[Author’s note: This essay will be free for all readers. My predictions will be for subscribers, only.

Correction: There was an incomplete paragraph in the essay that was mailed out under "The biggest impact of AI in media will be in ad sales and marketing, but not content". It has been corrected.

Total words: 1,700

Total time reading: 6 minutes

My 2024 Media Predictions—The Hits & Misses

Netflix’s “Grand Theft Auto” bet succeeds & accelerates its gaming strategy

💯

Nailed this one. According to data from digital intelligence and analytics firm Sensor Tower, “GTA: San Andreas” is Netflix's most downloaded game of all time with nearly 10 million downloads since its December 2023 launch.

Netflix has launched over 100 games, to date. It told investors in August that it has another 80 in development.

Co-CEO Ted Sarandos told investors on its Q2 earnings call that its objective with mobile games is to give “the superfan a place to be in between seasons [of a show], and to be able to use the game platform to introduce new characters and new storylines or new plot twist events." Netflix revealed four new interactive fiction mobile games based on its top reality TV franchises: “Netflix Stories: Perfect Match,” “Too Hot to Handle 3,” “The Ultimatum: Choices,” and “Netflix Stories: Selling Sunset.”

However, Netflix also pivoted away from blockbuster ("AAA") games in October. A few weeks later, former Netflix VP of Games Mike Verdu announced on Linkedin that he is now VP, GenAI for Games. Generative AI technology has matured to the point where Netflix is best off taking a blockbuster budget—AAA games greenlit in 2023 for potential releases in 2024 or 2025 typically received development budgets of $200 million or higher—and reallocating it across multiple teams using generative AI tools.

Streaming and gaming will increasingly overlap

💯

True at Netflix (see above). Also true at YouTube, which launched 75 games or “Playables” in March.

True at Amazon, too, which had success with the TV adaptation of the hit game “Fallout”. It also recently released “Secret Level”, an animated anthology series from the creators of "Love, Death + Robots" with stories inspired by video games from around the globe. It is offering Prime members the opportunity to "claim a variety of games from some of the franchises that feature in the show." Also, Prime members in the United States can "take advantage of several retail deals associated with games featured in Secret Level."

The trend has been harder to identify in broader marketplace. Paramount+Skydance step in that direction because merges Paramount+ with interactive gaming studio.

Warner Bros. Discovery trying and struggling to tell the story that its gaming and streaming assets both belong and can drive growth together.

Disney pursuing parallel paths in gaming and streaming with its investment in Epic Games.

But, Netflix will struggle to tell the story of its success

✅ and ❌

Netflix indeed announced it will change its story for investors in its Q2 earnings call (April 2024): “starting next year with our Q1'25 earnings, we will stop reporting quarterly membership numbers and average revenue per member (ARM)."

But, there was no struggle. The transition was seamless. Investors are buying into it: The stock is up 65% since that earnings call and almost 100% year-to-date. Its market capitalization (around $400 billion) is currently 1.88x that of Disney’s (around $200 billion).

A wave of legacy media mergers *won't* happen after April 8, 2024

💯

Yes, excluding Skydance acquiring Paramount Global. Every large media company management team was interested in partnerships, no one was interested in mergers or acquisitions.

Instead, Paramount starts selling parts

❌

In January, I believed National Amusements Chairwoman Shari Redstone was “(too) bullish on Paramount’s future" to sell the company, despite reported talks with Skydance. I predicted that instead, she would fund Paramount's expensive NFL deal ($1.1 billion per year) and debt obligations with the sale of smaller cable channels like BET and VH1 to private investors.

In July, Redstone reached an agreement with Skydance CEO David Ellison to sell all of Paramount.

I was wrong.

This means, all this talk of bundling is empty talk

✅ and ❌

I argued that the best bundling models in streaming operate from a single database:

“There is no marginal value to these media companies in having separate databases from each other. They have no management expertise about how to build out multiple business models to monetize the same customer within one ecosystem.”

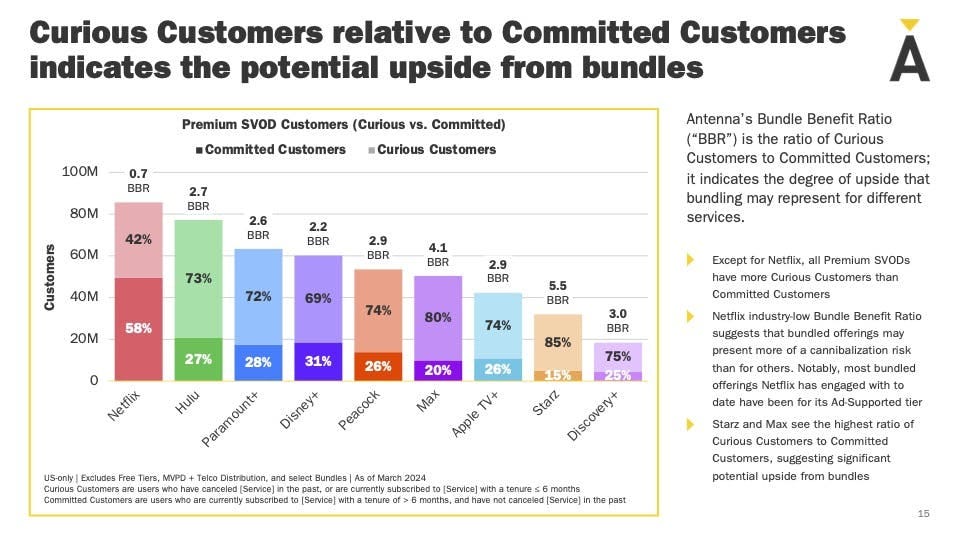

I still believe this, and I may have been to quick to dismiss the value of bundling models across independent, third-party subscription services (as research firm Antenna reported back in June). This approach offers tactical advantages in reducing churn, but few strategic advantages because bundles do not drive growth.

Disney’s ad-supported streaming efforts echo The Washington Post's failed programmatic ads business

✅ and ❌

Background: This comparison was to Washington Post’s past attempt to build out Zeus, a real-time, programmatic ad buying network across premium publishers. According to The Wall Street Journal, Zeus had “thrived for a time” but became “less relevant as it changed its technology approach and publishers adopted other systems.” A legacy media programmatic advertising play could not compete with the scale of Google.

I got the signal right for Disney but the competitor wrong: Disney was forced to drop its advertising rates at this year’s upfronts because of surprise entrant Amazon, which converted its entire Prime Video platform into an ad-supported platform in late January.

The comparison to Zeus raises the question of how much longer Disney's programmatic advertising ambitions can remain compelling to advertisers. If they were willing to walk away from The Washington Post brand in news, why wouldn't they walk away from the Disney brand in video? And didn't they do that in some fashion at the 2024 upfronts?

Google’s YouTube and Amazon are far better positioned in the long-run to deliver advertiser goals with better first-party data and greater scale.

The biggest impact of AI in media will be in ad sales and marketing, but not content

💯

Plenty of generative AI content tools emerged in 2024. But, none broke through in a way that suggested audiences will prefer AI-generated movies and TV series to Hollywood and professionally produced content. Instead, YouTube creators proved a “new business of living room content” is emerging: “[T]here are more efficient models than traditional theatrical and television production models that can entertain audiences, at scale, in their living rooms.”

Movies like "Where the Robots Grow"—the first feature-length fully animated movie made entirely with artificial intelligence (AI) tools—are generating buzz. However, it is not yet clear what the audience demand is for AI-generated content.

Google saw its cloud business grow in 2024, as did Amazon. In both businesses, advertisers and publishers pay for access to AI services in the cloud. However, the biggest impact to emerge was Meta’s aggressive bet on AI that will expand the definition of "creator" to include "hundreds of millions" of small business accounts, too.

A bummer of a year in the sports media business

❌ "It will be revealed the NFL has an insurance plan in place in case Paramount is truly in distress." → If the NFL had one, we never learned about it.

✅ and ❌ "The NBA will get a decent return on its rights deal for 2025, but nothing close to the amount it was seeking (3x its current deal)." → It improved its deal total from nine years, $24 billion to 11 years, $76 billion, reflecting an increase of 160% per season compared to the current contract.

✅ "Beyond Amazon, there will be uncertainty around the tech companies’ ability to deliver audiences at scale for live sports." → Peacock successfully dispelled any doubts with its Olympics broadcasts. Netflix's glitchy broadcast of Tyson vs. Paul fight last month both added uncertainty and redefined sports distribution. However, sports broadcasts on Max, ESPN and Paramount+ still are not reaching audiences at a scale competitive to their broadcast channels.

✅ and ❌ "Amazon moves into the regional sports network business by acquiring Diamond Sports Group, but nothing moves the needle." → A partnership but not an acquisition emerged in November, when Amazon signed an agreement to distribute Diamond's 16 RSNs in 31 states. They will be available "as an add-on subscription" for those who already have access to Amazon Prime, and limited to customers corresponding within each team's designated geographic area.

❌ "Netflix will not buy any rights, but will announce a deal for event-adjacent programming." → In May, Netflix announced a three-season deal with the NFL for Christmas Day football games.

❌ "Mark Cuban will be seen as the canary in the coal mine for the future of sports TV rights as regional sports network revenues (RSN) decline. MLB, NHL and NBA teams will struggle with payrolls. Apple's deal with the MLS shows signs of weakness as the impact of the Leo Messi signing wanes." → The assumption was that the decline of RSNs would negatively impact team payrolls and threaten the futures of those teams (Cuban had sold the Dallas Mavericks to the Adelson family as an exit after his RSN revenue began to decline). However, in 2024 the leagues adapted and evolved. For example, MLB and the MLB Players Association agreed in July on an effective "reallocation of the money generated from luxury tax overages this offseason": Teams that experienced losses in local-media revenue will receive up to $15 million.

Roku finds wins in connected TV advertising

❌ I argued in January that Roku had "the simplest story to tell investors in this marketplace because it is the only walled garden with scale and with an ad business that is focused almost entirely on Connected TV inventory." It also reaches over 85 million streaming households.

Financially, it has had a good year: Revenue and Adjusted EBITDA are up year-over-year in all three fiscal quarters of 2024, to date. Investors seemed to prefer the story of demand side platform (DSP) The Trade Desk (stock price up over 90% year-to-date) to Roku's (down over 6% year-to-date). Now they believe Roku is a likely acquisition target of The Trade Desk.

All signs are that Amazon disrupted the broader marketplace at 2024 upfronts. It exceeded its internal target of $1.8 billion in upfront video advertising commitments. Streaming advertising upfront revenue was up 35% to $11.1 billion for premium platforms—and Roku benefitted—but Amazon may have benefitted most.

Top Essays of 2024

Most Opens

AI Content Models Without Time, Budget or Creative Constraints

Will Apple, Amazon or Oracle (Paramount) Be First To A Cloud-Usage Streaming Model?

After Netflix Shuts Down AAA Gaming Studio, A Faster and Cheaper Future Lies Ahead

Most Shared

AI Content Models Without Time, Budget or Creative Constraints

Three Guidelines To Understand This "Weird" Market Moment In Media

Reconstructing The Media Conglomerate Portfolio For AI, Games & Streaming

Most Discussed With Readers & In Conversation

How Valuable IP Will Succeed Beyond The Walled Gardens of Media Conglomerates

Monetizing Mickey Mouse, "Superman" and "Batman" In The Public Domain

Meta Bets AI Will Turn "Hundreds of Millions" Of Small Businesses Into Creators, Too