In Q1 2023, PARQOR will be focusing on four trends. This essay focuses on "The definition of scarcity is continuously evolving away from linear. What happens next?”

Last April I wrote about how Hulu's integration of ESPN+ made it easier to discover and watch the lightning-in-a-bottle TV story of Tiger Woods’ return to The 2022 Masters. But, it did not solve the problem of friction in streaming: specifically, how the User Experiences (UX) and the User Interfaces (UI) of how connected TVs and devices control the last mile to the consumer.

Friction exists in the form of discoverability: the consumer may not know that The Masters could be viewed on ESPN+ and Hulu; or, an ESPN+ subscriber may not know they can watch the event unless they first log into Hulu. It also exists in the form of choice: a broadcast of The Masters is buried within the Hulu and ESPN+ apps. Meaning, on a connected TV device home screen, the target viewer must decide between apps before choosing Hulu or ESPN+ to watch The Masters. In conversion funnel lingo, there are countless opportunities presented for the target viewer to leave the funnel because they are confused or they opt to watch something else instead of “converting” to a Hulu or ESPN+ viewer.

I highlighted in Monday’s essay that scarcity is evolving away from linear over the next 10 years, and therefore “Disney or any company that does not own a smart TV solution does not have scarcity”. Scarcity is the linear distribution model’s historical moat — the linear model enabled multichannel video programming distributors (MVPDs) to aggregate millions of households locally, regionally and later nationally.

There is an obvious question I did not address: if Disney cannot solve for friction or scarcity then why does it need either or both Hulu and ESPN+?

Key Takeaway

The question facing Disney of whether to invest or to divest to solve for scarcity is ultimately an existential question. Neither option may be the solution Disney's problems.

Total words: 1,800

Total time reading: 7 minutes

The lens of sports rights makes the futures of Hulu and ESPN+ seem more pressing: sports rights are expensive, they are trending inevitably towards more expensive (the NBA rights deal is coming up for renewal in 2024 and its price may double), and neither linear nor streaming are delivering the scale or scarcity for the economics to continue to work as they did.

There is a sense of urgency given that the streaming business model needs growth, and friction is a real obstacle to growth. Friction is a particularly thorny obstacle to advertising revenues as Disney competes with the scale and sophistication of connected TV advertising technology offerings. So, a big question in FY Q1 2023 earnings for Disney — and, really, any media company with sports rights and streaming business — is, can Disney invest or divest to solve for friction?

Invest

Hypothetically, investing in a Smart TV platform with both enormous scale in the U.S. and competitive scale outside the U.S. would make the most sense as a solution.

Their models are built around long-tail revenues from the sale of digital advertising (both 100% owned and also shares inventory from apps they distribute), and shares of subscription and transaction revenues from apps they distribute. There are additional models, like selling branded channel buttons on remote controls that drive marginal revenues. By investing in a Smart TV provider, Disney would benefit from both preferential treatment and from the revenues generated by its competition.

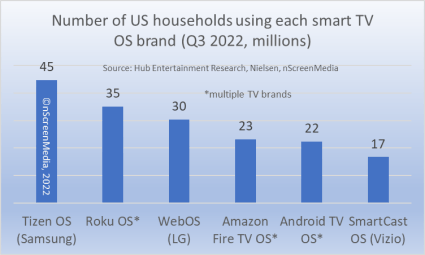

The challenge is, those investment opportunities do not exist because the connected TV device market is highly fragmented, and the biggest players are all conglomerates (Samsung, LG, Amazon, Google). Roku may be the only opportunity worth considering the advantages of solving for scarcity in the U.S.

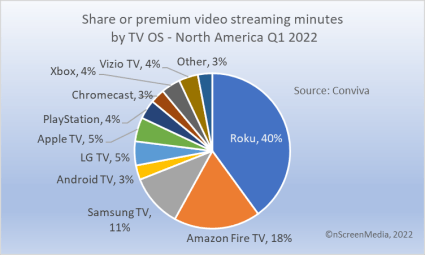

Based on the data below (Digiday has a similar chart without percentages), investing in Roku in exchange for preferential treatment would seem like the only choice for solving for scarcity, even if only 40% of the U.S. market. Disney has $11.6B in cash on hand, implying that it could make moves similar to its first investment of $1B for 33% of BAMTech in 2015. It acquired a controlling stake of 75% in BAMTech for $1.58B two years later. Roku’s market cap ($8.3B) is currently 3% of Disney’s ($205B), and its enterprise value is $7.8B, so it is affordable with some mix of cash and equity. Roku’s stock is down 60% over the past year, so any growth Disney could deliver would be all upside to both investors. [1]

Owning Roku would enable Disney+, ESPN+ and Hulu to become default home page offerings for all Roku device owners— meaning, on the top row every time a device launches. Roku’s home page ad slot could be used to target sports events to specific Roku users. Any marketing that drives a consumer to launch their Roku means that viewers of a sporting event would be one click away from that even on Roku devices. Ultimately it would be a solution for solving friction for U.S. ESPN+ and sports events, and perhaps internationally, too (Roku has over 65MM active users, globally, and is seeing growth in Mexico and Brazil).

But, investing in Roku faces two challenges. First, streaming minutes do not reflect household penetration: Samsung is emerging in the U.S. as the device of choice in households (below). So, investment in one device-maker will not solve for friction in the short-term and perhaps not in the long-term. Second, investing in Roku to promote Disney and ESPN content would kill off both supply and demand for third-advertising home page sponsorships.

Neither company ultimately would benefit from Disney’s investment, and Disney has no other obvious or appealing options.

Interlude: Comcast

Comcast’s Xfinity platform reaches 68MM potential residential customer relationships via X1 and Flex (now Xumo) customers across Comcast, Charter and Cox. Premiership viewership and broader sports offerings on Peacock are padded by Comcast’s reach. Recently, Peacock and NBCU Digital Sports registered an Average Minute Audience (AMA) of 358,000 viewers for Tottenham-Manchester City – second-best ever for a simulstreamed Premier League match – behind only Arsenal-Manchester United on Jan. 22 (510,000).

I wrote last month: “Comcast is solving for fragmentation by reinventing the wheel of its linear model: aggregating scarcity across multiple broadband and linear distribution households. But for Comcast’s scarcity and evolution of that value proposition in broadband via Xumo, Peacock might look more like a bundle-less ESPN+ at best.”

Comcast owns 33% of Hulu, and Disney is contractually obligated to buy out Comcast at the market price of Hulu (currently $27B to $33B estimated) in 2024. There has been plenty of speculation around horse-trading around this deal — including some speculation of trading ESPN for Hulu — especially given Comcast’s openly stated interest in owning Hulu. The speculation is right to focus on common ground: both have expensive sports rights deals, both are navigating the decline of cord-cutting, and both face a growing *need* to reduce friction in streaming. Comcast has the solution to both its pain point and Disney’s pain points, so it may make more sense for Comcast to invest in Disney. In 2022 Comcast generated $26B in cash flow from operations and net 11.48B in free cash flow.

This all said, though Comcast’s Xumo and Flex platforms have reach in broadband there does not appear to be any data that suggests it has usage of its platform at scale. So Disney pursuing some form of investment partnership would have better optics than substance (though Peacock is releasing its viewership data and ESPN+ has yet to).

Divest

If investing presents few good options in the connected TV space, would Disney be better off divesting Hulu and/or ESPN? Both outcomes have created plenty of speculation lately. Given connected TV device manufacturers are in a position to squeeze payments from streaming apps (or, “extract rents”) in exchange for better distribution, both would be good outcomes. Sports rights will get only more expensive — rights costs for the NFL are estimated to have gone up by 82% with its new deal — and connected TV device manufacturers will inevitably add to those costs given that they control the last mile.

ESPN has represented as much as ~50% of Disney’s profits in the past, and Morgan Stanley projected it will generate $4B in EBITDA in 2023. So divestment means giving up guaranteed but declining cash flow in exchange for some amount of cash and equity that will benefit Disney shareholders in the long run. That said, divestment would also mean dropping these higher rights costs and problem-solving for rent extraction at the mercy of connected TV manufacturers.

Hulu captured 3.4% of streaming consumption in December 2022 according to Nielsen’s The Gauge, or 45% of Netflix’s consumption (7.5%) and 39% of YouTube’s consumption (8.7%). Giving up Hulu means giving up third place in U.S. streaming consumption, and Disney+ is stuck in fifth place at around 2%. Another implication is, assuming YouTube has nearly 100% reach (135MM Connected TV device users per month), then Hulu reaches 52.7MM of those users.

That’s a big number of subscribers for Disney to divest. Throw in the math of the bundle that I highlighted Monday — there may be only 21.7MM subscribers who need Disney+ without the bundle with Hulu, and just 3.5MM who need ESPN+ without the bundle — and divesting Hulu could halve the scale of Disney’s streaming model in the U.S. That would harm sports streaming distribution for ESPN, too.

In both the cases of ESPN and Hulu, there are no clean cut outcomes that divestment would offer. But, in the simplest outcome of a sale or spin-off, ESPN could generate $20B (5x EBITDA) to help pay down $45B in long-term debt assumed with the Fox merger. It is not ideal, but is a business outcome with an objective business logic to it.

Management & Multiples

As I wrote in “The Tiger Woods Comeback Story vs. Streaming Bundles”:

“More friction between viewers and the feed means fewer viewers, and in turn, fewer ad views. Fewer ad views, in turn, will result in disappointed OTT and CTV advertisers, the precise outcome that Disney does not need as it builds out its ad-supported OTT story for advertisers across Disney+, ESPN+ and Hulu.”

This market dynamic was one reason behind why I asked at the end of “Be Like Peacock to Solve for Scarcity”: “Does Disney have the right management in place to evolve the business and figure out scarcity in streaming?”

It is worth asking that question again because scarcity in streaming is ultimately being defined by software, and therefore software is (re)defining sports distribution is, too. UI and UX are ultimately problems created by software and solved by controlling the software. Comcast seems to understand that with its bets on Xfinity, Xumo and Peacock. The recent stumbles of Disney’s streaming strategy suggest that Disney still lacks executive-level understanding of that problem, or may simply have underestimated this variable since Robert Iger and his team set the streaming strategy in motion five years ago.

It is a point that echoes venture capitalist Marc Andreessen’s argument that “A good test for how seriously an incumbent is taking software is the percent of the top 100 executives and managers with computer science degrees” (I highlighted this argument in 2021). None of Disney’s board or current C Suite management meet that condition. Meaning, the challenge of friction may not just be an operational blind spot, but a necessary skill set that is missing in the highest ranks at Disney that investment nor divestment will solve.

So, the question facing Disney of whether to invest or to divest to solve for scarcity is ultimately an existential question. The lack of an understanding of software at Disney's highest levels implies that neither option may be the solution Disney's problems.

[AUTHOR’S NOTE: The Slack for Must-Read Articles is now ready and I will be sending out invites to Subscribers tomorrow. There are three channels:

PARQOR Essays: a place to connect and discuss PARQOR essays and key trends with other subscribers

Must Read Articles: a dynamic, interactive feed of recommended articles about key trends, allowing reader comments and suggestions (as opposed to a clickable list), and

General: a place where Members can always have direct, real-time access to me

If you are interested in testing it with me this week, please respond to this email.]