Monday AM Briefing: Chapek v Iger; (Exclusive for Members) discovery+, HBO Max & Software

First, I had a brief exchange with WarnerMedia CEO Jason Kilar on Twitter, after he responded to my opinion piece on The Information - "A Vibe Shift Is Brewing in Streaming".

He goes on to have an exchange with me and a few others on the topics of physical vs. digital collectibles, Bored Ape Yacht Club, and the businesses have "a big opportunity in digital collectibles".

Over the weekend, I played with mapping Kilar's definition of the "best positioned modern storytelling companies" to the PARQOR Hypothesis, which offers another take on what a "best positioned" media business looks like in 2022 and beyond.

Barring the unforeseen - and given the streaming marketplace may be the most dynamic marketplace out there, the unforeseen may happen - I will be diving into this question in Wednesday's Member Mailing.

Sign up below to read it:

Chapek v Iger

CNBC's Alex Sherman had an excellent, must-read deep dive into the falling out between current Disney CEO Bob Chapek and former Disney CEO Robert Iger. The breaking point was an April 2020 email from Iger to then-New York Times media columnist Ben Smith which reported "Iger wasn’t going to turn Chapek to the wolves as a brand-new CEO while the world was falling apart".

Chapek - only one month into the role of CEO - was "furious" when he saw the story, Sherman reports:

He had not expressed a need or desire for extra help. He wasn’t looking for a white knight. Iger had postponed his retirement as CEO three times already. Chapek felt he was essentially doing it again, leaving him as a hapless second banana, according to people familiar with his thoughts. Chapek was already reporting to Iger, the board’s chairman, anyway.

Sherman added, "Since that incident, Iger and Chapek haven’t been able to mend their relationship, according to about a dozen people familiar with the matter who spoke with CNBC for this story".

Much chatter has been focused on the personal and corporate drama in the story, which is reasonable given Disney's history of drama in the C-Suite. Others have picked up on Alex Sherman touching on the underlying theme of organizational change in the streaming era.

I think it's worth adding the Fiduciary vs. Visionary framework here because the article highlights a nuance that I had previously missed: Chapek's October 2020 reorganization effectively rejected Iger's long-term vision for Disney+.

Sherman has a good history behind the decision that includes both YouTube Chief Business Robert Kyncl and former Chairman of Direct-to-Consumer & International Kevin Mayer. You can read it, I don't need to revisit it here.

Chapek is a fiduciary executive and Iger is a visionary executive (as I wrote last October in Robert Iger, Mark Zuckerberg & Vision). According to the framework, that means Chapek is effectively constrained by Iger's original vision for streaming because he himself is "a skilled and determined operator", but not a proven visionary in digital media.

Whereas Iger held the video iPod for the first time in 2005 and realized that Disney's future faced "complications" from a new technology but it was also a distribution channel on which Disney content needed to be.

Chapek Rejects Iger's Constraints

Until Sherman's article, I had assumed the October 2020 restructuring as solving for the lack of (1) content- and IP-related experience and (2) of DTC-related business experience of Mayer's replacement as Chairman of Disney’s Direct To Consumer-International (DTCI) division, Rebecca Campbell.

It turns out the issue was significantly deeper than one person: Iger's decision to centralize Mayer as Chairman of DTCI in May 2018 resulted in "power struggles" between Mayer and Disney TV studio head Peter Rice over who had the authority to decide which shows aired on Disney+.

Sherman writes that the structure required Iger "to solve the disputes by making control decisions on the fly". After Iger left, Chapek heard from both distribution and content executives that "the current arrangement had become dysfunctional".

So, in October 2020 Chapek "decided to reverse Iger’s decision to have greenlighting authority rest with the head of the streaming services", and gave that power back to content heads. But, he gave P&L oversight for all movie, TV and film distribution, advertising, sales, technology and other divisions to Kareem Daniel, who is now chairman of Disney Media and Entertainment Distribution. That centralized an enormous amount of power under Daniels, and has created a new set of operational tensions.

More importantly, Chapek now seems to have his own vision for Disney with Daniels as his #2:

Ideally, Chapek would like consumers to experience a more unified digital Disney experience, whether it’s logging into Disney+ or buying merchandise from the online Disney store or managing theme park experiences with Disney’s Genie service, which is a kind of digital concierge. Internally, some employees informally speak of this grand challenge of unifying Disney technology and experiences as “One Disney.”

Sherman writes that this vision is "exactly what Iger believed in". At the same time, Chapek's objective isn't the mythical "streaming multiple" of Netflix- which Iger and other companies seemed more narrowly focused on - but the multiple of a technology business more broadly. He wants to convert Disney into a more technology-oriented business to do so.

That seems exponentially more ambitious and complex in execution than the streaming multiple. Operationally, it seems like a nightmare: what are the incentives for Disney employees who are not technologically savvy to build this vision? And for those who are technologically savvy, are the incentives similar to the equity-laden incentives at tech companies?

It also seems misguided given how often my cynicism of Disney+ has been proven correct over the past two years. As I highlighted in Chapek's "Three Pillars" for Disney's Future Faces Tough Trade-Offs In Sports Betting, Disney isn't well-positioned to solve for direct-to-consumer (DTC) conversion funnels:

...the PARQOR Hypothesis highlights how sports betting does not offer any easy solutions for Disney's DTC aspirations. What happens in the sports betting conversion funnel is far more sophisticated than what happens in Disney's DTC conversion funnel for its streaming apps.

Bob Chapek seems to be a fiduciary both rejecting the constraints of Bob Iger's more conservative vision for Disney and making his own attempt to be visionary - despite little proven track of record of being one. Despite some real wins, to date - including FY Q1 2021 subscriber numbers outperforming investor expectations - that seems messy in both concept and execution.

Discovery+, HBO Max & Software

Another big headline from last week was Discovery CFO Gunnar Wiedenfels - who will also serve as the CFO of Warner Bros. Discovery - telling the Deutsche Bank 30th Annual Media, Internet & Telecom Conference that Discovery is making preparations to combine the two streamers.

They will be doing it in two forms:

First, a bundle after launch; and

Later, "harmonizing the technology platform".

I shared two thoughts on Twitter:

I think it is worth diving into these two points, briefly, about how to think about the pros and cons of this "harmonizing the technology platform" strategy.

Last month, I argued "If it seems hard to predict the future of Warner Bros. Discovery (WBD), that's because there are so many moving pieces that a coin flip may provide a better answer."

Non-Members, click subscribe to read the rest of this Members-only, exclusive

The Pro Argument

Wiedenfels spoke about both content mix and software:

“One of the most important items here is that we believe in a combined product as opposed to a bundle… We believe that the breadth and depth of this content offering is going to be a phenomenal consumer value proposition. The question is, in order to get to that point and do it in a way that’s actually a great user experience for our subscribers, that’s going to take some time. Again, that’s nothing that’s going to happen in weeks — hopefully not in years, but in several months — and we will start working on an interim solution in the meantime. So right out of the gate, we’re working on getting the bundling approach ready, maybe a single sign-on, maybe ingesting content into the other product, etc., so that we can start to get some benefits early on. But the main thrust is going to be harmonizing the technology platform. Building one very, very strong combined direct-to-consumer product and platform, that’s going to take a while.”

The big question here is whose software "wins". My guess, above, is it will be HBO Max for two reasons:

It is operating at larger scale internationally, and

It is still in the middle of its rollout of $100MM acquisition of You.i TV as a replacement for the HBO Go back-end.

It think there is a third reason hiding in plain sight in a Deadline piece on CEO David Zaslav's future WBD executive team:

A close associate of Kilar’s, Hulu vet and HBO Max head Andy Forssell, is expected to be in the new mix given his tech acumen and involvement in the turnaround of streaming since a rocky launch in 2020.

In Warner Bros. Discovery Is "A Real Company" Facing A Flip-of-a-Coin Future, I thought Forssell might be gone and that implied a bearish future for streaming under WBD. If he stays, there are reasons to be less bearish, including the fact that You.i TV is his team's initiative.

It's hard to say based on available evidence that this outcome creates an operational tension. However, Forssell has a longstanding working relationship with Kilar, and none with Perrette. It will be an open question of how well they work together.

The Con Argument

Above is the start to a short thread from former NBCU executive Salil Dalvi in response to my tweet. He thinks Wiedenfels is saying something a bit different than what I concluded:

This take suggests that if WBD's management bet on the You.i TV integration over the current discovery+ platform, that approach may end up being more conservative than WarnerMedia's current approach.

What is not clear from Wiedenfels' answer is whether content or software matters more to growth or to churn. In a separate answer he highlighted "the acquisition power of HBO Max, combined with the retention power of the Discovery content". But both Netflix and Hulu have proven that personalized recommendations in software help to reduce churn, too, and HBO Max is headed towards increased personalization.

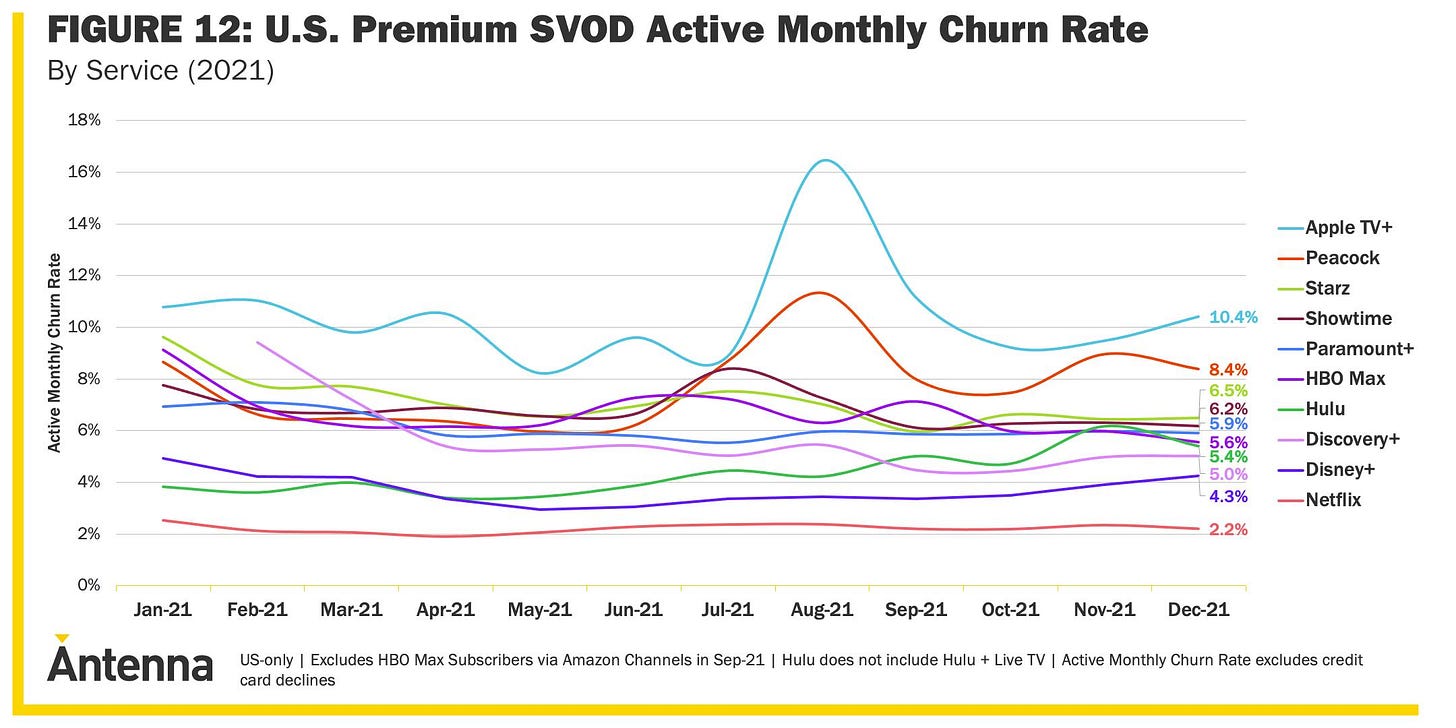

As per Antenna, Hulu has higher churn than Discovery+, which does not have personalized software.

Will software or library matter more to the entwined futures of HBO Max and discovery+? It's a fascinating question with no easy answers. It's certainly not clear whether WBD management has the right pieces in place to answer it.

Must-Read Monday AM Articles

* The Parents Television and Media Council argued that the addition of the Netflix Defenders shows like Daredevil "seems wildly ‘off-brand’ for Disney Plus to add TV-MA and R-rated programming to this platform."

* Forbes' Paul Tassi dove into the implications of more adult programming on Disney+ (and why "it opens the door to a lot of potential")

* Bob Iger is investing in and joining the board of a company called Genies, which lets users create their own digital avatars for use in virtual worlds

Emerging "Metaverse"-type convergence strategies

* Variety VIP asked, with data, why game collaborations with top-billing creatives - like the one between George R.R. Martin and hit game Elden Ring - more commonplace?

* Spotify is drawing up plans to add blockchain technology and non-fungible tokens to its streaming service, fuelling excitement in the crypto and music industries about the potential of NFTs to boost artists’ earnings.

Aggregator 2.0

* N/A

Sports & Streaming

* From summer 2022, Spotify will sponsor FC Barcelona, securing naming rights of the Nou Camp stadium, shirt rights for the men’s and women’s teams, and a fascinating “first-of-its-kind” plan to harness first-party fan data.

* The Chicago Cubs and Sinclair Broadcasting Group are in talks to launch a Cubs-themed DTC streaming service, allowing Cubs fans to watch their team without a cable or satellite subscription in 2023.

Creative Talent & Transparency in Streaming

* Data from StreamElements' analytic service CrowdTangle raises serious questions about the state of Facebook Gaming

* Vox's Rebecca Jennings dove into how Brat TV offers "a glimpse of the future of microcelebrity, where the endgame isn’t necessarily getting cast in an Emmy-winning series or becoming the world’s biggest pop star"

* Vimeo has been telling the top 1% of users who use the most bandwidth that, if they want to keep hosting their content on the site, they'll need to upgrade to a custom plan priced at almost 20x the current annual price.

Original Content & “Genre Wars”

* WarnerMedia and Sesame Workshop, currently in the middle of a pact that lasts through 2025, are expanding the content Sesame will provide HBO Max.

* Protocol's Janko Roettgers hones in on a key advantage of Amazon's now-closed acquisition of MGM: "[it] may actually have a bigger impact on... Amazon’s $31 billion advertising business. Janko also wrote about how virtual production - with LED screens - "is being adopted across the industry for a variety of reasons ."

* Less than a year since its June 29, 2021 launch in the region, HBO Max Latin America service now ranks second in the region.

Comcast’s & ViacomCBS’s Struggles in Streaming

* Paramount CFO Naveen Chopra told investors at Deutsche Bank’s Media, Internet & Telecom Conference that "Our view is that you’ve got to address the entire household" as a streaming service with scripted content, sports, news, movies, kids content, and unscripted.

* Omincom's media services division Omnicom Media Group (OMG) will be the first agency to integrate with the NBCUniversal Audience Insight Hub.

AVOD & Connected TV Marketplace

* Charter has previously said it hopes to launch a video aggregation marketplace, but now is telling investors the approach seems prohibitive.

Other

* Netflix will soon launch a test in Chile, Costa Rica and Peru letting primary account holders pay an additional fee for users outside their households — a new attempt by the company to address illicit password-sharing.

* The Direct-to-Consumer industry "built on cheap Facebook ad space and low cost shipping is crashing with no bottom in sight".