Good morning!

The Medium identifies a few key trends each fiscal quarter that reveal the most important tensions and seismic shifts in the rapidly and dramatically changing media marketplace. The key trends help you answer a simple question: "What's next for media, and where's it all going? How are the pieces lining up for business models to evolve, succeed, or fail?"

Read the three key trends The Medium will be focused on in Q3 2023. This essay focuses on "Legacy media companies are throwing in the towel on their bets to own the consumer relationship in streaming and beyond".

As some of you may know via X (née Twitter), I added a correction to Thursday’s essay:

Xumo is a joint venture between Charter and Comcast, only. Cox is not part of the joint venture. Cox has been licensing the Xfinity Flex platform for its Contour Stream player. So the more accurate version of my argument is that Charter may be negotiating on behalf of Comcast and Cox via the shared Xfinity Flex platform, and not via Xumo. I apologize for the error.

That said, the mistake highlights an interesting question: How exactly will the Xfinity Flex platform—whether within the Xumo or the Cox ecosystems— benefit from this standoff?

I wrote on Thursday: “As long as Disney needs Charter for both wholesale and retail distribution — and all signs from this negotiation suggest that it needs it badly for both — it also will need Comcast and Cox.” There is an important detail here: Each cable distributor still owns their respective relationship with their customers. The Xumo joint venture licenses Flex-operated devices and associated voice-controlled remotes from Comcast and renames them with the Xumo brand. In the Cox partnership, Cox licenses the Xfinity Flex software from Comcast for its Contour Stream player.

But, a Cox customer using Xfinity Flex is not a Comcast customer, nor is a Comcast customer using a Xumo-branded device a Charter customer. In the wholesale linear model, the consumer needs a connection and cable box to access Disney Channels. In the retail model, the consumer needs a broadband connection to access high speed Internet. But, the consumer does not need an Xfinity Flex device to stream Disney+, Hulu or ESPN+.

Key Takeaway

A bold bet by Comcast on its Xfinity Flex platform seems to be at the heart of the Charter dispute with Disney. But the dirty secret is that the platform is not yet necessary for consumers or a necessary path for Disney to the consumer.

Total words: 1,100

Total time reading: 4 minutes

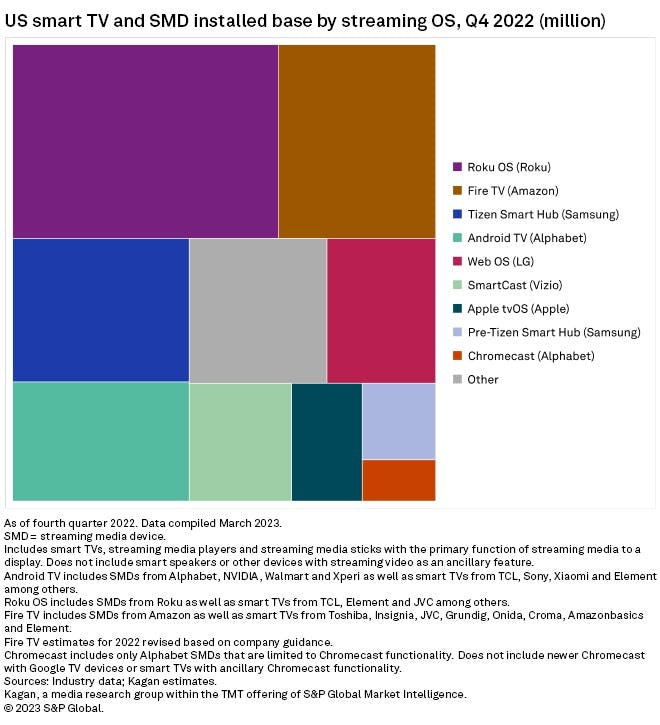

Those consumers can still stream Disney apps via Roku, Amazon Fire TV, Android TV or other Smart TV and/or connected TV device manufacturers, as this chart from research firm Kagan reflects.

For all the talk from Comcast CEO Brian Roberts of “the consumer wants simplicity, somebody to help aggregate and have the most bang for their buck”, the dirty secret is that Xfinity Flex platform is not yet necessary for consumers or a necessary path for Disney to the consumer.

Revisiting Charter’s Offer

Disney had asked for market rate increases on its linear channels and Charter granted those but with three additional requirements:

Lower penetration minimums to enable “à la carte” options for linear customers

“Inclusion of Disney’s ad-supported direct-to-consumer (DTC) apps within its packaged linear products for free “so the customer does not have to pay twice for similar programming”

Charter will market Disney DTC products to its broadband-only customers.

Disney walked away from these negotiations based on these proposals. The question in light of the above is, why?

I think there are two reasons. First, and somewhat ironically, the third bullet point is not compelling. Yes, Charter can market the Disney DTC products to its broadband-only customers. As of Q2 2023, Charter had 32.2 million total customers of whom 30.6 million are broadband customers.. It told investors 53.1% or 17 million were residential non-video customers. 46% or 14.8 million of 32.2 million customers were one product, only, consumer relationships. So the reasonable assumption is that, whatever the total of single product broadband customers may be, it is certainly less than 14.8 million, or less than 30% of its Hulu subscriber base of 48.3 million.

Also, the proposed conversion funnel assumes all homes have Charter's Xumo devices. As the research from Kagan highlights, Disney is better off with marketing partnerships with Roku, Amazon, Google and Samsung. This is a nice to have, but not a game changer for achieving scale.

Second, the inclusion of Disney’s ad-supported direct-to-consumer (DTC) apps within Charter’s packaged linear products for free seems a mixed blessing for Disney. Charter had 14.7 million video customers as of Q2 2023. There is an estimate that 20% of all Disney+ subscribers are on the ad-supported tier or almost 8 million in the U.S. Charter could help to double the Disney+ add base, but at the cost of lost subscription fees, or 50% of the revenue.

The deal also is a mixed blessing for Charter because, again, not all its broadband customers rely on it for broadband distribution. The conversion funnel has more friction in it than Charter would like to admit because it ultimately will require Charter customers to sign up for a Disney app through a Xumo device. As the Kagan data suggests, Xumo is a niche use case for consumers, and therefore the Xfinity Flex is, too.

Linear’s Importance

All this goes to show is that the simplicity Roberts has been talking up does not exist in broadband. Throw in Comcast’s 15 million video customers and Cox’s 3 million video customers and by comparison, the Xfinity device is still going to be a marginal use case for streamers. The only place Disney can accomplish scale with these partners will be in linear. Charter's offer—whether on its own or as a template offer for Comcast's Xfinity Flex platform—solves little for Disney's rapidly growing needs for scale. Disney seems in the right for being skeptical of Charter's proposals.

But, this also reflects Charter CEO Christopher Winfrey's point to the Goldman Sachs Communacopia + Technology Conference last week, too: Disney's attempt to "solve for DTC profitability by letting linear burn to the ground” is “not sustainable". Effectively, Disney is destroying the simplicity, scale and profitability of its linear business in the name of Clayton Christensen's "The Innovator's Dilemma". They are assuming they will be able to re-aggregate those linear consumers at the scale of Comcast, Charter and Cox across a bundle of their own apps. That has not been true, and given its variable churn rates across its apps, it seems unlikely to ever to be true.

Comcast, Charter and Cox each and all already accomplish simplicity for customers because they own the points of contact into the home, both for linear and for broadband. They also accomplish simplicity with a fee for broadband access (Comcast to the tune of over $6 billion, Charter to the tune of $5.6 billion). That access serves a much more profound set of needs for consumers than a streaming device or Disney content within that device. Consumers have infinite choice on the Internet and the best business model is charging for access to that choice.

Winfrey's point is much more about asking whether Disney's current streaming strategy maps to the consumer needs in a living room. Because Xfinity Flex sort of accomplishes that, as does its competition in the Smart TV and streaming media device space. But Disney and other legacy media streamers will never be as valuable to the cable distributors or cable customers as they were as linear channels. They are one of infinite choices for entertainment that Comcast's, Charter's and Cox's access to broadband enables.

That is the strategic miscalculation that Charter has exposed.

Must-Read Monday AM Articles

The demand for “premium content” is being redefined by creators, tech companies and 10 million emerging advertisers.

* In a wide-ranging Q&A with Next TV, Roku's global TV chief reiterates his company's position that consolidation is coming to TVOS and the barrier to entry is sky high

* Nielsen backed off a plan to incorporate first-party data from Amazon in its study of the audience for the company’s streamcast of “Thursday Night Football.” a move that was opposed by TV networks, putting to rest — at least for the moment — the idea that the measurement giant might utilize inputs from the companies it examines in its national viewership methodology.

* The Video Advertising Bureau had expressed strong objections to the plan in a letter to Nielsen.

* In A Streaming TV World, Whither U.S. TV Station Syndication? (free - email address required)

* “Sports is still at the heart of this company,” said Chris Ripley, who has been Maryland-based Sinclair’s CEO since 2017. “Take a look at what drives our business on the local media side and the broadcast side, it’s sports. And we continue to believe that it should be gamified and more highly integrated with sports betting, but also, not-for-money interactivity for virtual goods, or badging, or recognition.”

* Social media is in thrall of a peculiar new viral trend among creators called “NPC streaming” that’s now capturing fans — and their wallets. TikTok creators such as PinkyDoll, Cherry Crush and Natuecoco are mimicking NPCs, the acronym for so-called non-playable characters featured in video games that respond to player interactions with various scripted phrases and movements.

* Less Than 20 Percent Of Netflix's September Original Scripted Premieres From U.S.

* Influencers beware: Converting YouTube fame to an IPO is not easy ($ - paywalled)

* This Ad Tech Shakeout Seems Real

* YouTube has introduced 15-minute training courses that will help creators “learn how to better stay within our policy lines” while erasing any existing warnings on their channels. So long as a creator completes the course designed for their particular Community Guidelines offense—and doesn’t violate the same policy within 90 days—the warning will be removed from their channel.

* YouTube is giving creators more control over mid-roll ads—and less control over every other ad format

* Soccer superstar Lionel Messi helped drive a surge in U.S. subscriptions to Apple and Major League Soccer’s streaming services ahead of his North American debut in July, a sign that their partnership is bearing fruit. (Research company Antenna also shared data in a blog post)

* “The Summer I Turned Pretty” and “Reacher” may not have the kind of mass appeal that made “Game of Thrones” the topic of watercooler conversation, but taken together, they engage huge and passionate audiences. Rather than being all things to all people, Amazon is already finding success through the diversity of its programming.

* The new partnership between Shopify and TikTok Shop will keep Shopify sellers who want to experiment with TikTok happy, which is increasingly important as Shopify’s subscriber growth has slowed. And it’s good for TikTok, because it will help it lure more merchants and expand its Shop service.

AI & cloud computing applications and services are increasingly dictating content consumption

* Virtual creator Noonoouri recently signed with Warner Music Group, making her the first “digital popstar” to sign with the music label. Her first single, “Dominoes,” was released last week.

* Senior staff at YouTube have expressed concern that Shorts, the Alphabet-owned company’s answer to short-form video app TikTok, risks cannibalising its core business. Recent YouTube strategy meetings have discussed the risk that long-form videos, which produce more revenue for the company, are “dying out” as a format, according to these people. ($ - paywalled)

* Generative artificial intelligence has captivated marketers’ attention by promising to help them conduct research and produce campaigns more efficiently. But it is also poised to further complicate some of their most thankless tasks, such as ensuring that their ads run only near content they want and that their digital marketing materials stay on-brand. ($ - paywalled)

* In recent weeks, Google has come under fire for the transparency of media buys on its YouTube platform following critical reports from Adalytics Research. Yet sources at agency-holding groups claim subsequent attempts to seek systemic change have had limited impact, and some believe it’s indicative of a dysfunctional interdependency in the media industry.

Legacy media companies are throwing in the towel on their bets to own the consumer relationship in streaming and beyond.

* There seems to be no evidence to suggest that audience erosion in linear TV will reach some point where it will level off and still remain viable. "

* One major positive for sports on linear TV is that even with ESPN's departure, traditional TV networks -- especially broadcast networks -- still have a long-term stake in sports on those networks. One major example here is that decade-long NFL deals with Fox, NBC, CBS, ABC-ESPN, and Amazon will be around.

* A lawyer representing the National Hockey League told the judge overseeing the bankruptcy of Diamond Sports Group Friday that the league might want to seek injunctive relief from Diamond's Bally Sports regional sports networks if a restructuring plan can't be worked out soon.

* Amid ongoing issues with legacy pay TV systems, TV stations are prepping a return, at least in part, to real over-the-air TV. Is this new, updated old-school thinking, or just an old-past-its-moment swing-for-the-fences move?

* In the U.S., FAST services are gaining ground with viewers: the three FAST services that are independently reported in The Gauge (Roku Channel, PlutoTV, Tubi) already account for more viewing per month than all but the two top cable networks. In June 2023, these three services captured 3.3% of total TV viewing in the U.S.

* The Premier League plans to be more aggressive in tackling pirated streams of its matches, bolstering its internal taskforce, blocking illegal feeds, and pursuing private prosecutions in a bid to protect its broadcast partners and the value of its media rights.

* “This is Hollywood. No one conceals success. Overstating success is a hallmark of our business,” the first attorney tells THR. The most likely explanation for the opacity, he surmises, is that “the data is not good, and the studios are hiding it because revealing it would cause the entire house of cards to crumble.”