PARQOR is the handbook every media and technology executive needs to navigate the seismic shifts underway in the media business. Through in-depth analysis from a network of senior media and tech leaders, Andrew Rosen cuts through what's happening, highlights what it means and suggests where you should go next.

In Q4 2022, PARQOR will be focusing on four trends. This essay focuses on the themes, "Linear channels seem doomed. What happens next?"

This week Disney management delivered a fun answer to the question behind one of PARQOR’s four trends for Q4 2022: “Linear channels seem doomed. What happens next?” It announced it will be airing the first two episodes of the Disney+ series “Andor” on a few of its other channels over the Thanksgiving holidays, including on linear TV channels ABC, FX, and Freeform. It will also be making the two episodes available on Hulu for two weeks.

Andor is a science-fiction, action-adventure series that is a prequel to the 2016 film “Rogue One”. It has a darker, more mature tone than previous Star Wars projects.

The move raises an obvious question: why is Disney doing this when Disney+ has been sold to customers and investors as the home of the Star Wars library and the future of Disney?

I think there are three obvious answers.

Key Takeaway

Disney's surprising "Andor" cross-network holiday tactic reveals how the company is quickly realizing the limits of its streaming strategy, and especially its need to keep its advertisers happy in a complex market moment.

Total words: 2,000

Total time reading: 8 minutes

The first two are related to the advertising marketplace: a move like this gives advertisers who spent big at upfronts a Star Wars-themed event, something only Disney can deliver. It can also rustle up hidden demand in a fading scatter advertising marketplace. I learned while at Viacom that just because market demand goes soft that does not mean it’s dead — there are always sales to be made.

The third may simply be that it’s a smart move: Andor has underwhelmed on the Nielsen charts (and on other measurement services like Parrot Analytics), but it’s loved by critics and fans of Star Wars. Putting it on ABC and cable during the holiday season expands the awareness of the show. Given that ABC is effectively free – its signal can be captured by digital antennas – it also effectively replicates the Pluto TV conversion funnel and turns ABC into a FAST channel for Disney+.

But I think the ad market — which Warner Bros. Discovery CEO David Zaslav described to the RBC Global TIMT Conference yesterday as “currently weaker than at any point during the coronavirus pandemic slowdown of 2020” — offers the best explanation for Disney’s motivations for this unusual move. It has the additional value of unintentionally exposing Disney’s shortcomings and challenges in streaming as it sets to launch its as-supported plan Disney+ Basic in early December.

The math

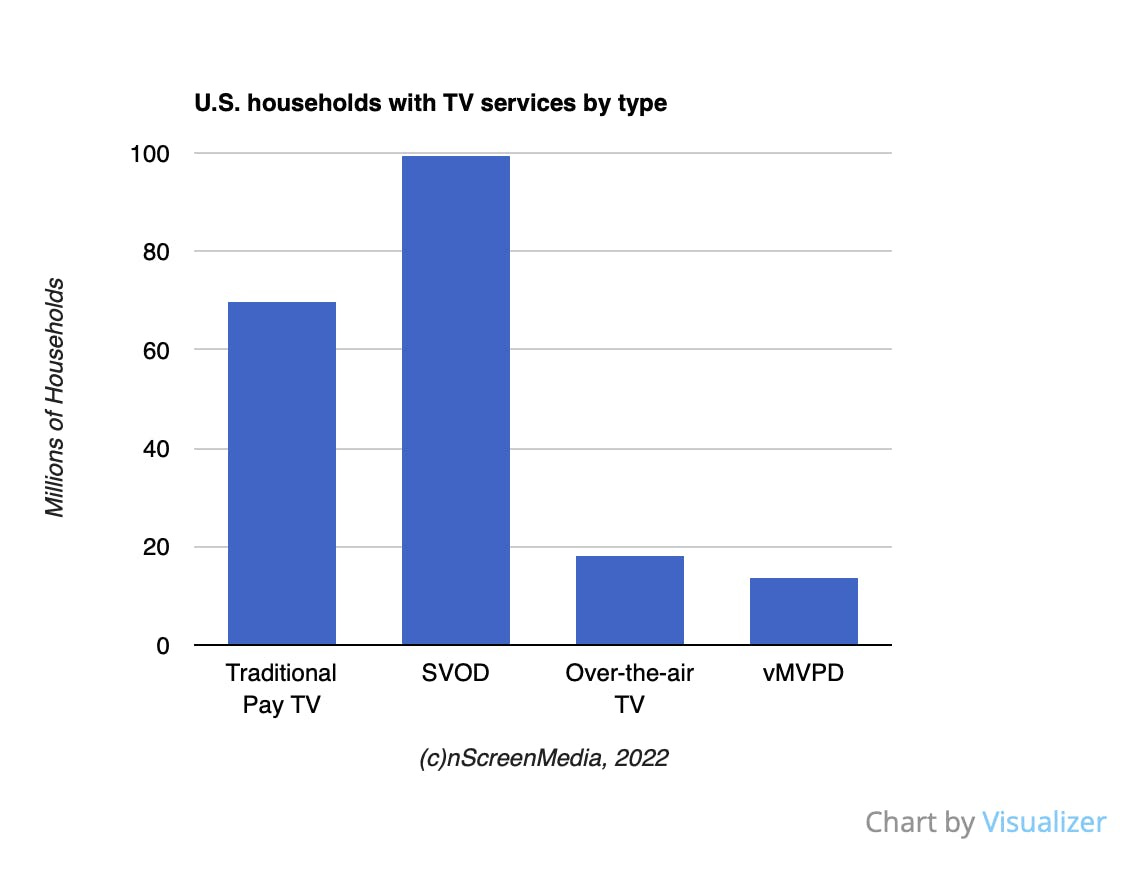

First, there is basic math that explains why Disney is releasing Andor across broadcast, linear and Hulu. According to nScreenMedia’s Colin Dixon, as of Q1 2022 there were:

70MM traditional Pay TV households (cable, satellite or telco)

99.4MM SVOD households

18.2MM Over-the-air TV (meaning, digital antenna)

14MM virtual MVPD (vMVPD)

We can tweak those numbers two fiscal quarters later:

There are now 66.5MM traditional Pay TV homes, assuming ~5% of Pay-TV homes have cut the cord since Q1 2022,

And we can assume vMVPD has grown ~5% to 15MM (Hulu + Live TV grew by 10% between FY Q3 and Q4 2022).

So, we can estimate that the ABC Network reaches 99.7MM homes (66.5MM + 15MM+ 18.2MM), or more than 2x the reach of Disney+ (46.4MM households in U.S. and Canada) or Hulu (42.8MM with SVOD only, and 47.2MM with Hulu + Live TV). And, Freeform (programming geared toward teenagers and young adults) and FX (programming with mature themes, high-quality writing, directing and acting) each duplicate reach in 81.5MM homes.

On that math of reach alone, distributing Andor on ABC, Freeform and FX beyond Disney+ makes sense. There are still target audiences, at scale, who still may not be subscribing to Disney+ or actively using the app.

However…

ABC shows have not been showing up in Nielsen’s TV Top 10, and few if any in Nielsen’s Top 20, in 2022 to date. Its year-over-year ratings for certain shows have fallen anywhere from 20% to as much as 45%. As of last week, ABC is watched by 2,828,000 people (of the big four networks, ABC has the lowest average audience), FX is watched by 457,000 people, and Freeform is watched by 325,000 people during primetime.

Disney received $9B in commitments from advertisers at its 2022 upfront — its “strongest Upfront ever”. Given this data and cord-cutting data, Disney may not be fulfilling advertiser expectations across linear and cable, and therefore a mix of unhappy advertisers and a growing need for make-goods may require a big holiday event in primetime like Andor. And events work on ABC — The Country Music Association Awards show on ABC captured 7,574,000 viewers last week.

A Star Wars holiday special (that isn’t that infamous Star Wars Holiday special) can be a rising tide that floats all Disney boats.

The Problem with Hulu

It’s less clear what additional reach Hulu offers. There is one clear answer: In Q1 2022, The Entertainment Strategy Guy estimated that ~15MM subscribers are duplicated across Disney+, Hulu and ESPN+. So it’s reasonable to assume there are ~30MM Hulu-only subscribers, and that adding two episodes of Andor to Hulu will expand its reach to those audiences, too. It makes sense: In this week’s Nielsen Top 10, Hulu’s “The Handmaid’s Tale” was almost tied with Andor, landing in 8th place with only 2MM less minutes streamed.

But, Disney’s quarter ended on September 30, 2022, or less than two weeks after it ended next-day airings of NBC TV shows on Hulu. NBCU instead has made them exclusive to Peacock. So there’s less reason for consumers to subscribe to Hulu now, in addition to Discovery clawing back some of its library, too.

This may mean the audiences on Hulu who might be receptive to Andor are fewer and in decline. But it’s ultimately hard to say: Hulu has historically been operated as a black box that does not share much information, and that continues to be the case within Disney (which continues to issue press releases about record viewing numbers without including those numbers). We may not find out until the next earnings call in January.

Keeping advertisers happy

So, there are objectively good scale reasons for Disney to pursue this distribution strategy with Andor, and therefore the optics for investors and advertisers will be good: Only Disney with its unique set of assets can pull off this unprecedented move. They also offer competitive advantages: Netflix doesn’t own linear channels so it could never pull this off. Disney’s closest competitors who own IP (Comcast, Warner Bros. Discovery) are still figuring out how to develop original IP from their libraries of hit IP.

But it’s also hard to dismiss the reality that Disney needs to make its Upfront advertisers happy — Networks lock in as much as 80% of their annual advertising revenues during upfronts week — and solving for that is easier to for me to write about than it is for them to actually execute. When advertisers promise $9B in spend and a network underdelivers, it’s fire drills and all-hands meetings at the network. It's also ad sales leaders soothing the fears of media buyers and advertisers while managing up to C-Suite executives that a solution is in the works and the “fire” will be put out.

From my own experience at Viacom, it plays out as existential chaos within the entire organization until a solution is found. Andor seems like a company-wide solution that makes a lot of internal and external stakeholders happy, so I don’t think it’s unreasonable to assume that there were sizable fire drills that preceded the decision.

Why Andor matters to Disney+ Basic

Disney especially needs its advertisers to be happy with Disney+ Basic launching in less than one month. Advertisers committed 40% of upfront spend to streaming, too, at market premium CPMs ($50+). Also, as CFO Christine McCarthy told investors on its recent earnings call, Disney+ has secured more than 100 advertisers the ad-supported tier's domestic launch. The Disney ad sales team has a lot of mouths to feed, and until Disney+ Basic launches next month, it remains unproven.

Once it launches, it will need to prove itself at a time when CMOs and CFOs are carefully watching cost and spend, and pressure builds to demonstrate the value and return of every advertising dollar. Also, there is the backdrop of a slowdown in ad spend, the decline in viewership at linear networks, and Disney+ growth plateauing in the U.S. On top of that, Disney+ Basic will be limiting inventory for advertisers. McCarthy said on the FY Q4 2022 earnings call in August: “And as it relates to the ad experience… not all content on Disney+ [will be] treated equally. There will be no ads in kid's profiles or preschool at least at the launch. And so this is going to be done very thoughtfully and looking at the content and also making sure that the advertiser is consistent with the content.”

Andor seems to be Disney’s best foot forward in answering advertiser concerns because it falls in the bucket of content that Disney will *need* to monetize on Disney+.

Three other factors

The economics of the move are also worth highlighting a little more closely.

Again, Disney went to market selling Disney Plus inventory at $50 CPMs. According to a recent analysis from Wells Fargo Securities media analyst Steven Cahall, Hulu draws CPMs in the $35 range and average cable advertising is sold at $25 CPM. So Andor is going to be monetized across networks in a variety of ways and with a variety of CPMs lower than Disney+ Basic, but at a greater scale. Given that there are only two episodes launching, this may be a conversion funnel into Disney+ Basic so that Disney may monetize the remainder of Andor episodes with premium CPM ads.

Zaslav said yesterday the market is anticipating a shift to higher CPMs in 2023. So there is also reason to believe that Andor also reflects Disney putting its best foot forward with advertisers to achieve even higher, more premium CPMs across channels in 2023.

The move is also costly, as Andy Greenwald of The Watch podcast pointed out this week: once a show or movie goes on linear, there are extra payments and residuals that kick in as required by union contracts. So despite this move being something that Disney could pull off with zero marginal cost, there is a marginal cost to Disney to pursue this move with Andor. He speculated that this may be why only released two episodes.

Last, the economics of Disney's debt suggests that the fire drill was about more than just keeping advertisers. Disney’s operating income relies almost entirely on Linear Networks (it was 95% in FY Q1 2023). Disney currently carries $48.4B in debt.

Any drop in operating income makes it more expensive to pay debt, and more expensive to run a business. Any loss of advertiser confidence will change Disney's priorities overnight (and in this light, the announcement to start layoffs, a hiring freeze and limiting makes more sense).

A revelation of Disney+

Greenwald and his co-host Chris Ryan also noted that the Andor release reflects Disney admitting that the show has not found traction on Disney+. They thought the move also raises questions about whether Disney+ may ultimately be a niche service that is more for children and hardcore fans of Marvel and Star Wars IP than it is for the broader adult population. Meaning, Andor is a great show for adults,

Ryan and Greenwald concluded that the move may reflect Disney understanding that perhaps people just like watching television and having the ability to easily flip between Andor and an NFL game on ESPN. That the user experience and user interface of streaming services create unnecessary friction for broader audiences that otherwise might enjoy a critically-acclaimed show like Andor.

In short, the Andor strategy broadly reveals that Disney is quickly realizing the limits of its streaming strategy. As advertisers pullback on spend and evolve their strategies to real-time and programmatic, the existential question being asked of Disney is what will bring advertisers back in 2023.

Andor is Disney's bright, shiny Star Wars-universe answer to advertiser concerns. But, it may not be enough.