Monday AM Briefing: Paramount+ & Ubiquitous Distribution, Verizon Expands Its "Aggregator 2.0" Bundle

Paramount+ & Ubiquitous Distribution

I was interviewed by The Verge's Catie Keck last week for an article about the future of Paramount+ in "Paramount Plus is still figuring out Paramount Plus".

To prepare for the interview I re-read the transcript of the Q4 2021 earnings call, and I realized I'd missed a fascinating detail about its go-to-market plans for scaling Paramount+. President and CEO of Streaming Tom Ryan was the first to mention "hard bundles":

To scale most effectively, we’re creating customized go-to-market plans for each region, with tailor partnerships, marketing and distribution strategies, and even product offerings. We’re deploying hard bundles, where we work with a local provider to give their customers immediate access to Paramount+, as well as direct-to-consumer and à la carte distribution or sometimes a hybrid of all three.

CFO Naveen Chopra later added some color to this term:

Second, when it comes to distribution, we’re also running with a differentiated playbook, combining the top notch consumer experience and massive addressable market of streaming with the attractive economics of the traditional cable model. At a time where our partners are focused on using streaming services to further leverage their broadband presence and expand customer offerings.

Take our hard bundle deal with Sky or the deal we announced today with Canal+, where Paramount+ is instantly distributed to millions of Sky cinema or Canal+ customers. While ARPU is lower than in our direct-to-consumer channel, it’s higher than linear TV, subscribers scale very quickly, we incur no customer acquisition, billing or support costs and we eliminate the risk of churn when series reach end of season. This play is enabled by our longstanding relationships with global MVPDs and the data differentiated value proposition of Paramount+.

And of course, these hard bundle relationships let us maximize reach by complementing our higher ARPU direct channels and customers we acquire through streaming platforms like Amazon, Roku and Apple.

If it isn't clear from these two quotes, they are both saying that Paramount Global will not build scale Paramount+ as a purely Direct-to-Consumer business. Instead, "hard bundles"- which effectively Paramount+ the equivalent of a cable channel on Sky Cinema and Canal+ - will be a key element of what CEO Bob Bakish labeled "ubiquitous distribution":

So, look, if you look at the history of the company, you see that we’ve long been a believer in ubiquitous distribution and executed in that way. And so as we look at the D2C space, we believe ubiquitous distribution is a powerful lever to pull to drive access to largest potential TAM.

Now, in doing so we believe you need to combine -- a strategy that’s really multifaceted and this is where you see us pursuing hard bundles, channel stores and pure D2C. And each of the strategies have different characteristics, but in totality, they’re very powerful.

So on the hard bundle side, notably exemplified by Sky and by the Canal+ deal, we announced today, there’s an opportunity to get very quick sub base at a very low subscriber acquisition cost, with minimal churn going forward. So we like that a lot as we begin to build scale.

You look at the channel store side that provides access to a flow of traffic, you’re paying a little bit higher cost of sales, but again, a nice chunk of users and then you get D2C, which gives you the highest ARPU and gives you access to the full marketplace. We think that put together creates the highest growth sub base with the most stability over time, and again, allows us to work with partners of different shapes and sizes, in building our streaming business.

Effectively, "ubiquitous distribution" means that to reach competitive scale with international DTC heavyweights like Netflix, Disney+ and HBO Max, Paramount+ is not being built as an international DTC service. If that means lower ARPU and higher net cost of sales, so be it: scale is the objective and hard bundles are necessary to achieve it.

Given that the original objective for Paramount+ was to compete internationally with Netflix and every other legacy media DTC streaming service, Paramount has effectively thrown in the towel in competing in DTC. Instead, it is focused on both the business objectives of scale (100MM subscribers by 2024) and better monetizing their users.

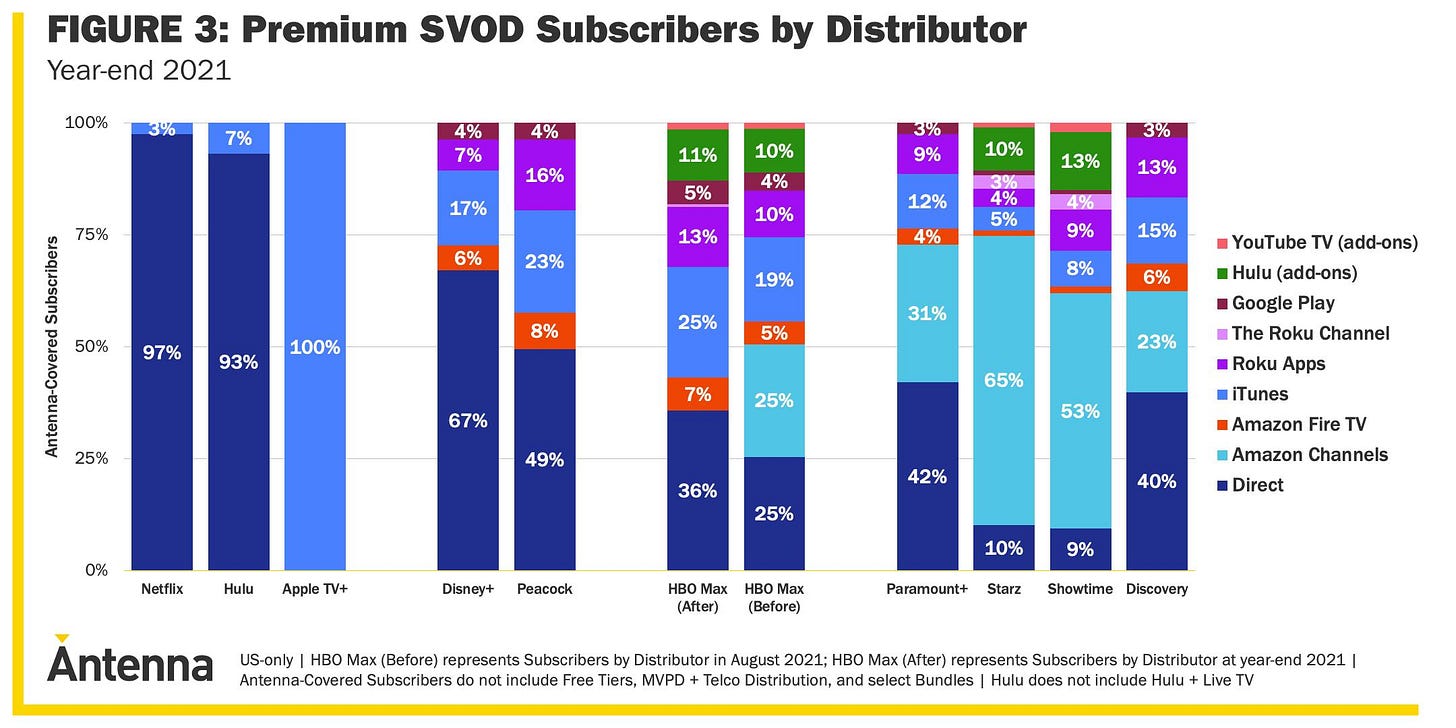

In other words, I think they are effectively conceding to Wall Street that they are a Wholesale company unable to make the leap into Retail, and marketing is a pain point for which they cannot solve. According to Antenna's Year in Streaming Report, third-party channel stores accounted for 58% of Paramount+'s subscriber base in the U.S. in 2021:

The headscratcher is, why will Paramount lose $1B per year in operating income through 2024 to become a "ubiquitous distribution" platform that relies so heavily on third-party platforms, and not to build better DTC relationships with its consumers? Why is it an either/or choice?

Strong DTC relationships are crucial to a strong media business model in 2022 - something that the PARQOR Hypothesis both argues and highlights. Also, Disney and HBO Max have cancelled Channels distribution relationships - including HBO Max's year-long stand-offs with Roku and Amazon in 2020 - because they will not own the customer relationships in those models.

Instead, Paramount has ceded ownership of direct-to-consumer relationships to channels and hard bundles, and that alone seems notable. This doesn't imply whether "ubiquitous distribution" is the right or wrong strategy. But, it is a significant departure from the strategies that market leaders are pursuing in streaming.

Verizon Expands Its "Aggregator 2.0" Bundle

There was an eyebrow-riasing announcement from Verizon this week about its new +play service, exclusive to Verizon subscribers:

...to discover, purchase and manage some of their favorite subscriptions across entertainment, audio, gaming, fitness, music, lifestyle and more – all in one place. Through new partnerships with Netflix, Peloton, Live Nation’s Veeps and featuring leading services like Disney+, discovery+, A+E Networks, AMC+ and many others, the hub will give Verizon customers a simple and efficient way to access and take advantage of exclusive deals for content services.

It is a step forward in their "aggregator 2.0" bundling model, which I first wrote about last July in First-Party vs. Third Party "Aggregator 2.0" Bundles:

“Aggregator 2.0” bundles offer “the ability to personalize offerings like never before, mixing and matching television, news, e-commerce, gaming, health, and any other service that charges a monthly or annual subscription rate.”

The question is whether this is a smart next step for Verizon.

[Author's Note: This section will be exclusive to members, only.]

This may be what Verizon CEO Hans Vestberg was hinting at when he told the virtual UBS Global Technology, Media and Telecom Conference last month that there "is probably more to be done there":

“We are positively surprised about the stickiness and how customers have stayed with the services and the retention,” including when rolling them over to paying service, Hans Vestberg told the virtual UBS Global Technology, Media and Telecom Conference.“We are very happy with that model and there is probably more to be done there,” he reiterated. “We now have streaming services, we have gaming services, we have music services, and let’s see what we can do more.” He added that these bundles were “a key differentiator from anyone that is in the market” that provides customers “more value, more optionality.”

But that model seemed more decentralized, offering users the ability to bundle - at will - within the "Manage plans and services" option of their Verizon accounts.

As Verizon describes it, "+play is a unique digital hub designed to centralize subscription services at no additional cost to Verizon customers". So, the user experience has been simplified.

Also, +play will expand its offerings from its existing partners to include "new partners, including Netflix, Peloton, Veeps concert livestreams, WW International, Inc., A+E Networks (Lifetime Movie Club, HISTORY Vault, and A&E Crime Central), The Athletic, Calm, Duolingo, and TelevisaUnivision’s Vix+, among many others."

In short, Verizon is both simplifying and expanding its bet on "Aggregator 2.0": "customers will have one location to manage all their streaming services, and participating providers will be able to use +play to easily reach Verizon's massive customer base."

Is this a Good or Bad Bet?

Mike Dano of LightReading argued that "Verizon's error here is its seemingly intractable belief that it should have a role in the streaming video market."

I think Dano is both right and wrong here. I think he is wrong because, like AT&T and T-Mobile, Verizon has proven it has a better understanding of the streaming customer than legacy streamers moving from Wholesale to Retail models (like Paramount+, above): It plays an invaluable role in driving growth and reduce churn for these services.

Also, as I argued in Markets Cool to Warner Bros. Discovery:

The mobile subscription model is growing mobile accounts and minimizing churn, and Verizon has proven that a model relying on a portfolio of third parties may offer more lasting value to consumers than the variable costs (which were to the tune of hundreds of millions for AT&T) of owning one of them.

Where I think Dano gets it right is pointing to how Verizon has failed when it has tried to play a more central player in the video space. His two examples are 2007's MediaFlo (with Qualcomm) and and 2015's Go90, both of which failed.

In other words, Verizon's shift from a passive to active role in a marketplace has historically introduced friction into its relationships with customers. It is not yet clear what +play will become.

If it is simply replacing the "Manage plans and services" option of Verizon accounts, then it's an easier-to-use version of that option. But, if it aims to be its own app store or "bloatware" on Verizon Android devices, it may be back to the future for Verizon.

Must-Read Monday AM Articles

* Streaming Media Blog's Dan Rayburn shared data from a Salesforce survey that 58% of OTT Services Surveyed Have “Limited” to “No” Insight Into The Main Reasons for Churn

Emerging "Metaverse"-type convergence strategies

* Epic Games bought online record store and music community Bandcamp. Music Industry Blog outlined what Epic could do with Bandcamp. An essay from September 2021 outlined how Bandcamp is a good example of Epic's arguments against Apple's App Store model in Epic v. Apple.

* Vice reports an internal culture war is playing out across the video game industry, with developers (and players) pitted against executives and crypto evangelists.

Aggregator 2.0

* YouTube is reaching out to podcasters and podcast networks, offering “grants” of up to $300,000 to entice them to create video versions of their shows.

* Netflix has announced “Trivia Quest,” a new daily interactive trivia series based on the hit Etermax mobile trivia game app “Trivia Crack,” and will premier April 1.

* Maureen Polo, who has been an exec at WarnerMedia and GM of streaming service Fullscreen, has been named to a newly created role of head of direct-to-consumer at Reese Witherspoon’s Hello Sunshine. She will oversee the growing DTC portfolio.

Sports & Streaming

* WarnerMedia will be the new home of United States men’s and women’s soccer games beginning in 2023 in an eight-year agreement that sources say is for around $200 million. All non-World Cup and CONCACAF national team games will be on WarnerMedia’s streaming service, HBO Max, while the biggest games will also air on TNT.

* Apollo Global Management, which acquired Yahoo from Verizon for $5 billion last year, is having preliminary discussions with sports-betting companies to merge their assets with Yahoo Sports, according to people familiar with the matter.

Creative Talent & Transparency in Streaming

* Agents are navigating an increasingly crowded market of A-listers and big tech platforms as more clients debate whether to ink an exclusive deal with Spotify or Amazon/Wondery, or brave the open advertising market.

* Several sources told The Daily Beast that aspects of Season 2 of HBO Max's "Euphoria" production were hellish, with some describing the work environment—particularly in certain departments—as toxic.

* Business Insider had a breakdown How much money YouTubers make, according to dozens of creators

Original Content & “Genre Wars”

* NBCUniversal officially terminated its next-day TV streaming deal with Hulu, clawing back streaming rights for its current-season TV shows to Peacock.

* Nielsen says that in its first three days, Amazon Prime Video's Reacher racked up 1.84 billion minutes of viewing time for its eight episodes, more than the previous high, The Wheel of Time, at 1.16 billion minutes in November 2021.

* ITV will replace ITV Hub with a brand-new streaming service titled ITVX later this year. There are two tiers available: the advertisement-funded and ad-free options, with the latter offering content from other partners such as BritBox. ITVX will stream the broadcaster's many channels live.

* Netflix is hiring Condé Nast and Time Inc. journalists for its Tudum publication, in part to cultivate fandoms around specific shows and build on that direct connection they have with consumers ($ - paywalled)

* Sony Pictures will acquire a majority controlling interest in Industrial Media - whose portfolio includes "American Idol" and "90 Day Fiancé" - based on a purchase price which values the company at $350M. Sony’s stake is believed to be close to 100%, valuing the deal at more than $300M.

* Existing and new Crunchyroll subscribers will now have access to library and simulcast content previously available exclusively to Funimation.

Comcast’s & ViacomCBS’s Struggles in Streaming

* N/A

AVOD & Connected TV Marketplace

* N/A

Other

* Bitmovin's Annual Video Developer’s Report found that H.264 usage actually dropped, from 92% to 83%. AV1 increased from 11% to 15%, far lower than the 22% predicted in last year’s survey (which I wrote about in YouTube's Q4 Earnings & The Quiet Revolution of the AV1 Codec).

* Why dubbing has become more crucial to Netflix’s business (which I wrote about in Netflix & Dotdash, Imitated But Never Replicated by Condé Nast)