Monday AM Briefing: Connected TV Advertising May Be Evolving Away from "Four-Dimensional Chess"

Back in June, I had the opportunity to attend the annual IAB Video Leadership summit. My main takeaway from my many conversations there - and there were many other takeaways - is that Connected TV (CTV) advertising has become “four-dimensional chess”.

You may have noticed I have since written less on the topic I’ve labeled “The 200 vs. The 10 Million”, or the emerging dynamic in advertising of competing demand for CTV inventory between the 200 “retail-cartel” advertisers supplying 88% of U.S. network television revenue (the term “retail-cartel” applies to the brick-and-mortar retailers who have historically bought from networks), and many of the 10MM or so advertisers who buy from Google and Facebook

The reason is simple: “four-dimensional chess” is not the stuff of 1,000-word essays.

But, when clear signals emerge about how the complexity is resolving to simplicity, especially during a recession market, that’s worth everyone’s time to revisit that theme. There are really two signals as of late:

Signal #1: The slowdown of performance ad buys from the 10MM will boost buys of branding campaigns (which is linear TV’s strength); and

Signal #2: The audience for over-the-air viewers (“OTAs”) is being undercounted.

eMarketer's "elegant misrepresentation"

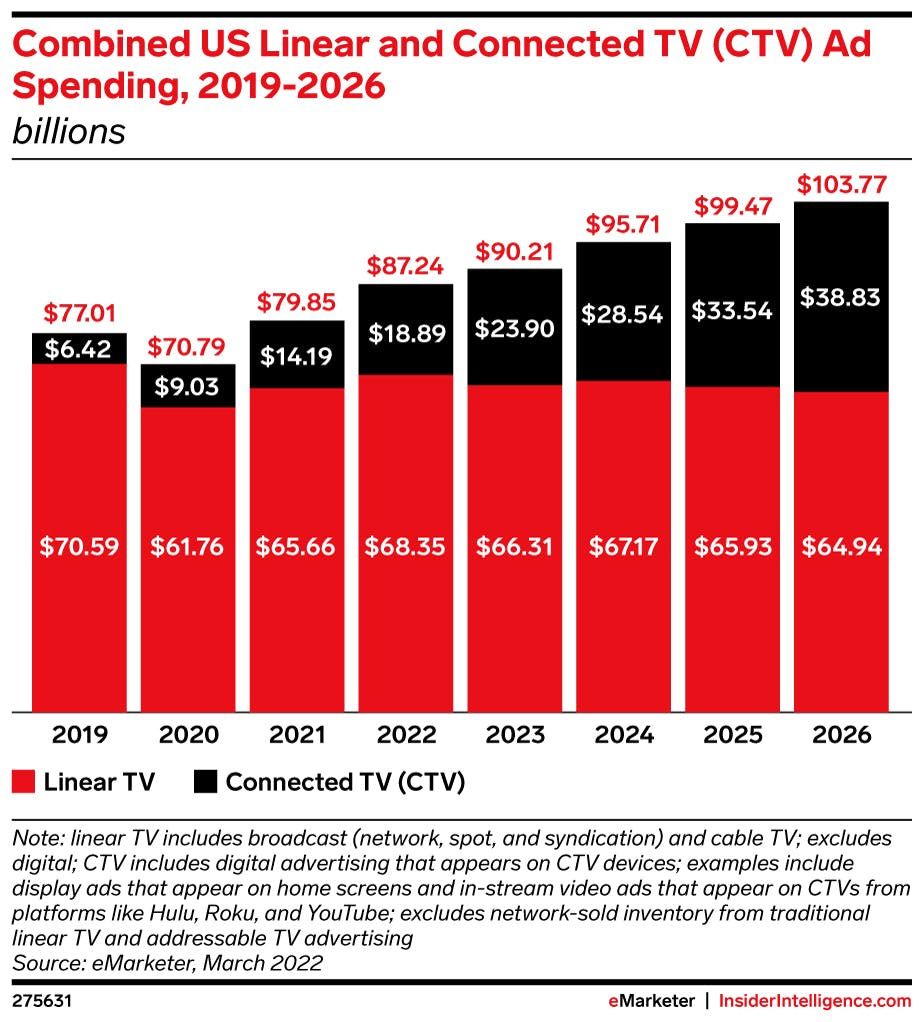

I wrote about “a data-driven misperception of Connected TVs” a few weeks back, an essay that highlighted the disconnect between the available data. The most notable chart for the purposes of this essay is this eMarketer chart, predicting linear spend to remain stable.

For a while this projection seemed counterintuitive in the face of growing CTV ad spend and CTV device adoption (recent estimates have over 500MM in the U.S. and 1.3B in the world). As I wrote two weeks ago,

“the reality is that some of that linear ad spend is in package deals that go to digital video and CTV inventory. Disney Hulu XP is a video ad management platform built for precisely this: it enables advertisers "to buy once and deliver to audiences across streaming, sports, entertainment and news content in one single deal". So that ad spend may be booked as linear according to how eMarketer accounts for it, but in practice it’s actually allocated across multiple channels, including websites.”

So, eMarketer’s chart ends up being an elegant misrepresentation of how the market actually works.

Theme #1: Performance Buys Shift to Branding

Lately I have been enjoying the “This Week Next Week” podcast, co-hosted by Brian Wieser, Global President of Business Intelligence for GroupM, and Kate Scott-Dawkins, the VP, Thought Leadership & Innovation for Essence Global.

In last week’s episode they wandered into a hypothesis that Weiser came up with from questions GroupM’s general-market brand advertisers have been asking about shifts in branding vs. performance campaigns. His hypothesis was that the slowdown by “digital endemic ad category” - or the 10MM, above - will inherently boost the share of branding campaigns.

If performance-oriented digital endemic brands are decelerating ad spending while traditional brand-oriented brands are continuing to grow, “the overall mix of advertising shifts possibly in favor of brand rather than performance.”

That perspective implicitly answers the question posed by the eMarketer chart, above: why isn’t linear TV inventory going away?

The answer is, linear TV inventory *is* branding and awareness inventory. Despite constant and continuous evolution of advertising away from the linear advertising measurement of Nielsen panels to specific customers, and an inability to solve for the “attribution gap” (in linear advertising this has been the gap between (1) where people learn about products, services and brands, and (2) the mediums where they do the shopping and the buying), demand for linear inventory remains strong.

Also, Wieser pointed out that Upfront commitments make it more difficult to reduce branding spend during an economic downturn. It’s not clear whether eMarketer researchers accounted for these factors (they have a long list of factors on the page hosting the chart). But, Wieser’s examples help to explain why market conditions favor eMarketer’s predictions of the lasting power of linear inventory.

Theme #2: OTAs are being undercounted

This data point on OTAs being undercounted emerged in a Mike Shields interview with Radha Subramanyam President and Chief Research and Analytics Officer at CBS. Subramanyam told Shields that CBS’s research says “a good fifth of the country still gets TV the old fashioned way, including a large number of Hispanic households as well as homes that are mobile-first but don’t have broadband connections.”

Subramanyam also told Shields that CBS research found that the broadband-only TV universe is closer to “20% not 40%”

It ends up being a two-fold point. First, that the OTA linear audience is larger than many observers may have been assuming, and therefore the linear market is larger than many observers may have been assuming, to date. Again, it’s not clear that eMarketer assumes this, but its estimates for ad spend reflects this.

Second, this undercounting of OTAs and over-counting of streaming households reflects the messy debate playing out in the ad marketplace about measurement and currency (which I wrote about in June). This is a point that Subramanyam makes to Shields, and also one that Kelly Abcarian, EVP for measurement and impact at NBCUniversal, made to Shields and also to Amobee’s SVP and Head of Marketing Pam Zucker on the Amobee Out Loud podcast.

Subramanyam argued to Shields:

“the ‘older’ panel based TV metrics firms tend to undercount the audience for streaming, while newer ‘big data’ researchers- the kind of companies that pull data directly from millions of TV sets, tend to over-count cord-cutters and cord-nevers, while missing out on “OTAs” or people who get TV over the air, while newer ‘big data’ researchers- the kind of companies that pull data directly from millions of TV sets, tend to over-count cord-cutters and cord-nevers, while missing out on “OTAs” or people who get TV over the air.”

Abcarian made a similar point to both Shields and Amobee’s Zucker that cross-platform measurement may be “broken” - and implicitly that may also be reflected in the eMarketer estimates - but solutions are being developed.

Abcarian discussed with Zucker insights from a recent pilot NBCU conducted in partnership with Conviva and iSpot during the 2022 Winter Olympics and Super Bowl LVI. NBCU were also able to determine what percent of their participating advertisers had reached impression weight on linear versus digital so that advertisers could redistribute their impression weight across NBCU’s properties.

The implication from Abcarian and Subramanyam is that, but for the need from brands for better measurement of audiences across platforms, these shifts would not be happening as quickly.

Conclusion

Ultimately, the recessionary trends in the macroeconomic marketplace may end up forcing the TV marketplace to solve its complexity. In other words, the shift of spend to branding and awareness is a distraction: as the eMarketer data implies, there is an undercurrent of cross-platform spend included in Upfront buys that increasingly needs better measurement.

Oddly, these trends seem to be the catalyst to evolve CTV advertising into something simpler than "four-dimensional chess" for advertisers and sellers.

Must-Read Monday AM Articles

* Cord-cutters get antennas “to watch campy horror-movie anthology show on MeTV, led by a comedian in a top hat offering corny jokes from an upright coffin”

The Vibe Shift

* Netflix batted down as “speculation" a Wall Street Journal report ($ - paywalled) about aggressive pricing in its rollout of a cheaper ad-supported tier.

* A good breakdown in The Hollywood Reporter of how Netflix has four movies in the Venice Film Festival but still won’t release its movies in theaters

* “Bollywood may be broken, and it has itself to blame.”

The 200 vs. The 10 Million

* AdAge is tracking “the measurement upheaval” across social, TV and digital

Aggregator 2.0 & Bundles

* Disney is exploring a membership program that could offer discounts or special perks to encourage customers to spend more on its streaming services, theme parks, resorts and merchandise ($ - paywalled)

Sports & Streaming

* America’s Bad Bet on Sports Gambling

Creator Economy, Platforms & Transparency

Original Content & “Genre Wars”

* Variety’s Cynthia Littleton argues “HBO Max has an inventory problem: The long-tail theory of content that has fueled the streaming business conflicts with the focus on tentpole hits that has traditionally fueled the entertainment economy.”

* Digiday’s Marty Swant interviewed Steven Cardwell, vp of Originals Marketing, HBO Max, about how marketing for the show has evolved, the strategy for shorter marketing windows and the impact of the planned Discovery+ merger.

* Netflix and Japan’s Nippon TV have agreed to a new distribution deal that will see the streamer adding 13 popular anime titles to its platform.

AVOD & Connected TV Marketplace

* Netflix hired Jeremi Gorman and Peter Naylor from Snap to to lead the development of its global ad strategy. Digiday has a good piece on Gorman, “How Jeremi Gorman brought collaboration to the forefront at Snap”

* Eric Seufert asks on MobileDevMemo, “Can Netflix command premium advertising pricing?”

* Samsung rebranded Samsung TV Plus with a focus on premium content

* Apple plans to nearly double the workforce in its fast-growing digital advertising business less than 18 months after it introduced Anti-Tracking Transparency ($ - paywalled)

Other

* The California Age-Appropriate Design Code Act will require sites and apps that serve users under 18 to “consider the best interests of children when designing, developing, and providing” their products.

* Why YouTube decided to make its own video chip for its data centers