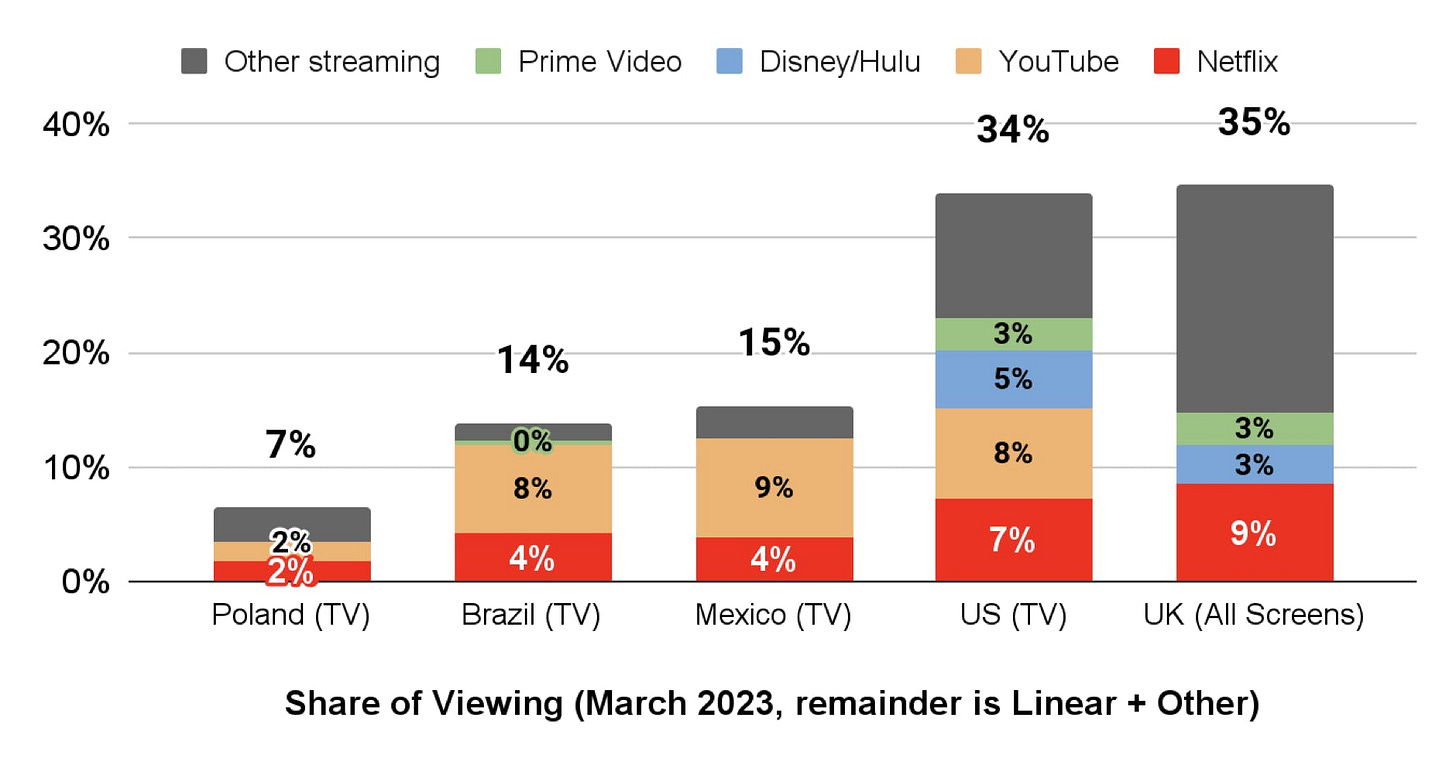

I think Netflix answered that question this week with a chart of third party data showing “Netflix and YouTube are the clear leaders in streaming engagement”.

The implied story here is that streaming is currently a niche user behavior. This reads counterintuitive given the scale of Netflix (232.5 million subscribers) and YouTube (nearly 3 billion monthly active users). But Netflix management wrote to shareholders on Tuesday that they envision growing their “share of total viewing by multiples higher than today’s 2-4% share in Brazil, Mexico and Poland, or 7- 9% share in the US and the UK.” And they “remain highly confident that streaming’s share of engagement will continue to grow at the expense of linear”.

Netflix and YouTube have always pursued the disruption of the linear model as a mission statement: Cord-cutting was inevitable, and the emergence of smartphones and tablets meant younger generations would increasingly consume content over the Internet and via mobile devices instead of via cable networks. The companies that solved that problem would have enormous global scale, perhaps even 1 billion subscribers.

So, Netflix has sought to “become the best global entertainment distribution service” (its new mission statement from then-CEO Reed Hastings in 2011), and YouTube launched in 2005 with the mission “to give everyone a voice and show them the world.”

The surprising implication of the Netflix letter, especially in the third party data it shared, is that neither of the mission statements seem true anymore in 2023. In fact, Netflix's data suggests that both businesses seem niche.

Key Takeaway

It seems a bit ridiculous to describe both YouTube and Netflix as niche businesses. But, both face headwinds that counterintuitively make it easier to imagine them unable to fulfill their original visions of global domination.

Total words: 1,700

Total time reading: 7 minutes

New territory

In one way, it seems a bit ridiculous to describe both YouTube and Netflix as niche businesses. In large part that is because both are primarily consumed via smartphone: Netflix has said as much as 50% of its consumption is via mobile devices, and YouTube has shared data that three in four adults report watching YouTube at home on their mobile devices.

Generally, estimates for smartphone users worldwide are around 6.6 billion. Assuming 15% are in China, there are 5.61 billion smartphone users. Assuming YouTube’s “billions and billions” means they reach over 3 billion users across devices, and 75% use smartphones, we can assume they reach over 2 billion smartphone users. That scale is not a niche business.

Nor is Netflix's scale niche: 50% of 232.5 million subscribers is 116 million who consume Netflix via smartphone. That may seem niche compared to YouTube’s billions of users or TikTok’s nearly 2 billion users worldwide. But in streaming, most services other than Disney have less than 100 million subscribers worldwide and less global penetration.

But they seem niche because Netflix and YouTube both have long set their sights on conquering the linear business. There are over 1 billion pay TV households worldwide, but neither captures more than 10% of TV viewing in the five markets Netflix offered as examples of where it has TV consumption. In other words, other models like terrestrial distribution, satellite and cable networks still dominate TV despite demand for pay TV offerings dropping in all five markets.

Why Niche?

The upside for disrupting the TV business in the U.S., in particular, is two-fold: first, households who cut the cord will free up over $100 per month in available spend for streaming entertainment. At $16 per month, Netflix seems relatively cheap. Second, advertisers who want to reach families in those households will increasingly have to rely on ad-supported streaming services to reach consumers via streaming apps on connected TVs and connected TV devices.

In the latter case, eMarketer projects linear TV advertising spend to drop to $61.3 billion in 2023 from $65.7 billion in 2021. Advertising spend on connected TVs (CTV) is projected to grow from $17.3B in 2021 to $25.1 billion in 2023. The total ad spend across is projected to grow from $82.4 billion in 2021 to $86.4 billion in 2023. eMarketer’s projections for the next five years envision total ad spend of $97.7 billion of which linear TV will still capture around 60% of that spend.

It is also worth noting that most estimates for cord-cutting project the trend leveling off at around 50 U.S. million households. Current estimates have total U.S. households at around 70 million. So, even if there is a growth opportunity in TV, linear consumption is going to stick around at a scale that will leave both YouTube and Netflix at less than 10% of total consumption as effectively niche services.

Madison and Wall’s Brian Wieser offered an estimate for ad-supported TV streaming in the U.S. that suggests just how niche both YouTube and Netflix may be relative to linear. Around 14% of ad-supported TV viewing occurs on ad-supported streaming content. If we include YouTube’s connected TV app as part of an ad-supported TV universe, that estimate rises to 23%. Wieser concludes from this data that:

“there is a meaningful difference in the scale of streaming ad-supported inventory depending on whether or not YouTube’s CTV app is included. If it is excluded, CTV is sizeable, but still decidedly a minority of total TV viewing. Even if recent trends continue, ad-supported CTV viewing ex-YouTube will take many years before it is as big as ad-supported CTV including YouTube is today.”

This is a U.S.-only observation, but it seems more broadly applicable given the data shared by Netflix from other countries: what is true in the U.S. also seems to be broadly true both in Europe and South America.

Lost?

I think the above reflects how both the long-term visions of YouTube and Netflix are in new territory and also kind of lost. There are two points there. First, Netflix and YouTube’s founders always envisioned their opportunity being driven by Internet distribution of video content disrupting linear TV distribution.

That has proven true, to an extent, as the data and eMarketer projections reflect, above. But, Netflix launched with the vision that HBO, Showtime and even cable channels like The Disney Channel and AMC Networks would be disrupted by Internet distribution. Netflix’s focus on streaming-only would position them as the default service that legacy media companies would need to rely upon in order to reach cord-cutters.

That didn't happen. Instead, by 2013, Netflix learned that licensing third party content was expensive and going to be increasingly expensive as it scales. Also, legacy media companies realized that licensing valuable shows and movies to Netflix was like "selling nuclear weapons technology to a Third World country”, as Disney CEO Robert Iger once described it. Netflix now spends $17 billion per year to both produce original content and license third party content for its service. That has been new and largely unexplored territory for the business.

As for YouTube, its mission was broadly to “democratise the video experience”, as co-founder Chad Hurley once described it. That has made creators core to its value proposition: today, more than 500 hours of content are uploaded to YouTube every minute. Over 50% of content consumed on YouTube is creator content, and there are over 2 million creators in its Partner Program which launched in 2007. It has very much followed the vision of its founders,

But, the emergence of TikTok forced it to pivot into short-form video in 2020, and expand its YouTube Partner Program to short-form creators in 2022. Short-form video has over 50 billion daily views and more than 1.5 billion monthly logged-in users.

Netflix now invests over $17 billion annually into content and technology to compete with streaming services from companies it assumed it would subsume. YouTube now invests hundreds of millions of dollars, perhaps even $1 billion, into updating its back-end and various apps to accommodate that is both vertical in format and up to 60 seconds in length. They are both navigating new business assumptions about what users want in a cord-cutting world where linear may remain a dominant use case.

Not lost?

The counterargument is that YouTube is still operating within the parameters of its vision of democratizing TV and away from the hold of cable networks. It now reaches 135 million connected TV users in the U.S., it is used the most on a monthly basis, and it now has landed the NFL’s Sunday Ticket (perhaps the best evidence of YouTube’s success in disrupting legacy media). It also has the YouTube TV virtual cable network reaching over 5 million subscribers in the U.S..

That said, it is objectively in new territory in competing with TikTok for a new generation of Gen Z and Generation Alpha consumers who were raised on YouTube and Netflix and seem to prefer shorter form video on their smartphones. And, TikTok is increasingly expanding its distribution onto connected TVs.

As for Netflix the question it faces is, how will 5% annual growth get them to 1 billion subscribers worldwide? That figure that has been tossed around confidently as the most likely scale for a subscription streaming service by Netflix Executive Chairman and co-founder Reed Hastings, and media executives like Candle Media co-founder Kevin Mayer and former WarnerMedia CEO Jason Kilar.

The short answer is, it won’t. Netflix is now betting on gaming to help drive growth, including recent hires for a major publisher-type console game (known as “AAA”). But even that is a more iterative, longer-term vision being figured out in real-time.

Similarly, YouTube’s business relies on its ability to capture ad dollars in both CTV and in social media. It is struggling to grow ad revenues, up a meager 1.3% year over year in 2022. This was largely due to macroeconomic headwinds. But it is also facing growing competition from both legacy media streamers moving into ad-supported CTV, free ad-supported TV services and TikTok. Advertising dollars are crucial to its relationships with creators, though not the only means of monetization available to creators in the partner program.

The more legacy media competition can convince advertisers that their content is more “premium” and brand-safe on linear and connected TV— especially in connected TV where average pricing is multiples higher than on mobile — the harder it will be for YouTube to pay creators. Netflix faces a similar dynamic as it pivots into advertising, though its relationships with third party content providers are seems existentially crucial to its ad model than creators are to YouTube.

Both companies face headwinds that, counterintuitively, make it easier to imagine them five years later as niche services, and unable to fulfill their original visions of global domination.