Why Media Mergers Need Software Skills

Legacy media talks consolidation math while Amazon captures 25% of streaming signups through software - revealing the psychological and innovation traps that billions can't solve

The rumors of a Paramount Skydance (PSKY) acquisition of Warner Bros. Discovery (WBD) echo a larger trend of “inevitable” consolidation in legacy media. As FX Network chairman John Landgraf told the Royal Television Society’s Cambridge Convention yesterday, “If you look at the balance sheet for half of these [legacy media] companies independently, they really don’t have any way of scaling to 200, 250, 300 million global subscribers without some kind of consolidation.”

Meaning, Landgraf is defining consolidation in streaming as a cost efficiency, and that is similar to how media executives are looking at generative AI as a short-term cost efficiency for visual effects (VFX) budgets. For this reason, this framing misses the fundamental question: Whether better software solutions for consumers can emerge with consolidation.

PSKY's partnership with Oracle represents one path to solve this through consolidation, but the broader industry faces the same fundamental challenge. Landgraf’s take talks past the existence of Amazon Prime Video Channels, which is leveraging the company’s global scale—over 200 million subscribers— to drive subscribers to smaller apps with a single Amazon login.

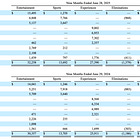

Research firm Antenna found that Prime Video Channels add-on subscriptions accounted for 25% of all U.S. SVOD signups in Q1 2025. In Q2 2024, 58% of sign-ups to niche services were generated through Amazon Prime Video Channels. That means Amazon is solving a problem for legacy media companies. The better it is as solving this, the more consumers will rely on Amazon as a streaming solution. That makes Amazon a growing “elephant in the room” between audiences and legacy media streaming content.

Even if executives like Landgraf understand and recognize that there is structural misalignment between studios and emerging technologies, they are still talking about accounting solutions instead of technological solutions.

I have had four conversations this week about this topic. Each offered a different rationale for why this may be happening.

Psychological Hurdles

I had coffee with a research analyst in the Communications and Software sectors earlier this week and when the topic of Disney and ESPN came up, we agreed Disney's executives appear psychologically trapped by their expertise in the cable model, both unwilling and unable to pivot to product-first approaches despite clear evidence that their current strategy isn't working.