It's Not TV, It's GVOD

App store data shows 'dramaslop' gamified video apps dominating downloads, so why is Netflix doubling down on its TV-first strategy?

[Author’s Note: A reminder that Thursday’s essay will be a video presentation exclusively for Platinum members. I will be sending out the first 10 minutes to all Paid Subscribers, only.

To upgrade your subscription to Platinum, click here.]

Recent app store data from AppMagic—a mobile market intelligence platform that provides data and analytics on the mobile app and game market— reveals that I understated how 'dramaslop' apps threaten Netflix.

The streaming service may be missing a fundamental shift in consumer behavior: It is doubling down on TV growth strategies while app store data shows consumers flocking to gamified video-on-demand (GVOD) apps that Netflix refuses to build.

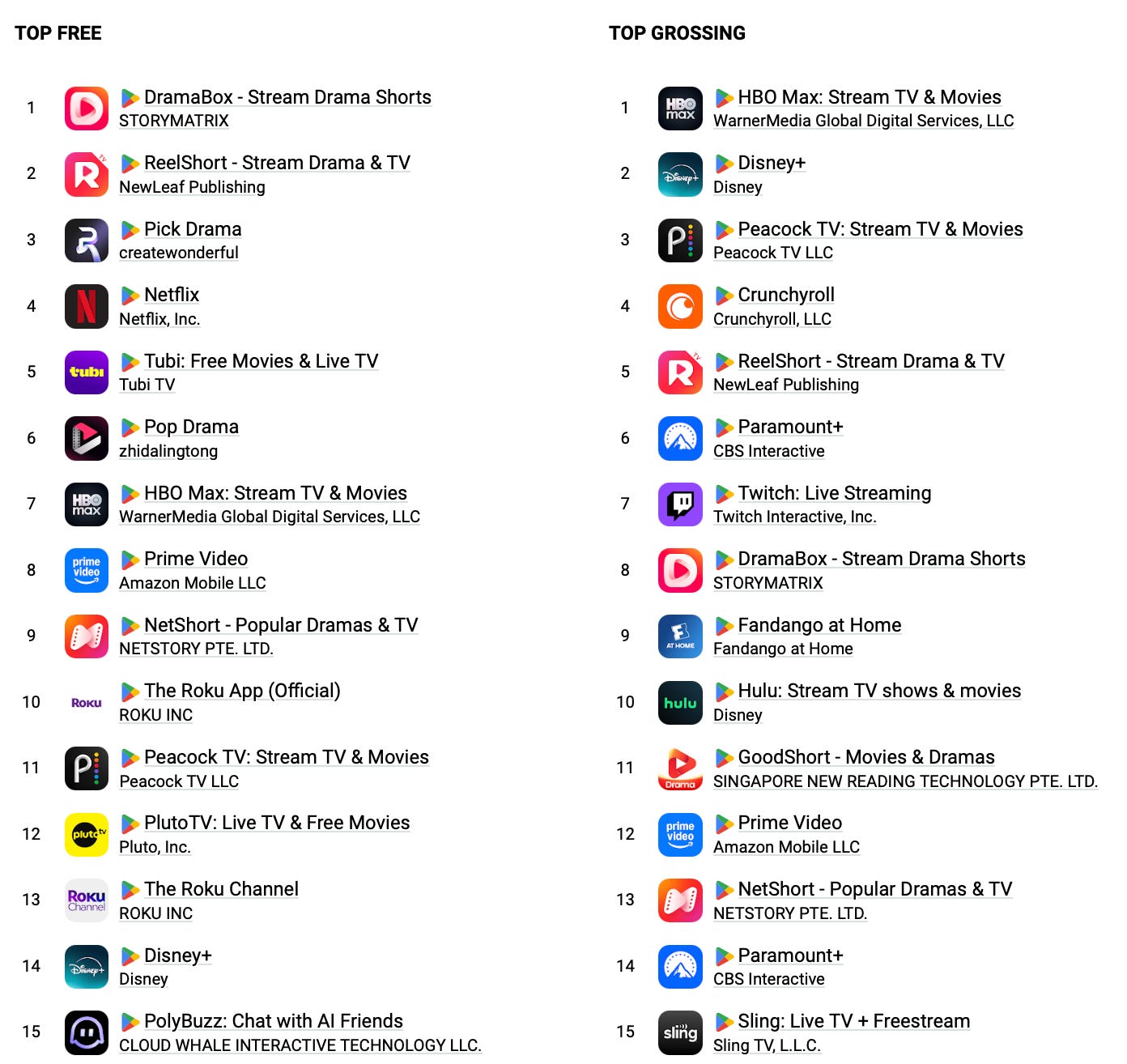

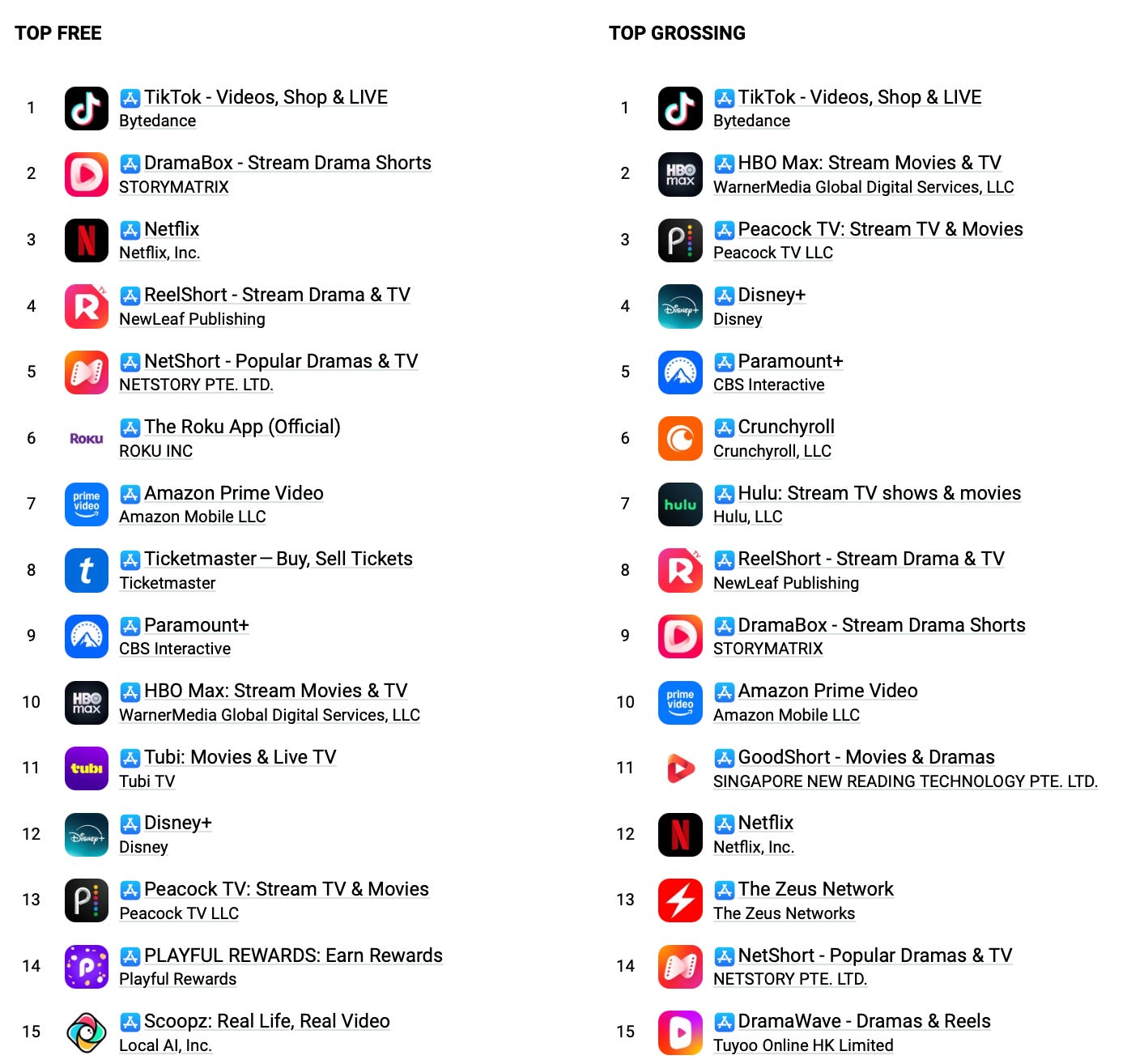

Below are two screenshots taken yesterday from of the top performing Entertainment apps in both stores.

Google Play (Android)

iPhone App Store (iOS)

The top two free apps in the Google Play store and three of the top five free apps are “dramaslop”. Two of the top 10 “Top Grossing” apps in both stores are “dramaslop” apps.1

It is against this backdrop that Netflix management are talking up TV and its ad-supported tier as the opportunities for growth. Co-CEO Greg Peters told investors on their recent earnings call that in the U.S., there is “about 80% of total TV view share that neither Netflix or YouTube are winning right now.” Netflix believes that “represents a huge opportunity” for which it is “competing aggressively” and aims to capture more share.

They are betting on streaming, “more narrative games based on Netflix IP” and “party and couch co-op games on TV” as their wins.

However, with “dramaslop” apps like ReelShort capturing significant market share of downloads on the app store, the question is whether they are missing a deeper shift in consumer behaviors. Because, if they are, the technological assumptions behind their story about growth are already outdated.

The Change Is Here

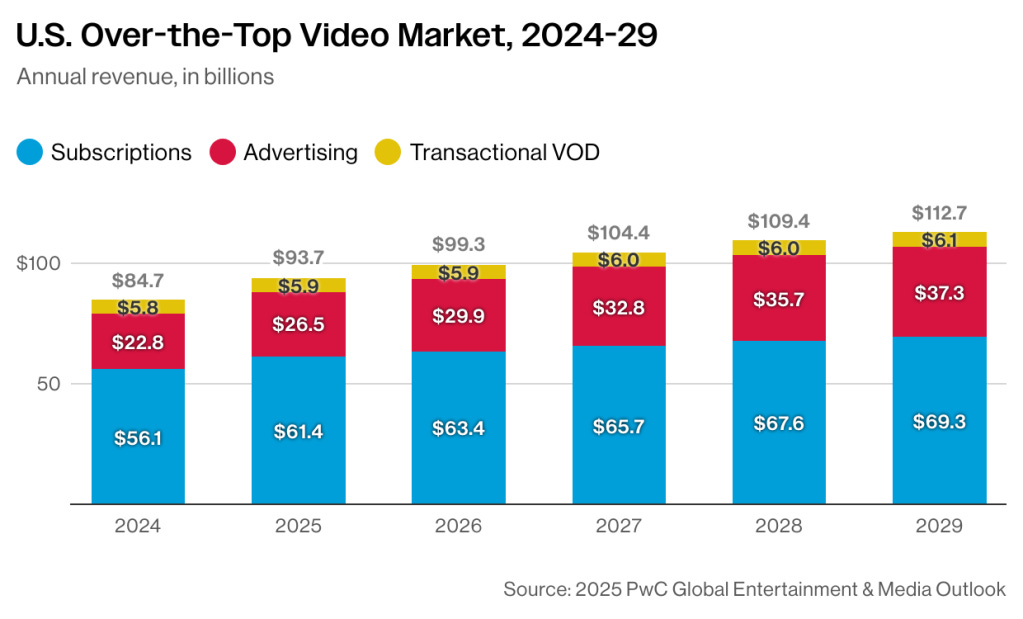

There are a growing number of signals that consumer preferences are shifting, at least in the U.S. PwC released its 2025 Global E&M Outlook report today. It shows the U.S. remains the “largest and most influential” streaming video market globally, generating $61.9 billion in transactional and subscription VOD revenue in 2024.

However, it is also a “mature” marketplace. The report includes a forecast that the US Over-the-Top (Direct to Consumer) video market is projected to grow only ~6% annually through 2029.

That data point raises a logical question: Why bet on TV or advertising for growth?