Monday AM Briefing: Two Objectives for 2022 & The Curse of the Mogul Strikes Back in 2022

Two Objectives for 2022

Happy New Year!

It's a new year for PARQOR on a new platform. I want to take a moment to share two key objectives for 2022:

Objective #1

To further build out and flesh out our value propositions of:

Revealing insights (our new tagline), and

Anticipating market developments

I started reading Maria Konnikova's The Biggest Bluff over the holiday. A passage about why John von Neumann, the father of game theory, was inspired by Poker to write Theory of Games and Economic Behavior reminded me of PARQOR's tagline (emphasis in bold added):

Poker has a mathematical foundation, but with a dose of human intention, interaction, psychology — nuance, deception, little tricks that don’t quite reflect reality but help you gain an edge over others. Humans aren’t rational. Information isn’t open to all. There are no “rules” of behavior, only norms and suggestions — and within certain broad constraints, anyone might break those norms at any point. The games that interested von Neumann are the ones that, like life, can't ever be mapped cleanly. Real life is based on making the best decisions you can from information that can never be complete: you never know someone else's mind, just like you can never know any poker hand but your own. Real life is not just about modeling the mathematically optimal decisions. It's about discerning the hidden, the uniquely human. It's about realizing that no amount of formal modeling will ever be able to capture the vagaries and surprises of human nature.

I think this quote adds valuable color to our value proposition: PARQOR's new tagline "revealing insights" is synonymous with "discerning the hidden".

PARQOR's focus on executive incentives helps to reveal "the uniquely human" beyond what seems "mathematically optimal".

A better understanding of an executive’s incentives to deliver a promised outcome is perhaps the most valuable insight one can have in anticipating future market developments.

The goal in 2022 is to be create more products and to be more active on more distribution channels to deliver those insights. The fun challenge will be to extend the insights gleaned from the media marketplace, to date, and to begin applying those insights more broadly to executives in other marketplaces.

Objective #2

To leverage the back-end of The Information and expand Membership into a broader, more premium offering.

One fun option I have available is paywalling certain content within mailings for Members, only. Today's mailing is the first use of it.

I will be running more experiments with talks, events and new products over the coming year, so please keep an eye out!

The objective is more value in exchange for exclusivity.

I have been doing weekly Twitter Spaces about Member Mailings with Morning Brew's Brandon Katz (Thursdays at 2pm), and our plan is to do more of them in 2022.

ICYMI, I sent out Lessons From 2021 to everyone, and Predictions for 2022 exclusive to Members, only.

To read these Predictions, and both the essay and Top 5 Highest-Converting Member Mailings of 2021, below, sign up for a membership by clicking the "Subscribe" button.

Top 5s of 2021

The Top 5 Most-Read Free Mailings of 2021:

Robert Iger, Mark Zuckerberg & Vision (October 2021)

A Short Essay on MLB’s, NBA’s & NHL’s Potential Streaming Solution for RSNs (October 2021)

A Short Essay on Bobby Flay's post-Food Network Future (October 2021)

Hello Sunshine, Curse of the Mogul & "G" (August 2021)

A Short Essay on NBCU’s Possible New Streaming Service (March 2021)

The Top 5 Highest-Converting Member Mailings of 2021:

HBO Max's bet on Snyder Cut: Justice League, Disney's bets on Hulu & Star (February 2021)

Key Themes from 2021 (as of Q3 2021) (August 2021)

Churn & “Consistently Good” Content (June 2021)

Disney, Sinclair & The Sports Streaming Consumer (June 2021)

Netflix & Verizon Test Bundling Streaming with Gaming (June 2021)

Two quotes from the last week of 2021 struck me as related and worth highlighting to start 2022.

The first was from The Financial Times in Streaming wars drive media groups to spend more than $100bn on new content:

The top eight US media groups plan to spend at least $115bn on new movies and television shows next year in pursuit of a video streaming business that loses money for most of them.

Ampere Analysis projects SVODs drove total content spend in 2021 past $220B.

The second is from an anonymous Marketing Executive interviewed in The Ankler's The Exit Interviews — 2021's Final Word:

Some would say, "Movies may be having a hard time, but overall for entertainment, this is the best of time, more money flowing than ever, more chances to make more things."I think that is true, but requires a dot, dot, dot, at the end of the sentence, which says: but what if there's just too much to consume?

What is the danger of that?The danger of that is that nothing cuts through, that you do not have any communal experience. You have to ask yourself, are we only going to hear about content through our peers? How are things going to reach any form of mass audience? These things cost too much money to deepen niche audiences.

So, content spend is escalating, while the risk of "nothing [cutting] through" to mass audiences is escalating. $115B in content spend in 2022 with fewer guarantees of success, if not an increasingly opaque definitions of success emerging.

The Curse of the Mogul strikes back in 2022!

Below is a short essay available to members, only, on two key implications for the broader media marketplace in 2022.

Sign up below to read it, and to get access to top 5 Member Mailings of 2021, above.

The Curse of the Mogul Strikes Back!

[NOTE: the following section will be visible to PARQOR Members, only]

The Curse of the Mogul highlights instances where media company CEOs may be rewarding content creators at the expense of shareholder value.

The Curse of the Mogul also helps to identify Media CEOs who believe the media industry is not subject to traditional strategic, financial or management appraisals.

According to the two quotes above, content spend is going up, but higher content spend may not result in consumption of more expensive titles, at scale.

That will not always be true: Netflix's content spend is going up to $17B in 2022, and it is seeing hits in Hollywood star vehicles like Red Notice (~$200M budget) becoming the most-watched movie titles in Netflix history.

That said, Netflix also had an expensive flop in Jupiter's Legacy (also, ~$200M budget) which still ranked on top of the Nielsen charts for two weeks in May. [1]

So, the challenge for every streaming service will be growth in the U.S. –which is tapering off according to Kantar – while hoping for Jupiter's Legacy-type Nielsen numbers for their flops (unlikely, but possible). This means, overpaid and increasingly in-demand creators are likely to reap more benefits from content spend in 2022 than shareholders of the top eight US media groups.

I wrote in the Member Mailing Why Growth in Streaming May Be Too Expensive for Shareholders:

An investment in new software is a sunk cost with minimal marginal costs associated with management and updating. But as Disney's planned 30% YoY increase in spend reflects, content investment is the same sunk cost repeated annually and growing.

Legacy media companies seem to be wasting both capital and shareholder value on an inefficient business model, an increasingly undefined target customer, and an increasingly uncertain terminal value. That is not immediately evident, but it is a logical implication of a continued plateau in streaming subscribers.

This market plateau has exposed how the ambition of legacy media businesses to evolve into software businesses is less a growth story, and increasingly a story about growing long-term risks from increased content spend.

Legacy media companies seem to be wasting both capital and shareholder value on an inefficient business model, an increasingly undefined target customer, and an increasingly uncertain terminal value. That is not immediately evident, but it is a logical implication of a continued plateau in streaming subscribers.

If the quote from the anonymous Marketing Executive in The Ankler is indeed prescient (and I think it is), two trends are shaping up to play out in 2022:

We will see less, and not more, transparency in streaming.

Nielsen's The Gauge – which highlights the interplay of streaming services with YouTube and gaming on Connected TVs – may end up being the most valuable lens for understanding whether increased content spend matters at all in the U.S. in 2022.

Must-Read Monday AM Articles

* The Hollywood Reporter's Scott Roxborough writes that "The worldwide consolidation of independent producers looks likely to continue in 2022 as the global streaming boom pushes up both demand and budgets for film and TV series."

Emerging "Metaverse"-type convergence strategies

* Will Oremus wrote about the Metaverse in The Washington Post, and how "Meta’s ‘Horizon Worlds’ app, Microsoft and Roblox are capitalizing on a buzzword that’s far from reality". Author Wagner James Au, founder of New World Notes, the longest-running metaverse news/culture site, offered this interesting response about the challenges of Metaverse-type interoperability:

* Xbox's Phil Spencer told Protocol's Nick Statt he thinks Minecraft is a blueprint for the metaverse

Aggregator 2.0

* Brooks Barnes of The New York Times wrote about the growing rosters of stars in Hollywood movies:

In a severely disrupted marketplace, stars are seeking safety in numbers; no one person can be held responsible for failing to deliver an audience, as with “Nightmare Alley.” Movie marketing has also changed, becoming less about carpet-bombing prime-time TV with ads and more about tapping into social media fan bases.

* Business Insider dove into HBO Max's podcast strategy ($ - paywalled).

Sports & Streaming

* Major League Soccer is seeking $300MM for its rights, but may not get it due to "ok" ratings relative to other leagues.

* JB Perrette, Discovery’s president and CEO of streaming and international, acknowledged to Deadline "the company’s struggles in the sports arena even as it has gained scale in recent years."

Creative Talent & Transparency in Streaming

* Fast Company offered Five predictions for the creator economy in 2022

* Bloomberg's Tara LaChappelle asked about the future of Hollywood compensation after streaming, "Will the Stars Ever Make Money in This Town Again?"

Original Content & “Genre Wars”

* At least half of European Netflix and Amazon Prime subs’ viewing time could be spent watching non-English language content by 2030, according to leading analytics firm Digital-i.

*Forbes' Scott Mendelson argues "the ability for Netflix to pull in huge viewership with franchise-free star vehicles like Red Notice or Bird Box along with or new or new-to-you television sensations like Squid Game (1.65 billion hours in the first 28 days) and Bridgerton (625.5 million hours in the first month) means that they really don’t have to crawl with the IP mud or even try to make franchises at all."

Comcast’s & ViacomCBS’s Struggles in Streaming

* Parks Associates shared that "ViacomCBS's successful rebrand and content-fueled reformulation of CBS All Access into Paramount+ have allowed it to leapfrog Apple TV+ into seventh place behind ESPN+, and time will tell if the service will break into the top 5."

* Cynthia Littleton argued "It seems likely that under the Biden administration, the biggest of the Big Media pack — Disney and Comcast — would have a hard time pursuing major M&A deals without having to slim down first through asset divestitures."

AVOD & Connected TV Marketplace

* Business Insider predicts 2022 is "shaping up to be a big year for advertising M&A".

* Kantar reported "Four of the biggest ad-supported video on demand (AVOD) platforms in the U.S. generated $3.5 billion in advertising revenue in the 12 months leading up to September 2021."

Other

* Redbox plans to run digital video ads on nearly 4,000 of its trademark DVD rental kiosks across the U.S. — inventory it hopes to sell to Hollywood studios as well as national and local marketers.

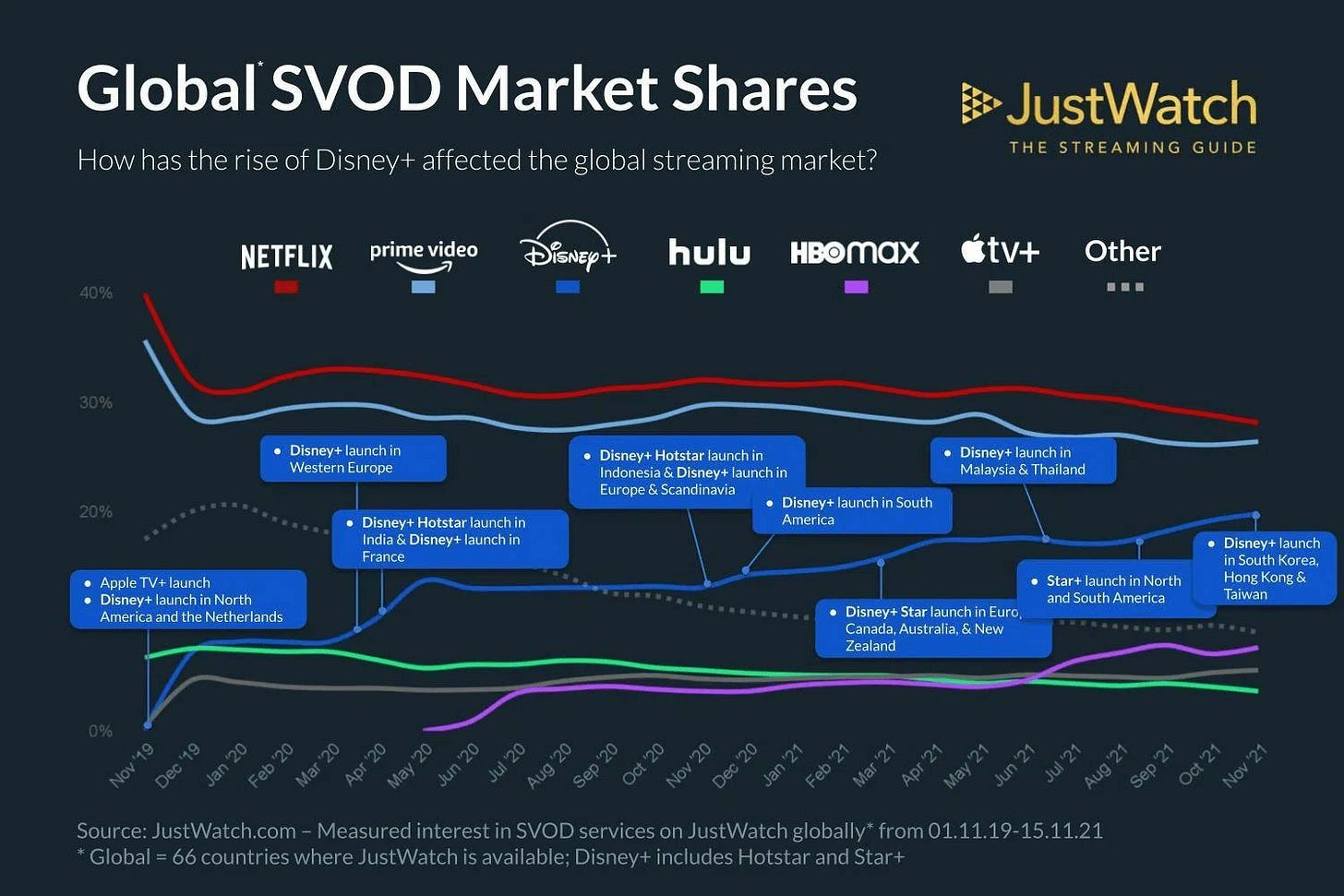

* This timeline provided by JustWatch depicts the global SVOD market shares including Disney+ as it became available in countries throughout the world.

Footnotes

[1] I wrote about this in Jupiter's Legacy Marks Another Failure for Netflix's Big Bet on Owned IP back in June.