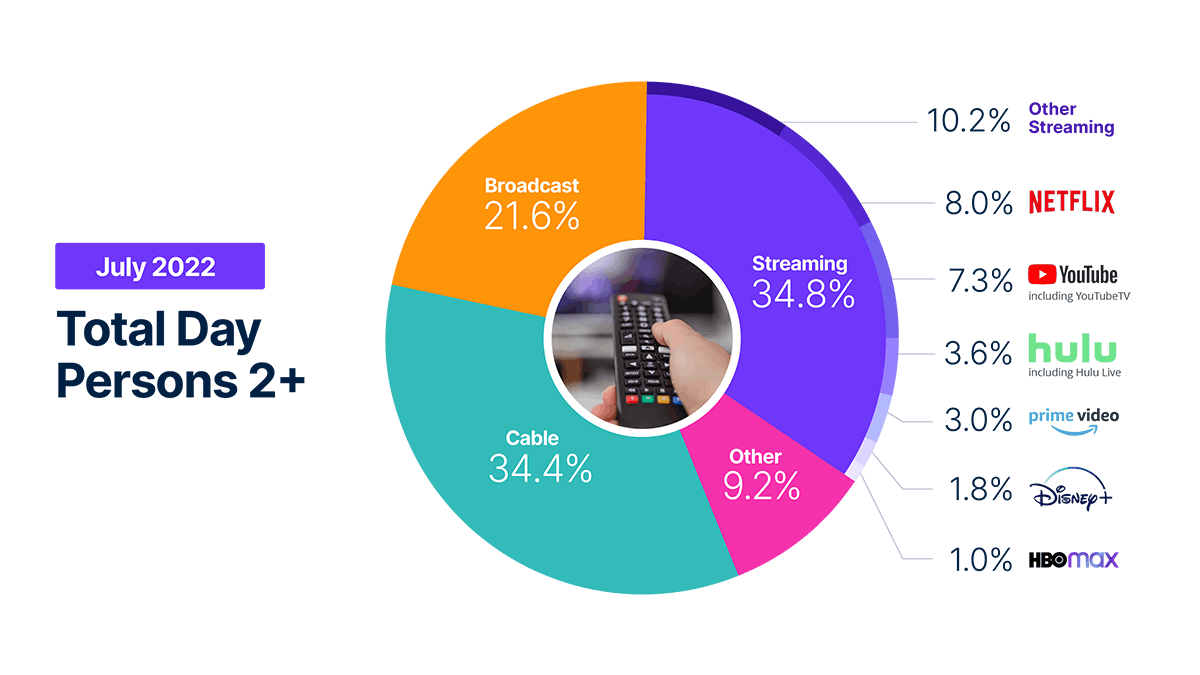

Nielsen's story that streaming had finally surpassed both cable and broadcast viewing according to its proprietary The Gauge got a lot of press last week. One problem with it is the research has told a different story for the past six years: Parks Associates reported back in 2016 that Internet video over-took broadcast video and accounts for the lion’s share of all video consumed.

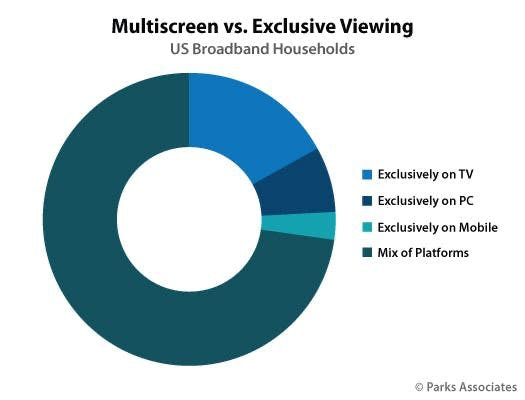

Recently it shared that 72% of consumers report regularly using multiple platforms to consume video and over 40% view video on all tested platforms – TV and TV-connected devices, mobile devices such as smartphones and tablets, and PCs.

The other problem is Nielsen tells us its total viewing hours are derived from a subset of Streaming Meter-enabled TV households within the National TV panel. That means they do not take into account streaming usage on tablets, desktop or phones.

So this story from The Gauge is an imperfect one, so that the “the first time [streaming] has also surpassed cable viewing” is misleading. The TV no longer remains the center of households filled with smartphones, desktop computers, tablets, smart speakers, and video calling devices.

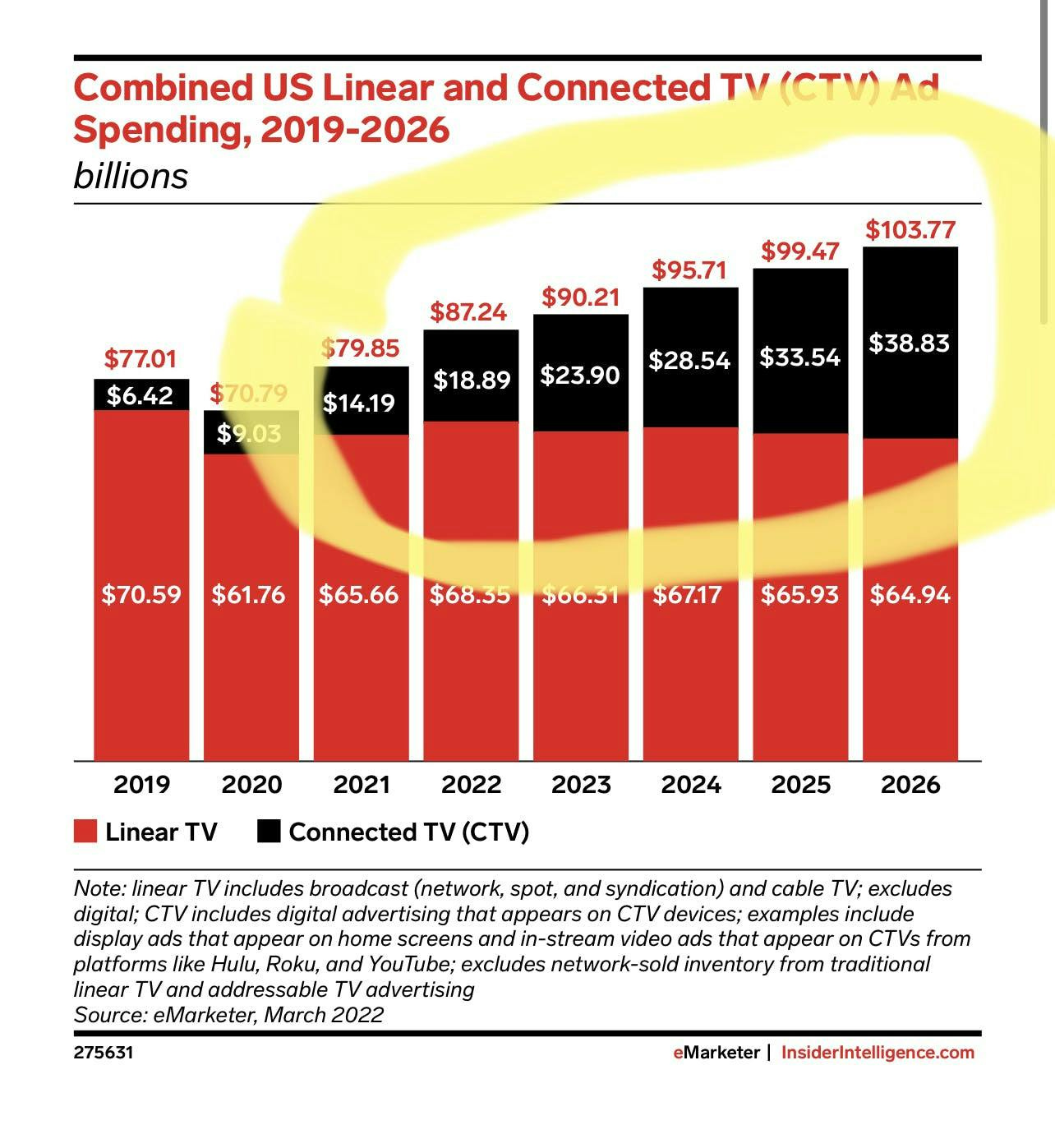

It’s worth briefly discussing this misperception in light of recent essays I’ve written about connected TV ad spend and Automatic Content Recognition, and even the eMarketer data about linear ad spend that I frequently cite. It is lingering in the marketplace a bit too long that it is distracting from some important trends.

The Attribution Gap

The easiest way to think about this misperception is the “attribution gap”, which in linear advertising has been the gap between (1) where people learn about products, services and brands, and (2) the mediums where they do the shopping and the buying.

Solving for the attribution gap has long been considered to be the holy grail of TV advertising, and Connected TV has emerged in recent years as *the* solution. So, anyone reading Nielsen’s The Gauge will conclude that the “holy grail” moment has happened and advertisers can now advertise to audiences in ways that linear TV never could.

Except, advertisers, TV manufacturers and media buyers in Connected TV can’t agree on how to count or identify viewers. Also, a recent study by GroupM and ad measurement firm iSpot.tv found that about 17% of advertisements shown on televisions connected through a streaming device—including streaming boxes, sticks and gaming consoles—play while the TV is turned off. The study also found that on average, between 8% and 10% of all streaming ads were shown while the TV was off.

In other words, better and more efficient ways exist to reach the streaming video consumer in the household than via a Connected TV. Solving the “attribution gap” in the living room doesn't require Connected TV.

eMarketer

The funny thing about the Nielsen data is that it mirrors the story eMarketer has been telling about linear TV: by 2026, advertiser demand for linear TV inventory will still be 1.6x demand for Connected TV inventory (or 62% of all linear and CTV spending)..

It reads objectively like a bull case for linear TV. Despite accelerating cord-cutting trends - 2MM in the last quarter, alone - demand for linear advertising remains strong enough that it is projected to drop 5% over the next five years.

Now, the reality is that some of that linear ad spend is in package deals that go to digital video and CTV inventory. Disney Hulu XP is a video ad management platform built for precisely this: it enables advertisers "to buy once and deliver to audiences across streaming, sports, entertainment and news content in one single deal". So that ad spend may be booked as linear according to how eMarketer accounts for it, but in practice it’s actually allocated across multiple channels, including websites.

Like The Gauge, eMarketer’s chart is an elegant misrepresentation of how the market actually works.

Linear AND Interactive

I think it’s also worth revisiting something WarnerMedia CEO Jason Kilar told Recode's Peter Kafka last December 2021: “If you’re going to invest a lot of upfront capital in creating beloved characters in worlds, I think it’s only natural… to lean into telling those stories both in a linear fashion with narrative storytelling, but also [in] an interactive fashion with gaming.”

The obvious point is that his vision for the future of the living room, implicitly, also does not have the TV at the center of the living room. By envisioning gaming as an investment of upfront capital, he sees the gaming console and/or the smartphone, desktop computer and tablet as the future of the living room.

But he’s also saying that storytelling for beloved characters is no longer only served by TV. That is not a story about streaming versus cable and broadcast: that is a story about changing user behaviors for engaging with IP across devices and media.

Anti-Tracking Transparency (ATT)

The ad marketplace is increasingly being shaped by Apple's Anti-Tracking Transparency (ATT) initiative, which has killed the value of third-party cookies and boosted the value of first-party data.

That means it’s harder to target audiences across smartphones, connected TVs, tablets and even consoles because it’s harder to collect data on them. So, if the TV is no longer the center of the household then advertisers are going to have a much harder time targeting consumers within the household across those devices.

In some ways, what the eMarketer predictions tell us is that the world may be too complicated and the winning platforms will either be TV - because it’s proven and has scale - or CTV apps that have scale and reliable first-party data (YouTube). .

MobileDevMemo’s Eric Seufert explained to Stratechery’s Ben Thompson in a must-read/must-listen discussion about the aftermath of Apple’s anti-tracking transparency efforts Seufert explained why this trend is playing out more broadly than just ATT:

…it’s not necessarily a post-ATT environment that we’re talking about anymore. We’re talking about the new legislative reality, the new rules for digital advertising will prevent third party measurement apparatus from just sitting in between an advertiser and publisher and consumers and just aggregating all that data.

We are also at a moment where the privacy laws play out in cross-device households for advertisers in such a way that a user who turns off one device while streaming a show and turns on another is seen as the same user by the streaming service, but as two different users by the advertiser.

Even if advertisers have opportunities to reach other consumers in the household, it is getting more complicated to do so.

Three possible answers to consider

How do we think about the future of TV advertising when the TV is no longer the center of the living room, but eMarketer and Nielsen are telling us it is?

The answer requires an advertising-focused lens, and it offers two obvious answers:

One answer is the service with the most scale and the best first-party data will win. That may be YouTube with 135MM CTV subscribers, or the smart TV operating systems with the most penetration (Amazon, Comcast, Roku or Samsung); or,

The other answer is that the future of TV in the home trends towards fragmentation and finding audiences across devices beyond the TV because Connected TV advertising is such a mess.

The third is a bit more convoluted and conditional on how the post-ATT marketplace resolves itself; There is an emerging tension between the narrative around CTV solving for the "attribution gap", CTV not always solving for that, and the problems emerging from ATT. The answer lies in other devices in the living room, but it's not yet clear how anyone reaches the consumer those ways in a post-ATT world.

Must-Read Monday AM Articles

* Nielsen and Amazon have struck a three-year deal to measure Prime Video’s new season of “Thursday Night Football” and stack it up against TV programs with national audiences tabulated by the media-measurement giant.

* A recent study found 91% of respondents think having access to multiple services via a single device improves the viewing experience – with over half of consumers (52%) saying aggregation makes the experience “a lot” better.

* The Entertainment Strategy Guy dove into what the data tells us how HBO’s “The House of the Dragon”, Amazon’s “The Rings of Power”, and Disney+’s “Andor” may fare.

* Younger adults now watch almost seven times less scheduled TV than those aged 65 and over, Ofcom has found, as the generation gap in media habits reaches a record high.

The Vibe Shift

* As Wall Street takes a magnifying glass to Hollywood’s streaming businesses — beyond scale and subscriber growth — one metric is gaining favor: average revenue per user (ARPU).

* Cloud gaming could play a major role in Netflix’s next phase of its gaming strategy, according to reporting by Protocol’s Janko Roettgers.

* Netflix is also looking into livestreaming.

The 200 vs. The 10 Million

* N/A

Aggregator 2.0 & Bundles

* N/A

Sports & Streaming

* Sinclair Broadcasting Networks reported its second quarter of earnings and the health of its DTC RSN initiative (74% conversion rate from free trial) but a dicey future for its MLB rights

* MSG Networks is taking its time developing a DTC service

* Activist investor Dan Loeb argued for Disney to spin-off ESPN and was met with a rebuttal from the board. The Wall Street Journal had a good piece framing the debate. ($ - paywalled)

Creator Economy, Platforms & Transparency

* Variety’s Cynthia Littleton had a good introductory breakdown of how Web3 and Hollywood are finding common ground

Original Content & “Genre Wars”

* Alex Sherman of CNBC wrote about why HBO Max is pulling dozens of films and TV series from the streaming platform

* Samba TV found significant front-loading of viewership for marquee titles from Disney+ and Netflix this summer. By the 30th day top titles were available, they had generated 86% of their 50-day viewership.

*‘ The Terminal List’ Is Amazon Prime’s ‘Yellowstone,’

* Netflix commissioned original film and TV content from 28 different markets in the second quarter of 2022, a record for the streaming firm according to a report by Ampere Analysis

AVOD & Connected TV Marketplace

* Disney CEO Bob Chapek’s decision to hike Disney+’s price by $3 per month runs counter to the strategy his predecessor, Bob Iger, had set in place.

* Google Pushing Google TV and Android TV Device Makers to adopt 16GB of storage ($ - paywalled)

Other

* Chicken Soup's CEO explains why he bought Redbox

* Amazon is searching for a senior movie-studio executive to help lead its growing entertainment division, turning to rivals for a chance to poach an experienced Hollywood player. ($ - paywalled)