And, *need* to know stories and trends for this morning and the week ahead.

A Short Essay on The Kids Streaming Marketplace After Q3 2021

In last Friday's Mailing, I observed that "Kids and news content on AVODs seem to be the same or as good as kids and news content on SVODs and linear."

Variety's Brian Steinberg and Elaine Low recently delivered some good, in-depth reporting on the current dynamics of the kids TV and streaming marketplace:

Capturing kids’ attention may be one of the most important missions in the entertainment business. Young viewers are chasing their video playmates to new venues faster than many mainstream companies can follow. If Apple, Netflix, WarnerMedia, Disney and Nickelodeon can’t win them now, who will do so in the future? Yet there’s not one set strategy, and all the efforts, many executives note, are creating a glut of content.

There were a few notable quotes in Q3 earnings calls about kids content

Netflix Co-CEO Ted Sarandos:

What I believe is that you don't need necessarily this enormous machine to create brand loyalty around its characters in kids film. We've had great success on -- without any of the machine, without any of the machine, just being able to be a very important part of kids' viewing life. So I think we've got to really focus on -- like we do everything else, on how good is the storytelling, how good is the execution, how great is the production value, are we advancing the art of animation for the animation world, which will continue to attract the best and brightest? And those things, I think, we're all on the right track for. And I think it's going to take a couple more years for it to really play itself out.

ViacomCBS CEO Bob Bakish:

[K]ids and family content... was the top genre on Paramount+ for both acquisition and engagement in the quarter. In fact, over half of our subscribers streamed kids and family content from our globally loved Nickelodeon brand. What's even more impressive is that content consumption was balanced across new, originals and library, both film and television, including enduring franchises like SpongeBob and PAW Patrol and young adult content, such as the new iCarly.

Notably there were no mentions of kids or animation from AT&T (WarnerMedia), Apple, Comcast (which only mentioned how The Boss Baby: Family Business help to grow studio revenues), Discovery, Disney (!) or Google.

This is both odd and yet expected.

Research from nScreenMedia cited by Steinberg and Low reflects why this is odd:

A survey of 3,000 U.S. adults conducted in the fall by nScreenMedia, a broadband consultancy, found that 75% of parents watch video with their children several times a week or more. Two-thirds of respondents indicated they expect time spent with kids watching TV and movies to stay the same or increase once the pandemic ends.

Around 60% of all Netflix subscribers watch kids and family content every month, and half of all members watch animated kids shows and movies on the service, as Netflix's director of product innovation Jennifer Nieva shared in a recent interview with Protocol’s Jankko Roettgers.

But, this is all expected because of a lack of transparency in the marketplace, and competition.

Problem #1: A Lack of Transparency

Amazon, Disney, Hulu and Netflix are the only streaming services sharing data with Nielsen. So we can get a sense of which kids titles "pop" on Nielsen each week and month. But, as Disney Veteran Emily Horgan writes, there is one big caveat:

From the beginning of 2021 Nielsen began publishing 3 separate lists: Originals, Acquired, and Movies. Cut through for kids’ content will be skewed by the demo, a broad Persons 2+. The metric is “minutes viewed” (in millions) so there will be a natural generosity towards more bountiful content, both in terms of duration and episode volume. Finally, Nielsen only clocks consumption of Amazon Prime, Disney+, Hulu, and Netflix, which all have different subscriber penetration. This is done through a national TV set panel, so consumption on mobile and tablets is excluded.

But, other streamers tend not to offer much transparency on their kids content initiatives. For example, WarnerMedia launched a new preschool initiative - Cartoonito - earlier this year - "WarnerMedia’s biggest commitment to preschool in 100 years" - but neither AT&T nor WarnerMedia shares little to nothing about it in quarterly earnings calls.

Discovery CEO David Zaslav told investors that Warner Bros. Discovery will have kids and family as part of "the biggest and most compelling menu of IP for consumers in the world. And that is the most we heard from either AT&T or Discovery about what may be anywhere between 60% to 75% of its content consumption.

But most notable is Disney, which managed the optics of a weakened content pipeline on Disney+ day more than it sold investors on its slate of kids content.

Problem #2: Competition

If there is unusual silence from the big streamers about t0 60% to 75% of streaming consumption, competition may not be the only answer. YouTube is the "long reigning champion in this space", as Emily Horgan also wrote in Observer last month:

Kids content clocks billions of views on YouTube; a whopping 41 percent of views for the Top 30 most-viewed channels come from content catering to younger demographics. YouTube is such a go-to destination for kids worldwide that a dedicated YouTube Kids app was launched in 2015 and, according to some reports, is the most used streaming app globally. However, the question of how responsibly the platform services our children is becoming more and more pointed as time goes on.

Steinberg and Low also write:

There are also a bevy of child-focused services — from PBS Kids to Vooks, a company that creates ad-free animated storybooks, to Sensical, an ad-supported service from Common Sense Networks that promises age-appropriate content.

Amazon has entered the space with both hardware and software:

Amazon introduced Amazon Glow, an interactive device that combines immersive projection, sensing, and video technologies to make users feel like they are in the same room. Designed with children and grandparents in mind, the device allows kids to see loved ones on an 8-inch display while, at the same time, reading stories, playing games, or creating art on a 19-inch touch-sensitive projected space below. Glow comes with one year of Amazon Kids+, bringing hundreds of hours of fun designed specifically for Glow.

Other companies, like Genius Brands, have gone public to raise funds to bet big on distribution via YouTube, apps and AVODs (Pluto TV), and acquire other studios (Wow! Studios, owner of “Channel Frederator Network,” YouTube’s #1 Talent Driven Animation Network.

The competition is both long-tail and multivariable (e.g., Amazon's hardware and software bets).

Conclusion

Wall Street questions are growing about the future of streaming services: where will future growth come from after the pull-forward impact of the pandemic?

Maybe the reason to be skeptical about the future of the streaming model is that its best driver of subscriptions and engagement is kids content. We have little understanding of it, little information on it, and it lacks transparency on both the supply side (largely private content producers) and demand side.

But above all else, it is a highly-competitive marketplace with a long-tail of producers finding more success on YouTube than on streaming platforms.

Maybe that's the story we all can run with until we get more transparency.

Must-Read Monday AM Articles

* Ryan Kaji, the kid vlogging star who has amassed 31 million subscribers on his Ryan’s World YouTube channel, is set to headline his first-ever live special — with an IRL component courtesy of Chuck E. Cheese.

* According to Kevin Westcott, vice chairman of Deloitte and the firm’s U.S. technology, media and telecom leader, subscription VOD providers need to develop growth strategies that include both social video and social gaming to minimize churn rates.

* Global kids content firm Moonbug Entertainment will seek to create and acquire “more and better IP” following its recent acquisition by Kevin Mayer and Tom Staggs’ Blackstone Group-backed investment outfit

Emerging "Metaverse"-type convergence strategies

* Tencent says it has the technology to build the metaverse and Beijing does not oppose the concept

Aggregator 2.0

* Spotify's first task is to win over the telecom companies that often equate to banks as it implements a plan to expand in Africa to almost double its footprint.

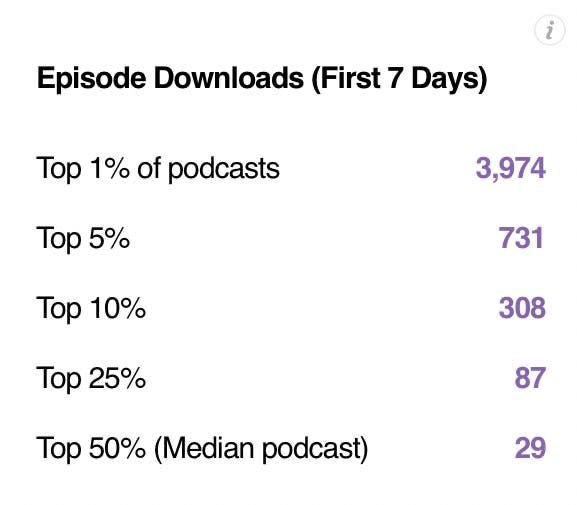

* According to Buzzsprout, 50% of all podcasts only have 29 downloads per episode within 7 days of posting.

* Netflix shared a blog post on its gaming strategy, and a medium post on bringing AV1 codec to Netflix users (the same codec at issue in the heart of the Roku-YouTube dispute)

Sports & Streaming

* The World Series did about 20 percent better than its prime-time competition, but 2nd smallest TV viewership, and brands love to advertise to the largest audiences. ($ - paywalled)

* Comcast, which lost the two MSG regional sports networks on October 1 due to a carriage battle, is now issuing a $3 monthly bill reduction to affected Xfinity subscribers in New Jersey and Connecticut.

* Daniel Kaplan of The Athletic dove into where Sinclair stands with its RSNs. Next|TV asks, "Does Sinclair have ATSC 3.0 plans of its own for its RSNs? And does it view multicast DTC distribution via NextGen TV broadcast as fundamentally different, legally and contractually speaking, than IP-based streaming?"

* The Premier League has told six U.S. media companies to resubmit their bids for a new round of rights by this coming Thursday (Nov. 18). Sports Business Journal's John Ourand reports "the Premier League made several important changes for the second round of bids that suggest NBC and a combined bid from CBS and ESPN are the front runners."

Creative Talent & Transparency in Streaming

* America’s internet is turning into QVC because of "greed, fear and China."

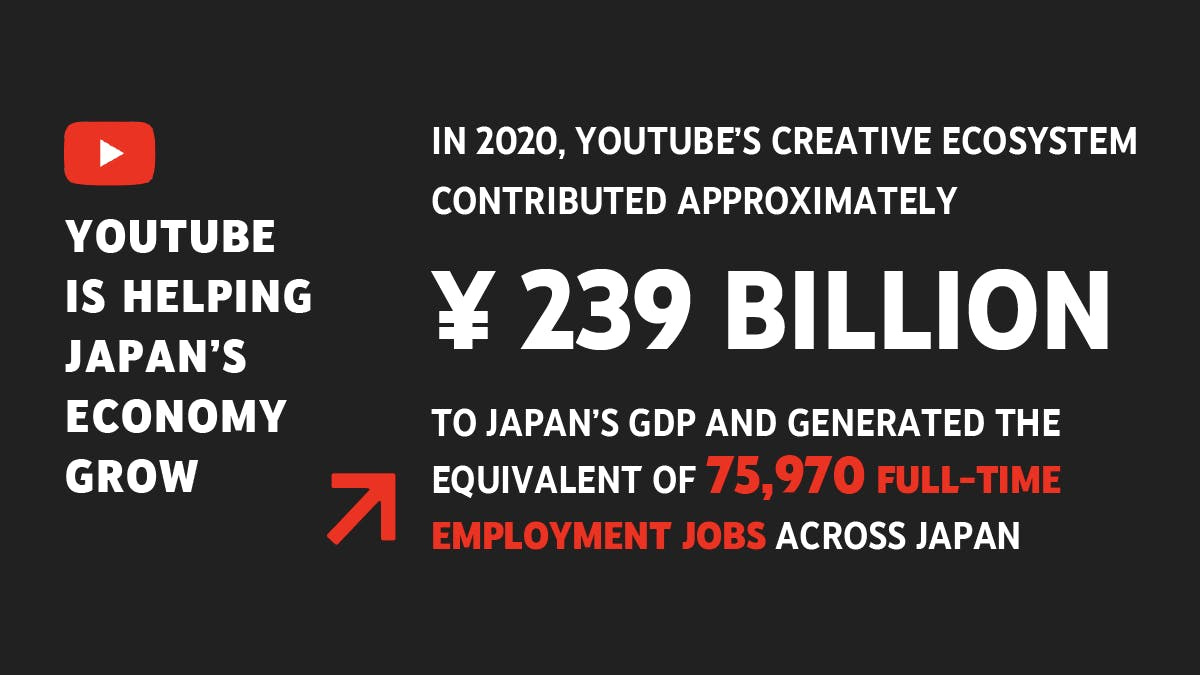

* YouTube CBO Robert Kyncl continues to tout the results of a recent Oxford Economics study

* Spotify's acquired Findaway, an audiobook distribution company, with hopes to democratize the audiobook space by making it easier for creators to develop and distribute their own audiobooks

* Public figures and creators “lack a reason to be on FB,” according to a more than 50-page presentation shared internally and reported by The Information.

* Instagram is preparing to launch in-app subscriptions, allowing users to pay for exclusive content from their favorite creators as the platform looks to move away from conventional ads for monetization.

* VC Li Jin wrote about the future of the creator economy for The Economist ($ - paywalled)

Original Content & “Genre Wars”

* A must-read interview with Netflix Head of Global Film Scott Stuber

* Disney wants Disney+ day because it "can ‘flame anticipation and advocacy’ while building brand loyalty" ($ - paywalled)

* Squid Game eclipsed HBO’s “Game of Thrones” on YouTube to earn 17 billion views across a spectrum of long and short form videos, a new report from content analytics firm Vobile says.

* Insiders in the subtitling industry say streamers, and Netflix in particular, have pushed down fees for their work, leading to a corresponding drop in quality.

Comcast’s & ViacomCBS’s Struggles in Streaming

* The two-hour debut of Taylor Sheridan's Yellowstone on the Paramount Network delivered 8.12 million viewers, setting a new live linear high for the Neo-Western. Observer's Brandon Katz writes "Paramount+ Needs ‘Yellowstone’ Creator’s Avalanche of New Shows to Take Off"

* David Nevins Nevins shared his programming strategy for Paramount+ with Deadline and addresses the internal dynamic among the ViacomCBS studios supplying the streamer

AVOD & Connected TV Marketplace

* According to LinkedIn blog postings, ad tech has a hiring problem.

* A piece in AdAge argues, "Ad tech leaders and television executives can redefine connected TV, but until buyers know who they are actually buying from, a rich CTV marketplace won’t be realized."

Other

* Consumers are three times more likely to discover a new show on a streaming platform than on a traditional network, according to Hub Entertainment Research’s “Conquering Content” study. ($ - paywalled).

* Netflix tests a TikTok-style feed for kids