Content is Dead, Long Live User Experience

Why the "Curse of the Mogul" continues to destroy shareholder value in the era of AI and DTC— and why it won't break until AI and DTC force the hand of legacy media companies.

Last Friday’s essay concluded that a media company in the era of AI and direct-to-consumer (DTC) will live or die according to whether its controlling shareholders understand the emerging technologies. Three DTC-savvy, Generation X Ochs-Sulzberger heirs are succeeding at The New York Times (NYT) with their focus on building and delivering apps that capture the inelastic demand that exists after everything else is stripped away.

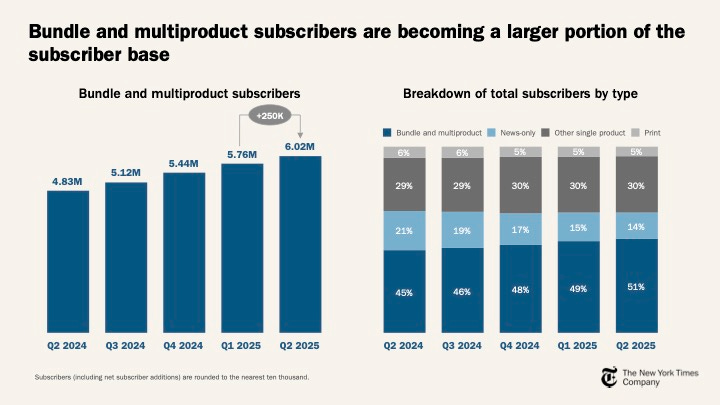

The NYT's apps deliver the same journalism as its newspapers, but fragmented into products that serve specific user needs. Bundling these apps incentivizes subscribers to spend marginally more for additional services through all-in-one or custom multiproduct bundles.

The app is the product; content serves the product. Where traditional newspapers were "bundles of information," the business of content in apps is reduced to producing material that meets that specific user needs: new recipes for Cooking, new puzzles for Games, team-specific sports news for The Athletic and curated shopping recommendations for Wirecutter.

The NYT has found growth in subscribers and revenues with products while news-only subscribers have declined by one-third over the past year.

There is a lesson: “Content is dead, long live user experience (UX)”. Less is more.

Content must be continuously refined to serve products. When content meets existing consumer needs, shareholder value is created. Otherwise, it is destroyed.

The Curse of the Mogul

NYT management has built a solution for “The Curse of the Mogul”—the problem of legacy media CEOs who pursue creative businesses that they believe are not subject to traditional strategic, financial or management appraisals. As a consequence, media companies may reward content creators at the expense of shareholder value.

“The Curse of the Mogul” comes from a 2009 book which analyzed the heads or former heads of the world’s 15 then-largest media companies and concluded they had all collectively written down over $200 billion since 2000. However, creative talent had reaped more value than shareholders in that period of time.

In past essays for The Medium (then called “PARQOR”), I believed the era of DTC businesses like streaming would force media owners to disclose measurement of their subscription businesses. I used it as a framework for analysis to help to identify the “right” types of disclosure from executives.

It is worth doing an updated analysis of this point, and I am not going to do this here. Instead, I am taking this opportunity to lay out the logic of the argument.