My 2025 Predictions Scorecard

5 right, 5 wrong, 2 TBD—I called Disney/Epic and the NFL. I whiffed on Netflix.

It’s that time of year again. Last December I published 12 predictions for 2025. Now it’s time to grade them: 5 right, 5 wrong, 2 still playing out. I batted .500—or .416 if you count the inconclusives as misses.

For comparison, my 2024 scorecard was 4 right, 5 partially right, 5 wrong.

This piece is free. My 2026 predictions will be partially paywalled. Subscribe now to get all of them.

Key

✅= Nailed it.

❌= Wrong

⏳= TBD / still playing out

✅ 1. There will be no AI-generated hits, blockbuster or niche

I can’t name one. Can you?

✅ 2. AI emerges as a “storytelling” performer

“AI will be less a storyteller and more a producer of faster, cheaper “performances” of stories.”

The release of OpenAI’s Sora 2 was proof in the pudding of AI’s ability to be an independent storyteller.

❌ 3. A messy debate about the “Quality” vs. Possibility of storytelling emerges

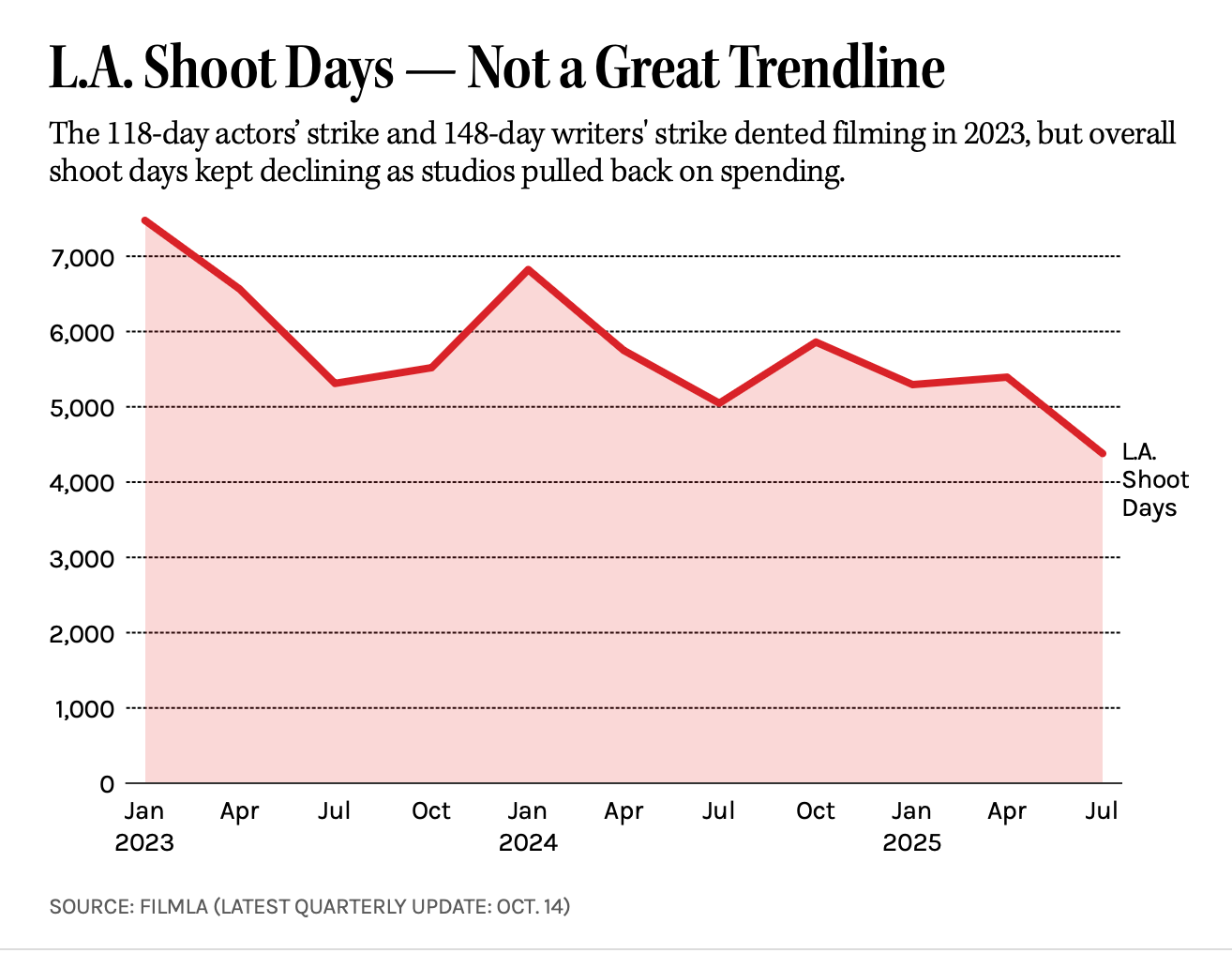

There was not much of a debate but rather a logical evolution of creator understanding. The volume of AI “slop”—low-value, high-volume videos—grew as the number of Hollywood productions declined. For example, nearly ten percent of the fastest-growing YouTube channels were using AI “slop” to grow.

My own sense from conversations over the past year and from November’s Artist & The Machine summit is that Hollywood studios, showrunners and screenwriters see the path (back) to quality through the possibility.

One point I made was directionally right: “Newfound efficiencies and possibilities in production models from AI will matter less if consumers increasingly prefer their favorite IP in different formats than TV or movies.” However, videos which emerged from Sora, Google Veo 3 and an orchestra of other platforms suggested consumers prefer likenesses—which is a form of IP—to their favorite IP—like Disney’s “Star Wars” or Warner Bros. “Harry Potter”.

⏳ 4. “The new business of living room content” redefines the role of producer

YouTube’s dominance of living rooms grew in 2025—it was up 2.1% year-over-year in Nielsen’s most recent “The Gauge”. This *is* happening. You can infer it from the decline of Hollywood productions and the growth of YouTube (above).

There are over 3 million creators in the YouTube Partner Program. All of them are funded by their subscribers and their fans.

✅ 5. The value of IP libraries for TV series and movies continues to decline

This point may seem debatable given Netflix’s $82.7 billion price tag for Warner Bros. studios and streaming.

However, Disney took some tough feedback from consumers on the long-term value of its IP with box office disappointments “Captain America: Brave New World”, “Tron Ares”, “Thunderbolts*” and “Snow White”. Six Marvel shows failed to chart in Nielsen’s streaming ratings on Disney+:

“Daredevil: Born Again”

“Ironheart”

“What If…? (Season 3)”

“Your Friendly Neighborhood Spider-Man”

“Eyes of Wakanda”

“X-Men ’97”

Last, Disney implicitly conceded this point in its licensing agreement of over 200 Disney characters to OpenAI’s Sora. Effectively, the walls of the walled garden need to be loosened for brands to adapt to the generative AI era.

❌ 6. Netflix continues to pivot and evolve away from its legacy media movie and TV DNA

Its likely acquisition of Warner Bros. Discovery is a pivot towards that DNA.

❌ 7. A small business using Meta’s Movie Gen tools will create most successful AI-generated ad campaign of 2025

There were more controversial ad campaigns than successful ones.

Also, Meta’s AI efforts pivoted a few times, firing and hiring along the way. Yann LeCunn—Chief scientist of Meta AI—left the company with a skeptical prediction for LLMs.

Ironically, Meta made a terrific holiday ad without AI.

❌8. Only Spotify and YouTube will have outsized influence in the IP licensing marketplace for AI

Wrong (too early). Also, IP licensing is going to be more a concern in cloud training models than at points of distribution.

Legacy Media Predictions

✅ Three years closer to 2029 means we’ll see NFL starting testing the waters for a new deal

NFL Commissioner Roger Goodell said that the league could “begin renegotiating its media rights deals as soon as 2026,” four years ahead of the current agreement’s opt-out clause, according to Alex Sherman of CNBC.com.

✅ Disney and Epic hit the same operational and cultural roadblocks within The Walt Disney Company that past gaming and creator economy ventures have hit, and they dial back their ambitions.

“Some Epic executives have complained about the slow pace of the decision-making at Disney, with signoffs needed from so many different divisions, said people familiar with the situation. And an experiment to allow gamers to interact with an AI-generated Darth Vader was fraught.”

⏳ ”A smaller streamer drops its owned-and-operated subscription streaming model and licenses its content library entirely to Amazon.”

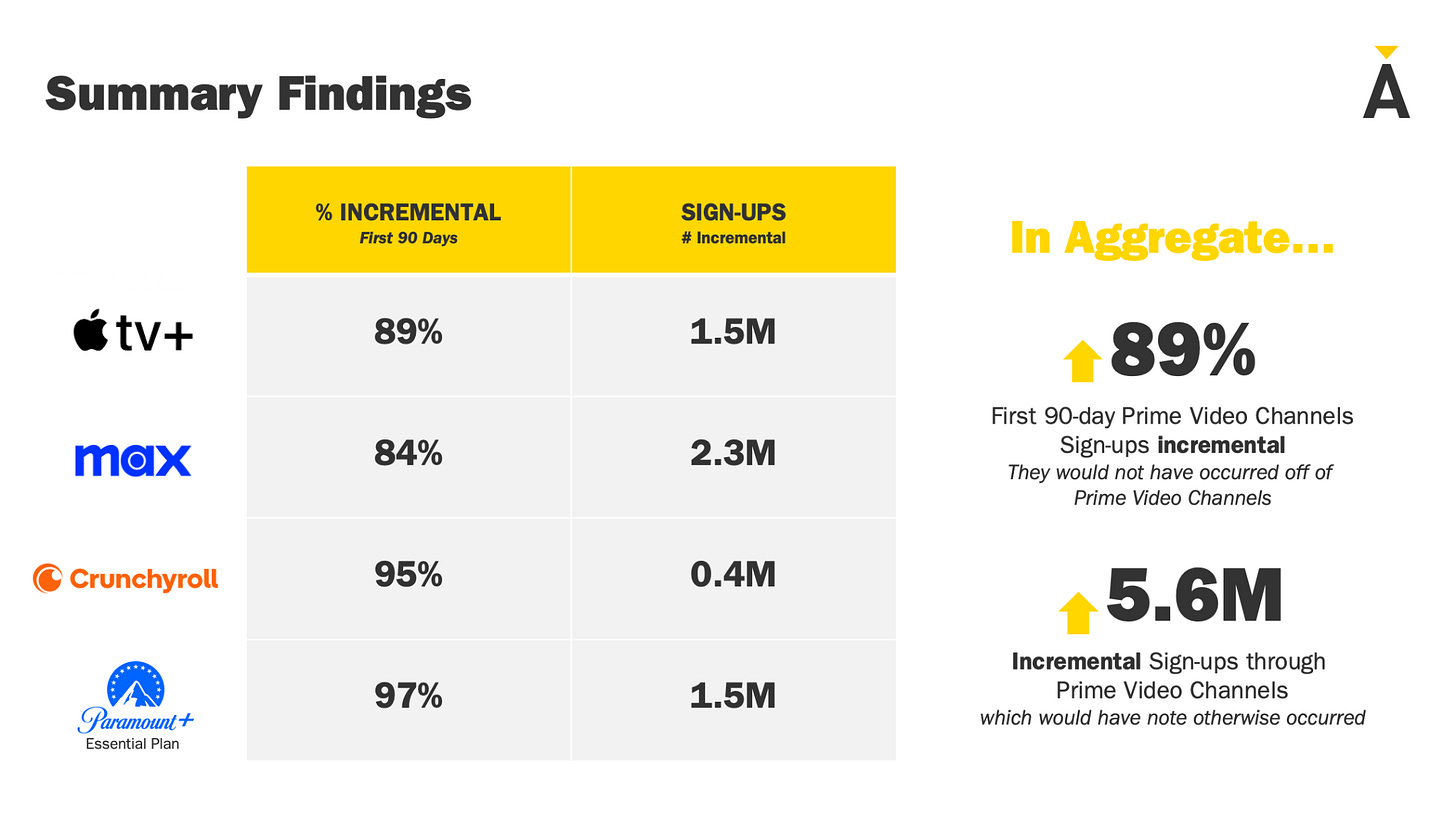

Amazon Prime Video Channels indeed emerged as a heavy hitter in SVOD distribution. Research firm Antenna found that in aggregate, streamers on Prime Video Channels saw an additional 5.6 million signups that would not have occurred off of the platform—an increase of 89 percent.

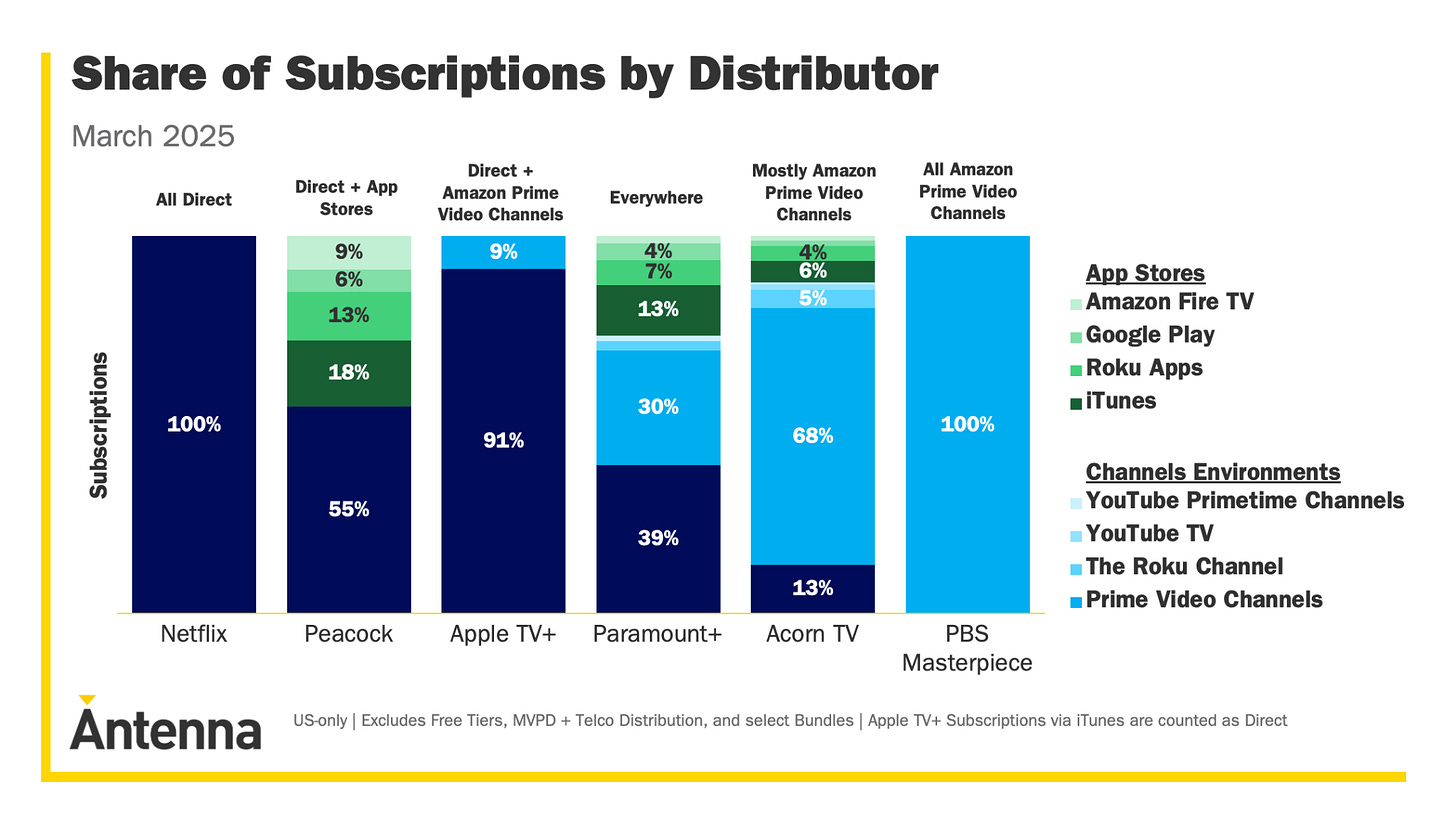

Antenna also found that different streaming services are taking “wildly different approaches to distribution”. PBS Masterpiece is the only channel that exclusively distributes on Amazon Prime Video Channels. But no one cried mercy.

❌ ”Neither Paramount Skydance nor Apple pursue the “cloud-usage model” I proposed in a September essay. However, Hollywood’s need for a free marketplace for content buying will push the market to find a solution, so we cannot rule it out?”

I suggested in 2024 that Apple or Oracle (with Paramount) could pivot to curating and distributing “prestige” third-party content across Hollywood studios within a cloud service-driven “pay-as-you-go” model. They would pay for content usage the same way they “pay for utilities like water and electricity” like on Amazon Web Services.

That obviously did not happen. Apple doubled down on its streaming model—rebranding to Apple TV from TV+, bundling with Peacock, distributing on Amazon Prime Video Channels (above) and ending its streaming partnership with Major League Soccer (MLS) three-and-a-half years early. This last move eliminiates the MLS Season Pass tier for 2026 and makes MLS matches available to stream for Apple TV subscribers at no additional cost.

Paramount Skydance's Oracle partnership is worth watching, but it has not offered any market signals that support the thesis yet.