The Air-Gapping Problem: Why Netflix Can't Protect Warner Bros IP Through Cloud Partnerships

Unless Netflix acquires (unlikely) or sells a stake to a cloud provider (super-expensive but possible), the $82.7B WBD acquisition carries IP leakage risk PSKY's bid avoids.

[Author’s Note: AiMation released the first episode of “the world’s first 100% AI generated reality TV show”. It’s called “Non Player Combat”. AiMation Founder Tom Paton shared a some background on it in our conversation back in June. The Daily Mail published a good interview with Tom, and the show is being covered in the London tabloids.]

Several readers responding to my posts on LinkedIn seemed to misunderstand what I meant by the Ellison family’s control over Oracle Cloud Infrastructure (OCI) giving Paramount Skydance an advantage over Netflix.

The pushback I received focused on OCI’s weak competitive positioning as a cloud distribution platform. That criticism misses the point entirely—I am not arguing Oracle will out-compete AWS or Azure for distributing AI services. I am arguing that owning your cloud provider eliminates the IP leakage risk that partnerships with AWS, Azure, or Google Cloud cannot solve.

The Hollywood Reporter highlighted one version of this risk lurking in the Netflix acquisition: “given the Wild West nature of training and lack of clear legal restrictions”, it is not yet clear which tools Netflix has “to stop other studios or tech companies from feasting” on Netflix and Warner Bros. Discovery IP.

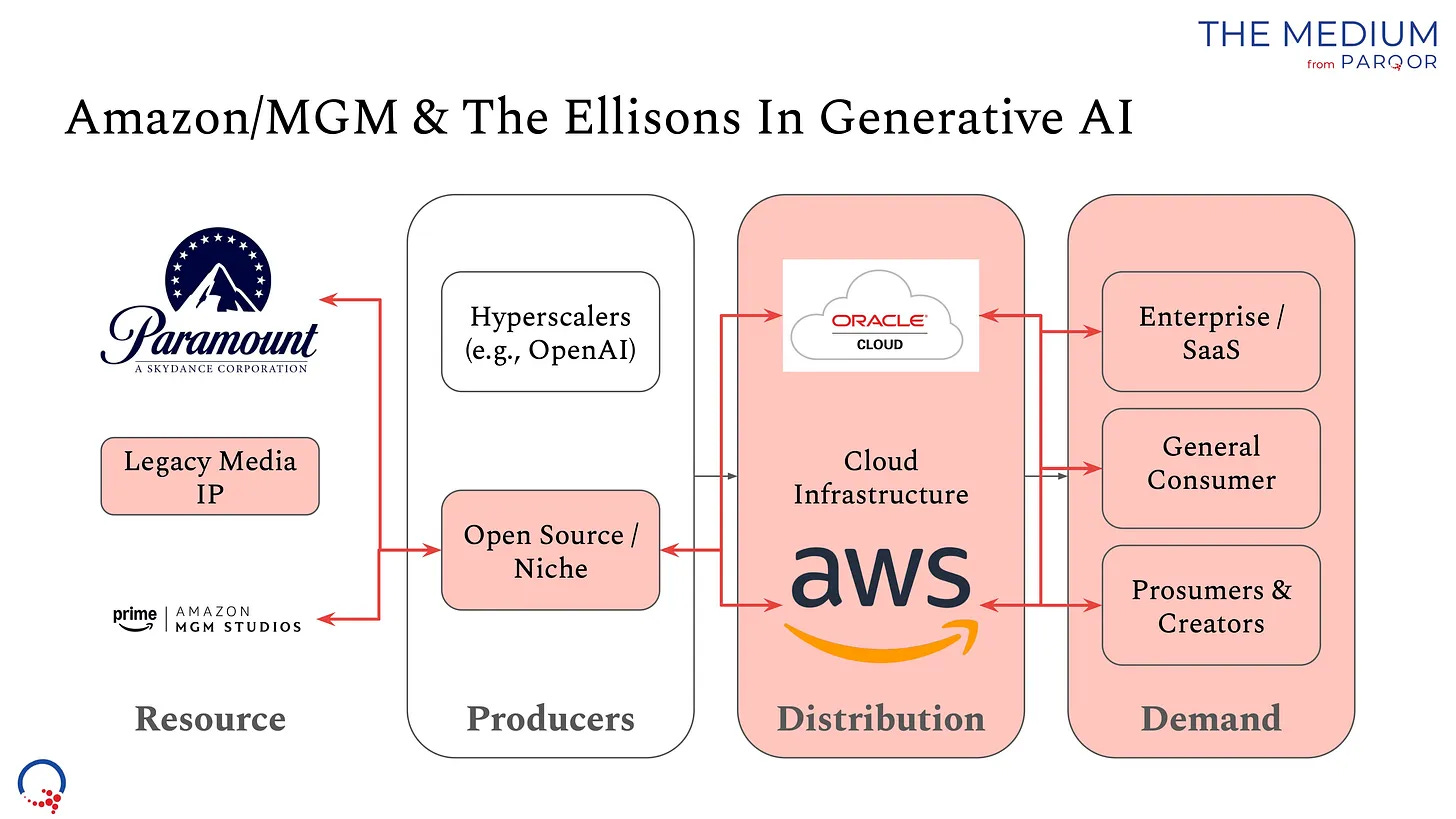

This reflects a key nuance in the fact that the Ellisons control both Paramount Skydance and Oracle. Controlling the cloud is an advantage in the AI era, where protecting IP from piracy will be an existential business. Open source and niche AI platforms enable piracy from Prosumers & Creators (see image below) in ways that are faster, cheaper and better than past forms of piracy.

From my own research, the fundamental problem is that AI models learn from their training data and can reproduce what they have learned. If the training data includes proprietary IP, the model “knows” that IP. So training data must be “air-gapped”—constrained within the cloud and isolated from other models and the broader internet—otherwise proprietary techniques, character likenesses, and plot points can leak to other users or models.

It also learns from what its users prompt it. So, for example, if Paramount Skydance employees use a generative AI platform to improve the visual effects for a scene in its future blockbuster “Call of Duty” movie, there is no guarantee that the platform will not share the likenesses or spoil the plot points when a user asks it “What is the plot of the Call of Duty movie?”

If Skydance Animation trains an AI platform with all its secret animation techniques with a cloud partner like Amazon Web Services (AWS), that AI might learn those tricks and then use them to help Netflix or Amazon make better movies. Skydance Animation does not want to teach their competitors their secrets. Perhaps most importantly, no legacy media executive wants to carry the legacy of having exposed their company to that vulnerability.

The Ellisons’ Advantage

Control enables Paramount Skydance IP to more tightly manage this vulnerability than partnering with cloud solutions from competitors like AWS, Microsoft Azure or Google Cloud.

AWS presents a particularly thorny issue because Amazon owns MGM Studios. If Netflix acquires the Warner Bros. library and uses AWS for generative AI training, there are currently no guarantees that AWS can or will protect Netflix’s or Warner Bros. library from being accessed by other models.

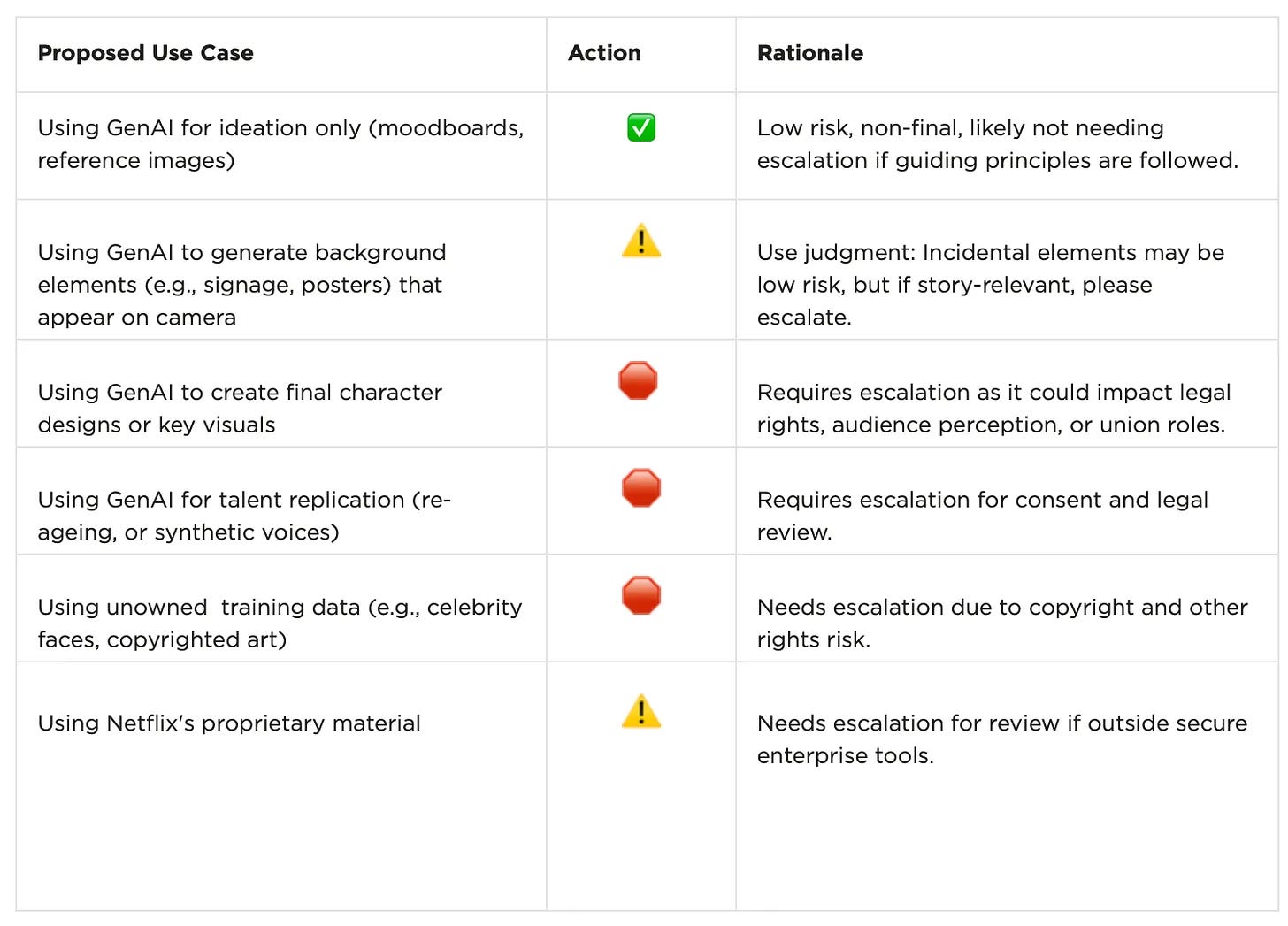

That may change. For now, that explains the risk aversion reflected in Netflix’s guidelines for licensing productions that use generative AI (see below). Generally, guidelines are reactive measures, not structural solutions.

This raises an important question about the $82 billion price tag for Warner Bros—if Netflix knows the IP is at risk, why does it find it so valuable that it would take on $59 billion of temporary debt financing?

Returning to the LinkedIn criticism and reader questions: Yes, OCI’s distribution capabilities are behind AWS/Azure. But that is irrelevant. The advantage is structural—Ellisons control both sides (content + infrastructure) so they can air-gap training within the cloud without relying on partners with conflicting interests. Amazon enjoys similar vertical integration with MGM Studios and AWS—which makes AWS an especially risky partner for Netflix.

Netflix cannot replicate this through partnerships. Unless Netflix acquires its own cloud provider (not clear it exists)—or sells a significant stake to a cloud provider (a price tag in the hundreds of billions but possible)—the $82.7B Warner Bros. acquisition carries an IP protection risk that Paramount Skydance’s bid does not.