Monday AM Briefing: More Than Catalysts That Will Drive YouTube's Inevitable Win in CTV

About PARQOR

PARQOR is the handbook every media and technology executive needs to navigate the seismic shifts underway in the media business. Through in-depth analysis from a network of senior media and tech leaders, Andrew Rosen cuts through what's happening, highlights what it means and suggests where you should go next.

I'm keen to connect with subscribers and readers on a free trial to learn more about you need from a subscription service. Click here to set up an appointment: https://calendly.com/andrew_parqor/30min

Last Friday I built an essay around a quote “Built to Fail”, a book on Blockbuster Video’s rise and fall. In that book, we learned the rental video market under Blockbuster changed the economics of movie productions because it:

Generated more revenues for producers to fund more productions, and

Aggregated the target audience at scale.

Effectively, the additional revenue catalyzed the supply of productions, and Blockbuster’s model catalyzed the demand for those productions.

Today’s essay looks past the demand side and supply side catalysts for Hollywood’s future lying in the creator economy. As I wrote back in January, “YouTube talent is moving closer to Hollywood’s model than Hollywood is moving toward YouTube’s.” Meaning, YouTube creators are finding faster and cheaper ways to produce legacy media–type content that both audiences and advertisers increasingly consider to be “premium”.

On a surface level this dynamic mirrors the Blockbuster story:

YouTube’s extraordinary scale and growth have generated more revenues for original creators to fund more productions, and

It has also aggregated the target audience at scale (135MM Connected TV (CTV) users, over 200MM monthly users in the U.S. and over 2.1B users worldwide).

So, it would seem the supply side and demand side catalysts are pushing the creator economy into a competitive dynamic with Hollywood and legacy media that is analogous to the “unprecedented independent film movement” of the 1990s.

But, the lens of YouTube’s 135MM CTV users in the U.S. reflects why the emergence of the creator economy presents two very different catalysts from the Blockbuster story:

YouTube creator content now captures a share of advertiser dollars at Upfronts that originally went to legacy media; and,

According to Nielsen’s most recent The Gauge, YouTube is tied with Netflix as one of the top two services with the highest share of streaming on TVs (7.6% of total TV usage).

YouTube is capturing more legacy media ad dollars, which it is sharing with creators, and those creators outperform legacy media content with faster, cheaper and sometimes better content. Instead of catalysts, these dynamics help to reveal how YouTube is changing the economics of streaming to its advantage.

Here are four marketplace tensions to consider.

Key Takeaway

YouTube's marketplace advantages in Connected TV streaming are so much more dynamic than simply supply or demand side catalysts. It seems inevitable that it will win.

Total words: 1,500

Total time reading: 6 minutes

Four Marketplace Tensions

I consider a "tension" to be a dynamic that, if a trend continues, seems poised to change or even "break" in a marketplace. Focusing on both supply and demand side elements of that tension helps to hone in on those breaking points.

Tension #1: Upfront Advertiser Dollars

YouTube recently told shareholders it had “strong growth in Upfront commitments” and one senior YouTube executive recently shared with me that he believed they took market share from linear at 2022’s upfronts.

YouTube is one of the most popular forms of “something else”: according to Pew Research, 95% of U.S. adults between 18 and 29 years of age said they used YouTube (the age demographic with the highest percentage) in 2021. Also, only 49% of U.S. adults who are 65+ years reported using it.

Advertisers need to be on YouTube because it has both supply and demand at an extraordinary scale. YouTube increasingly dominates CTV device consumption in streaming - according to Nielsen, over 50% of ad-supported streaming watch time happens on YouTube CTV for people ages 18 and up. So, advertisers looking to reach CTV audiences will need YouTube’s CTV inventory to reach valuable audiences.

The tension is obvious here: there are 500MM CTV devices in the U.S. according to Leichtman Research and, as cord-cutting accelerates, YouTube appears to be the best bet to reach audiences on those devices. The more advertisers shift spend to reach CTV audiences, the more they will need to rely on YouTube and the less they will need to rely on buying inventory from legacy media ad-supported offerings.

That will leave ad-supported offerings from legacy media companies and Netflix highly vulnerable as advertiser demand shifts away from both linear and weaker ad tech back-ends. Advertisers like to diversify, but they also don't like waste. YouTube seems to be a safe bet now.

Tension #2: Creator Content

In August I wrote about how, without YouTube, teenagers would have never found NBC's hit show “The Office”. I argued:

“This reflects an emerging problem for media companies who have assigned extraordinary value to the ownership of IP libraries for streaming: The value of IP is fragmenting across platforms, new generations “consume their art by algorithm”, and YouTube’s algorithm seems to drive the most impactful engagement with audiences, new and old.”

The second tension reflects this dynamic, something that I labeled as “The Netflix Paradox”, “'The Office' Paradox” or “The YouTube Paradox”:

Streaming services have invested billions into exclusive IP libraries at a time when the value of IP is fragmenting across platforms;

The best business models for monetizing this IP should be PARQOR Hypothesis businesses because they centralize the value of IP and monetize it in multiple ways; but,

Without a centralized model for the IP, the YouTube ecosystem and algorithm may be more valuable to building fan bases for IP than the exclusivity of a “walled garden”.

Meaning, YouTube is not only emerging as a powerful competitor to legacy media streaming within the Connected TV ecosystem, it is also proving to be a better destination for:

Short form and longer clips of legacy media content and

Consumers who want to consume that content for free instead of paying a subscription.

So, YouTube can also offer the same content to advertisers in short-form and long-form and with more valuable, younger audiences consuming it. At some point advertisers will be targeting premium content from legacy media on CTVs and choosing between the scale of YouTube and the lower scale offerings of legacy media. The choice will be obvious.

Tension #3: Scale

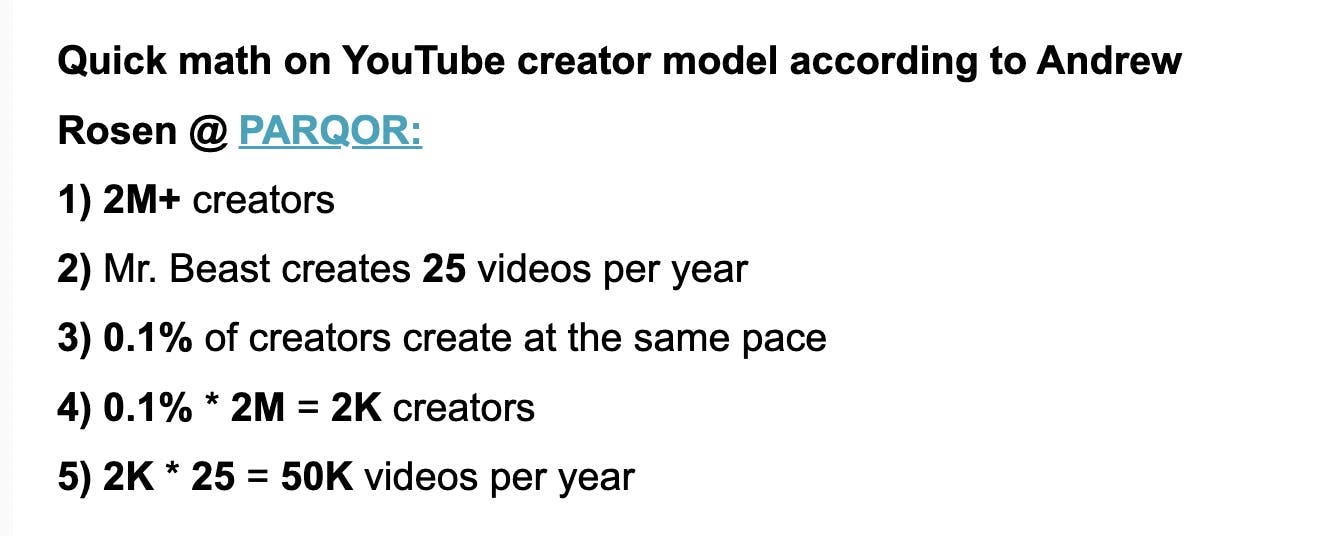

Michael Beach of Cross Screen Media recently wrote an elegant summary of my math for YouTube’s creator economy advantage in a State of The Screens newsletter (which I highly recommend):

In legacy media TV series terms, that’s 2,000 content creators producing three 8-episode streaming series per year. In Netflix terms, that’s 17K titles (which is around or just over the titles it has in its library worldwide).

With its expansion of the Partner Program - which helps these 2MM creators monetize their content - YouTube envisions over 3MM content creators monetizing their content both in short form and long form.

So, if advertisers increasingly agree with the premise that YouTube creators produce more “premium” content that audiences consume, YouTube seems poised to have exponentially more scale with premium content on CTVs than its legacy media competition.

The interesting question is what level of scale beyond 50% of CTV AVOD consumption will convince marketers to commit more CTV spend to YouTube. It's not clear yet. But the logical question is why aren't they doing it now?

Tension #4: Business Model

The fourth tension lies in how YouTube’s creator economy straddles two different business models that deliver the best creation of value “for users mainly but also shareholders”, as Andy Weissman, a Managing Partner of Union Square Ventures, recently proposed:

A service you check 20 times a day, every day, for delight (e.g., YouTube, TikTok, Spotify); or,

A niche media community that offers e-commerce, experiences, and more so that “people can now almost always find something they love”.

Meaning YouTube’s value proposition is two-fold: it’s a platform with its own business model, and its creators can build their own business models out of “content, community, and commerce”, as Candle Media’s Kevin Mayer describes it.

So creators can dominate AVOD watching on CTV, and engage and monetize their viewers in multiple ways that legacy media apps do not offer. The closest model to this in legacy media is Chip and Joanna Gaines’ Magnolia Network, which I wrote about last July (NOTE: on Substack archive): The Gaineses have built out Magnolia as a creator economy, DTC-type brand, but that is not reflected in how Warner Bros. Discovery has built out the Magnolia Network online or offline (linear). But Warner Bros. Discovery sees more value in B2B distribution relationships and the linear distribution model than it does in DTC relationships with multiple sources of revenue.

The tension here is how YouTube is squeezing its competition by forcing them to compete with its multiple models. But the latter creator model especially looms over every legacy media company that has avoided building deeper DTC relationships, to date. It's impossible to compete with thousands of creators.

What will lead to breaking points?

If YouTube continues to capture more ad dollars and more eyeballs as legacy media streaming services face plateauing growth in the U.S., the logical question is where the breaking points for legacy media efforts in streaming lie. All data suggests CTV is generally where they seem most vulnerable.

I think these four tensions - which emerged from past mailings - are obvious bets for breaking points. But there is no supply side or demand side catalyst we can point to that will lead their emergence. Rather, they highlight the basics of how complex YouTube's presence in the CTV marketplace has become: its advantages are so much more dynamic.

And, even with a superficial glance, those may be why it seems inevitable that YouTube will win.

Must-Read Monday AM Articles

* VIP+’s “Demographic Divide” report highlights a deeper take on the “demographic divide” behind this issue ($ - paywalled)

* YouTube has been asking users to upgrade to the premium tier to watch videos in 4K

The Vibe Shift

* BCG consultant Doug Shapiro addressed three questions in an excellent post: 1) is the slowdown in streaming subs a temporary lull (spoiler: probably not)?; 2) what are the financial implications?; and 3) if you’re a media conglomerate who’s been betting that streaming is a major growth and profit engine, what do you do now?

* US cable companies make almost all of their income from selling broadband, so “carriage and retrans fees can start to seem superfluous”

* The days of prioritizing subscriber count are over – as they should be, writes Innovid’s chief technology officer and co-founder Tal Chalozin.

The 200 vs. The 10 Million

* Warner Bros. Discovery overplayed its hand with hiked ad rates, insiders say, and advertisers are 'nervous' about layoffs that 'cut to the bone' ($ - paywalled)

Aggregator 2.0 & Bundles

* Publishers believe they “have a lot to make up for” in cookieless browsers, and they aren’t happy

* Major publishers are buying ads in mobile games like ‘Subway Surfers’ to juice podcast traffic

* A good piece on bundling and its drawbacks in streaming from CNBC’s Alex Sherman

Sports & Streaming

* N/A

Creator Economy, Platforms & Transparency

* TikTok parent ByteDance Ltd. saw its operating losses more than triple last year to above $7 billion as it spent heavily to continue its torrid growth, according to a financial report shared with employees. ($ - paywalled)

* TikTok to launch live shopping in US using outsourced technology ($ - paywalled)

* Podcasts are waiting on Apple, Spotify and other podcast-hosting platforms to offer more flexibility and features to grow listenership and make it easier for people to find the shows that offer subscriptions

Original Content & “Genre Wars”

* A public statement from Spotify’s Parcast Union states that Gimlet Media suffered a loss in listenership after going exclusive on Spotify, and Spotify will be cancelling 10 of them

* Sox Entertainment is is taking advantage of what its founder sees as “growing appetite in the streaming business for lower-cost, advertiser-friendly programming” ($ - paywalled)

* Netflix’s shake-up of its European operations points to a broader strategic shift at the streaming giant toward faster-growing international markets to make up for domestic subscriber losses.

AVOD & Connected TV Marketplace

* A senior executive at an ad tech company told Digiday about what that third-party cookie limbo is like, how it affects relationships with clients and what he wishes the industry would change.

* Every single one of the partners to ad-supported services from Disney and Netflix “could become a source of a data leak”

* Amazon has been doubling down on original content for Freevee, its ad-supported video service, which has seen a lot of growth thanks to a deep integration with other Amazon properties.

* Insider’s Lara O’Reilly spoke with Microsoft Ads Chief Rob Wilk. MoffettNathanson now expects the streaming company's global ad play to generate about $2.7 billion in advertising revenues by 2025

Other

* Why Netflix and Disney+ are trailing a local service, Vidio, in SE Asia