Monthly Series: The Numbers Behind Netflix's Gaming Retreat and Short Drama's Rise

Updated AppMagic Data on Sora, Netflix Games & "Drama Slop" App Downloads

In three recent essays, I have used data provided by AppMagic to shed light on the performance of OpenAI’s Sora, “dramaslop” gamified video apps and Netflix mobile games. This marks the launch of a monthly series where I update past data from AppMagic on three new and dynamic business cases of disruption in digital media:

A deal for OpenAI’s Sora to license over 200 character likenesses from Disney was regarded as a paradigm shift from one of legacy media’s most digitally risk averse companies

“Dramaslop” apps like DramaBox and ReelShort captured significant market share of downloads on app stores and outperformed Netflix in 2025 (see below)

Netflix’s bet on mobile games abruptly pivoted last December and is “retreating from gaming exactly when gaming architecture is becoming the model for AI-era media.”

Sora by OpenAI

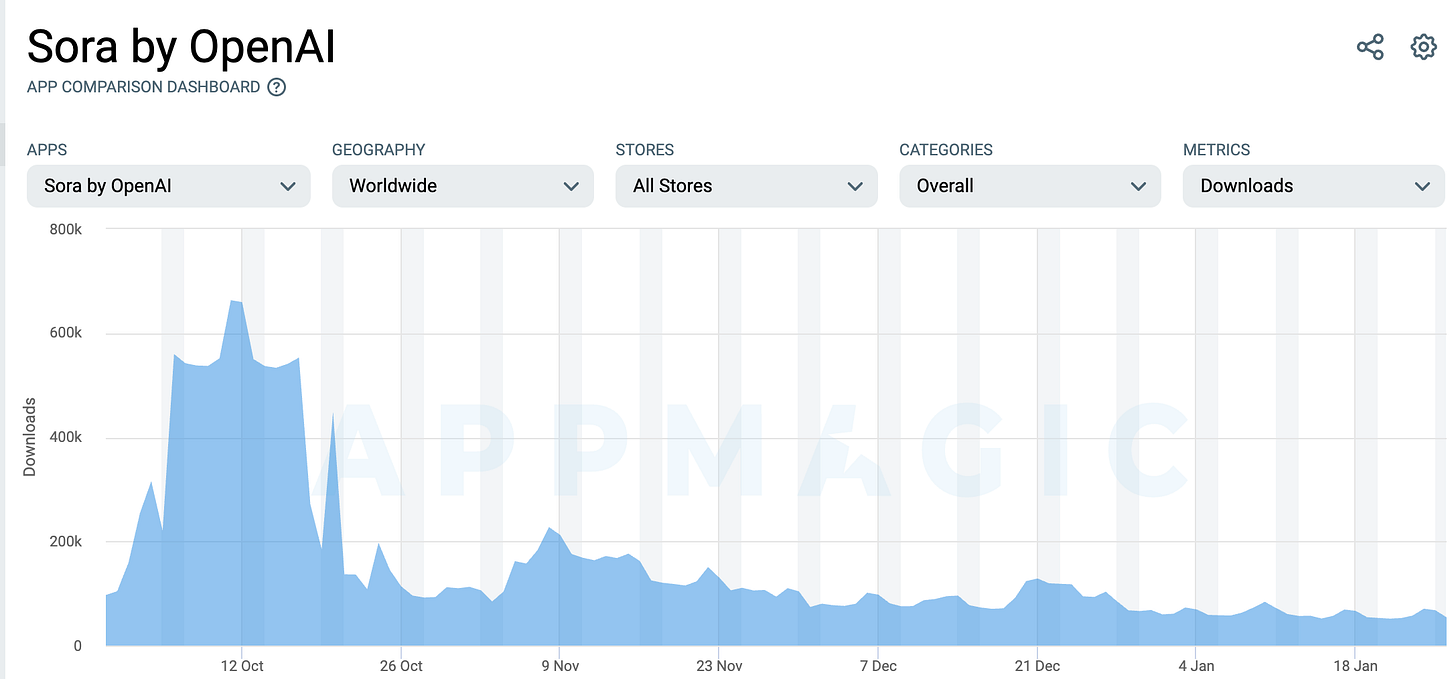

Below is the lifetime data of downloads of Sora, to date. The Disney-OpenAI partnership announcement was on December 11, 2025. It drove about 20% bump in downloads for about five days—up from ~75,000 downloads per day—and then dropped back down. A bigger bump emerged during the holidays (reaching ~120,000 downloads per day) and then dropped back down to baseline.

AppMagic reports 18.7 million downloads of Sora, to date, but over 1.5 billion downloads of ChatGPT. It will be worth revisiting this data when the character likenesses are released on Sora at some point during this fiscal half.

Netflix—Red Dead Redemption & Stranger Things: 1984

Netflix announced in December 2025 it would no longer distribute 'GTA: San Andreas.' AppMagic estimates the game reached nearly 50 million lifetime downloads—up from 39.7m downloads in March 2025—before being discontinued, making it Netflix's most successful mobile game to date.

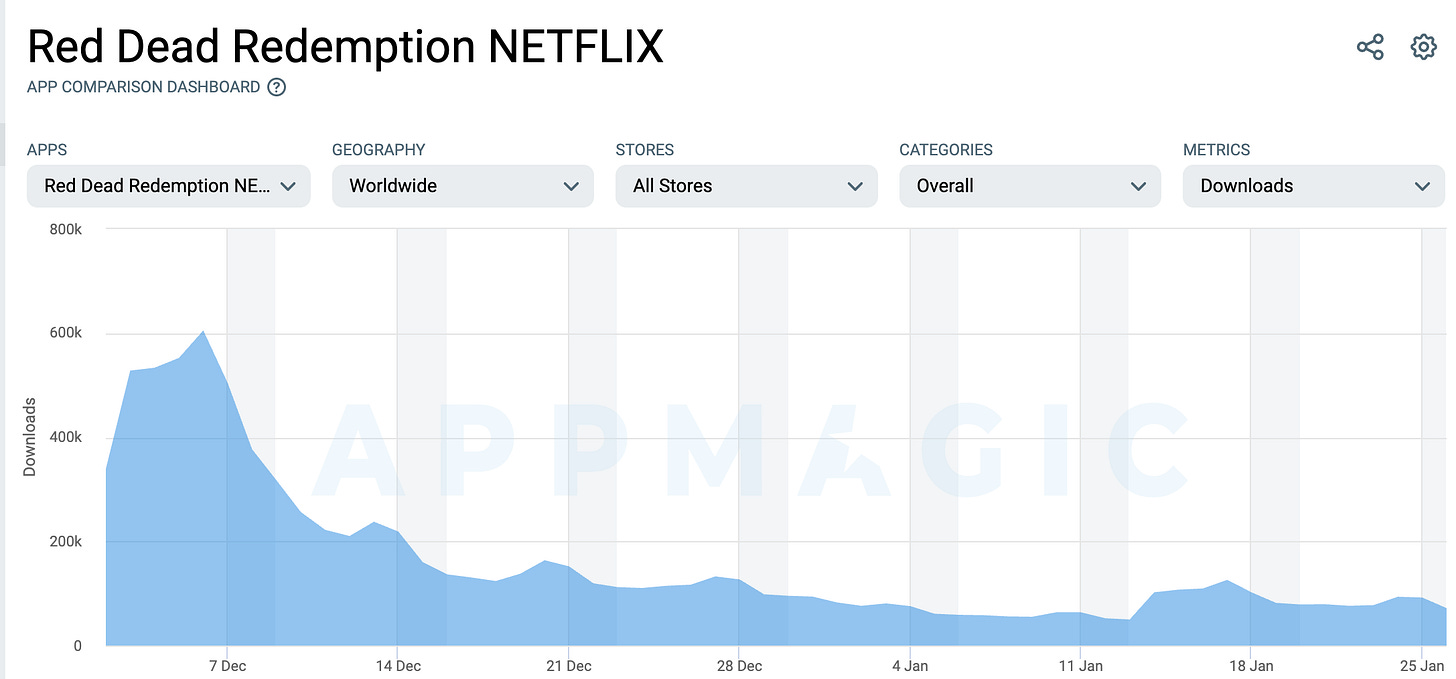

Management mentioned “Red Dead Redemption” on its recent earnings call. AppMagic estimates 9.1 million downloads since its release in early December 2025.

By comparison, “GTA: San Andreas” was downloaded 11.6 million times over a similar period post-launch.

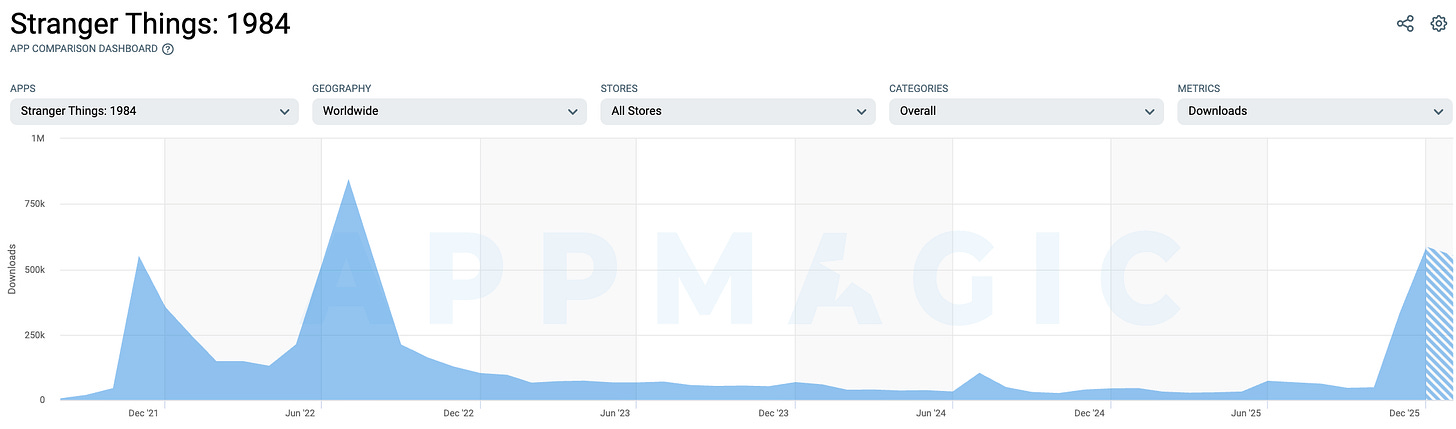

Netflix is cutting back on licensed mobile games but will continue to issue games based on its IP. “Stranger Things 1984” is an interesting use case because it reflects the ambitious flywheel they outlined to investors in July 2024. Mobile games give “the superfan a place to be in between seasons [of a show], and to be able to use the game platform to introduce new characters and new storylines or new plot twist events.”

You can see usage of “Stranger Things 1984” has spiked with recent season releases, then went largely unused until the debut of the show’s final season in December 2025. Downloads of the mobile game spiked nearly 11x from ~49,000 downloads in October 2025 to nearly 600,000 downloads in December 2025.

It has 7.6 million lifetime downloads.

“Drama Slop” Apps

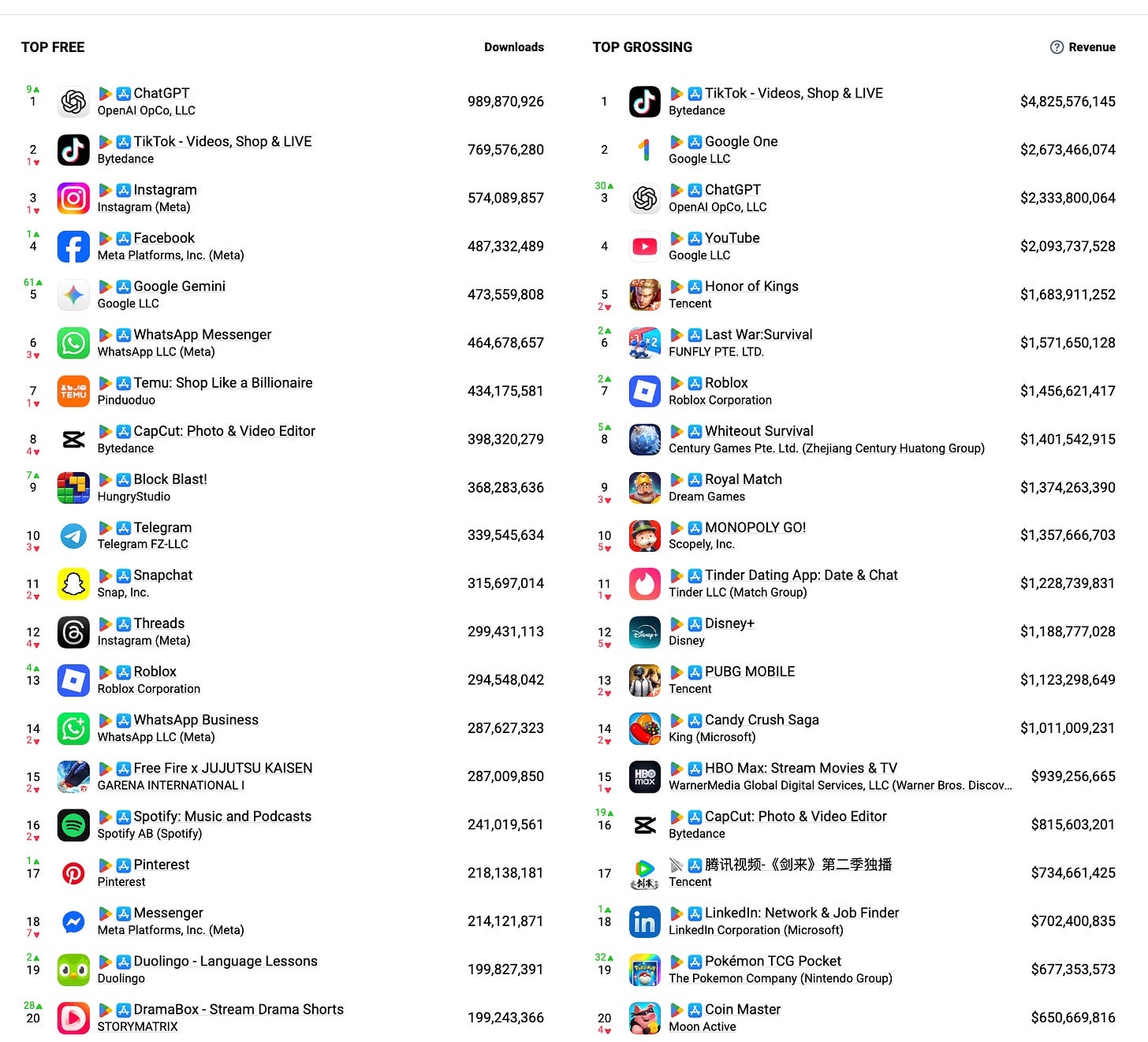

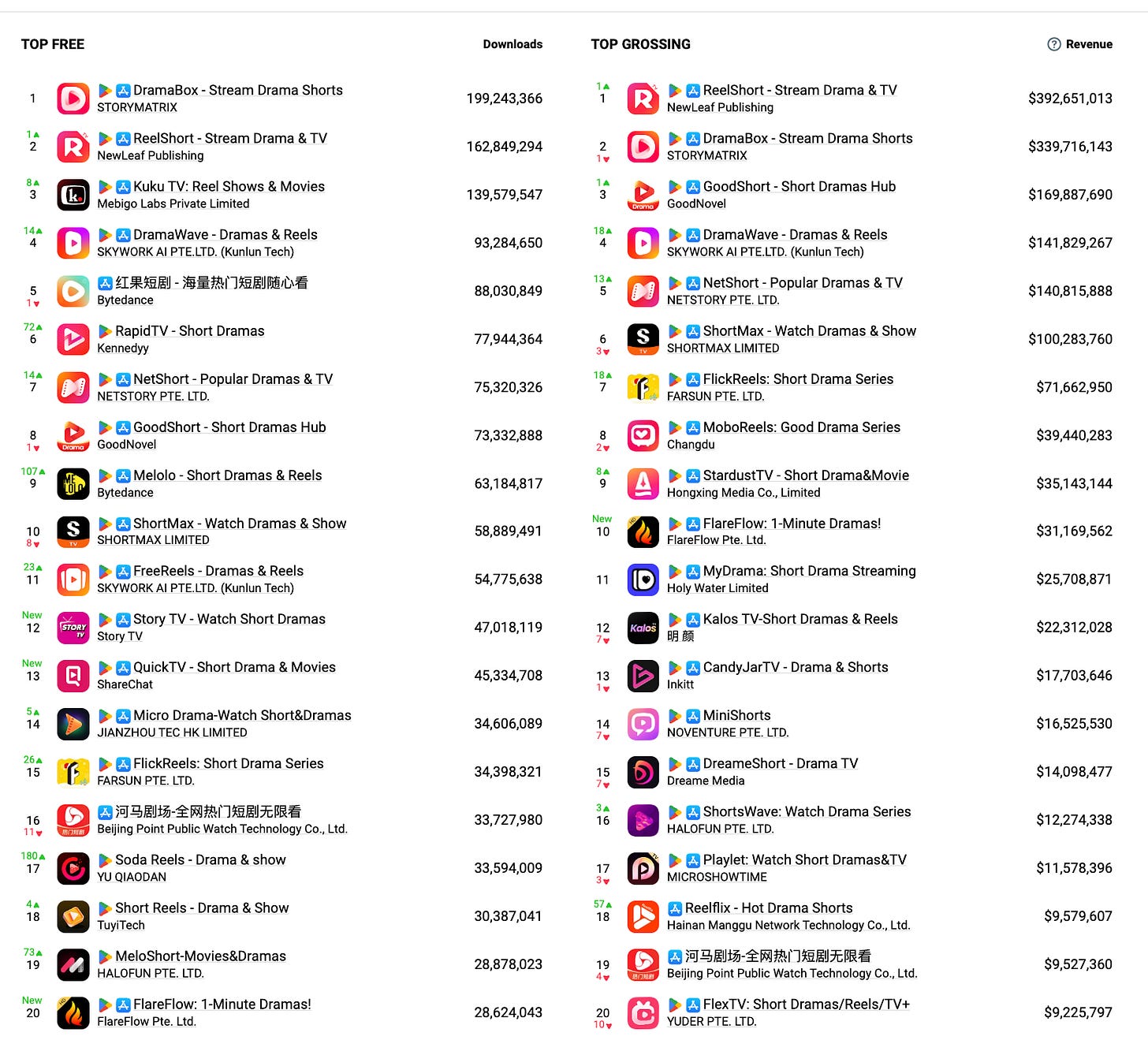

Back in July 2025, AppMagic data showed short drama apps on the rise: the top Two free apps in Google Play and three of the top five were ‘dramaslop.’ Two of the top 10 ‘Top Grossing’ apps in both stores were short drama apps.

For all of 2025, none cracked the top 10 downloads globally. However, DramaBox made the top 20 in downloads (199.2 million), just behind language education app Duolingo (199.8 million). ReelShort ended up being the 27th most-downloaded app with 162.9 million downloads, just above Netflix’s 161.2 million downloads. ReelShort grossed $392.6 million in 2025 and DramaBox grossed $339.7 million (AppMagic does not report Netflix gross).

NOTE:Netflix reported $45.2 billion in gross revenue in 2025, but AppMagic only tracks in-app mobile revenue. These are different data sets—AppMagic likely captures a fraction of Netflix's mobile revenue, so we cannot directly compare Netflix's performance to short drama apps despite what the download numbers suggest.

Among Short Drama apps only, there is a 45% drop-off in earnings after the top 7 grossing apps. The trajectory of total downloads across apps follows a smoother, incremental decline. Interesting details include NetShort as the 7th most-downloaded app but generating $40 million more in 2025 than its next competitor (ShortMax).

KukuTv is an Indian app backed by Google that is the third-most downloaded but only grossed $641,000 in 2025.

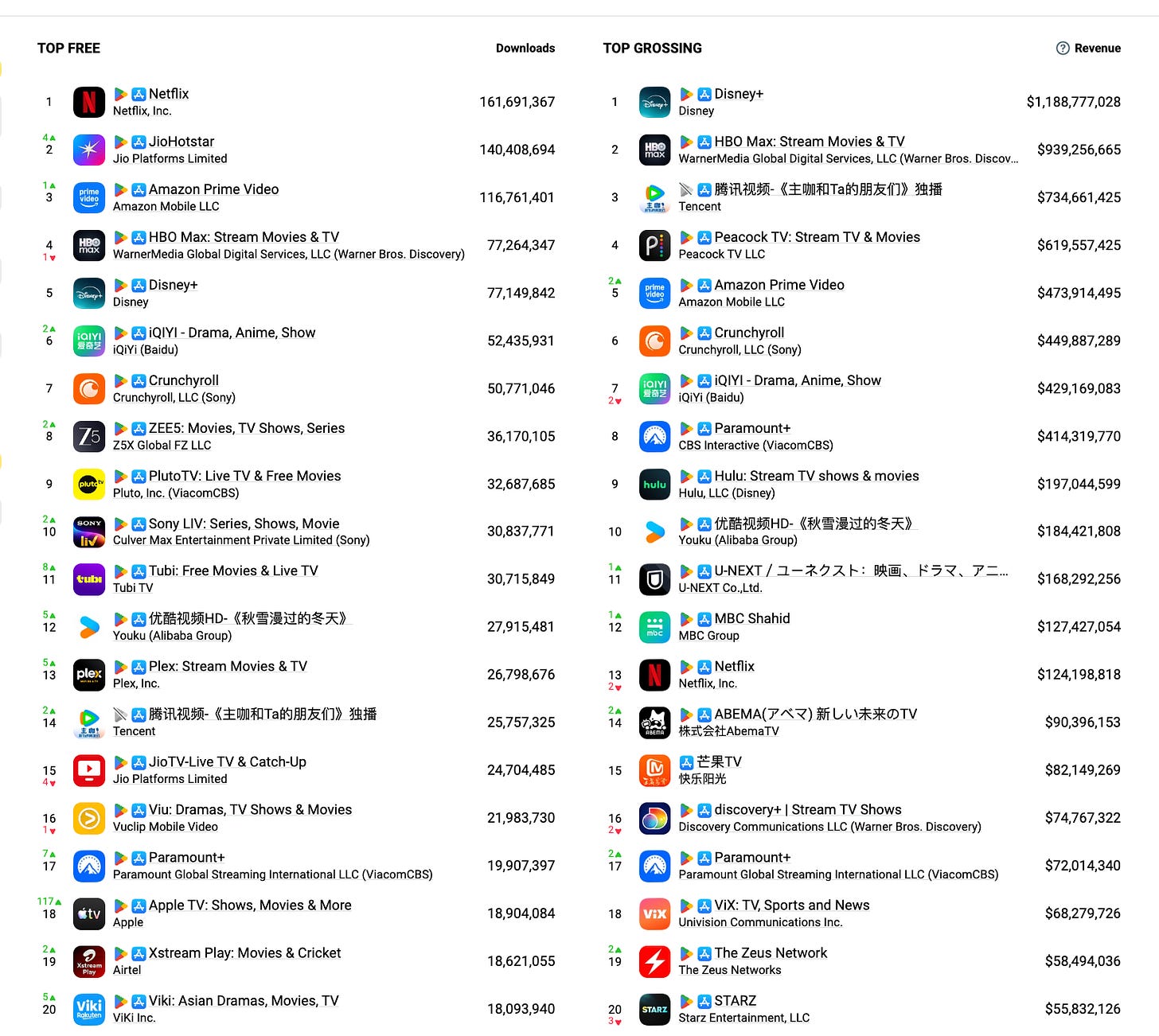

Also, comparing this data to the AppMagic OTT downloads, we can see the Top 20 Short Drama apps average 70 million downloads—with a maximum of 199.2 million (DramaBox) and a minimum of 28.6 million (FlareFlow). The Top 20 OTT apps average 50.5 million downloads or 28% less than Short Dramas—with a maximum of 199.2 million (DramaBox) and a minimum of 18.3 million (Viki).

The numbers flip when it comes to gross revenue. The Top 20 OTT apps average $327.6 million in gross revenue—with a maximum of $1.2 billion (Disney+) and a minimum of $55.8 million (STARZ). Whereas the Top 20 Short Drama apps averaged $86 million in gross revenue or 26% of OTT—with a maximum of $392.6 million (ReelShort) and a minimum of $9 million (FlexTV). That said, the top 5 Short Drama apps gross more than all OTT apps ranked 12 through 20.