Member Mailing: WarnerMedia & Netflix's Narrow but Fascinating Challenges in AVOD & Gaming

Key Takeaways

AVOD and gaming highlight two fascinating strategic challenges for WarnerMedia and Netflix.

Recent data on Gen Z and millennials seem to reflect substantial changes in consumer behavior on the demand side.

But, from WarnerMedia and Netflix's perspectives, gaming and AVOD are not sure-fire bets on capturing these changes.

Nor are Netflix and WarnerMedia management clear on the economic advantages of AVOD and gaming models

Investors and management looking for growth strategies may be disappointed by gaming and AVOD models in the short-term

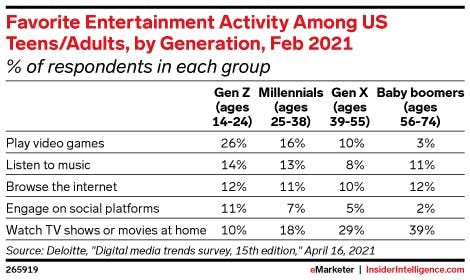

This chart from eMarketer (based on a chart in Deloitte Digital Media Trends - 15th Edition) surfaced earlier this week:

As a signal from the demand side, it tells us two things:

"Generation X may not be 'video first'" in the U.S., as Deloitte found; and,

Other generations mostly watch TV shows or movies at home.

It is a notable data point at a moment where Netflix is pivoting towards gaming, and other streaming services are beginning to pivot towards AVOD models (Disney+ announced its ad-supported model last week).

So, one story this data suggests is Netflix may be more focused on capturing/paranoid about losing Gen Z users to gaming than its competition. Then again, another story is that a majority of audiences watch TV shows or movies at home, and lower-priced, ad-supported models offer the best means for newer streaming services to capture them.

In short, Netflix may be telling the market it needs to focus on gaming to capture additional growth, while services Disney+ and HBO Max are focusing on ad-supported models with TV viewers at home to capture additional growth.

Netflix and WarnerMedia are a particularly interesting comparison after the past week, as this basic chart shows:

WarnerMedia has an existing gaming division. But, at $1.8B in annual revenues, or ~10% of WarnerMedia operating revenues and less than 1% of AT&T total revenues for 2021 ($168.9B) gaming has not been a driver of growth (according to its most recent Financial and Operational trends). Instead, WarnerMedia is betting on a lower-priced AVOD model to drive subscriber growth.

Netflix has just launched an in-app gaming platform to drive growth and has rejected an AVOD model, to date.

In light of the Deloitte data, these two distinct approaches raise an interesting question: is gaming a better bet for positioning a streaming company for future growth? Is AVOD a better bet? Or are neither of these bets good bets for growth?

[Author's Note: The rest of this essay will be exclusive to members, only.]

Netflix & Gaming

I wrote about Netflix's ambitions in gaming last week in Amazon, MGM, and How Lina Khan's FTC Misunderstands the Value of IP in Streaming:

Netflix has a broader objective of leveraging its IP to become like Disney, and to do so it is betting heavily on gaming. That would imply the competitive advantage of IP to Netflix will become progressively less valuable to streaming, and progressively more valuable to evolving its business model around creative universes.

The "huge, long-term multiyear" vision is to "take the franchises or the big titles... that we are excited about and actually develop interactive experiences that are connected to those." That vision implies streaming will be a necessary condition of its longer vision, but will not be the core business.

But, Netflix has not yet framed this business objective around growth or demographics. Rather, it has framed it around developing interactive experiences that are connected to "the franchises or the big titles", as COO Greg Peters told investors on its Q4 2021 earnings call. Interactive experiences help to drive consumer satisfaction and engagement, which in turn help to reduce churn.

Yesterday, CFO Spencer Neumann played down the importance of gaming helping to drive quarter-to-quarter- subscriber numbers at the Morgan Stanley Technology, Media & Telecom Conference. He described Netflix's objectives as "growing revenues, growing profits growing cash flow and that's not just driving membership but driving engagement". He also said double-digit revenue growth, increased profit margins, and growing positive free cash flow are its primary metrics.

Financially, Netflix needs to grow: Netflix has borrowed over $14.6B in debt to fund its content production, and its ongoing subscription revenues both help to run the business and pay back that debt. It only began to reduce that debt load in 2021 and expects positive free cash flow in 2022.

Any uptick in churn (as in Q4 2021) impacts its ability to pay down its debt. Higher churn can also play into lower Average Revenue Per User (ARPU), especially if it sees higher churn from the U.S. and Canada, its highest ARPU region ($14.78 in Q4 2021 and $14.56 over 2021).

Morgan Stanley's Ben Swinburne tried to get Neumann to bite on the premise that gaming is "its biggest TAM [Total Addressable Market] expander", but Neumann played that point down, describing 2022 as a "learning year":

"This is something I hope is a big part of our business in a decade," he said. "It is not going to be a big part of our business in the next 12 months.... The first year was really about getting the plumbing right... Now we're leaning into learning which games our members enjoy".

The implication is that we should focus more on the recent price hikes in the U.S. and Canada regions, instead, as the key indicators for where Netflix's growth is going to come from in the short term.

Swinburne also asked Neumann whether Netflix globally could look like the Netflix business in the U.S. "from a penetration perspective":

"I think it would be great if it's a leading indicator. If we can get to that level of penetration around the world. Again, by the time we get there, there's probably roughly 1B connected TVs around the world. You can see our penetration in the U.S., you can do that math, we're roughly 60% penetrated today so yeah that’s pretty good quickly get us to a business of over a half 1 billion members and if we can do that while we keep increasing value and drive kind of a reasonable monthly subscription price that’s a pretty large and healthy revenue model and we think we could drive pretty hefty profit pools against it."

Gaming may drive growth in the future for Netflix, but it is not a short-term solution. The answer also implies that Deloitte's U.S. data is a helpful indicator for how Netflix is looking at growth across generations.

Netflix & AVOD

Netflix has seemed near-religious in its rejection of ad-supported models, to date. So, Neumann's response to a question from Swinburne about the potential for ads on Netflix was notable:

“For us, it’s not like we have religion against advertising, to be clear. What we’re focused on is optimizing for long-term revenue and big profit pools, and we want to do it in a way that is a great experience for our members. So, we lean into consumer experience, consumer choice and what’s great for our creators and storytellers. So, if at some point we determine something we have the right play or win in the space and it meets those dimensions, then great, but that's not something that's in our plans right now.

He added:

“Again, never say never, but it’s not in our plans. Other folks are learning from it so it’s hard for us ignore that others are doing it. But for now, it doesn’t make sense for us.”

One implication from these answers is Netflix is now keeping a close eye on how WarnerMedia and Disney navigate the ad-supported model. The other implication is that both WarnerMedia and Disney have assumed risks for growth that Netflix have actively avoided for reasons related to their business model. Neumann doesn't sound like an executive who worries Netflix may be proven wrong.

WarnerMedia & Gaming

WarnerMedia CEO Jason Kilar discussed WarnerMedia's gaming strategy in a podcast interview with Recode's Peter Kafka last December 2021 ("WarnerMedia CEO Jason Kilar's almost-exit interview"). It's a five to six minute discussion that starts at around 17:00, when Kafka asks him why legacy media companies struggle with gaming:

I think it’s for the same reason, Peter, that a lot of companies are in retail didn’t figure out e-commerce. It turns out that it’s a very unique skill set, it is technical in nature, it’s incredibly complicated in terms of being able to pull all these things together. And, you have to have conviction about it and one of the things that I was most excited about in terms of coming into WarnerMedia was the gaming opportunity and I continue to feel that level of conviction...

...It turns out that a lot of people that [gaming is] their first go-to choice when it comes to entertainment and we happen to be as you also said uniquely positioned, we have thousands of world-class talented game developers, we have a sandbox of IP that people would kill for when it comes to creating incredible immersive worlds we’re doing really well with it and so I happen to be very bullish on it because the consumers are very bullish on it.

Kafka asked him about the market dynamics of Netflix going into gaming and Epic Games going into gaming, too:

...the biggest opportunity in storytelling is to pursue a strategy that we have and let me explain what I mean by that. Which is, if you’re going to invest a lot of upfront capital in creating beloved characters in worlds, I think it’s only natural if you have the capabilities and if you have the skillset in terms of leadership and talent to be able to lean into telling those stories, both in a linear fashion with narrative storytelling but also an interactive fashion with gaming. And so we happen to have that conviction, we happen to have that skillset - both at the leadership level and at the software developer level. So we're able to do it and we're able to do it with confidence and high judgment. Very few companies on the planet or in that position because gaming is hard to my earlier point and it’s not for the faint of heart.

Kilar was asked if "giving potential competitors some of your best stuff" - referring to Fortnite and the Matrix on the Unreal Engine - and he responded:

I’m incredibly focused on that dynamic and it’s the reason why I’m so excited about an upcoming game we have called "Multiverses". And, I think it’s fair to say that there could’ve been an era of WarnerMedia, historically, where they would license their characters to be in a game, a brawler game, where somebody else kind of created it and we got it a paycheck for allowing our IP, our characters to be in that other person‘s brawler game. Instead what you’re seeing us do and you should expect to see this in terms of the strategy of the company - is we’re actually building our own immersive persistent environments where our beloved characters are in Warner Brothers games as opposed to being present in other peoples games.

From Kilar we have a sense of how games fits into WarnerMedia's strategy: it is quietly, behind the scenes, a key piece of Kilar's original vision for WarnerMedia. But, there are two challenges.

First, unlike Netflix, we do not have a sense of the economics: will something like "Multiverses" turn a $1.8B line item into something exponentially larger, like the $5B Epic Games generated from its own immersive world Fortnite in 2020? And how does it relate to driving consumers to and engagement on HBO Max, which in turn impacts ?

Second, what will happen to gaming when the Warner Bros. Discovery merger is finalized and David Zaslav takes over as CEO? Gaming has not been a talking point of his in conversations with investors, though it also has not been one of Kilar's, either.

Moreover, to Kilar's point, Zaslav's management team from Discovery - who will be running Warner Bros. Discovery with him - has not been proven to have the leadership or talent "to be able to lean into telling those stories, both in a linear fashion with narrative storytelling but also an interactive fashion with gaming".

The Deloitte data suggests that gaming is a growth opportunity with Gen Z and millennials that outgoing CEO Jason Kilar understands and envisions. But, incoming management sees the growth opportunity in streaming and linear across the other three demographic buckets. It is a disconnect worth keeping an eye on as David Zaslav attempts to build out a growth story for Warner Bros. Discovery.

WarnerMedia & AVOD

Yesterday Variety's Brian Steinberg broke an exclusive on how WarnerMedia has been selling advertisers on HBO Max with Ads:

Advertisers can strike exclusive alliances with specific films or groups of movies on the ad-supported version of HBO Max, where they can buy a “brand block,” a new commercial concept that runs before a movie starts, then continues without any further commercial interruption. The ads allow WarnerMedia to sell the streaming service at a lower monthly price and give subscribers the chance to watch a broad array of films without too much distraction, says Julian Franco, senior vice president of product management at HBO Max, in an interview.

“It’s very simple math from our perspective. Don’t interrupt the story if you don’t have to,” he says. “If we can create meaningful products that will bring advertisers close to the content, customers will have an appreciation for that brand,” after being told that commercials make it possible to watch the movie without further disruption.

Notably, WarnerMedia is open to running ads against HBO straight-to-streaming movies:

While signature HBO series — think “Euphoria” or “Game of Thrones” — don’t carry advertising, WarnerMedia executives say few movies are off limits.

Advertisers might want to experiment with the “brand block” in front of films related to Christmas or Halloween, says Franco. The ads can run in front of a new series of Warner Bros. films that will bypass theatrical release and go “straight to streaming” says Ryan Gould, head of digital ad sales and client partnerships at WarnerMedia, as well as “catalog” movies. Straight-to-streaming titles include a re-imagining of the classic film “Father of the Bride” starring Andy Garcia; Steven Soderbergh’s “Kimi,” already released; and “Moonshot,” a science-fiction romantic comedy starring Lara Condor and Cole Sprouse.

I wrote more on this topic in HBO Max's AVOD, DotDash, and Unlocking Value Through Fewer Ads back in May 2021.

However, it is still early days for the model. That is true also in terms of revenue. I highlighted something AT&T CEO John Stankey had said in its Q4 2021 earnings call in The Cola Wars, Retail Velocity & Why I Disagree With "The Streaming Wars":

I expect there'll be some customers that choose to go the ad-supported route that may have gone the subscription route before. However, what will happen is it's not that one is less accretive than the other. The subscription line will possibly dilute a bit, but the advertising line will increase. So when you look at the customer overall, they're no less profitable. It just books to two different places on the P&L.

And our goal, and in fact, what we are seeing today, we are indifferent as to what the customer chooses. Frankly, maybe in some cases, it's a bit more accretive if they go the ad-supported route.

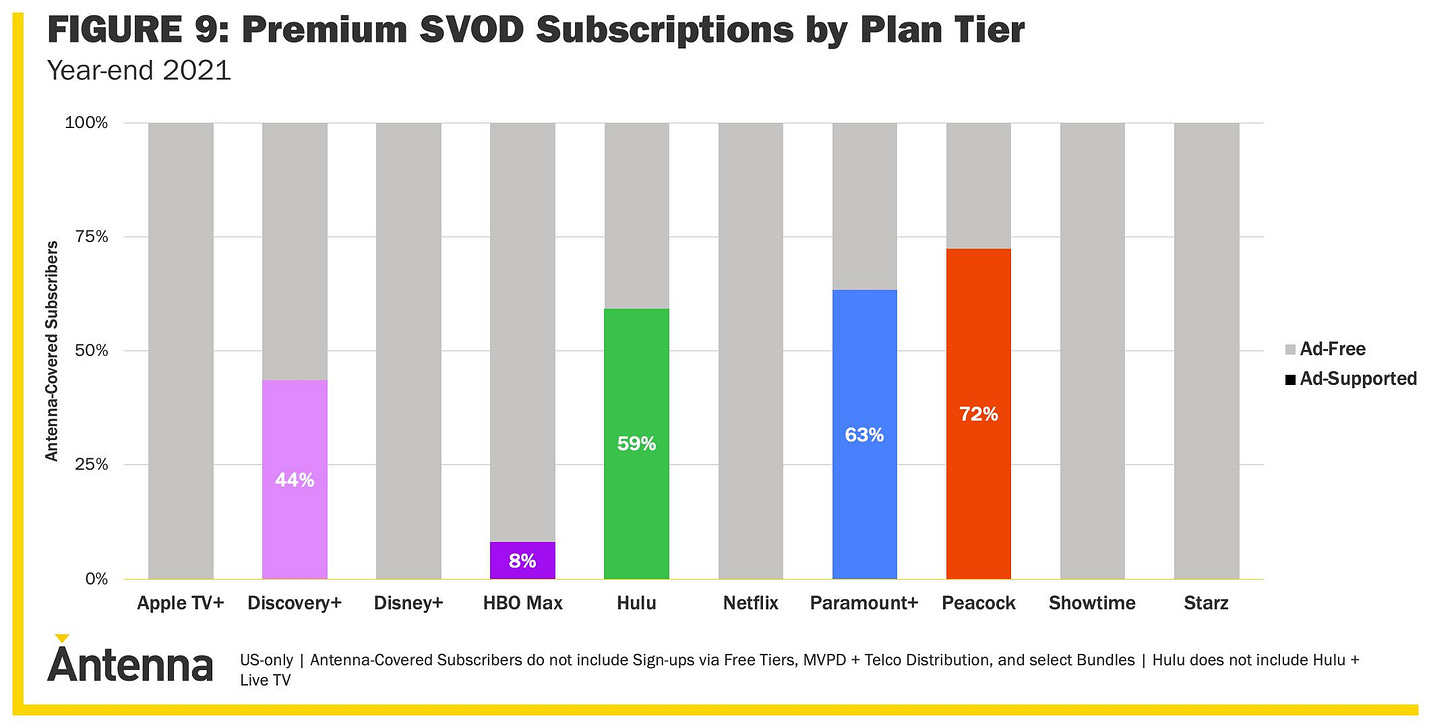

Data from Antenna's Year in Review emphasizes just how low AVOD subscribers (and revenues) currently are for ad-supported HBO Max:

HBO Max's objective is Hulu-like ARPU on AVOD, where ad revenues per user are greater than subscriber revenues per user. As I wrote in If Streaming Growth *Is* Slowing, What Will Advertisers Buy In CTV?:

Hulu reported an ARPU of $12.75 in FY Q1 2022 on a higher monthly price of $6.99 for its ad-supported offering. Assuming two-thirds of its audience chose the ad-supported model, again, Hulu generated $15.58 off of its ad-supported offering, or $8.59 in ad revenue per user over the quarter (up from $8.27 or 4% from Q1 2021).

Hulu also has 40MM subscribers, of whom 27MM are likely ad-supported subscribers. If 8% of HBO Max U.S. subscribers (~10% of 13.9MM) are AVOD, we can conservatively estimate that to be around 1MM subscribers.

For the ad-supported model to drive growth for WarnerMedia, HBO Max with ads will need substantially more scale.

Conclusion

If we were really to boil down the two strategies of gaming and AVOD for Netflix and WarnerMedia to their essences, they are:

Netflix is betting on gaming to expand its Total Addressable Market and to drive higher subscriber engagement with hit properties

Netflix is betting on its competitors to figure out AVOD, or better yet, not figure it out.

WarnerMedia is betting on gaming to better monetize its Warner Bros. IP in-house

WarnerMedia is betting on AVOD to expand the Total Addressable Market

Deloitte's demographic data presents an odd mirror on these strategies. Meaning, Kilar is suggesting that gaming is a narrow solution for reaching Gen Z and millennial audiences because of the execution risk. Neumann is suggesting that gaming is actually a broad solution for all streaming audiences because it can expand engagement within the Netflix app.

As for AVOD, WarnerMedia is betting that lower subscriptions drive more subscribers in the short-term, and higher ARPU in the long term. Whereas Netflix seems to be willing to allow others to assume the risk of figuring that out.

Investors and management looking for growth strategies may be disappointed by both gaming and AVOD, despite consumer research like Deloitte's pointing them in that direction.