I had lunch in Simi Valley, CA over the weekend. While driving back with my friend - a Chief Technology Officer at an AdTech Software as a Service (SaaS) company- I realized that the last time I had been there was to evaluate a Search Engine Optimization (SEO) vendor for MTV Networks (MTVN) websites in 2006. At the time, Google was rapidly becoming the way that MTVN websites would be found by younger generations of audiences.

It was a paradigm shift for the entire media industry playing out in real-time and MTVN had been behind the curve on SEO. We were playing catch-up with a steep learning curve because MTVN websites had not been built with SEO as an objective (a relaunch of MTV.com had been built entirely in Adobe Flash, Google’s algorithms could not read Flash, so no one could find MTV.com via Google search), and Google Search had not been on Viacom management’s radar as an immediate disruptive threat to the business.

Over lunch, my friend and I discussed whether Consumer Data Platforms (CDPs) marked another paradigm shift for media. A CDP is software that combines data from multiple tools to create a single centralized customer database of data from all consumer touch points and interactions with a product or service.

Investors want to see greater Average Revenue per User (ARPU) in streaming, and CDPs are built to enable marketing to and monetizing users in multiple ways across multiple channels. Apple, Amazon, Disney and Netflix have businesses built upon what I have been describing as “CDP business logic”.

My friend pushed back on the premise that CDP *software* represented a paradigm shift in media. Even if “CDP business logic” is emerging within businesses, his point was that having the operational set-up to maximize a CDP is more important than the software itself. And, as coincidence would have it, that mirrors the lessons I learned during the paradigm shift to intent-based search and Search Engine Optimization (SEO) in 2006.

A quick overview of CDPs

I liked this description of CDPs from a peer-to-peer software review site called G2:

Customer data platforms (CDPs) are used to consolidate and integrate customer data into one single database. These tools offer marketing teams relevant insights needed to run campaigns. A CDP can grab information from online and offline sources such as websites, mobile apps, and email platforms to offer a complete view of the customer. After retrieving this data, a CDP can then help organizations predict the optimal next move with a particular customer. This allows businesses to learn what needs to be done to retain specific customers. A CDP can also be used by customer service teams to cater their support to each individual.

In short, data is ingested to tell the CDP owner important details about its customers, and the data is then applied throughout the ecosystem to market and/or deliver services and goods to the customers. It also may be used to improve how the broader consumer ecosystem runs.

In terms of ARPU, “the optimal next move” may be understood as the types of tactics and strategies that generate marginal revenue from new and existing customers.

It is important to note that, at a technical level, SEO is not analogous to a CDP. SEO is “the process of improving your site to increase its visibility when people search for products or services related to your business in Google, Bing, and other search engines. The better visibility your pages have in search results, the more likely you are to garner attention and attract prospective and existing customers to your business.”

Rather, the analogy applies more at a macro level: SEO emerged as a solution following Google driving search-driven usage of the Internet, and CDPs now emerge as a solution as business models begin to expand across Internet verticals (e.g., e-commerce, gaming, streaming) and into traditional verticals (e.g., merchandising, theme parks).

A great example of how a CDP can solve a problem is in an MGM Resorts press release from 2020:

With Amperity’s CDP, MGM has now achieved:

* A single universal Customer 360 database replacing multiple separate team databases. * Significant deduplication of records for greater accuracy in reaching customers. * The ability to create flexible predictive modeling accounting for customer experiences beyond gaming.

Notably, this press release emphasized that the CDP had been adopted as part of a “five-year digital transformation plan” that MGM Resorts had been pursuing (NOTE: MGM Resorts’ business model inspired the PARQOR Hypothesis). Meaning, MGM Resorts management pursued a transformation to solve pain points around siloed customer data, and a CDP seemed the best available solution.

In other words, it was not the software driving the change but rather CDP software helping to solve outdated operational practices around data.

Challenges with CDPs

My friend challenged the assumption CDP software reflects a paradigm shift because engineers often build a product without an end customer in mind. His perspective supports a data point that the “vast majority of marketers are unhappy" with their CDP from a Forrester study commissioned by Zeta Global in January 2022. Zeta has a competitive CDP and counts car companies (Jaguar, BMW Lexus) and CNN as its customers.

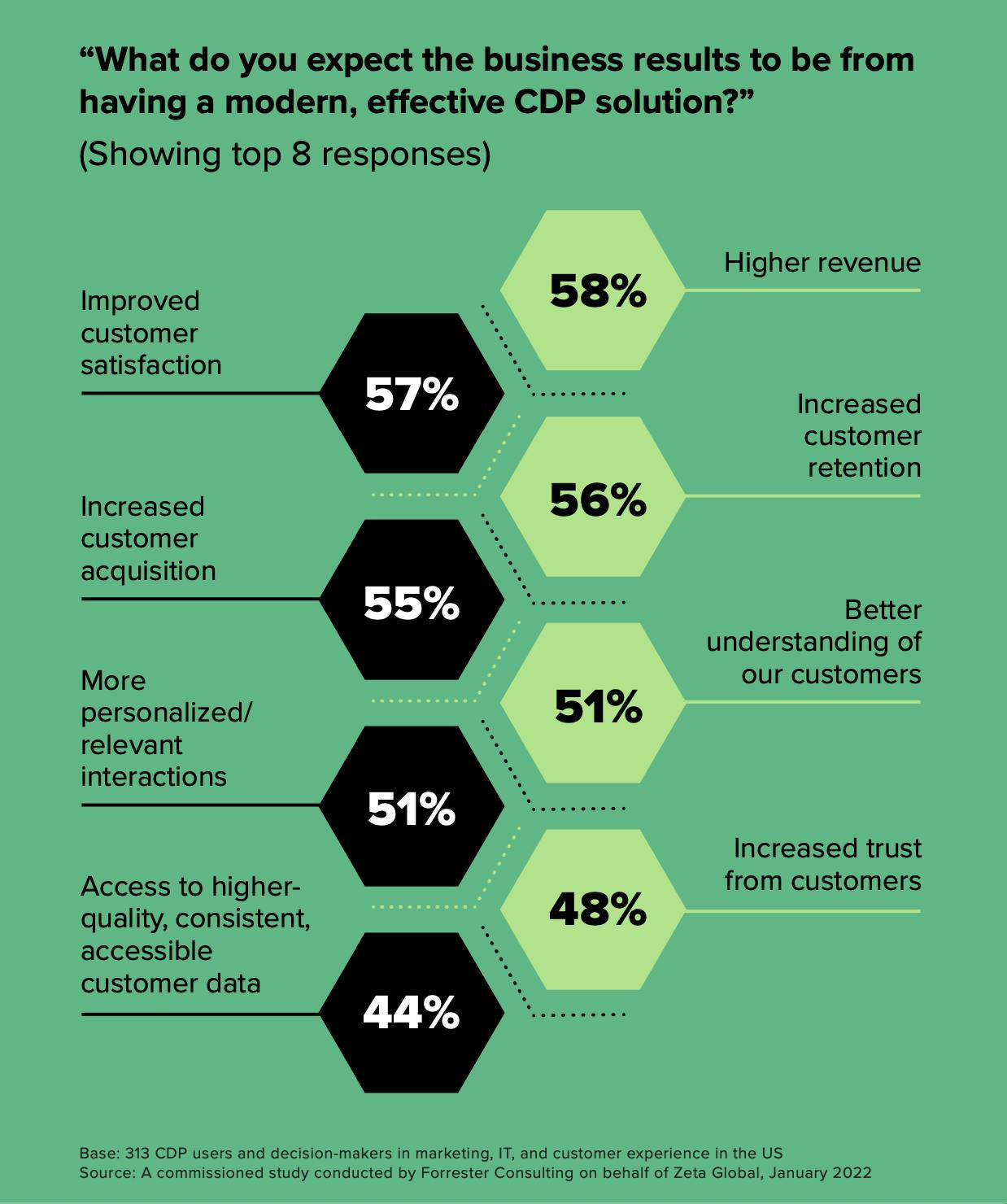

That study found that only 10% of CDP owners today feel their CDP meets all needs, and that number drops to 1% who believe their CDP can address future requirements. Their largest requirement is higher revenue (58% of respondents), and the third and fourth answers were increased customer retention and increased customer acquisition.

There is also this paragraph summarizing how poorly CDPs map to the needs of customers:

Beyond data ingestion and data management, few respondents report that they are satisfied with the capabilities that enable the core functionality of CDPs like customer segmentation (#3 function — 29% mostly satisfied) and customer profile assembly (#4 function — 25% mostly satisfied). Unfortunately, satisfaction with some of the analysis and execution-related capabilities is even lower — like personalization (#5 function — 22% mostly satisfied) and integration with campaign endpoints to help with execution (#6 function — 24% mostly satisfied).

These data points led to one conclusion from the study: “Marketers’ expectations outrun current CDP functionality”. Meaning, unlike SEO CDPs are not driving business models expanding across Internet verticals (e.g., e-commerce, gaming, streaming) and into traditional, real-world verticals (e.g., merchandising, theme parks).

Rather, as in the case of MGM Resorts, they are emerging as solutions to operational pain points from trying to evolve business models and grow ARPU across digital and real-world businesses.

An SEO lens on CDPs

Senior management in MTVN digital media understood SEO as *an* organizing principle for the business, but no one in management perceived SEO as *the* organizing principle for a digital media business.

Competitive digital media businesses at a greater scale emerged in the marketplace built upon this latter assumption, either by gaming the Google algorithm - like ”content farms” which married low-cost content production and domain name registration like Demand Media - or simply being a search-friendly ecosystem for consuming videos - like AtomFilms and YouTube.

For MTVN its profitable linear model was *the* organizing principle for its digital media business. There were two customers for media produced by MTVN websites: the intended audiences for that content and the advertisers who had strict requirements for the content they were comfortable sponsoring.

MTVN management was stuck in a complex dance where they needed to scale their digital media businesses but they were limited by their existing library (and rights deals around that library) and oriented more to producing TV-quality content than low-cost content. They were also constrained by the fact that advertiser customers would only pay a premium for TV content across digital and linear, and did not value low-cost content similarly. [1]

They were constrained from adapting to the paradigm shift, and that prevented them from solving for SEO as *the* organizing principle for the business (It did not help that they also were suing Google over YouTube in 2006, too).

What problem does a CDP solve?

So what should legacy media companies with streaming services do to successfully adapt to the emerging paradigm shift? How can they expand across Internet verticals (e.g., e-commerce, gaming, streaming) and into traditional verticals (e.g., merchandising, theme parks) to grow ARPU? Should CDPs be *the* organizing principle?

Disney is pushing the boundaries of solving for the paradigm shift because it is operationally set up to do so - The Wall Street Journal reported that Disney is exploring a membership program that could offer discounts or special perks to encourage customers to spend more on its streaming services, theme parks, resorts and merchandise (I wrote more on this two weeks ago).

But no one else is pursuing a similar strategy, despite having similar assets. Warner Bros. Discovery has games and streaming and it also has a licensing deal with Six Flags (I wrote about WBD’s challenges under new management last month). Comcast has both Universal Parks and its streaming service Peacock. But, they have yet to connect the dots across those businesses promotionally and all indications suggest that they are not interested in doing so (Warner Bros. Discovery seems most obsessed with cutting $53B in debt).

Every other legacy media company - Paramount, Lionsgate (Starz), AMC Networks - lacks those assets. For them, pursuing CDP business logic has no clear path to success, and adopting a CDP will solve nothing because they do not have offline consumer-facing businesses. If SEO is the analogy, they are all faced with a paradigm shift analogous to Google emerging in 2006 but CDPs will not be *the* new organizing principle for their businesses.

Can anyone solve for a CDP?

This all points to a tension in the marketplace: if the SEO precedent applies then CDPs are directionally where media companies with streaming businesses must be oriented, but few of those companies are operationally structured to solve for heading in that direction.

In SEO, only media business I have seen successfully solve for SEO as *the* organizing principle is Dotdash Meredith. Before Dotdash merged with Meredith Corporation late last year, I described their business last July as:

“parasitically embracing Google’s dominance over search and building a Co-opetition relationship. It was a contrarian move that conceded Google’s ownership of the last mile to the consumer, but also realized that there were opportunities for Dotdash’s content verticals to better serve the consumer than Google.”

Those verticals were The Balance (personal finance), Lifewire (tech), The Spruce (home and food), VeryWell (health), TripSavvy (travel), and ThoughtCo (education).

The surprising solutions that helped those sites to scale were to reduce page-load time and boost the quality of content within its verticals, as CEO Neil Vogel told Fast Company in January 2020:

“Our job is to make great content that loads quickly with relevant non-intrusive advertising,” he insists. “If we execute, the search results will be fine.” His critics call this naive, but Vogel is trying to build a billion-dollar publishing business, not a search colossus. He’s betting that Google will drive traffic to the best content.

A focus on minimal page load time and high-quality content niche sites as solutions for SEO emerged internally in a series of trial and error experiments over nine fiscal quarters in which Dotdash lost millions. In one quarter, it actually turned away advertisers (I wrote more about this last October).

This solution was surprisingly elegant and contrarian. When pursuing SEO, legacy media websites struggled with high bounce rates and monetization challenges with programmatically served ads, both in-house and external vendors (with fraud being the biggest issue). Rather than fight those dynamics, Dotdash management focused on understanding them. The solution - building everything around shorter page load time - was not an obvious one.

The ultimate lesson of Dotdash is that a software solution to a paradigm shift was a byproduct of an operational process, and not the driver of it. If Dotdash’s success in navigating the SEO shift is precedent, the best business CDP model will emerge from a smaller, niche player with the assets to build a CDP-based model and operationally orient itself towards figuring that model out in the long-run.

If CDP business logic as *the* organizing principle is indeed what is necessary for media companies to grow ARPU, the companies most likely to solve it will rely on stronger management and operational models than CDP software vendors.

Footnotes

[1] I also worked on a fun problem related to this limitation in a division of MTV Networks Ad Sales called Digital Fusion: MTV.com and VH1.com were losing viewers to YouTube because of ad load. MTV Networks had opted to run multiple 30 second pre-rolls in front of short 3 minute music videos. Users started dropping off during the ads and going to YouTube, instead, where the ads were free. So we invested in non-interruptive advertising.