ICYMI, I sent out Lessons From 2021 to everyone, and Predictions for 2022 exclusive to Members, only.

To read these Predictions, and both the essay and Top 5 Highest-Converting Member Mailings of 2021, below, sign up for a membership by clicking the "Subscribe" button.

Is It Really a "New World" for Connected TV Ad Buyers?

In Friday's mailing I wrote about NBCU, The Winter Olympics & First Party Data.

I later added an article I had intended to include: eSeller's 2022 eCommerce Predictions – 26 eCommerce Experts Predict The Biggest Opportunities For Your Business.

It's a good overview of just how important first party data will be to marketers and advertisers in 2022, and is an especially helpful summation of what different types of marketers weigh as their priority or priorities in 2022.

Over the weekend I caught this interview with IAB's David Cohen in The Trade Desk's in-house publication, The Current. He has a few quotes about marketplace changes being driven by first party data that are worth highlighting in the context of this piece.

The big one was this message to television ad buyers:

“The way you have done business over the last decade will no longer be valid in this new world,” David Cohen, chief executive officer at the Interactive Advertising Bureau (IAB), tells The Current. “One of the inhibitors that is standing in the way of the industry is the reliance on year-on-year comparisons.”

He later added:

“You don’t want to be at the eleventh hour trying to figure out how to go to market, connect with your consumers and drive your business,” says Cohen. “The rise of the direct-to-consumer economy and the explosion of data usage and data assets has really made established brands sit up and take notice.”

Cohen's first point relates to a favorite quote of mine from Rob Norman (ex Group M) in this must-read opinion piece:

It would be ignorant to express relief that digital looks to be moving away from third-party cookies because, let's not forget, the tech giants are staying exactly where they are in terms of first-party data. That means premium publishers, and many advertisers who have a co-dependent relationship with premium publishers, need to focus on the intersection of context and data. They also need to think about what data matters most.

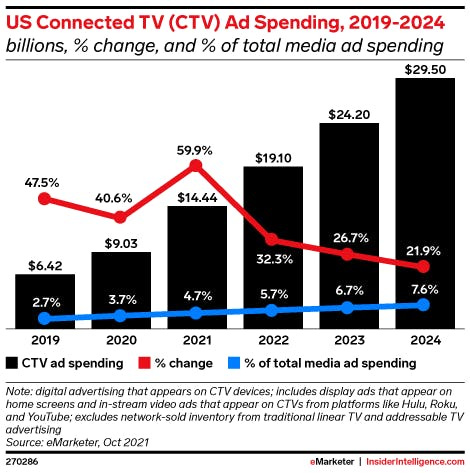

Whereas the purpose of Norman's perspective was foresight, I think the purpose of Cohen's statement is urgency. Norman wrote his piece in November 2020, when Connected TV ad spending in the U.S. was $9.3B, and grew to $14.4B in 2021, according to Insider Intelligence.

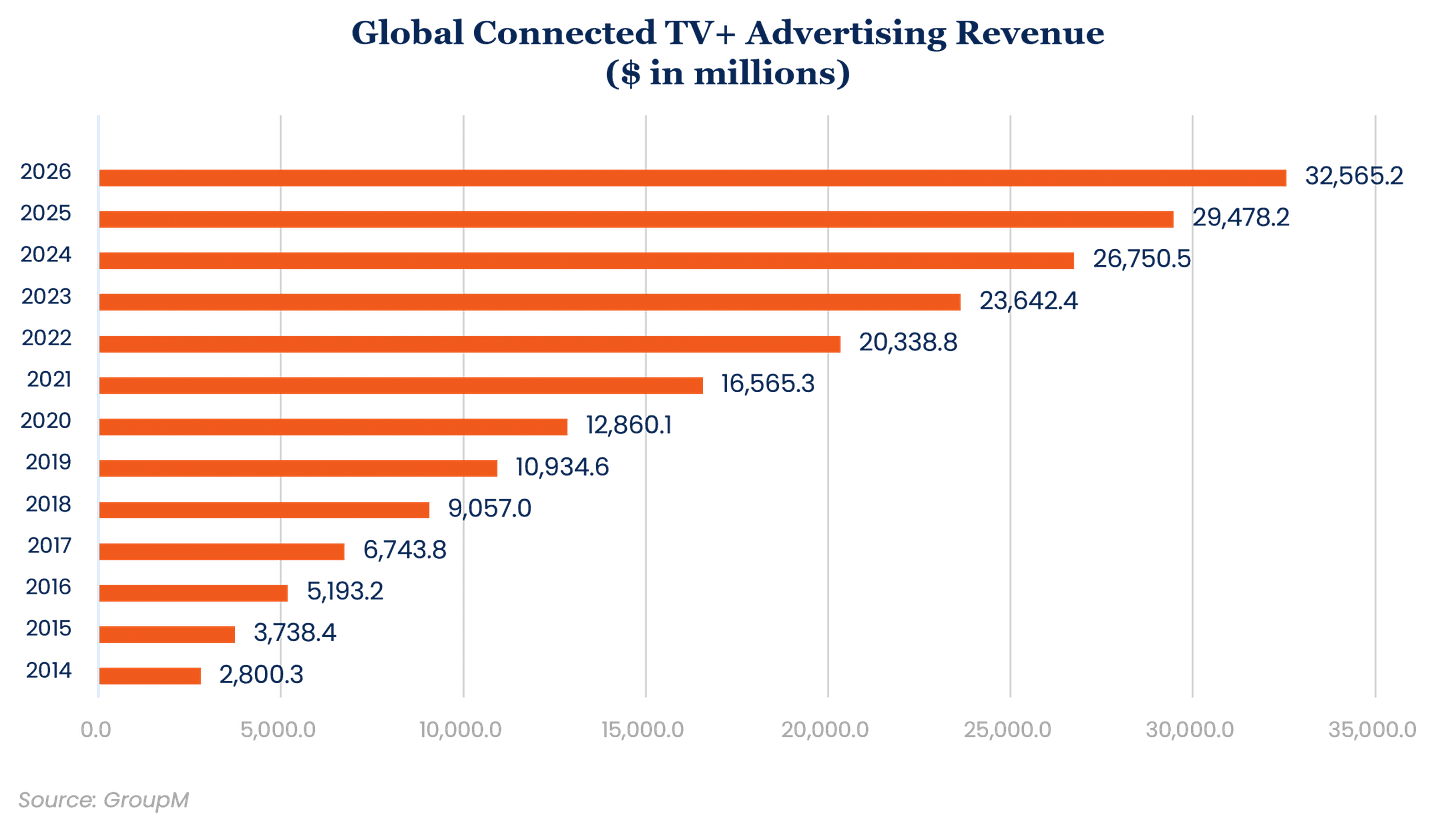

GroupM had a slightly more aggressive take, seeing $12.9B in CTV ad spending in 2020 and $16.6B in 2021. It is projecting $20.3B in CTV revenue, globally, in 2022.

Both predictions share one thing in common: 50% growth in the Connected TV marketplace between 2022 and sometime between 2024 and 2025.

As for programmatic, Insider Intelligence's eMarketer also estimates that 7 in 10 CTV ad dollars were transacted or fulfilled programmatically in 2021, or somewhere between $10B and $11.6B.

So, what we're looking at in 2022 is a tipping point towards exponential growth in Connected TV. The overall challenge for ad buyers and ad sellers from both Norman and Cohen is, in broad brushstrokes, adapt or die.

But, there is another level down to what they are saying worth diving into briefly.

Non-Members, click subscribe to read the rest of this Members-only, exclusive

Norman's point of co-dependence reflects how publishers delivering what an ad buyer needs at scale is most often met by various combinations of personal relationships and a brand having the "right" story and metrics. But, this approach also led to suboptimal outcomes like digital inventory often being sold at a discount, or at a greater scale than the websites typically saw in a month, because linear ad sales teams did not understand digital.

So, digital inventory priced at $20 CPM might get sold at a $15 or even $10 CPM because a linear ad sales executive could package digital inventory as an add-on to a linear sale. Success was measured in year-on-year comparisons.

A sale in Connected TV may rely more on relationships than the data because the scale isn't there [1], as journalist Mike Shields summed up back in October while “roam[ing] the halls of Hudson Yards for the yes-we’re-back-in person version of Advertising Week”:

It seems that in every other panel session, ad executives were gushing with enthusiasm over the potential of CTV - that is until they got into the details. Measurement is tricky. Managing reach frequency? Forget it- there are like 12 walled gardens. Measuring impact? Yes, as long as I have some kind of custom report that only works in this one instance. Using first-party data - um, yes, sort of, but the rules are different everywhere.

Is there enough CTV ad space out there?

“There is demand,” said Amy McGovern, vp of addressable sales, Warner Media. “One of the biggest challenges is scale.”

This point about the challenges of scale in Connected TV popped up in the GroupM post, too:

...investments in streaming services within the U.S. are occurring at a significant scale and profoundly impacting trends around the consumption of TV. As this U.S.-led phenomenon is set to become even more global than it already is, it should produce a warning sign, of sorts, for marketers around the world. Already we can see that total internet-connected device-based consumption accounts for 24% of total TV consumption, up from 19% at this same time last year. Meanwhile, pay TV subscriptions continue to fall, limiting the reach potential of ad-supported TV by a greater degree than what we are seeing in most other markets.

A lack of scale in Connected TV creates a fascinating question: to what extent are "co-dependent" ad sellers and buyers incentivized to move past their relationships and existing standards of success into new ones?

As an investor in the CTV space the told Insider (subscription required), even if the ad spend is projected to grow by 50% by 2025:

"The ad spend isn't flowing as fast as people want it to because you can't measure it as well as you can the other stuff — the tech is still being developed".

That means, at a time when linear TV still has more scale than every AVOD offering, there is not enough scale in connected TV to incentivize and ad sellers to move past their relationships.

This was notably reflected in interviews with TV industry’s top execs and ad sales chiefs by Adweek's Jason Lynch about their priorities for 2022: few mention data, and none mention Connected TV inventory.

Connected TV is still very much in an experimental phase.

Must-Read Monday AM Articles

Emerging "Metaverse"-type convergence strategies

* A good HBR essay on brand management in the Metaverse from Janet Balis

Aggregator 2.0

* EA Sports svp of global brand management Andrea Hopelain broke down EA Sports' lessons from 2021 to Digiday.

Sports & Streaming

* Sinclair Broadcast Group Inc.’s Diamond Sports Group is close to clinching deals to carry National Basketball Association games on its new streaming service and $600 million of financing to support the launch later this year. Rumors are the app will be "gambling heavy".

Creative Talent & Transparency in Streaming

* The NY Times had a profile on Ryan Kaji, the 10 year-old "king of toy videos"

Original Content & “Genre Wars”

* Variety Intelligence Platform's Kevin Tran has a good summary of How Movies Powered HBO Max 2021 Subscriber Growth. WarnerMedia CEO Jason Kilar told the WSJ that he doesn’t expect the fast spread of the Omicron variant to slow production of television shows and movies in 2022.

* The Economist highlighted how demand for children’s content rose sharply during the pandemic ($ - paywalled)

Comcast’s & ViacomCBS’s Struggles in Streaming

* WarnerMedia and ViacomCBS are considering a sale of some or all of the CW Network given both are now giving priority to content being distributed on their own streaming services.

AVOD & Connected TV Marketplace

* MoffettNathanson’s quarterly Cord Cutting Monitor report estimates that vMVPDs, led by Hulu + Live TV and YouTube TV, now have approximately 14.2 million combined subscribers after adding an estimated 980,000 subscribers during the third quarter.

* The New York Times' Shira Ovide argues Cable TV Is the New Landline

* Scott Rosenberg, SVP and general manager of Roku's Platform business, plans to step down sometime in the spring of 2022.

Other

* A new report from Accenture revealed that 60% of streaming service users are frustrated with streaming, and 44% found that they spent more than six minutes just trying to find something to watch.

* John Peters, head of Accenture’s media and entertainment practice, predicts a “bifurcation of the [streaming] industry — those who can charge rent and those who pay rent"

Footnotes

[1] I wrote about this in: