Monday AM Briefing: Nielsen's The Gauge, Netflix's Price Hike, Raise A Big Question in CTV

It was an unusual move by Netflix to embrace Nielsen's The Gauge in its Q3 2021 letter to shareholders, though unsurprising given Co-CEO Reed Hastings' public endorsement of The Gauge in Q2 2021.

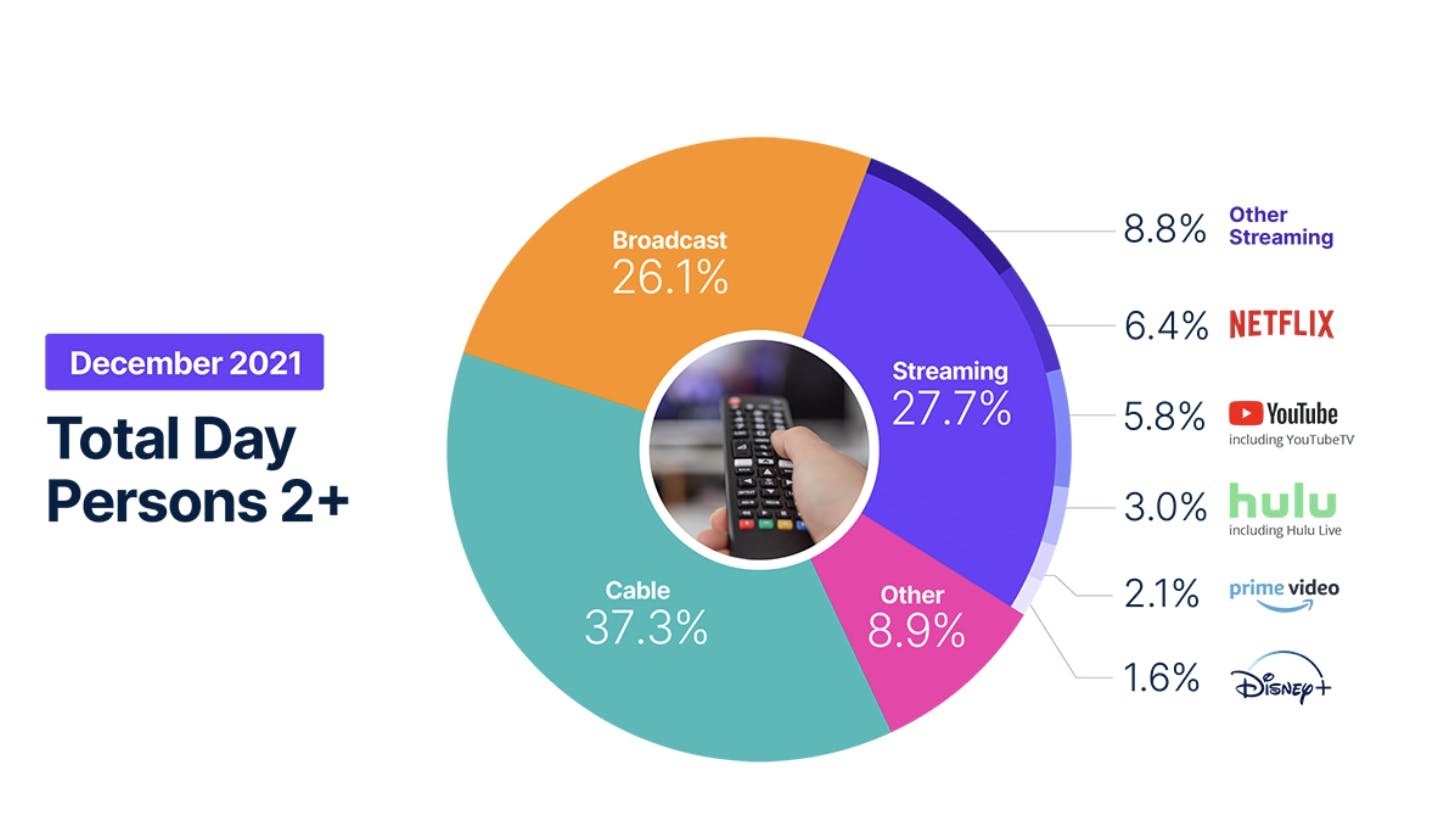

The Gauge suggests a worse story for Netflix in December than it had in May:

But, in December, Nielsen "expanded viewing share calculations to display an additional decimal of data" for the purpose of "month-to-month changes in viewing share". One challenge, then, is it has not updated the past six months of data to add decimals to past data.

So we could say Netflix's share has dropped from 7% to 6.4%, but Nielsen may have been rounding that figure up from 6.5% or more, or down from 7.4% or less in November.

We don't know if there was a drop in share as significant as 1%, or as marginal as 0.1%. But, there was an objective drop in share.

There was a spike in engagement: from a total viewing perspective, "streaming was the clear outlier during the week of Christmas, as Americans watched a total of 183 billion minutes – an all-time high – across the growing range of over-the-top platforms".

The spike in streaming viewing gave streamers a 33% viewing share of total TV viewing during the week of Christmas. Otherwise, Nielsen tells us streaming consumption was "fairly flat" compared to the 28% from November.

So, Netflix had higher engagement but lost share, which objectively reads like a scenario where Netflix is losing subscribers in UCAN but its remaining subscribers are engaging more.

It's notable that Netflix followed Nielsen's data release on Thursday with an announcement on Friday by announcing price hikes in the U.S. and Canada for all three tiers:

The company’s standard plan will rise 10% to $15.50 per month from $14,

the 4K plan will rise 11% to $20 per month from $18, and

the basic plan, which doesn’t include HD, will rise 11% to $10 per month from $9

A price hike is a logical action in the face of flat to negative growth but increasing subscriber engagement.

Both Netflix's price hike and Nielsen's The Gauge imply we are witnessing the next phase of the "pull-forward" impact of the pandemic that Netflix predicted back in April 2020, where heightened churn for Netflix and other streaming services kick in.

This should also imply the smaller players grew: according to Martin Peers of The Information, Wall Street firm MoffettNathanson published a report last week predicting that ViacomCBS’ Paramount+ and NBCUniversal’s Peacock would show the most net additions in U.S. subscribers in Q4.

But, again, streaming's share of user behavior was "flat" for the month, and cable grew share by 8% (despite evidence from Disney's 10-K and elsewhere that cord-cutting trends are driving linear households into the low 70MM range).

Moreover, Nielsen's Other category - which includes video on-demand content, cable set top box streaming, gaming, and DVD usage - "gained 1.6% share on the strength of video gaming".

Something else is going on.

Meaning, if we believe Nielsen, in December:

streaming as a share of consumer behaviors flat despite a 22% spike over Christmas week,

cable was flat,

video gaming was up, and

Netflix lost engagement in Q4 (but Nielsen won't reveal by how much).

It's a mixed signal for streamig, but is it a bearish signal?

And how do we interpret what it tells us about the road ahead in 2022, especially in light of Netflix's first price hike since October 2020?

I offer a contrarian argument for Members, only, based on one of these three signals, below.

Non-Members, click subscribe to read the rest of this Members-only, exclusive.

I think the big tell here is that streaming as a share of consumer behaviors stayed flat despite a 22% spike over Christmas week, and has stayed flat since 2018 (as per Netflix, below).

Assuming the Netflix signals in UCAN are indeed bearish, a comparison of MoffettNathanson data and Nielsen data suggests that there may have been some zero sum losses of subscribers from Netflix to Peacock and Paramount+ in the U.S.

But, the Nielsen data on its own suggests an alternative explanation that Netflix may have lost more subscribers to linear and Other, particularly video gaming, instead.

Netflix recently embraced gaming on mobile devices (NOTE: The Gauge only measures TV consumption). I wrote about this in October in After Q3 2021, Does Netflix Have the AVOD Model In Its Sights?

In that essay, I picked up on how in its in Q1 2020 letter to shareholders, Netflix compared itself to other digital media, but in Q3 2021, Netflix compared itself to TV viewing and gaming. Notably, those were Netflix's two primary competitors in The Gauge, too.

But, Netflix defines its competition more broadly in its Q3 2021 letter to shareholders:

We compete with a staggeringly large set of activities for consumers’ time like watching linear TV, reading a book, browsing TikTok, or playing Fortnite, to name just a few.

Going off of that, Nielsen's bearish signal isn't just for Netflix, it's for streaming in the U.S. in general.

Meaning, if streaming remained flat as a share of behavior after a month where its consumption jumped by 22% in one week, then we have to ask: what will drive a higher spike in streaming as a share of behaviors in the U.S.?

In both Q4 2018 and Q3 2021 letters to shareholders, Netflix noted that they were less than 10% of US television screen time, and added "We are still quite small, with a lot of opportunity for growth".

But, Nielsen is telling us is that growth is unlikely to come from streaming.Then where will growth come from in the U.S. for Netflix to top 10% now that streaming seems to have plateaued though cord-cutting has accelerated?

The seeming answer is gaming, but Netflix is betting on mobile gaming and not connected TV or console gaming.

Rather, I think last week's one-two punch of Nielsen's The Gauge and Netflix's price raise reflect a disconnect between supply and demand.

Because something doesn't add up when linear still dominates streaming in consumer behavior despite linear homes dropping 16.7% from ~90MM in 2018 to ~75MM in 2021.

I think Netflix genuinely believed it would see growth at the expense of cable by 2022 and seems surprised it is not seeing that outcome.

Demand for sports - specifically the "extraordinary" demand for the NFL - is still strong in the MVPD business. But that doesn't explain the disconnect, because live sports events are infrequent and because newcomers like Barstool Sports have built a business exploiting ESPN's weak spots in-between sports events.

So where else should we look? Hard to say.

It's not gaming.

The only available conclusion is that connected TV is starting to look ugly as a marketplace in the U.S. No one seems to be breaking through past linear's market share four years after Netflix first shared it owned 10%, and especially not the market leaders.

Something else is going on in the connected TV marketplace.

Must-Read Monday AM Articles

* Asia Pacific currently represents Netflix’s greatest opportunity for growth, and "capitalizing on its current momentum in Korea will be crucial", writes Lucas Shaw of Bloomberg

* Ryan Faughnder of the LA Times looked at HBO MAx's announced 73.8MM subscribers and asked, "is streaming actually a good business?"

* Mike Shields argues that we should start looking closer to the problem of self-reporting in connected TV advertising.

Emerging "Metaverse"-type convergence strategies

* Nickelodeon Extreme Tennis is headed exclusively to Apple Arcade's catalog of over 230 games on Jan. 21, where it will join Disney Melee Mania. a CNET Editors' Choice Award pick for 2021.

Aggregator 2.0

* Apple shared that it paid developers $60 billion in 2021 as part of announcement touting the progress of its Services business.

* Take-Two Interactive agreed to acquire Zynga for a mix of cash and stock in a deal worth $12.7 billion with an objective to solve for its pain point in mobile gaming.

Sports & Streaming

* Apple TV could carry live MLB games next season

* Sports streaming service DAZN is nearing a deal to acquire Britain's BT Sport in an estimated $800 million transaction that will give it access to sought-after rights to the English Premier League and UEFA Champions League matches

* Sinclair Broadcast Group Inc.'s sports unit secured $600 million in debt financing as it develops a streaming service that it aims to launch by the third quarter, and also renewed its deal with the National Basketball Association for the digital rights to air live games on a streaming platform.

Creative Talent & Transparency in Streaming

* Candle Media - the Blackstone-backed venture from ex-Disney executives Kevin Mayer and Tom Staggs - hired Brent Weinstein, a longtime UTA partner, and Salil Mehta, former president of FoxNext Games.

Original Content & “Genre Wars”

* Vanity Fair's Joe Pompeo dove into CNN+

Comcast’s & ViacomCBS’s Struggles in Streaming

* The Hollywood Reporter asks whether The CW Network - currently being shopped by WarnerMedia and ViacomCBS - going to be a casualty of the streaming era.

AVOD & Connected TV Marketplace

* Nielsen is helping advertisers to target CTV audiences with sharper precision, with its latest Connected TV tool, Streaming Signals (registration required).

* Jordan Rost, head of ad marketing at Roku, spoke to MediaPost's Data & Programmatic Insider about what he sees ahead in 2022. Roku has been expanding its presence in LA as it moves into original production.

* Google TV Director of Product Management Rob Caruso spoke with Protocol about the future of the platform. Decider's Scott Porch sat down iwth Samsung’s Lydia Cho, head of product marketing, and Dan Schinasi, director of product planning, to discuss user interface upgrades to Samsung TV.

Other

* WarnerMedia ad sales president JP Colaco told the TV of Tomorrow Show consumers had been enticed to “sign up in droves” for its cheaper, ad-supported tier.

* fuboTV CEO David Gandler told the Needham Virtual Growth Conference that sports betting is tough to be differentiated in because it is “100% saturated, there is no loyalty.”

* Redbox CEO Galen Smith showed investors at the Needham Conference how Redbox is trying to capture content consumers at every price point and through every avenue, from Premium Video on Demand (PVOD) to FAST.