It was our belief that cord cutting losses would be offset by gains in streaming. This has not been the case. We are primarily a content company and the mechanisms for the monetization of content are in disarray.– James Dolan, Chairman, AMC Networks, Nov 29, 2022

Well, some linear networks now seem officially doomed. Last week, AMC Networks CEO Christina Spade stepped down after being on the job for less than three months, and the company announced a restructuring plan with “initiatives that will include, among other things, strategic programming assessments and organizational restructuring costs”.

My first mailing on The Information’s platform was about whether AMC Networks’ and Starz’s bets on more niche streaming services — each focused on various genres (British, Horror, Independent) or audiences (women, African Americans) — would succeed.

One year later, AMC Networks is facing a strategic restructuring and Starz has rebranded its streaming service internationally to LIONSGATE+ while withdrawing from seven international territories (six European and Japan). AMC Networks has also fallen short where Starz has succeeded: streaming now accounts for 71% of STARZ subscribers and 62% of its revenues. “This has not been the case” at AMC Networks.

AMC Networks has effectively thrown in the towel on its strategy. It is a canary in the coalmine… but, for narrower purposes than those wondering whether it augurs the end of linear networks.

Key Takeaway

AMC Networks has successfully built a suite of niche services, and its headwinds are the result of its own lack of Internet savvy (but may be solvable).

Total words: 1,600

Total time reading: 6 minutes

In streaming terms AMC Networks is a weird business:

It has six streaming apps across multiple genres; but,

It relies primarily on its linear networks for revenues; and,

It owns very little of its library from the past 30 years (though recently it has been investing in more originals); and,

Because it lacks IP, its bet on a portfolio genre-focused streaming apps lacks other, nonstreaming direct-to-consumer offerings that could drive a flywheel business model.

So James Dolan’s statement, above — “the mechanisms for the monetization of content are in disarray” — may both be true of the marketplace and also reflect the lack of Internet marketplace savvy in AMC Networks’ streaming strategy.

Cost-efficient curation of library

“The Walking Dead” is AMC Network’s biggest hit. Its 11th and final season ended last month. It has six spinoff series.

It is also one of the few owned and original hit titles that AMC Networks owns. Three other recent hits — “Breaking Bad”, “Better Call Saul” and “Mad Men” — are all owned by third parties.

Its diverse bets on niche services are intended to solve for that: Acorn TV (British TV), Shudder (horror), Sundance Now (indie TV and movies), ALLBLK (content targeting Black audiences), and HIDIVE (anime). AMC+ is a bundle subscription that includes “the best of AMC, BBC America, IFC, and Sundance TV - with full access to Shudder, Sundance Now, and IFC Films Unlimited.”

Last year then-AMC Networks CEO Matt Blank sold investors on "the beauty of small numbers and a very specific and carefully constructed approach to serving subscribers with targeted offerings that complement the larger streamers". Meaning, its $1.1B in original program rights is 54% greater than it was in December 2021 ($740MM). The premise seems to have been that efficient spend on curating owned and original content and licensed content would drive streaming growth.

But, Product Channel Fit

A streaming service hyper-focused on hyper-serving genres and/or particular demographics can engage and convert audiences to build a subscriber base at scale. They can do so without competing head-to-head year-round with the streaming giants. But, those services could do so only if they find Product Channel fit.

Odds are, you have seen AMC Networks apps offered at steep discounts ($1.99 for two months) across Amazon Prime Video Channels, Roku, Apple TV+ and other Connected TV channels platforms.

Effectively, AMC Networks has built a suite of apps targeting particular audiences and genres but relies heavily on third-party intermediaries to scale those businesses. That exposes AMC Networks apps to both larger audiences at scale (65M+ on Roku) but also has left its streaming apps vulnerable to the easy opt-in and opt-out user experience on those platforms. That $1.99 deal reflects that reality as much as it does a need to capture more subscribers even if at lower Average Revenue Per User.

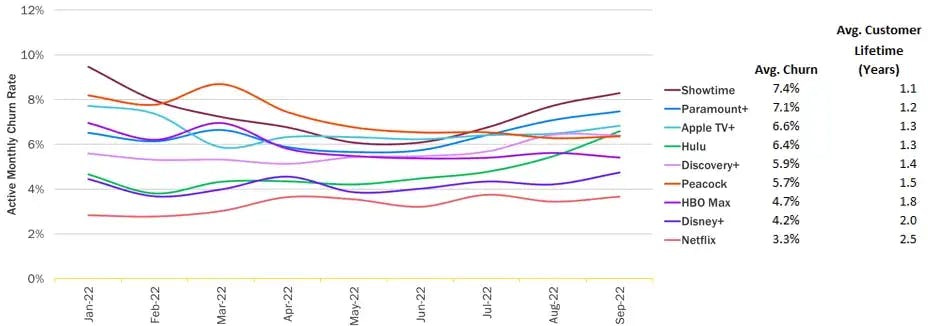

Leading subscriber analytics provider Antenna does not include AMC or other niche platforms in its churn data. But, it seems fair to assume that they are higher than the nine or so that Antenna lists (and which Doug Shapiro, Senior Advisor at BCG, analyzed recently), means their monthly churn may be higher than 7%.

It was AMC Networks’s Product Channel Fit strategy which led to me coin the term “the genre wars”:

…one way to think about product channel fit in streaming is to think of the “streaming wars” more as ‘the genre wars”, which are more like focused, zero-sum conflicts around specific content genres than broader head-to-head, zero-sum conflicts between platforms for the same audience.

AMC Networks believed it could scale predictably by betting on genres discounted or neglected by the bigger players and treating CTV platforms like MVPDs. It was obvious early on (and I wrote about this in March 2021) that had AMC Networks picked the right battles, it still misunderstood what was required for it to succeed.

Crunchyroll & flywheels

I wrote back in September about how AMC Networks reflects an “an absurd market reality for public media companies.” That “absurd reality” is that the outcome Wall Street wants most - higher gross revenues, higher profits and higher ARPU - will have the easiest story and metrics to follow within businesses it values least - subscale niche content businesses. And the businesses that best map to this story - AMC Networks and Lionsgate’s Starz - have no available means of building a flywheel now or tomorrow.

The example I gave was Crunchyroll, another subscale, niche streaming service (5MM subscribers) focused on anime that has found more financial success than AMC Networks suite of apps.

Crunchyroll is an independently operated joint venture between U.S.-based Sony Pictures Entertainment and Japan’s Aniplex (both part of Tokyo’s Sony Group) that specializes in all things anime. The company makes money through multiple channels: first-party streaming and theatrical releases of new anime content, sales of home entertainment products (e.g. DVD box sets), merchandise licensing, and secondary distribution. The first three of those make up a flywheel and the membership very clearly drives those line items (or CDP business logic).

AMC Networks’ bet was a portfolio of content attracting various niches across fragmented audiences (I wrote about Netflix’s challenges with fragmentation last Friday). But Sony and Crunchyroll have a growing business focused on serving fans of a particular niche genre in multiple ways. It sees the Internet as a means of delivering multiple business models that can be tied together under one roof and to one user credit card.

AMC Networks’ vision has stuck to streaming.

What happens next?

The turn of phrase “the mechanisms for the monetization of content are in disarray” has some truth to it: returning Disney CEO Bob Iger conveyed to employees a broader sense of change with “this is a time of enormous change and challenges in our industry, and our work will also focus on creating a more efficient and cost-effective structure.”

But, solutions exists and AMC Networks seems pretty late to the game in finding them.

So what happens next? I thought the key lines in its 8-K were its estimates of pre-tax restructuring charges of:

Strategic programming assessments leading to content charges of approximately $300 million to $400 million; and

Organizational restructuring costs, including severance, retention and other costs, of approximately $50 million to $75 million

Because both point to hundreds of millions of dollars of productions — which nominally total the difference between original and owned productions that were added between December 2021 and November 2022 — being cancelled. And this goes back to the question I was asked by a streaming in September, and which I noted in my Four Trends in Media for Q4 2022 essay: “the question is when an AMC Networks or a Paramount network disappears due to lack of demand, how will the post-production marketplace adapt to the sudden drop in productions?”

AMC Networks is not disappearing, but it’s on that path: its operating income dropped by 20% last quarter.

So, the primary reason to pay attention to AMC Networks is how its demise is going to impact the post-production marketplace — which is already over-saturated with demand from Peak TV productions (559 scripted shows produced last year, and 357 scripted series across broadcast cable and streaming that had launched through the month of June). Given AMC Networks' investment in horror and fantasy (Shudder, "The Walking Dead"), any sudden shift in investment will likely hit the VFX market hard (as I wrote in October's "How Linear's Decline May Fuel Gaming's Next Decade").

But the other reason to pay attention is that for all the flaws in its strategy, AMC Networks has successfully built a suite of niche services. As I highlighted in my opinion for The Information the other week, there are savvy buyers out their like Apollo, and also like Sony (above), who understand that a flywheel of products is a better media business in 2022 than a distribution business.

AMC Networks may not be "The Walking Dead".

Must-Read Monday AM Articles

* A good breakdown of the options on the table for AMC Networks’ streaming services

Some past PARQOR mailings on this topic

* Disney's Complex Path to Higher ARPU (September 2022)

* Why The End of "Peak TV" May Bring "Jurassic Park"-type Chaos (September 2022)

* Starz, AMC Networks Reach A "Genre Wars" Crossroads (November 2021)

* A Short Essay on The Dolan Family & AMC Networks CEO Josh Sapan's Resignation (August 2021)

The Vibe Shift

* Parks Associates has released a new report which shows that Prime Video has surpassed Netflix’s paid subscriber total in the U.S. for the first time in history.

The 200 vs. The 10 Million

* N/A

Aggregator 2.0 & Bundles

* N/A

Sports & Streaming

* Sports media executives discussed their shifting strategies as viewing habits continue to rapidly evolve

* Lenny Daniels is leaving as President of Warner Bros. Discovery Sports U.S., ending a 27-year run with the company

Creator Economy, Platforms & Transparency

* Creators say YouTube's new shopping features do 'next to nothing' to help them make money as they prepare for the holiday sales season ($ - paywalled)

* YouTube lists top trending videos, creators, and songs of 2022

Original Content & “Genre Wars”

* The Los Angeles Times’ Ryan Faughnder dove into the creative challenges Bob Iger now must navigate at Disney (and the WSJ had a related story ($ - paywalled)

* How a show like HBO’s ‘The Rehearsal’ gets made

* Wesley Morris, cultural critic for The New York Times, argued there are fewer films now that allow an actor to grow a persona and a Tom Cruise level of stardom. It’s a crisis, and the movies know it.

AVOD & Connected TV Marketplace

* Pay-TV's decline hits a new bottom in Q3 2022

* Streaming services' "churn" continues to grow, now at a 5.8% rate in September, according to a new report from Antenna, a subscription data and analytics company.

* 85% of people who use YouTube in their shopping journey saying they have purchased or planned to purchase a brand again

* Disney Advertising gave access to its “clean rooms” to TV measurement company VideoAmp and Omnicom Media Group in a test of integrated identity data

* Can Pluto TV’s Expansion Be Powered by Library Content Alone? A Chat With International Chief Olivier Jollet

Other

* The Chapek-era wasn’t the best of times for the Disneyland Resort

* Five Far-Fetched (or Are They?) Megadeal Scenarios for Disney under Iger

* Kids execs react to Bob Iger’s Disney return

* Disney CEO Bob Iger will overhaul predecessor Bob Chapek's business structure — here's why company insiders hated it and what they hope will change ($ - paywalled)