To remind you, The Medium identifies a few key trends each fiscal quarter that reveal the most important tensions and seismic shifts in the media marketplace. The key trends help you answer a simple question: "What's next for media, and where's it all going? How are the pieces lining up for business models to evolve, succeed, or fail?"

Read the three key trends The Medium will be focused on in Q3 2023. This essay focuses on "Legacy media companies are throwing in the towel on their bets to own the consumer relationship in streaming and beyond" and "There is a less-discussed lens on how the demand for “premium content” is being redefined by creators, tech companies and 10 million emerging advertisers."

If you watched the excellent interview CNBC’s David Faber delivered with Disney CEO Robert Iger from Sun Valley on Thursday (transcript here) — so good that CNBC rebroadcast it at 8pm that evening —you witnessed Iger eloquently toss aside his long-term vision he had left Disney with in 2021. That vision was greater, global scale to compete with the likes of Netflix.

Now, he is open to reducing the company's size, even selling its prized broadcast and cable networks.

Iger’s most notable reveal was that Disney is open to strategic partners for ESPN “that could either help us with distribution or content.” Iger is the archetypal legacy media executive who started his career at ABC 49 years ago. His best business as CEO has been ESPN, which ABC bought in 1984 while he rising the ranks as an executive, and which Disney acquired when it bought Capital Cities/ABC in 1996. ESPN has been Disney's profit engine because of its enormous reach of cable subscribers (across multiple ESPN-branded channels), reliable revenues from affiliate fees and advertising revenue. It produced $2.5 billion in cash flow in 2021, almost 50% of Disney's $5.5 billion in cash flow from operations that year.

So, with that in mind, my guess is he is saying “the past is precedent”, and ESPN’s future in streaming will need to look much like its past. It’s not hard to imagine he will sign some form of a distribution agreement with Comcast that will help get ESPN’s DTC app maximum distribution in the U.S. on Comcast’s the Xumo Stream Box, which will be rolling out to Comcast, Cox and Spectrum customers this year. Comcast has the potential to reach 68 million households nationwide as a result of this partnership (I wrote about this in April).

A deal like this would hit a lot of needs for both parties involved:

It would achieve “something else” in exchange for the $9B+ Disney will end up paying to Comcast for Hulu in January 2024;

It would be a win for Comcast which is increasingly focused on sports, and needs a better exclusive value proposition for its Xumo initiative (which in turn could boost both broadband subscriptions for those services and enable them to raise prices sooner); and,

It could reduce the cost of ESPN as a DTC-only service — which is its planned future and is currently projected to be $20 to $30 per month in addition to advertising revenues and other sources of revenue — by ensuring scale and bundling it with Peacock and other apps.

Key Takeaway

EA Sports and ESPN would both benefit from a DTC partnership. However, EA's robust vision of retail-first, consumer-first models for Gen Z and Gen Alpha consumers exposes the limited ambitions of Iger’s vision of solving for ESPN’s future.

Total words: 1,500

Total time reading: 6 minutes

That’s a broad brushstrokes overview of a linear-type outcome for Disney’s digital future for ESPN. Ultimately it would be an outcome that would play to the shared expertise of both Iger and his Comcast counterpart, CEO Brian Roberts.

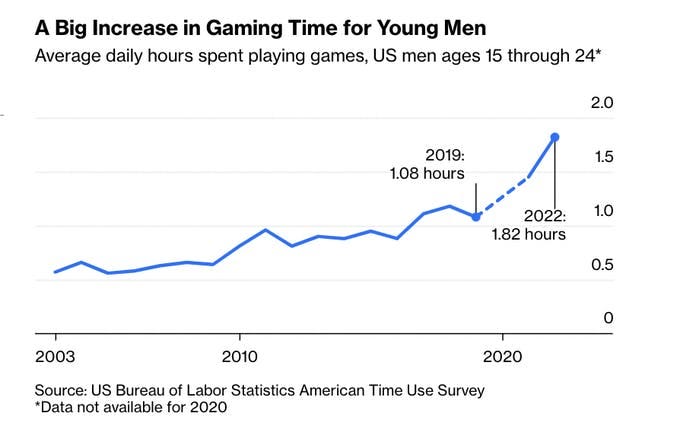

But, there is another outcome to consider both in light of The Medium’s key trends for the next three months, and a recent Bloomberg survey which found men aged 15 to 24 were spending the most time gaming ever on average. Among those who spent any time playing games, the average was 3.82 hours daily. In that light, the question is what a more digitally savvy, digital native CEO would do in Iger’s place given that Electronic Arts recently split off its EA Sports studio from EA Entertainment.

Because EA is pursuing the very opposite objective of “throwing in the towel on the bets to own the consumer relationship in streaming and beyond”.

Disposing of Disney Prime

Last month I highlighted on Twitter the “counterintuitive” facts that in-house innovation and tech evolution have been Iger’s consistent weakness as CEO:

Gaming (closed down Disney Interactive in 2014)

YouTube ($500MM investment in Maker Studios failed to get traction w/in Disney, failed in 2016)

Streaming (record launch, now losing $4B annually and growth stagnating worldwide).

On the third, a Wall Street Journal piece on Friday “some Disney executives have expressed doubts” about whether Disney+ would be profitable by September of 2024, a promise Disney has held itself to investors over the past three years. Notably, former CEO Bob Chapek’s "Disney Prime initiative" aggressively envisioned growing subscribers and was the foundation of a vision for Disney pivoting to a consumer-first, retail-first media business. Iger dismissed this initiative obliquely as “marketing” in his first investor call.

But Chapek’s membership program sought to achieve a single customer relationship monetized in multiple ways across the Disney ecosystem. For ESPN, that would mean Disney would understand both the favorite sports teams of 25.3 million subscribers and their favorite Disney rides. Disney would be able to monetize the consumer across multiple channels the same way that Amazon does across its websites, platforms and Whole Foods stores.

Enter EA Sports

A partnership between EA Sports and ESPN would offer a similar platform for monetizing ESPN consumers across DTC platforms. Both the Bloomberg research, above, and recent research from NewZoo which found 9 in 10 Gen Alpha and Gen Z are game enthusiasts, but stream movies and series equally as much. So, any outcome that solves both gaming and streaming needs for each company would ideally position both for the next generations of media consumers. Sports may seem like a narrow content for a partnership, but it is perceived increasingly by the marketplace to be table stakes for consumers.

The challenge is that, when put side-by-side, EA CEO Andrew Wilson’s retail-first, consumer-first vision for driving more engagement with EA Sports consumers exposes the limited ambitions of Iger’s vision for ESPN. Would Iger want to do a deal that makes his understanding of the consumer and business logic appear out-of-date?

I wrote about Wilson’s vision last October in “How Linear's Decline May Fuel Gaming's Next Decade”: EA sees Gen Z and Gen Alpha consume media across four behaviors: "play, create, connect, and share stories.” They envision Gen Z and Gen Alpha as “an audience that will represent 4 billion people by 2030 and 45% of the workforce and have tremendous buying power.” Wilson has framed the challenge as “in a world where we have 600 million or 1 billion players engaging with us for 1.5 hour a day: What could we offer them that would get 10 more minutes, 15 more minutes?”

He added, “as we think about that across our sports businesses, as we think about that across our owned IP or our licensed IP business, what are those things that we can bring into this ecosystem and really use our games and these global online communities as platforms for engagement?”

Wilson's vision suggests ESPN’s retail-first, consumer-first value to EA in any partnership would be defined in terms of marginal engagement. But, Iger has framed a deal in terms of Disney needing to get more content or distribution for ESPN's retail-first, consumer-first future. Of the two, only Wilson is thinking more broadly about the value of video to consumers beyond traditional distribution. That is a significant disconnect in 2023.

Looking past Iger…

This disconnect brings to mind two pain points at Disney I have highlighted in the past.

First, something venture capitalist Marc Andreessen’s argued in an interview two years ago: “A good test for how seriously an incumbent is taking software is the percent of the top 100 executives and managers with computer science degrees.” I have argued before that: “Andreessen's point is that the extent to which executives responsible for a streaming service understand the math of a sales conversion funnel, "user intent" and the science of the software is crucial to both growth and competing.”

Wilson’s background is building websites early in his career and then later rose the ranks of EA helping to design, produce and make games. Even if not the owner of a computer science degree, Wilson has hands-on experience in coding and computer programming, neither of which Iger has nor his potential successors: Dana Walden, co-chair of Disney Entertainment, film chief Alan Bergman and theme parks head Josh D’Amaro.

Second, it reflects the concern of Dan Loeb of Third Capital that “Disney directors don’t have enough experience in digital advertising, the monetization of consumer data and other areas that could help Disney boost profits as the company becomes more technology-focused.” He was able to get one new director with those qualifications — former Viacom, Facebook and Instacart executive Carolyn Everson — but is still pushing for another. In other words, neither the board nor the CEO has enough consumer-first, retail-first experience in digital media, and the track record is pretty poor, even with the successful launch of Disney+.

Partnering with EA would preserve if not grow the ESPN brand in front of hundreds of millions of EA Sports users who “play, create, connect, and share stories”. But the Disney board and CEO would need to understand that how that outcome would be robust for ESPN’s DTC future, and there is little if any evidence to suggest that they do. Disney's retail-first, consumer-first future seems limited in large part because its management team simply has no background in the business models of the medium.

Addendum: After Monday’s mailing, a subscriber suggested it was not clear how I imagined ESPN’s DTC app being integrated into Xumo.

Xumo is an over-the-top (OTT) play for aggregating third-party streaming services. It aims to solve a pain point for streaming consumers by making “search and discovery across live, on-demand and streaming video seamless and incredibly simple for consumers.” In Comcast’s Xumo Joint Venture with Comcast and Cox, it licenses its Xfinity Flex streaming platform, Flex-operated devices and associated voice-controlled remotes to those partners. Comcast also contributes its smart TV business (XClass) and free ad-supported streaming service Xumo to the venture.

I was envisioning a Disney partnership with Comcast making ESPN+ a default across all Xfinity devices — X1 linear and Flex broadband set top boxes— or over 32 million TV and/or broadband households. Add in Charter’s reach (30 million) and Cox’s (6 million), and you get 68 million as the potential reach.

Must-Read Monday AM Articles

* "Sports will drive people into the streaming world -- and that's going to be the next phrase of development here,” said Michael Nathanson, senior research analyst/co-founder of MoffettNathanson Research, recently on CNBC.

* Disney needs to plan for a future where Bob Iger is not indispensable

* Disney Explores Strategic Options for India Business

The demand for “premium content” is being redefined by creators, tech companies and 10 million emerging advertisers.

* On a recent visit to South Korea, Netflix co-CEO Ted Sarandos shared that more than 60% of its users have watched at least one Korean title on the streaming service.

* As more live sports migrate to streaming—for instance, soccer’s Premier League and UEFA Champions League also stream on Prime Video in certain markets outside the U.S.—brands will discover the power of streaming to reach new audiences, create innovative advertising moments and gain deeper insights about their consumers.

* One of the key issues in the TV animation world has reared its head in the writer’s strike: the unusual way that animation projects are covered by labor unions.

* Roku is getting its first voice-activated game: a version of enduring TV hit “Jeopardy!”

* What is Apple’s intention with the Messi deal? Is this a bet on MLS? Or is this a testing ground, as Apple weighs more ambitious ventures into truly prized sporting rights, such as the NBA, the NFL and the Premier League?

* World’s Top Anime Site Crunchyroll Is Sony’s New Money Maker

* Don’t waste time wishing you were Mattel. Any company can build an entertainment empire. Here’s how.

* Good data in a WSJ piece, “TV’s Golden Era Proved Costly to Streamers”

AI & cloud computing applications and services are increasingly dictating content consumption

* Industry leaders are publicly sounding the alarm and privately negotiating with the likes of OpenAI and Microsoft to get paid for their content. As News Corp CEO Robert Thomson has warned: “We need to be more collectively assertive.”

* "I think the framing of AI systems — that they are used to communicate, without any clear origin for what is being communicated — creates a gap, which we fill by projecting the illusion of intelligence and expression. This masks something fundamental to these systems: there is nothing being communicated. Rather, information is being assembled from a melange of messages."

* Understanding AI as a "Many to One to One" Media System

Legacy media companies are throwing in the towel on their bets to own the consumer relationship in streaming and beyond.

* The Phoenix Suns and Mercury are moving forward with its Gray Television deal after its incumbent regional rights holder Diamond Sports Group didn’t make an offer to continue broadcasting games on Bally Sports Arizona.

* UK households forecast to spend £4.2bn on Netflix and other services by 2025, overtaking TV packages

* Sinclair CEO Chris Ripley argued “The regulations reflect the world as it was thirty years ago,” he added, “We are competing in a land of giants.”

* Universal has generated more than $1 billion in premium V.O.D. revenue in less than three years, while showing little-to-no decrease in ticket sales. In some cases, box-office sales even increased when films became available in homes, which Universal has decided is a side effect of premium V.O.D. advertising and word of mouth.

* DAZN will sell tickets and hospitality packages to major sporting events directly within its mobile application, hoping a seamless purchase experience and a highly engaged user base will open up a lucrative new source of revenue.

* First came DVDs. Then came streaming movies and TV. Now, Netflix is betting big on video games—and new release ‘Oxenfree II’ may be just the beginning of a long-term plan.

* Roku users can buy products from Shopify merchants with their TV remote

Other

* Netflix can lose lots of subscriptions because of its hardened password-enforcement approach (although 80 million seems clearly to be an exaggeration). At the same time, Netflix can also add lots of subscriptions because of the very same policy.

[NOTE: two excellent essays by a college classmate that I offered input on]

* Today’s challenges require leaders to re-think business models, rather than doubling down on current ones while making marginal changes to trim costs. This entails reassessing where they compete and where they don’t. Leaders would be well served by reviewing two basic economic principles: comparative advantage and the theory of the firm.

* Why the usual profit-boosting tactics and M&A solutions will buy time but won’t solve today’s problems.