Good afternoon!

The Medium delivers in-depth analyses of the media marketplace’s transformation as creators, tech companies and 10 million emerging advertisers revolutionize the business models for “premium content”.

Each fiscal quarter, The Medium identifies three or four new trends that have momentum and seem poised to play out at a larger scale in 2023. These key trends pinpoint dynamic and constantly evolving developments in the media marketplace that are emerging from incremental shifts or fundamental changes. The bi-weekly mailings analyze these trends as developments emerge in real-time.

Of the three trends I wrote about last quarter, the trend I wrote about most was “Legacy media companies are throwing in the towel on their bets to own the consumer relationship in streaming and beyond.” Both Warner Bros. Discovery (HBO’s “The Pacific”) and NBCUniversal (“Suits”) are seeing lesser-known titles become hits on Netflix. Licensing matters. But the more advanced examples lay in the “daisy” product strategy at The New York Times and the product-focused strategy at Yahoo.

The trend I wrote about least was “Artificial intelligence (AI) and cloud computing applications and services are increasingly dictating content consumption.” Now, I wasn’t sure that would be the case, as I conceded at the end of the prediction: “It may be ambitious to assume that the AI marketplace is evolving so quickly that we are guaranteed more answers in Q3 2023, alone.”

But, the gist of the prediction remains true: AI is increasingly dictating which marketing content we will see and/or consume depending on the data that a media company has on us. The continued success of YouTube, TikTok and Netflix as every legacy media company struggles with less data and fewer tech capabilities are each and all proof of the pudding. We also saw it in the rapid, “disorienting” emergence of Meta’s Threads.

As for the third trend—“There is a less-discussed lens on how the demand for “premium content” is being redefined by creators, tech companies and 10 million emerging advertisers”—I wrote in Monday’s mailing that the contraction in demand for legacy media content is playing out alongside a contraction in the supply of legacy media content. This will continue as one of the key trends of Q4 2023.

Here is a quick summary of that trend from Q3, and then two other trends for Q4 2023.

Key Takeaways

There is a less-discussed lens on how the demand for “premium content” is being redefined by creators, tech companies and 10 million emerging advertisers.

In the shift from wholesale to retail models, there are many business models that delight consumers but no single, dominant one.

AI-meets-the-creator-economy business models are emerging.

Total words: 2,500

Total time reading: 10 minutes

1. There is a less-discussed lens on how the demand for “premium content” is being redefined by creators, tech companies and 10 million emerging advertisers.

This trend offers one answer to the question I posed in Q2: “Media companies have millions of consumer credit cards on file. What are they building for their customers?”

In Q2 2023, Warner Bros. Discovery, Paramount and Disney removed titles from their respective streaming libraries. Notably, Warner Bros. Discovery removed prestige HBO titles like “Insecure”, “Band of Brothers”, “The Pacific”, and “Six Feet Under” and licensed them to Netflix. Notably, “The Pacific” surfaced in Netflix’s Top 10 lists this week. If Netflix or another platform values these titles more than Max subscribers value these titles, then Warner Bros. Discovery is properly maximizing the value of its library through licensing.

But from the perspective of a retail, direct-to-consumer model, the move is a head-scratcher: If those titles have value to existing and target subscribers of Max, and the relaunch of the app includes personalized recommendations, then why are these prestige titles *not* on Max?

Warner Bros. Discovery CFO Gunnar Wiedenfels recently offered one answer at an investor conference: Consumers signing up for a subscription VOD service for two or three weeks, “going through an enormous amount of content and then mov[ing] on.” In other words, there simply is not enough “bang” for the buck in a legacy media streaming service. Consumers have more and better choices for spending money in exchange for delight elsewhere, like Netflix and YouTube.

In May’s “The ARPU of Storytelling”, I wrote about how average revenue per user (ARPU) offers the best retail business story to be told by media companies now that they have all these credit cards on file. As I wrote in May's Medium Shift column, media executives and Wall Street investors alike are coming to realize that the new ARPU from streaming alone will not replace the lost ARPU from cord cutting. That extra revenue will have to come from somewhere else.

But what does that demand look like somewhere else and how can it be monetized?

I argued on Monday the YouTube story is one answer. The combination of over 50% of its viewing being creator content and its growing domination of TV usage in streaming suggests that it is driving consumer demand towards more niches, and also setting them up to spend more in new and different ways via its Partner Program monetization tools (e.g., channel memberships, shopping, chat).

2. In the shift from wholesale to retail models, there are many media business models that delight consumers, but no single, dominant one.

In July’s “The Disorienting Emergence of Threads”. I quoted something Instagram head Adam Mosseri said in an interview with The Verge’s Alex Heath:

Creators are becoming more and more savvy. They’re using more and more platforms. It’s becoming rarer that a creator is completely attached to one platform because they’re always worried about the risk of being overly beholden to one company that they obviously can’t control.

I argued that Mosseri is describing consumers, too, and saying neither creators nor consumers seem to have any loyalty to any platform. They seem to only have loyalty to each other. They both just want to be delighted, if not on a familiar platform, then somewhere else where someone knows how to delight them.

As I have argued previously in last September’s “Can Disney TikTok-ify or Amazon Prime-ify Itself?”, a business model that successfully delivers “delight” to consumers will also deliver shareholder value. In both The Medium and my Medium Shift column on The Information, I have been writing about how legacy media companies have been struggling with solving for consumer “delight” as their business models shift from wholesale to retail.

Two of my favorite companies to write about who have successfully built solutions for delight are Yahoo—which I wrote about in August’s “Why Disney Needs to Yahoo ESPN”—and The New York Times, which I wrote about in September’s “The Daisy or The Flywheel?”. Another favorite example is Sony-owned anime entertainment company Crunchyroll, which I wrote about in “Fare Thee Well, Media Conglomerate (...After April 2024)”.

There are effectively three levels to the question of consumer delight emerging, ranked from smallest to largest in terms of business model size:

Creators delivering delight across platforms (e.g., $20 million to $80 million in revenues per year)

Media companies that have figured out delight on their own platforms (e.g., YouTube and Netflix belong here at $30 billion in annual revenues)

Media conglomerates struggling to identify delight in the shift from wholesale to retail (e.g., Disney at over $80 billion in annual revenues)

Adam Mosseri's insight is fascinating because it reveals how competitively weak the media conglomerate model is. Cable TV has been replaced by multiple platforms, and consumers are no longer beholden to any single one, both online and offline.

3. AI-meets-the-creator-economy business models are emerging.

Last October, I wrote in “What Will Happen When Artificial Intelligence Recasts "The Office"?” that there is a compelling argument—”though early and incomplete”—the future business models for videos produced by AI engines like Midjourney will “look a lot like the creator economy”. That is because:

“the businesses best positioned to host all that content, to target different content to fans of those celebrities with an algorithm, and to monetize it are Netflix, YouTube or TikTok. Because all that content will need algorithms to map different celebrities and different clips to the audiences who are most likely to watch them.”

One year later that remains true, though with a dark underbelly: actor Tom Hanks recently shared a photo of an AI-generated version of him selling dental products warning his followers it is not real. AI-recreations of the late comedian Robin Williams have been going around, too, much to the concern of his daughter. Algorithms on TikTok understand that Hollywood actors are popular with audiences, but they are not yet understanding that the actors in the video clips are AI-generated.

Hollywood actors are the blockbuster side of the business and the creator economy is the niche side of the business. The success of the creator economy has been driven in large part by YouTube’s 2007 decision to share advertising revenues via its Partner Program, which now has over two million creators in it. Since then, platforms like Instagram, TikTok and Snap have incentivized creators to produce videos on their platforms, too.

Creators like Jimmy Donaldson aka MrBeast (312 million YouTube followers, $82 million in annual revenue) and Charli D’Amelio (213 million TikTok followers, $23 million in annual revenue) have found extraordinary success by fully embracing the algorithmic distribution and powerful monetization tools offered by their distribution platforms. They are considered “premium content” that competes with linear and legacy media content as must-have advertising.

If one subscribes to the investment hypothesis that The Chernin Group founder Peter Chernin has held and tested in media for the past two decades—"Content will aggregate at two extremes: the big blockbuster hits and niche products”—then Hollywood blockbusters and creator-led niches will be the only two models that will succeed in media. The rest of the models, what Chernin calls the “bland middle”, will be “gone, and gone forever.”

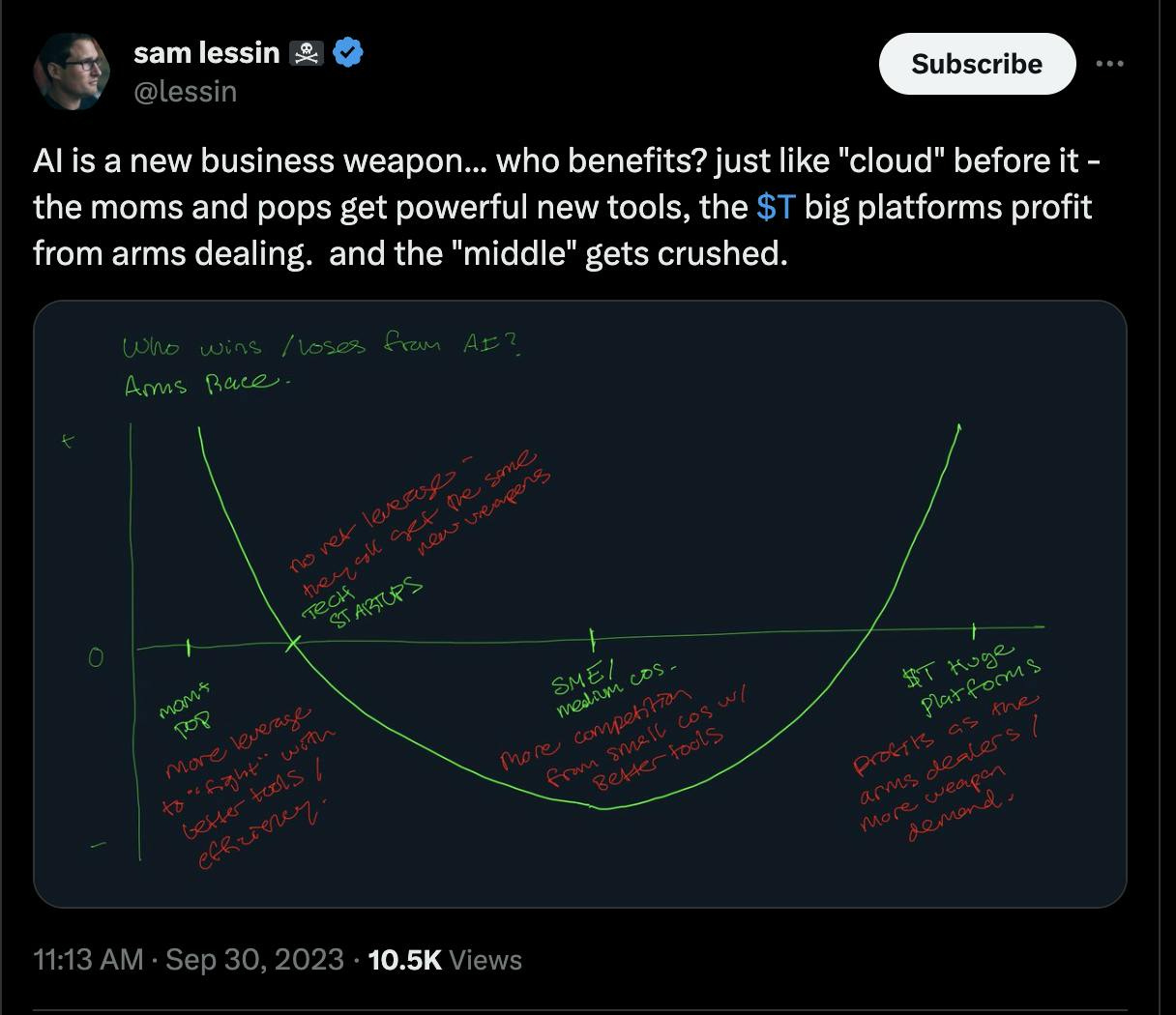

Slow Ventures General Partner Sam Lessin recently argued this dynamic will play out in AI on The Informations’ More or Less podcast and later fleshed it out in a diagram:

Their guest on the podcast that week, Adobe's Chief Product Officer Scott Belsky, tweeted a different version of the same argument:

Often lost in the narrative: AI will help small companies leverage advantages typically reserved for big companies (making sense of data, security, marketing at scale, personalized experiences, etc…), and this could redefine how we think about SMBs.

They are both adding meat to a point that I made in my Q3 2023 trends mailing: “The view of any individual or cohort of consumers by a singular AI program is ‘now truly holistic, and the decisions that are made about serving us content from data within a warehouse may be made without human insight or guidance.’”

AI working in the cloud shares a lot in common with algorithms recommending content on YouTube or Netflix. The difference is that the algorithms in AI are more sophisticated (and require more back-end computing power from chipmakers like Nvidia) and the data sets they work with are exponentially larger. The implication of the tweets, above, is small companies can imitate the playbooks of YouTube or TikTok creators by fully embracing and investing in the powerful capabilities of AI tools in the cloud.

For example, in May’s “Consumer Data May Be Too Complex Media's DTC Models”, I wrote about AI apps built by marketers that now run within the data warehouses—the system of record or authoritative data source for all consumer data owned— that assume the roles of third-party Adservers, Demand side platforms (DSPs), and attribution/measurement. So, all three roles be different operational centers within a media conglomerate like Paramount Global or Comcast’s NBCUniversal. The hypothesis of the tweets above, a savvy small business owner can build a bot within the same data sets and can replicate the scale and power of these businesses at a fraction of the cost.

In doing so, they will be positioned to be more agile and to produce larger returns than Small and Medium-sized businesses (SMBs). The key question for Q4 2024 will be, how will we identify these businesses? What will they look like? That opacity is the key difference from the creator economy, where performance data is public. And that makes the value of any data or signals much more valuable.

And, Three Things To Keep Your Eye On...

The advertising marketplace continues to be too messy.

To repeat what I wrote in the Q3 key trends mailing:

Anyone in my position cannot avoid writing about the shifts in advertising. I know more needs to be written, but there is so much noise and so few signals coming from that marketplace. Everyone, including me, is better off being made aware of clear, market shifts and signals when they happen. And therefore, it is saner for me not to try to follow the play-by-play of that marketplace .

I also liked something Brian Morrissey wrote in a recent The Rebooting newsletter:

Everything in ad tech gets quickly into the weeds with speeds and feeds. But one inconvenient truth revealed by GDPR is, whether there’s real harm created or not, when given a clear choice on ad targeting, most people say no thanks.

So, if there is one clear signal from the advertising marketplace, it is that privacy regulations like GDPR and technological solutions like Apple’s Anti-Tracking Transparency initiative have had enough of an impact that advertisers are progressively losing the signals they once had to drive targeted advertising.

And nothing has emerged as an alternative unique identifier yet. Perhaps AI offers solutions in the clouds to better translate the data from within the walls of walled gardens like Amazon and Google.

The SAG-AFTRA strikes, AI and "informed consent" in gaming.

The writers’ strikes may be over but the SAG-AFTRA actors’ strikes continue, and “the union is insisting that performers must give “informed consent” and that the right to use AI on additional projects must be separately bargained.” As overall production budgets get cut in the aftermath of the deals with the writers—the costs of individual productions have gone up, thereby reducing the total amount of productions a studio will be able to make—the gaming industry is going to be offering alternative work, likely voiceovers, for Hollywood actors who may need additional work. In last month’s “Hollywood Actors Face A Bigger AI Threat From Gaming” I wrote about the particular challenges of “informed consent” created by gaming and its tech-savvy fanbase.

SAG-AFTRA members have voted overwhelmingly to authorize a strike against 10 of the major video game companies. The vote was 98.32% in favor. So this issue will be playing out in ways that may surface important signals for how Hollywood talent adapts to growing demand for gaming content from Gen Z and Gen Alpha, according to recent research from NewZoo.

Awaiting the aftershocks of Disney, Comcast and Hulu

We are also awaiting the outcome of Disney and Comcast’s arbitration over the value of Hulu, which was pushed forward from Q1 2024 to the end of this fiscal quarter. Under the terms of a put/call deal with Comcast from the Fox merger, Comcast owns 33% of Hulu, and Disney is contractually obligated to buy out Comcast at the fair market price of Hulu with a floor of $27.5 billion. An arbitrator is determining whether that should be higher. In either case, it will be expensive for Disney, which has $11 billion of cash on hand while carrying over $47 billion in debt obligations.

Our best bet of finding out will be on earnings calls, either later this month (October 26th) on Comcast’s call, or five weeks from now on Disney’s earnings call (November 8th). A few scenarios are possible:

Disney emerges Hulu-richer and cash-poorer), and Comcast emerges with $9B plus in

Disney emerges Hulu-richer and with deal terms with Comcast that dampen the impact (e.g., a deal similar to Charter whereby it gets wholesale distribution for Disney+)

Comcast ends up keeping a share of Hulu.

Some sort of merger-type deal that precedes the April 2024 Warner Bros. Discovery outcome.

We cannot rule out the unexpected, either. Whatever the outcome, Disney and Comcast will emerge from this arbitration with fundamentally different economics for their media businesses. Because they are deeply interwoven with the rest of the media ecosystem across linear, digital, theatrical and even theme parks, the arbitration ruling will reverberate widely and in unpredictable ways.