Monday AM Briefing: Netflix ($NFLX) May Not Have Any Answers For YouTube Shorts

PARQOR is the handbook every media and technology executive needs to navigate the seismic shifts underway in the media business. Through in-depth analysis from a network of senior media and tech leaders, Andrew Rosen cuts through what's happening, highlights what it means and suggests where you should go next.

In Q4 2022, PARQOR will be focusing on four trends: this essay is on the trend of "Hollywood’s future lies in the creator economy, what happens next?"

I'm keen to connect with subscribers and readers on a free trial to learn more about you need from a subscription service. Click here to set up an appointment: https://calendly.com/andrew_parqor/30min

My favorite section in every Netflix quarterly letter to shareholders is the discussion of their competition and threats to growth. YouTube, Epic Games an its popular multiplayer game "Fortnite", TikTok and Disney’s Hulu have had pretty consistent mentions over the years. In fact, Netflix highlighted Fortnite as a competitor back in January 2019, almost three years before it launched its own gaming offering.

There was also the surprising sales pitch last July of “we have a long runway for growth” built off of Nielsen’s The Gauge, which highlighted how “streaming represents just 27% of US screen time” and how Netflix’s share was “just 7% of US TV screen time.” It was surprising because all growth trends then were pointing towards a slowdown, and they came true.

At the time of that letter, YouTube’s share was 6% of US TV screen time or 85% of Netflix’s share. But, Nielsen's most recent The Gauge had YouTube and Netflix neck-and-neck in August 2022 (and YouTube is on 135MM Connected TV (CTV) devices in the U.S.). And, as I highlighted recently in September’s A Short Take on YouTube Shorts, “YouTube seems poised to capture more valuable CTV and streaming ad dollars with ‘premium content’ at a time when Netflix and Disney are trying to build a story for advertisers at a smaller scale.”

Given that Hollywood’s future seems to lie in the Creator Economy - one of PARQOR’s themes for Q4 2022 - it’s worth asking what Netflix will and won’t be saying about this evolving competitive threat.

Key Takeaway

Netflix will have less to offer advertisers than YouTube its closest competitor on CTV screens, and increasingly less as YouTube's bet on Shorts creators shifts to Connected TVs.

Total words: 1,400

Total time reading: 5 minutes

The Competitive Threat Has Evolved

It’s an interesting question of what exactly is the competitive threat that YouTube Shorts presents for Netflix. The obvious challenge seems to lie in CTV where YouTube has nearly 2X the devices to Netflix’s current U.S. subscriber base (an estimated 67MM), and where the majority of Netflix consumption takes place in the U.S.

YouTube is going to support YouTube shorts within its smart TV app, too. Putting the two and two together, YouTube is expanding its inventory of content for advertisers across mobile and CTV devices. It’s also worth noting that TikTok - which has over 1B users worldwide, and 136.5MM users in the U.S. - has also been expanding its CTV distribution, according to a recent job posting in August. So, both competitors to Netflix are growing their presence across platforms, competing with Netflix for attention for streaming and gaming on mobile, and attention for streaming only on CTV.

So, one question Netflix management may feel compelled to answer is how to compete with the scale of YouTube’s free CTV offering as YouTube pivots towards Shorts. Because now Netflix will be competing with multiple formats from YouTube, and has no obvious answers for Shorts.

The deeper challenge from Shorts

I’ve been enjoying a newsletter on the creator economy called ICYMI by Lia Haberman, and last month she highlighted some takeaways from the Made on YouTube event, and one that she highlighted as “key”:

The Shorts algorithm and the long-form algorithm will “speak to each other.” So someone who watches a Shorts video on a particular topic could be served up long-form content around the same topic. “That connectivity exists and we’re going to continue to build on it,” Amjad Hanif, YouTube’s VP of Creator Products told the audience. That means more discovery opportunities for all creators.

I haven't seen much coverage on this point, and it is indeed a “key” one for another reason Haberman doesn’t mention: it implies Shorts isn’t just another format for 135MM CTV device users to consume on their TVs. Rather, it’s effectively saying to consumers, “watch Shorts to build a better YouTube experience.” Shorts aren’t an either/or choice, they’re now integral to the YouTube experience.

Netflix’s vulnerabilities to YouTube Shorts

All reporting suggests that YouTube is gunning for TikTok, and not for Netflix. Protocol’s Janko Roettgers recently wrote, “YouTube has a massive advantage over TikTok on TVs. YouTube’s app is installed on virtually every smart TV these days, while people have to actively seek out TikTok’s app — something few people may feel inclined to do, due to the assumption that TikTok is a mobile-only service.”

But Netflix is still vulnerable in two ways. The most obvious way is that YouTube is a neck-and-neck competitor to Netflix on U.S. Connected TVs, according to Nielsen. Assuming Shorts is as potent as YouTube believes it to be as a format on CTV as it is on mobile - 30 billion daily views and 1.5 billion logged-in viewers watching a month - then Netflix faces a new competitive dynamic across mobile and TV for which it will have no answers.

Its bet on Basic with ads seems most vulnerable. YouTube has told advertising agencies that it expects to have roughly 4.4MM worldwide viewers on its ad-supported tier by the end of 2022, and 40MM by Q3 of 2023. There is little reason to believe that they have not built the popularity of YouTube Shorts into their financial models that estimated these outcomes.

Then again, if you’re an advertiser comparing Netflix’s Basic with ads offering and YouTube, there are two extraordinary advantages in YouTube’s favor.

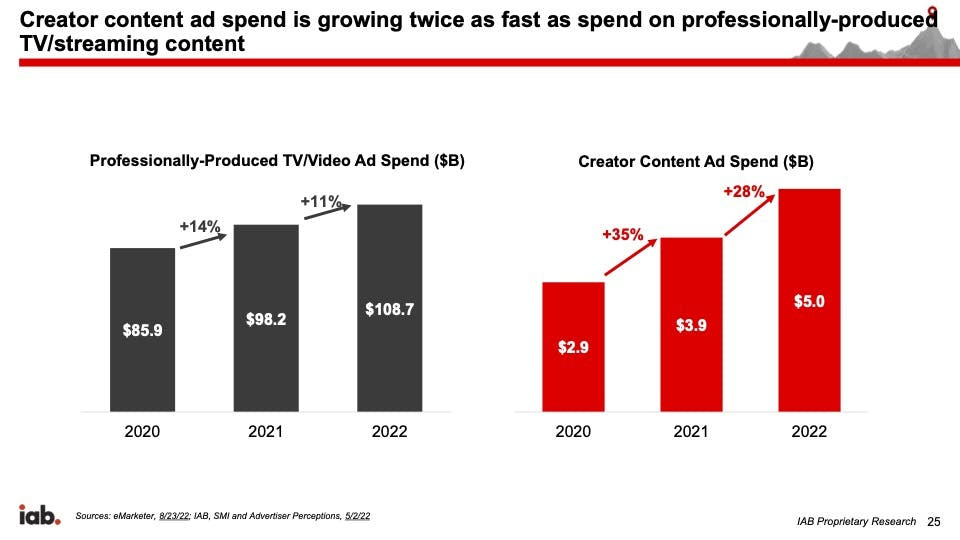

First, YouTube, alone, is managing nearly $30B in ad spend per year (as of 2021). Meanwhile, Netflix's ad tier has yet to launch and its partner Xandr has been reported to manage 1% of that ($300MM to $380MM in 2021). Second, in a presentation at the IAB Brand Disruption Summit 2022 by Chris Bruderle, IAB’s Vice President of Research & Insights, highlighted, ad spend on creator content is growing 2x as fast as spend on professionally produced content.

Advertisers are going to go where their audiences are, and they’re on YouTube consuming creators who are increasingly delivering faster, cheaper and better versions of "premium" than legacy media's models.

So how can Netflix speak to YouTube?

“Well, it’s a bitch,” is what Netflix Chairman and Co-Chief Executive Reed Hastings told employees after a brutal stock price decline back in April. It’s not unreasonable to assume he had the same reaction to YouTube’s recent news:

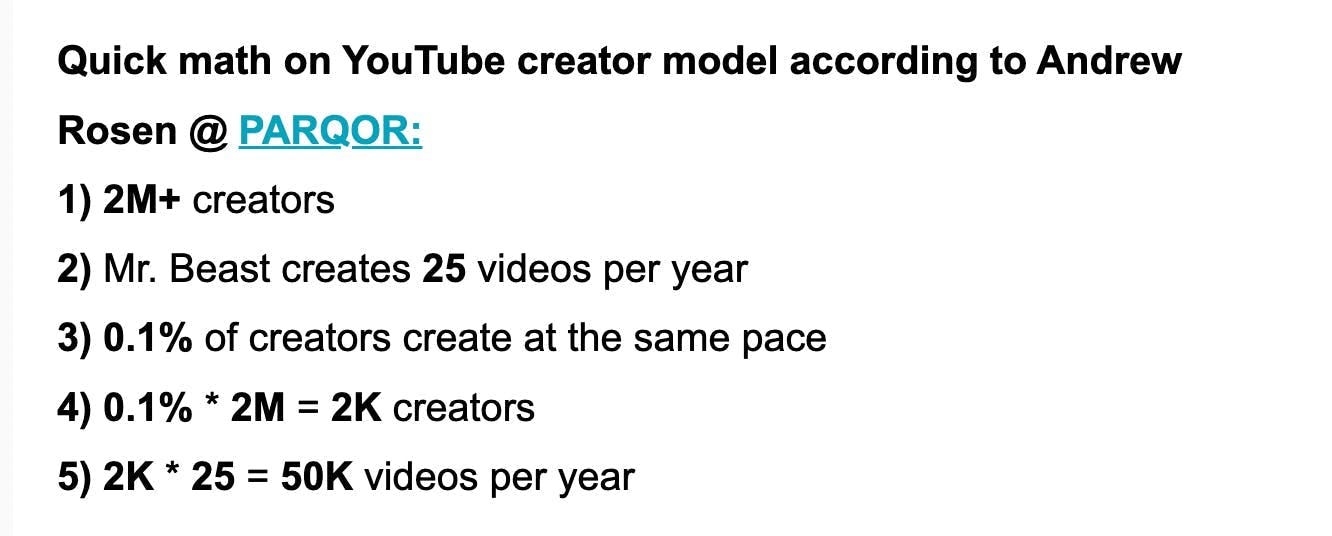

Netflix's closest competitor in CTV will now have more content, more creators, and more recommendations for CTV users. Last week I highlighted an elegant summary of my math for YouTube’s creator economy advantage from Michael Beach of Cross Screen Media in the State of The Screens newsletter (which I highly recommend):

In legacy media TV series terms, that’s 2,000 content creators producing three 8-episode streaming series per year. In Netflix terms, that’s 17K titles (which is around or just over the titles it has in its library worldwide).

With its expansion of the Partner Program - which helps these 2MM creators monetize their content - YouTube envisions over 3MM content creators monetizing their content both in short form and long form. If advertisers increasingly agree with the premise that YouTube creators produce more “premium” content that audiences consume, YouTube seems poised to have exponentially more scale with premium content on CTVs than its legacy media competition.

That said, Jeremi Gorman – Netflix’s new president of worldwide advertising – recently said Netflix had nearly sold out its inventory for the initial launch globally with “hundreds” of different advertisers in categories including automotive and consumer packaged goods (though they’ve openly complained about Netflix’s ask for $65 CPMs and perceive it as “a ceiling from which buyers would negotiate downward”).

So, if Netflix says anything, it’s going to be about how it’s better positioned to make CTV advertisers happy better than its legacy media competition, who are more vulnerable to YouTube, TikTok and Netflix. There's no reason for them to mention YouTube when it has more scale in the U.S. But, anything to distract Wall Street from the growth of the creator economy will be necessary.

Must-Read Monday AM Articles

* Coming Soon on Netflix: A New Netflix by Bloomberg’s Lucas Shaw

* A bearish analyst take on Netflix’s ad model, and a prediction of a sale to Micrsooft by 2025 (free - registration required)

* Eric Seufert of MobileDevMemo argues why we can anticipate higher ad load (meaning, more ads per hour) on YouTube and more generally in the marketplace

The Vibe Shift

* A good interview by Meta CEO Mark Zuckerberg about the metaverse and creator economy with The Verge

* Layoffs at Gimlet and Parcast expose cracks in Spotify’s exclusivity model

The 200 vs. The 10 Million

* Ad buyers and sellers need to be fluent in both the language of TV (gross rating points, households and demographics) and the digital language of CTV (uniques, impressions and first-party-data targets). (free - registration required)

Aggregator 2.0 & Bundles

* The New York Times’ attempt at bundling The Athletic with its subscription isn’t going so well

Sports & Streaming

* The NFL still hasn’t picked a winner in its Sunday Ticket negotiations, and Apple and Amazon are vying for it.

Creator Economy, Platforms & Transparency

* The 5 behind-the-scenes stars of the creator economy of 2022, according to Fast Company

* TikTok is now capturing 25% of spend once allocated to Instagram

* YouTube rolled out handles for its creators and their channels, which help people find and engage with creators and each other.

* How TikTok has both changed and preserved artist discovery for Artists and repertoire representatives (A&Rs)

Original Content & “Genre Wars”

* Samanth Subramanian of The New Yorker dove into how Bollywood now is “flooded with stock Hindu heroes and Muslim villains.”

* Ryan Faughnder wrote about how and why media companies are filling out their streaming lineups with more network-style shows

* Family movies moving to streaming from theatrical are hurting the theatrical business

AVOD & Connected TV Marketplace

* Digiday reported Apple is preparing a more serious push into monetizing its original video content with an ad play

* The release of the Matter standard should “unlock new innovation in the smart home space”

* Roku is imminently expanding beyond streaming media and into the smart home

* Smart TV advertising-sales platform Vizio Ads reported upfront TV advertising "commitments" totaling $200 million (free - registration required)

Other

* Meta produced research about how people are now shifting their energy away from maintaining a wide array of casual connections to cultivating a smaller circle of the people who matter most.

* If you’re not following what Chicken Soup for the Soul is doing in AVOD, you might want to start paying attention