Creators lack the ability to sell effectively on platforms. More new formats on platforms will not create more opportunity for them or for Hollywood talent.

Key Takeaways

“This decade is the disruption of retail into platforms where people consume content” — YouTube Chief Business Officer Robert Kyncl

Creator Economy platforms could increase revenue “if they had better ways to charge fans for content directly” — Every co-founder Nathan Baschez

But, Baschez also argued: “platforms need to build out the features for creators to effectively make the sell”.

The implication: new bets on new formats from Pinterest, Spotify and YouTube may not necessarily lead to more revenue for creators.

If Hollywood talent had a disadvantage against creators before last week, more new formats on platforms will not lead to better business outcomes.

I was struck by a prediction made by YouTube’s Chief Business Officer Robert Kyncl at The Information’s Creator Economy Summit last Thursday:

“This decade is the disruption of retail into platforms where people consume content”

He is describing “distributed retail” as a marketplace theme for the 2020s, something which can be best summed up as individuals selling products to “trusting audiences”. He predicted it could turn the creator economy into a “juggernaut”.

On that same day Every co-founder Nathan Baschez offered an alternative prediction for the Creator Economy in a blog post on A16Z’s Future in “What’s Next for Creator Platforms? Learning to Sell”:

If there’s one main idea driving excitement in the “creator economy,” it’s this: Creators with large audiences on platforms like Instagram, TikTok, Twitter, and YouTube could generate orders of magnitude increases in revenue if they had better ways to charge fans for content directly, rather than relying on ads or [merchandise] sales.

In one day, two quotes and two different predicted futures emerged for the “creator economy”: Kyncl’s point is creator business models are evolving towards disrupting retail commerce (traditional and e-commerce), and Baschez’s point is that creator business models are evolving towards charging fans for content directly.

They have some overlap but each imagines very different marketplace dynamics: effectively the differences between QVC and every other linear cable channel.

The more interesting prediction lies in something else Baschez wrote: “platforms need to build out the features for creators to effectively make the sell”.

In other words, it does not matter whether business models move more towards retail or content in the 2020s: creators lack the ability to sell effectively on platforms.

Recent bets from Pinterest, Spotify and YouTube on new content formats seem to fly in the opposite direction of solving that problem, as all bet on more formats. But more new formats may not necessarily lead to more sales for creators.

The Creator Economy Sales Funnel Is Evolving

It is worth starting with Nathan Baschez’s argument that:

More attention must be paid to the sales funnel — and platforms need to build out the features for creators to effectively make the sell.

Because a sales funnel framework helps to better frame recent developments from Pinterest, Spotify and YouTube.

Baschez’s argues why he thinks creator economy conversion funnels are suboptimal:

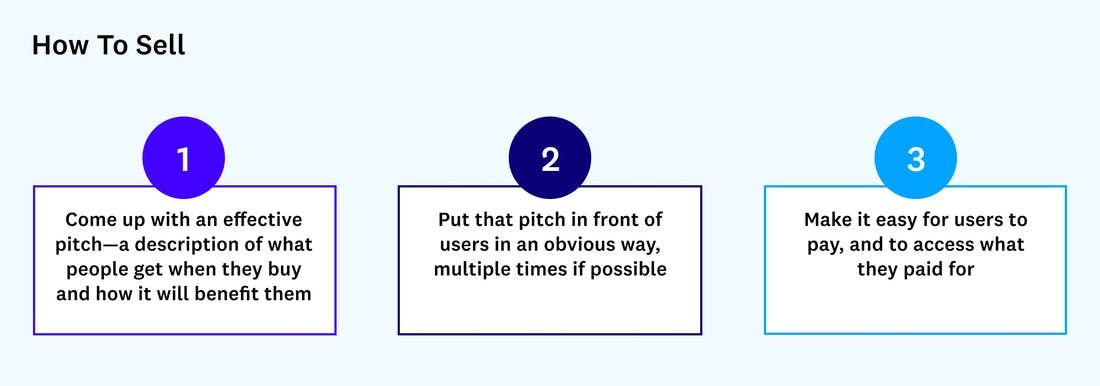

In my time helping creators sell subscriptions at Gimlet, Substack, and Every, I’ve come to understand there are three things that need to happen to acquire a new customer. They may seem simple, but effectively executing them can be tricky to nail:

While most platforms focus on that third step, as evidenced by the examples above, the first two requirements are more likely to be neglected.

He adds:

In the traditional media world, you can look at a movie trailer for a comedy and easily understand the value proposition is that you’re going to have fun and laugh. You can walk into the business section of the bookstore and understand that all the covers in front of you basically promise different ways of succeeding professionally. With creator platforms, on the other hand, the pitch often begins at “support this creator” and ends with “get bonus content”; this doesn’t bolster the creator’s case or manage fans’ expectations.

Baschez thinks this reflects a larger problem:

Creators need to craft a good pitch, beyond simply understanding their genre, and

Creator platforms need to ensure that fans actually encounter creator sales pitches.

Baschez is focused more on user experience than formats (and he makes a broader argument about the challenges of content genre for creators), but the implication is clear: platforms improving product around more format offerings for creator offerings are not improving connecting creator sales pitches to fans.

Spotify’s Bet: Audio also needs Video

Spotify announced video podcasts for creators two weeks ago:

When we began rolling out video podcasts on Spotify, we tested the format with a variety of Spotify Originals. Since then, we’ve found that our users want the option to easily switch between audio only and video depending on where they are, what they’re doing, and what they’re enjoying. So today, we’re beginning a major expansion of our video podcast catalog—by putting it in the capable hands of creators.

Soon, Spotify users will see a lot more video podcasts on the platform as we open up access for creators to begin publishing video podcasts to Spotify. This tool will be accessible through Anchor, Spotify’s podcasting platform, and will offer a seamless way for creators to upload video content and publish to Spotify.

Separately on the Anchor blog, it fleshed out the value proposition of video podcasts for creators:

Video Podcasts allow fans to feel more connected to creators behind the shows they love: Through video, fans can get to know their favorite podcasters—or the ones they just discovered—better than ever, whether you’re offering them a rich cinematic storytelling experience or just putting a face to the voices in your latest interview. It’s every bit as much a breakthrough for creators, too. You can finally add the context, creativity, or color to your content that you’ve always wanted—and simply let your imagination wild. Plus, your show and brand will become more open for discovery on Spotify. For you, that means unlocking new ways to extend your reach, deepen audience engagement, and even earn more.

That second paragraph sheds the most light on Spotify’s strategy: the implication is that Spotify’s discovery algorithm will favor content that is both in audio and video formats.

There is a good reason why for that: ad revenue growth.

In Q3 2021 Spotify reported its ad revenues had jumped 75% YoY and is on pace to hit $1B in ad revenues for 2021. Its podcast strategy has created new inventory that has met growing advertiser demand in the audio space.

Spotify’s move in video podcasting is a move to capture growing advertiser demand for creator economy videos, reflected in YouTube’s $20B in ad revenues in 2020, and 43% YoY in Q3 ad revenues ($7.2B, up from $5B one year ago).

More content formats lead to more ad revenue growth, and subscriber growth.

YouTube’s Bet: Video also needs Audio

YouTube has been moving in the opposite direction of Spotify, seeking to capture more of the podcasting market.

The entire podcasting business in 2020 equaled 5% of YouTube’s 2020 revenues, or $1B. But podcasting revenues are beginning to double, and Spotify is growing.

Robert Kyncl confirmed at The Creator Economy Summit YouTube had hired an executive to focus on podcasts — first reported by Lucas Shaw on Bloomberg. He also added:

“Podcasts [are] something that has been part of YouTube for quite some time and it’s grown to a pretty sizable business for us, but we have not really focused on it,” Kyncl said. Now, “we really want to make sure that the podcasting community actually thinks about YouTube as a must-have distribution platform because of its monetization and reach.”

Like Spotify, YouTube is focusing on improving monetization of formats, if not also adding the podcast format as something creators can monetize, too (NOTE: I wrote about this in Member Mailing #282: A Big PR Push from YouTube & Hollywood-Meets-Creator-Economy).

Pinterest: Images also need Video

Last Friday, Pinterest announced Pinterest TV:

a series of live, original and shoppable episodes featuring creators right on Pinterest. Pinterest TV episodes are refreshed each weekday and will be recorded and available for Pinners to view on-demand, and save and rewatch later. Beginning November 8, episodes will air Monday-Friday at 3PM PDT / 6PM EDT in the U.S. on iOS and Android. Each Friday, products will drop in a live shopping setting where Pinners can take advantage of discounts from brands including All Birds, Crown Affair, Melody Ehsani, Outdoor Voices, Mented and more….

On Pinterest TV, creators can showcase and tag products so Pinners can shop and purchase on the retailer’s site. Hosts will have a shopping toolbox to enable live shopping experiences including a product drawer with prices and product details, product drops and brand collaborations, a display of how much is left and a limited-time-offer module to offer discounts.

This followed three other related announcements in the previous weeks:

It introduced “Idea Pins” back in May, a TikTok-like feature aimed at creators who want to tell their stories using video, music, creative editing tools and more.

During its second annual Creators Festival on Oct. 20, Pinterest announced it will start an in-product monetization platform for its creators, called “Creators Rewards”, and that it is giving its home page a redesign to better highlight these Pins in a more TikTok-like format.

It hired its first chief content officer from YouTube, Alain Ducard, and tasked him with developing its content strategy and vision to tap into the creator economy

Pinterest also announced it is investing $20 million over the next year to pay and support creators, and that it will be adding more shopping features, including Amazon affiliate link capabilities.

Like Spotify and YouTube, above, Pinterest is focused on expanding formats for creators to monetize. Like YouTube’s $100MM creator fund for Shorts, it sees TikTok as the business model to imitate.

Formats Are Multiplying, But Creators May Need Something Else

There are two takeaways from the above:

Creators have increasingly more options to monetize content formats across social media platforms, and

There will be increasingly more content creators competing for the same eyes and ears of audiences across these platforms.

In other words, the important dilemmas I highlighted for the future of Hello Sunshine in A Short Essay on Talent Trade-offs in Streaming vs. The Creator Economy are not only playing out in the creator economy marketplace, but now at a greater scale.

The open question is whether that will matter to Hollywood-meets-Creator-Economy models. I understand through my own research that Kevin Mayer envisions the influencer model on YouTube and other platforms evolving towards the shoppable livestream model from Asian tech giants like WeChat and Alibaba.

This mirrors the “distributed retail” model Robert Kyncl was describing above. It sounds exciting — effectively the idea is Reese Witherspoon and other Hollywood celebrities with their own personal QVC-type livestreams on YouTube (basically Reese Witherspoon hosting a Draper James livestream).

There were implications that Pinterest was one step closer to this model with rumors of PayPal’s offer to buy the platform: PayPal’s objective is “becoming a ‘super app’ that folds in numerous services and functions, like some apps in Asia.”

But it is also worth considering Nathan Baschez’s point that creator platforms need to ensure that fans actually encounter creator sales pitches. That seems to be the big disconnect on creator platforms outside of Asia.

In other words, even with greater investment from platforms in creator economy content production, platforms still “need to find elegant ways to cause fans to actually encounter pitches from creators.” This pain point will be true for both platform-specific content creators and Hollywood stars seeking to capitalize on creator economy business models.

The reality of the creator economy is, as Sara Fischer of Axios reported this month, “that a small portion of creators still reap the most revenue for their work across multiple platforms.”

In that light, the prospects of Hollywood-Meets-Creator-Economy models succeeding seems even less likely, something Matt Belloni hinted at in his newsletter on Sunday.

With more competition across more formats and with little ability to sell to fans, where are the wins for Hollywood talent?

Conclusion

The creator economy is inevitably headed towards a revenue mix of “distributed retail”, livestream e-commerce, advertising, and merchandise sales. Given the weakness in sales that Nathan Baschez identified, it is anyone’s guess what that mix will be.

Given that “more attention needs to be paid to the sales funnel”, the other factor worth highlighting is Apple’s Anti-Tracking Transparency (ATT) privacy policy, which Snap and Facebook “blamed for creating significant advertising measurement and targeting frictions that adversely impacted revenue”. I wrote more about that impact on the broader ad marketplace last week.

Mobile Dev Memo’s Eric Seufert made an important point about the now-dead PayPal and Pinterest merger. It would have been a “distributed retail” model whose sales funnel would have been “a formidable Content Fortress”:

…by combining PayPal’s payments platform with Pinterest’s advertising infrastructure, it could allow advertisers to bring about purchases for their products directly in the Pinterest app, which would give Pinterest first-party access to the data emitted by those transactions. And this integrated platform delivers value through better advertising targeting in the ATT environment as well as the superior economics of facilitating the retail transaction in addition to the advertising for it.

To remind you, a “Content Fortress” is “any platform or portfolio of products supported by a rich advertising ecosystem serving owned and operated inventory using only first-party data”.

The takeaway from this is: whatever the mix of “distributed retail”, livestream e-commerce, advertising, and merchandise sales ends up being over the next decade, the sales funnels will need better first-party data. An unintended positive benefit of ATT for platforms is they are being forced to need better first-party data and host more e-commerce transactions.

Better first-party data leads to better offerings for advertisers and e-commerce shops. “Distributed retail”, livestream e-commerce, advertising, and merchandise sales models all will benefit. That was the opportunity PayPal saw in Pinterest.

But even then, they may not be solving the problem creators, and Hollywood talent need the most help with: more opportunities to directly sell their fans.