[Author's Note: I made a technical error in a few paragraphs, referring to Sinclair going bankrupt instead of Sinclair's Diamond Group division – in which the RSNs sit – going bankrupt. However, I included quotes that referred to Sinclair RSNs going bankrupt, and all four scenarios are built around whether RSNs will go bankrupt.

I regret the error and apologize for any confusion it may have caused.

Today, I also came upon an article from John Ourand of Sports Business Journal from late October in which he interviewed several executives who own some of Diamond’s debt. There are a few quotes worth higlighting:

But debt holders contacted for this column said that bankruptcy is not imminent. The main reason: Sinclair’s deadlines to start paying off the majority of Diamond Sports’ debt still are five and six years away. That is a long time in the debt world.

Creditors also point to the overall RSN business as a reason why they don’t want to see Diamond Sports go into bankruptcy....

Creditors, though, see a business that still is profitable today. They believe that if Sinclair can figure out how to launch a direct-to-consumer business around its teams, it could be set up for the future.

Creditors also pointed out that Sinclair is "well-enough capitalized to invest more money into the RSN business".

Does this change my Q3 2022 prediction? Yes and no.

Yes, in the sense that bankruptcy can be avoided for a few years.

No, in the sense that Sinclair is still in a race to secure enough digital rights to convince the leagues that the RSN model is still viable.]

Key Takeaways

Over the past year, the NBA and MLB have been lining up the pieces for a DTC future without RSNs.

Sinclair Broadcasting Group has promised a DTC streaming service by Q3 2022 & just secured DTC rights for 12 NHL teams

There are four scenarios for Sinclair's DTC service in Q3 2022 & in three it fails to achieve at least one of two business objectives

Leagues increasingly seem to be openly looking past the RSN model, even if it remains the best model for rights revenues.

Verizon, AT&T and T-Mobile may be best positioned to reach younger consumers who prefer free & digital sports content

Last week I shared five themes/questions which had surfaced for me over the Thanksgiving break. One of the five was about sports streaming:

How a recent piece on RSNs from Bill Shea of The Athletic reflects the emerging problems with sports fandom in the streaming era.

Shea's article was about Regional Sports Networks (RSNs), asking "what happens if Sinclair’s RSNs go bankrupt next year?"

I have written a bit about the future of RSNs in the streaming marketplace (see articles at bottom of mailing).

Last week, I had a good Twitter debate with strategic media consultant and former senior Fox executive Patrick Crakes about the emerging tension between the future of RSNs and new digital distribution models.

There are two key points from Patrick's argument about the economics of RSNs worth highlighting:

Leagues still need rights fees (according to Shea, RSN fees account for about $2 billion of MLB’s $10 billion in annual revenue, and "for some teams, those fees account for half their yearly income"); and,

There is no distribution alternative at scale that can either generate similar rights fees for league teams.

My counterargument was all leagues are saying, “an entire generation prefers consuming our games for free and digitally, what should we do?”

They are also increasingly acting on that concern: over the past year, the NBA and MLB have been lining up the pieces for a DTC future without RSNs.

I think the debate with Patrick perfectly encapsulates the tension of this moment:

consumer behaviors are evolving away from linear consumption,

change is imminent in 2022, but

the best business model for teams continues to be RSNs.

This tension is worth diving into a little bit more, as it exposes some of the key moving pieces lining up in RSN distribution for Q3 2022 – when Sinclair has promised to launch its streaming service – and beyond.

The Evolution Away from Linear Consumption

The pandemic created uncertainty on both the supply and demand sides in 2020, accelerated cord-cutting is amplifying that uncertainty, and both are key drivers of this market tension.

The numbers are messy: 38.5MM homes overall have been estimated to have cut the cord or have never subscribed in the first place, to date, since Q1 2010. But post-pandemic viewership is going up:

23 of the top 25 most-watched telecasts this year are NFL games, and The Super Bowl, both championship games and both divisional playoff games make up the top five.

Viewership of NBA games on ESPN is up 20% so far this season, and is up across many demographics, including adults ages 18-49 (up 28%) and women (up 26%).

As for the NHL, it has seen improved success in the first year of its $1B media rights package:

Combined, the NHL Faceoff doubleheader on ESPN averaged 884,000 viewers on ESPN over the more than five-hour window, which is up 54 percent over the 2019-20 season-opening doubleheader and up 19 percent over the 2020-21 season-opening tripleheader. It also topped the 2018 season-opening doubleheader by 81 percent. Among viewers 18-49, the doubleheader is up 28 percent vs the 2020-21 season-opening tripleheader, and up 56 percent and 74 percent respectively vs the 2019 and 2018 opening doubleheaders.

But, for RSNs, the picture is a bit more mixed. Sinclair has said that at the end of 2020, it has 52MM subscribers across 35MM unique households, but has since lost distribution on the Dish Network, reducing its distribution closer to 44MM subscribers.

A loss of over 8MM subscribers is not fatal to Sinclair, as it is 15% of its subscribers, and 10% of the 70MM-plus remaining linear households.

Sinclair renewed its distribution deal with Comcast for 18 of its 21 RSNs in July 2020, and that reaches 18.55MM households [NOTE: Comcast owns seven RSNs, and is looking to sell them].

It still has distribution via Charter (15.29MM subscribers), Cox (6.5MM), and Altice (2.5MM), too, making up 42.84 of its 52MM subscribers. Presumably smaller MVPDs and vMVPDs like Fubo TV make up the rest of the 44MM.

But, it is struggling in the virtual MVPD (vMVPD) world after being dropped by YouTube TV and Hulu with Live TV. The total vMVPD marketplace in the U.S. is expected to total 13.4MM by the end of the quarter, and YouTube TV and Hulu with Live TV total just over 8MM subscribers as of Q3.

There is also an additional level of friction for RSNs in MVPDs and vMVPD models: RSNs are carried on premium tiers require additional opt-in via upgrade to a more expensive plan, whereas RSNs carried on Basic Tiers get automatic opt-in from linear subscribers.

DTC

Sinclair is pivoting to DTC because growing cord-cutting makes the move a strategic necessity, as it told investors in Q3:

The evolution of viewer habits makes it imperative that our current product is extended, so that it is attractive to all viewers in the teens territory, who can subscribe to it, whether traditionally through MVPDs or through direct-to-consumer.

A key challenge is a lack of stakeholder buy-in:

What's important to note is that we have exclusive local rights for our teams and those rights cannot be infringed upon by any other party to launch a direct-to-consumer product without significant ramifications. So we continue to negotiate in good faith with all interested parties to make direct-to-consumer a reality. In addition, we continue to engage in discussions with stakeholders around funding the direct-to-consumer product.

Another challenge lies in continued buy-in from teams and leagues. Until last week, Sinclair only had four of its 14 MLB franchise partners signed on to its DTC service.

It announced last week it had signed on 12 NHL teams:

As part of the deal, it also extended their ability to offer TV Everywhere access to Bally Sports RSNs for in-market streaming to cable and satellite customers. The agreement offers post-game highlights that can be shared on Sinclair digital platforms like Bally Sports App, as well as access to alternative feeds and player tracking data.

In August, the company said they are on track to launch a DTC product for Bally Sports as soon as the start of next MLB season. On pricing though, Ripley said on the call, “everything is still subject to change and final pricing plans and packaging is still something that is yet to be finalized.”

But, as in linear, the biggest challenge is cost, as I wrote back in June in A Short Essay on Sinclair Broadcasting Group’s $250MM Streaming Service:

Sinclair is attempting to replace a guaranteed $3/month across 52MM RSN subscribers, or just under $2B per year, with a $23/month fee across a bucket of different, seasonal consumption patterns over the year, and different target consumers within those buckets. To gross the same amount of revenue annually, it would need to average just under 7MM subscribers per month at $23, or 13.5% of those 52MM subscribers.

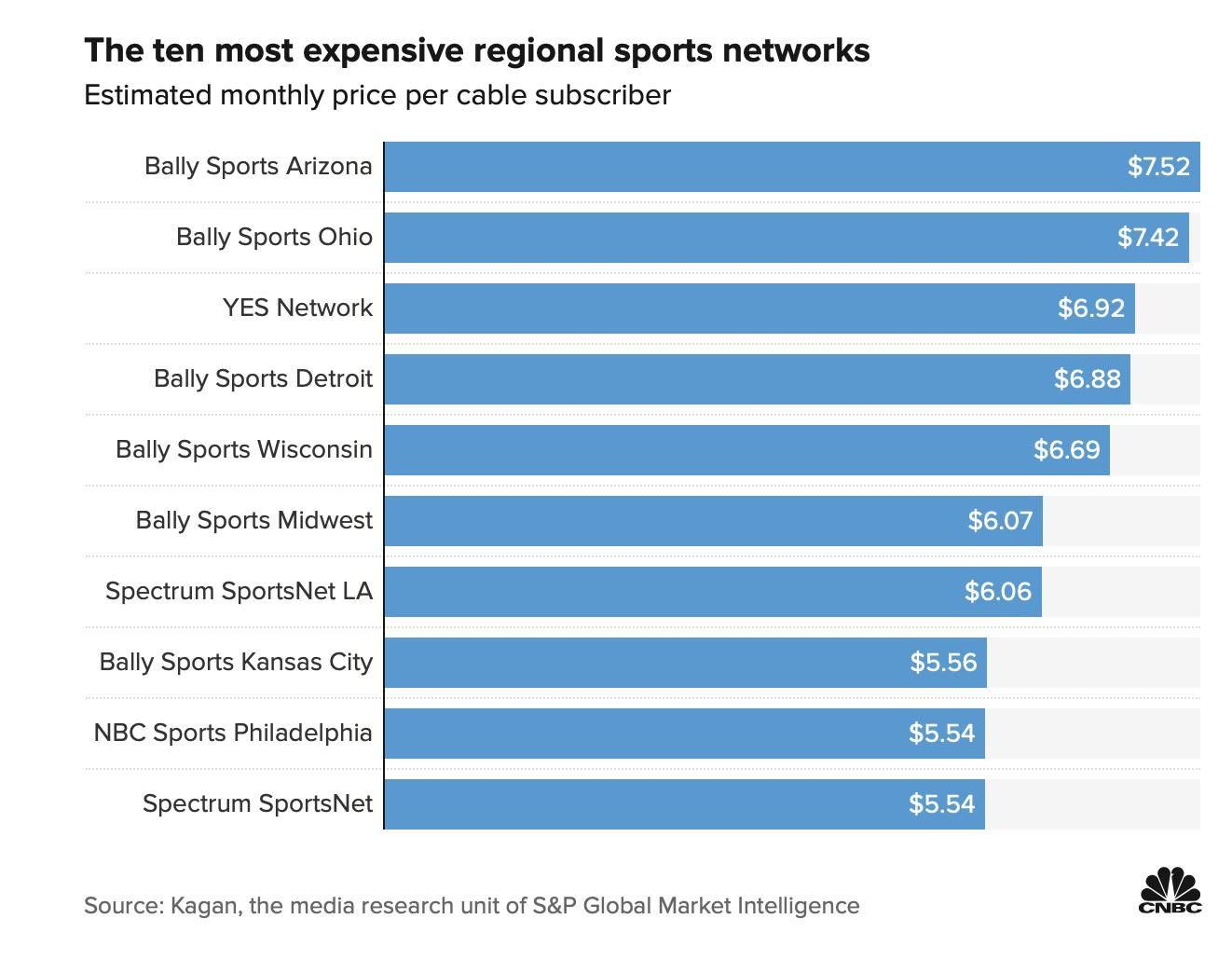

Also, a flat rate across all MVPD services seems financially hard on fans. The challenge is, CNBC's Alex Sherman writes, is few fans watch RSNs, and:

Other than ESPN, RSNs are the most expensive networks in the bundle. Many charge more than $5 per month per subscriber, according to research firm Kagan, a subdivision of S&P Global. Cable bills have to rise to support the added cost, which leads to more cancellations.

Sinclair is facing declining buy-in from stakeholders and target customers, which invite questions for its DTC bet.

Change is Imminent in 2022

MLB allows each team to negotiate separately for their respective digital media rights. but the NBA and NHL own digital rights for all of their teams.

The New York Post recently reported the MLB is "in talks to launch a nationwide video-streaming service that would enable fans to watch their teams’ hometown games without a cable-TV subscription", and could launch as early as the 2023 season.

The National Basketball Association and the National Hockey League are also considering partnering with MLB on the new streaming service, sources said. Insiders say subscription rates would vary by geographic market and could be between $10 and $20 a month — well below the monthly cost of most cable-TV packages, which can easily stretch past $100.

MLB's Manfred was quoted as being bearish on Sinclair's DTC streaming future at SBJ’s World Congress of Sports:

"Sinclair does not have enough digital rights from enough clubs in order to have a viable direct-to-consumer product. The other set of rights they've talked a lot about is gambling rights, they don't have those either.... We’ve been very clear from the beginning that we see [the streaming and gambling] rights as extraordinarily valuable to baseball, and we’re not just going to throw them in to help Sinclair out.”

So was Commission Silver at the same conference:

“The bundle is broken,” Silver said. “It’s clearly broken. Our regional sports networks – Sinclair in particular. They paid $10 billion. It’s not clear it’s a good deal at $5 billion.”

The NBA is pursuing its own service via a deal with Microsoft Azure back in 2020 to build:

a new, innovative direct-to-consumer platform on Microsoft Azure that will use machine learning and artificial intelligence to deliver next generation, personalized game broadcasts and other content offerings as well as integrate the NBA’s various products and services from across its business

I wrote about this market dynamic of change back in May 2020 in NBA and Microsoft Azure's New Partnership.

Since then, Microsoft has posted an update on its efforts in a blog post, "NBA uses Microsoft Azure to power new content that elevates fan engagement":

The direct-to-consumer platform represents a subtle shift in mindset and strategy for the NBA. The NBA hopes that its new plans will strengthen the direct relationship with fans and increase levels of engagement across the board. One way to do this is through increased personalization of both content delivery and marketing efforts.

In that mailing I also highlighted an interview between Stratechery's Ben Thompson and both Commissioner Silver and Microsoft CEO Satya Nadella. I thought Silver highlighted two pain points that still exist:

first, young fans are “watching a lot less conventional television and the programs they watch, they often watch for shorter periods of time”; and, second, their direct-to-consumer relationship is currently limited by outdated technology.

Specifically, Silver believes “we’re fairly limited in terms of artificial intelligence, understanding what fans really want, customizing the program to their needs, customizing highlights especially.”

The NBA's platform will not be unveiled until the 2022-23 season (which will begin in Q4 2022), but what we know so far suggests that it will directly solve for these pain points.

The league offered a preview of the platform recently at Fast Company's Agenda 2022 summit:

the platform will encompass more than just live and on-demand game broadcasts. It will also offer fans different ways to access the NBA’s vast array of player data and historical video archives. And it will incorporate elements from the NBA’s e-sports and fantasy leagues, along with merchandise and ticketing.

Despite all this promotion, we have little sense of the economics of these platforms, facing key questions:

What will be the revenues and how will revenue-sharing work?

How will the expenses be allocated across teams (e.g, small market vs big market)?

Who is responsible for national ad sales? Local ad sales?

Who is responsible for national marketing? Local marketing?

Small market vs. big market team dynamics and cost structures will create a whole new set of tensions and politics within leagues. Even as leagues progress with DTC solutions, they do not have broader financial or operational solutions yet in place.

Nevertheless, the implication from both the NBA and MLB is that by 2023, direct offerings from the leagues will replace RSNs, if not sooner. As for the NHL, its permission for 12 teams to sign with RSNs is a skeptical signal about them joining the MLB and NBA in a national service.

In both instances, the market message is clear: change is imminent.

RSNs Still Are The Best Business Models

All of above suggests that, by Q3 2022, the best business model for local sports broadcasting will be the RSN model, and no one has an immediate solution.

That is Patrick's argument, above, and all available evidence suggests he is right.

That said, the looming threat of bankruptcy for Sinclair's RSNs implies that Q3 2022 is shaping up to be a watershed moment for emerging market tensions, as The Athletic's Bill Shea also reported:

Without a successful shift in Sinclair’s business strategy for its Diamond unit, S&P Global Ratings forecasts a potential default and bankruptcy in the second half of 2022.

In other words, Sinclair has at least nine months in 2022 to prove that its RSN model and DTC app both will be viable.

The looming obstacle is its debt, which is a mess and which Sinclair failed to restructure this past summer: Sinclair’s $9.6 billion acquisition in 2019 was financed with costly high-yield debt that fell to distressed levels after the pandemic, and with an increasingly uncertain future for distribution.

In Q2 it wrote down the value of the deal to $4.2B. It also used $945MM of cash flow to pay down debt in Q2, and in Q3 it used $400MM of cash flow to pay down debt.

Its net loss on operating income in Q2 was ($2.943B) with $1.6B of gross revenues and in Q3 was ($285M) with $1.526B of gross revenues.

So one aspect to this tension is whether Sinclair RSNs go into bankruptcy by Q3 2022. Given that this outcome relies on Sinclair solving for DTC distribution, the odds may be higher than most are assuming.

Given my own skepticism (A Short Essay on Sinclair Broadcasting Group’s $250MM Streaming Service), I think this scenario cannot be ruled out yet. Even with restructured debt, the question is whether Sinclair will have sufficient revenues to pay down that remaining debt.

Bill Shea is skeptical they will be able to do so, but Patrick Crakes argues that there is "no solution that replaces media rights". Meaning, even if Sinclair's Diamond Group is headed towards bankruptcy, there is no interim solution that immediately replaces those distribution rights or revenues.

Both are implying that Sinclair will not lose its RSNs in the short term, and that the leagues will not let RSNs fail. Shea implies that the leagues will find an interim compromise:

Does that mean teams may not be able to pay players if Diamond goes into bankruptcy and halts broadcast rights fee payments? Or that games might not be broadcast in local markets?

No. And that’s because teams have (or should have) cash reserves, and the franchises themselves and their billionaire owners have easy access to cheap borrowing if they need to resort to that to meet payroll and ensure games are televised in local markets.

“I think the vast majority of teams have reserves of cash or access to cash to maintain operations,” said Smith College sports economist and occasional MLB consultant Andrew Zimbalist. “There will be a few places with minor cuts.”

I doubt league owners will want to take on additional leverage in this scenario because Sinclair has failed to problem-solve for past, poor financial decisions. In other words, taking on more debt still relies upon Sinclair as a financial partner.

That, in itself, will be another source of tension: what will league owners decide to do given they rely on RSN revenues for 20% to as much as 50% of revenues?

There are currently no clear signals from any league or league owners

Conclusion

Nine months now, the most predictable outcome to anticipate is that RSNs will stick around, even in bankruptcy. There are no existing market alternatives to replace those rights revenues for the league or those local audiences at scale.

The tension lies in the uncertainty of outcomes for RSNs, of which I think we can deduce at least four from the above:

RSNs fine, Sinclair successfully launches DTC service

RSNs fine, Sinclair fails to successfully launch DTC service

RSNs go bankrupt, Sinclair successfully launches DTC service

RSNs go bankrupt, Sinclair fails to successfully launch DTC service

Three of these four scenarios involve failure by Sinclair to accomplish at least one of its business objectives by Q3 2022.

Another tension lies in the two bankruptcy scenarios – possibly three with the DTC service alone – where Sinclair fails to generate sufficient revenues and rights payments for the road ahead.

That may be true in all four scenarios: successfully launching a DTC service does not automatically result in instant growth, or 7MM subscribers at $23/month instantly manifesting.

So, a big part of the equation is how Sinclair will replace lost revenues. Currently, it is relying heavily on sports betting advertising, but even that seems poised to dry up after the growth phase is over.

But I wonder if it is more accurate to say the better question is how to replace the revenues and the lost fan bases?

Because first, that is the openly expressed concern of the commissioners and the owners; and, second, DTC streaming offers no immediate, scalable solutions now or over the next three years given both the recent plateau in the streaming subscribers and the smaller size of RSN fan bases (above).

Second, as I argued in Disney, Sinclair & The Sports Streaming Consumer, Sinclair seems positioned to be unable to deliver on price and price-value relationship or to adapt to rapidly evolving consumer preferences.

I wonder whether the telcos step in as a short-term and potentially long-term solution. Meaning, "Aggregator 2.0 bundles" solve for both scale and marketing in local sports streaming. Unlike cable bundles, "aggregator 2.0 bundles" can market sports streaming to be bundled with and gaming (Apple Arcade) and/or streaming services like Disney+ (Verizon).

They also are able to target promotional deals locally.

So, one has to wonder whether Verizon, AT&T and T-Mobile are better positioned for offering better marketing and growth for sports leagues where RSNs are falling short, and therefore whether mobile "aggregator 2.0" bundling is the future for RSNs.

Because that seems to be the best, if not only, scalable path that also results in younger fans having access to local sports content for free (mobile companies tend to comp promotions for users) and digitally (via their smartphones).

Additional Reading on RSNs from PARQOR*

Premier League Bidding, Sports Streaming & "User Intent" (November 2021)

AMC Networks, MSG Entertainment Face New Friction with Linear AND Streaming Consumers (October 2021)

Disney, Sinclair & The Sports Streaming Consumer (June 2021)

A Short Essay on Sinclair Broadcasting Group’s $250MM Streaming Service (June 2021)

COVID Drives the "Video Gamification" of Sports (August 2020)

Sinclair's ($SBGI) surprisingly optimistic future for its Regional Sports Networks (RSNs) (June 2020)

NBA and Microsoft Azure's New Partnership (May 2020)

* NOTE: I will be moving over old essays to The Information soon. In the meantime, if you are a new member who needs access to any of the Member Mailings, or would prefer I email them to you, please do not hesitate to reply to this email.