PARQOR is the handbook every media and technology executive needs to navigate the seismic shifts underway in the media business. Through in-depth analysis from a network of senior media and tech leaders, Andrew Rosen cuts through what's happening, highlights what it means and suggests where you should go next.

In Q1 2023, PARQOR will be focusing on four trends. This essay focuses on "The definition of scarcity is continuously evolving away from linear. What happens next?"

[Author's note: I will be publishing PARQOR's key trends for Q2 2023 on Wednesday. It will be a quick recap of Q1 2023 trends and what's looming for Q2 2023. The essay will be published Wednesday or Thursday.]

There is a follow-up question to last Thursday’s essay that’s lurking in the background: what is the purpose of a bundle in 2023? What problem does it solve for a customer?

The value proposition of a cable bundle is a portfolio of cable channels aggregated into one, and their individual distribution fees discounted and aggregated into a single monthly fee. Thursday’s essay focused on how these bundles also subsidize the survival of niche networks like regional sports networks (RSN). Households subscribing to a cable network do not have a choice of which channels to subscribe to, and so their single fee means they will subsidize channels that they may not ever visit or watch. But prior to streaming’s emergence in 2007, that mattered little because there were no available content distribution alternatives to cable networks.

The subsidy is missing in the “à la carte” value proposition of streaming, where users can sign up for individual streaming services and then churn in and out of a service at their whim. But, we still hear a lot of discussion in the market about streaming services replicating the value of the cable bundle. For example, HBO and HBO Max chairman and CEO Casey Bloys spoke at the Series Mania festival in Lille, France last week. He said Warner Bros. Discovery’s plan to relaunch the HBO Max app under a new name (“Max”) and with the discovery+ library as a plan that “kind of” replicates the cable bundle. He added, “How can you put the bundle together that will attract the most subscribers and keep the largest number of subscribers?”

Key Takeaway

The common belief is that NBCUniversal is subsidizing the WWE, but what if the WWE may be subsidizing Peacock and redefining its bundle of content?

Total words: 900

Total time reading: 4 minutes

This is a funny sales pitch for Bloys to be making given that Warner Bros. Discovery recently threw out plans to close discovery+ when it launches “Max”. It plans to keep a version of just running in an effort not to lose many of the platform’s current 20 million subscribers who might not be willing to sign up for Max and its higher price point when it launches. The bundle is not an end-all-be-all solution for Warner Bros. Discovery.

It’s also a funny sales pitch because, according to recent data from research firm Antenna, the bundle is marginally valuable: “the Disney Bundle now accounts for 22% of subscriptions for Disney+, 18% for Hulu, and 60% for ESPN+. The Apple One bundle accounts for 31% of Apple TV+ subscriptions, and Subscribers to the Paramount+ and Showtime bundle grew 251% in 2022.” Meaning, Bloys is not wrong that the bundle is valuable, but bundles are not integral to “keeping the largest number of subscribers” (unless you are ESPN+).

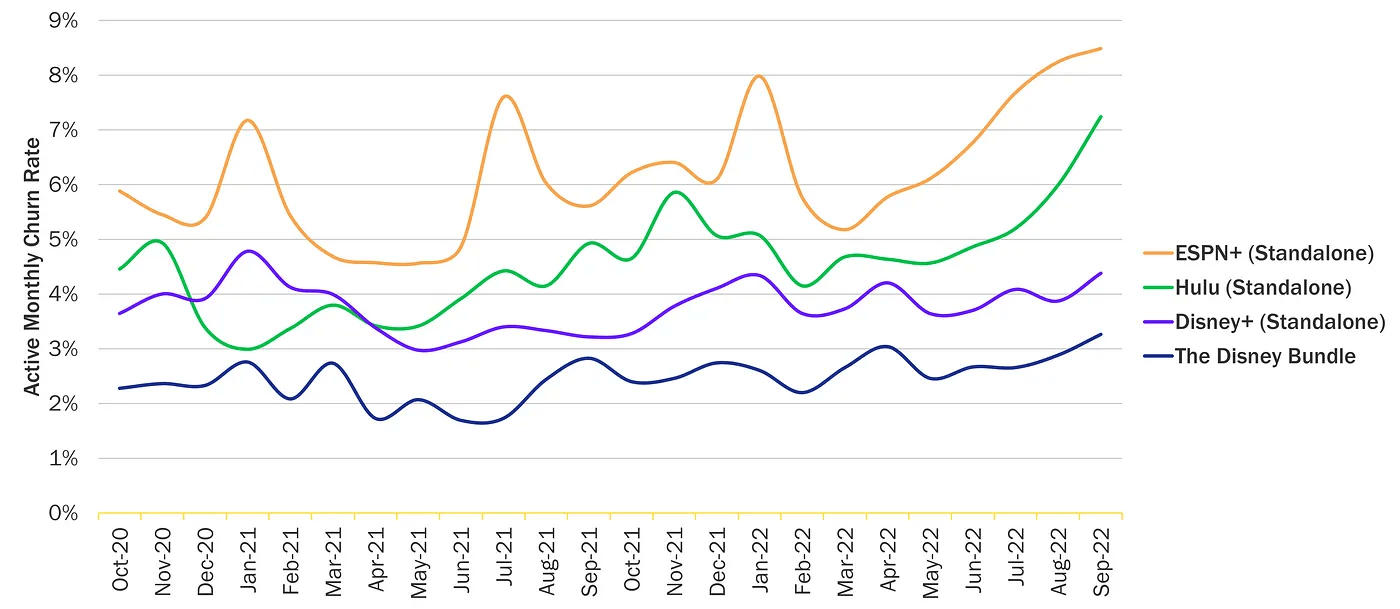

That phrasing only makes sense if he is referring to churn. As BCG Senior Advisor Doug Shapiro recently highlighted, the Disney+ bundle churn is significantly lower than its components, especially ESPN+.

The available data suggests the bundle is indeed a helpful tool, but it seems most valuable for preventing healthy percentages of users from deciding to churn out. Otherwise, the bundle isn’t for most streaming subscribers.

The Peacock subsidy?

WWE CEO Nick Khan made an interesting point on the Marchand and Ourand Sports Media Podcast last week. He said the WWE “love what’s happened with Peacock” and that NBCUniversal has been happy because “a significant number of Peacock’s paid subscribers… is because of WWE.” But more notably he said that the “stickiness” of WWE fans in exploring Peacock’s other content has been “extremely high.” It has been “significantly helpful” for WWE that they have the Spanish language World Cup rights, licensing Yellowstone from Paramount, and English Premier League (EPL) matches. The WWE audience samples other products.

In some ways he’s backing up Casey Bloys’ sales pitch: users need a wide variety of content to stick around, and having a variety of content “bundled” in one service will drive growth and reduce churn.

But in another way he’s making two very different points than Bloys about bundles and subsidies.

First, he’s contradicting Bloys’s sales pitch. Assuming Khan is not just spinning a favorable story for WWE (and given he is the CEO of World Wrestling Entertainment, Inc., there *is* spin there), he’s stating that Peacock’s best “bundling” strategy is to bundle for WWE subscribers. That’s not to say that NBCU has invested in the Spanish language World Cup broadcast or the EPL or Yellowstone to make WWE subscribers happy, specifically. They have always had a broader ambition to serve a broader audience (which paid off in Q4 2022, where they saw growth of 33% in subscribers to 20MM subscribers).

But he is mirroring the Crunchyroll-esque argument that a streaming service needs to invest in serving its core users, first, and broader audiences, second. That is not an unusual strategy — that is how Amazon and Apple have pursued their respective content investment strategies — but it is not how NBCUniversal has invested in streaming content, to date. As I wrote in January, Peacock offers sports alongside Universal movies, original TV series, popular NBCU channels like Bravo, and WWE. Khan is saying that of those five buckets, only the WWE drives significant engagement.

Second, in making this argument, he flipped any perception that NBCUniversal may be subsidizing the WWE. Rather, the WWE may be subsidizing Peacock (again, that assumes he’s not spinning, which he probably is). That would imply that everyone — including Warner Bros. Discovery management — who are selling investors and consumers on the bundle have not realized that “the bundle” has a narrower value proposition in streaming than it did in cable. It needs to be more focused on engaging a particular consumer.

Perhaps they all should be paying closer attention to Peacock, if not "be like Peacock", as it evolves towards the WWE subscriber (...if it is indeed evolving in that direction).

Must-Read Monday AM Articles

[AUTHOR’S NOTE: This continues to be a weird news cycle in which to launch a Slack. I have not been posting, but readers have been responding to essays.]

* CNBC’s Alex Sherman broke the news last night that the WWE is in advanced talks to be sold to Ari Emanuel’s Endeavor Group, the parent company of UFC. UFC and WWE are expected to form a new publicly traded company as part of the agreement.

* An argument for how NBCU could use “Vanderpump Rules” to boost Peacock

* Antenna co-founder Rameez Tase argues “we’re at an inflection point similar to the one that destroyed boxing, or the one that gave rise to the NFL — and it has less to do with sports than it does the business of sports.”

* The National Football League and private-equity firm RedBird Capital Partners are launching a commercial distributor (e.g., to sports bars) for NFL Sunday Ticket games called Everpass Media.

* Media buyers Digiday spoke with are expressing frustration at its still-too-high $55 CPM and the still-too-slow growth for its ad-supported sub base.

* Warner Bros Discovery has scaled back plans to cash in on its film soundtracks with a more than billion-dollar music sale after receiving offers that were lower than it had wanted. ($ - paywalled)

* Brian Wieser, former Global President of Business Intelligence for GroupM, argued “television’s capacity to satisfy reach objectives in a cost-effective manner (relative to alternatives) faces significant risk.” Dave Morgan, CEO of Simulmedia, argued why this analysis is “exactly on target” in Mediapost.

* There may seem to be a podcast recession looming, but users aren’t going anywhere.

* The Wall Street Journal had a good interactive feature on Hollywood’s pivot into horror ($ - paywalled)

* Amazon has sold over 200 million Fire TV devices

* An argument that “SVOD services need to adopt the concept of current versus library programming and return to the concept of windows of availability.”